Tech's "Prosperity Depression": The Employment Crisis Behind the GPU Investment Boom

Behind Amazon's 30,000 layoffs lies a zero-sum game between GPU investment and human capital. As enterprise AI adoption approaches the critical 50% threshold, are we replaying the 2000 internet bubble?

中文版

The tech industry is currently grappling with a core paradox: soaring stock prices juxtaposed with widespread mass layoffs. This isn't a typical economic downturn; it's a profound structural adjustment driven by the relentless march of technological innovation, specifically the rise of AI.

Consider Amazon's October 2025 announcement of 14,000-30,000 layoffs, marking the largest corporate workforce reduction in its history. This decision came even as AWS's backlog surged to an astonishing $195 billion, a 25% increase year-over-year. This phenomenon, which can be aptly described as a "prosperity depression," is not unique to Amazon; it's spreading across the entire tech sector.

In plain English, companies are profitable, and their stock prices are rising, yet employees are being laid off en masse. The primary driver behind this seemingly contradictory trend? A massive reallocation of capital. There isn't enough money for the GPUs (Graphics Processing Units) – the core equipment vital for AI training – so companies are cutting payrolls to fund this essential hardware investment.

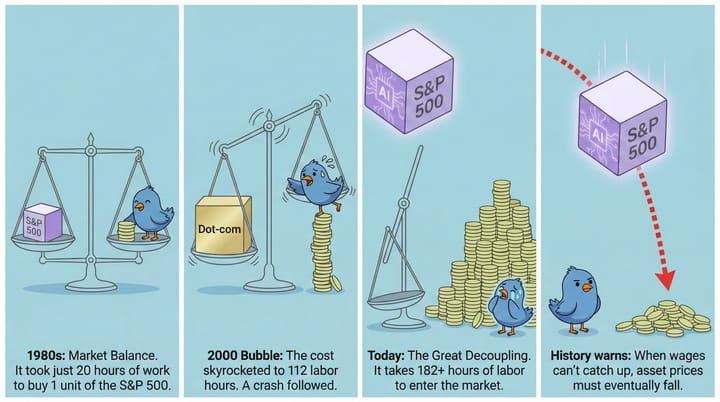

Key Data Comparison: Now vs. the 2000 Dot-Com Bubble

To understand the current landscape, it's crucial to compare today's metrics with past economic shifts, particularly the infamous dot-com bubble.

Unemployment Comparison

The job market reveals a subtle but significant shift:

- August 2025: The U.S. unemployment rate stands at 4.3%, a noticeable rise from the historic low of 3.5% seen in 2022.

- 2000-2002 Bubble Burst: Silicon Valley alone experienced a staggering loss of 200,000 jobs.

- 2025 Tech Industry: In just the first 10 months, the tech sector has seen 98,000 layoffs. While not yet matching the dot-com era's scale, the pace is concerning.

Stock Market Valuation Comparison

Market valuations paint a picture of unprecedented growth and potential overheating:

- March 2000 (Dot-Com Peak): The NASDAQ composite peaked at 5,048 with an exorbitant P/E ratio of 200.

- October 2002 (Dot-Com Crash): The index plummeted to 1,139, a 77% decline.

- October 2025 (Current): The NASDAQ hovers between 14,000-15,000, nearly three times its 2000 peak. This suggests a market fueled by strong belief in future tech growth.

Capital Expenditure Frenzy

The investment in AI infrastructure is colossal and accelerating:

- 2025 Projection: Tech giants are projected to invest an astounding $200 billion in GPUs.

- Microsoft: Their expected capital expenditure in 2025 is $62 billion, a 3.5x increase compared to their 2020 spending.

- Historical Context: This level of investment dwarfs even the entire internet industry's capital expenditure in 2000, underscoring the scale of the current AI infrastructure buildout.

Three Warning Signals

Several indicators suggest that the current tech boom, particularly in AI, may be approaching a critical inflection point.

Signal 1: AI Adoption Approaching Critical Threshold

Enterprise AI adoption has reached 78%. History teaches us that when new technology penetration exceeds 50%, the initial explosive growth often slows. For instance, the 2000 internet bubble burst when U.S. internet penetration was around 52%. While AI's potential is vast, the rapid early adoption could mean the low-hanging fruit has already been picked.

Signal 2: Human Capital Being Severely Squeezed

Tech companies are making a dangerous bet by prioritizing hardware over human talent:

- Savings from layoffs are almost entirely redirected to GPU procurement.

- Remaining employees face dramatically increased workloads, often doubling their responsibilities.

- This creates a vicious cycle within the industry, where "efficiency" is primarily sought through layoffs, potentially stifling innovation and creating burnout.

Signal 3: Return on Investment Beginning to Decline

Despite massive investments, the tangible financial returns on AI projects are proving elusive for many. MIT research indicates that 95% of generative AI pilot projects fail to achieve rapid revenue growth. This suggests that while the technology's promise is immense, translating that promise into substantial, immediate returns remains a significant challenge, raising questions about the sustainability of current investment levels.

Historical Lessons: Warnings from Three Major Crashes

Understanding past bubbles can offer critical insights into the present.

1. The 2000 Internet Bubble

- Bubble Formation: Any company merely adding ".com" to its name saw its stock price skyrocket, often without a clear path to profitability.

- Trigger: A combination of Federal Reserve rate hikes and companies' inability to achieve sustainable profitability ultimately popped the bubble.

- Aftermath: The NASDAQ plummeted by 77% and took an arduous 15 years to recover its peak value.

2. The 2008 Financial Crisis

- Bubble Formation: Excessive and speculative real estate lending, particularly in the subprime mortgage market.

- Trigger: The collapse of the subprime mortgage market.

- Tech Industry Impact: While not directly centered on tech, the crisis led to a significant drying up of venture capital, resulting in massive startup failures across the board.

3. 1840s British Railway Mania (Most Similar Historical Case)

- Similarities: This period in history presents striking parallels to today's AI boom. It involved a truly revolutionary technology (railways) that demanded massive infrastructure investment.

- Result: The mania led to a devastating bust, with 90% of railway companies going bankrupt. Despite the financial carnage, the underlying railway network fundamentally changed the world. This suggests that while the technology's impact is real, the financial bubble surrounding it can still be catastrophic.

Risk Assessment: Where Are We in the Bubble Cycle?

Assessing the current situation requires a balanced perspective, acknowledging both the unprecedented potential and the looming risks.

The Good News:

- AI is creating real value, unlike many of the speculative "pet websites" of the 2000s. Its applications are tangible and transformative.

- Enterprises have genuine AI use cases, indicating that adoption is driven by practical needs, not just hype.

- Technology is advancing rapidly, constantly pushing the boundaries of what AI can achieve.

The Bad News:

- Valuations have detached from fundamentals. Nvidia, a key player, trades at a P/E ratio of 65, suggesting high expectations are already priced in.

- Investment concentration is extremely high. Just four companies account for an astonishing 44% of all datacenter investment, creating a single point of failure and potential over-reliance.

- Small-to-medium enterprise (SME) AI adoption is only 10%, limiting the overall market penetration and potential for broad, sustainable growth beyond the tech giants.

Investment Strategy: How to Protect Yourself

Navigating this complex landscape requires a thoughtful and diversified approach.

1. Hedging Strategy

For employees in the tech industry, a practical hedging strategy could involve purchasing stock in key AI hardware providers like Nvidia or AMD. If your job is at risk of being replaced by GPUs, at least you can benefit from the rising stock prices of the very technology causing the disruption.

2. Watch for Signals

Stay vigilant for key market indicators:

- Be extra cautious when enterprise AI penetration approaches 50%, as historical patterns suggest growth could slow thereafter.

- Monitor whether GPU demand growth begins to slow, as this could indicate market saturation or a shift in investment priorities.

- Watch for major tech companies reducing their AI investments, which would be a strong signal of a market correction or a reassessment of ROI.

3. Diversification

Do not put all your eggs in one basket:

- Don't go all-in on tech stocks, especially those with extremely high valuations.

- Focus on industries benefiting from AI but not dependent on GPUs for their core business, offering a buffer against direct tech downturns.

- Maintain cash reserves for potential market corrections, allowing you to capitalize on opportunities when asset prices become more reasonable.

Conclusion: Is This Time Really Different?

Every bubble is accompanied by claims that "this time is different." While it's true that AI is a more mature and practical technology than the dot-com era's nascent internet, historical patterns offer enduring lessons:

- The technology is real, but so is the bubble: Railways fundamentally changed the world, but railway stocks still crashed spectacularly. The value of the underlying innovation doesn't preclude speculative bubbles.

- Timing matters: Being too early or too late are both costly mistakes. Identifying the inflection points is crucial.

- Cash flow is king: Eventually, markets return to rationality, and sustainable cash flow and profitability dictate true value.

The current "prosperity depression" is not a traditional recession, but rather a radical reallocation of capital from human resources to computing power. It's a structural adjustment triggered by a technological revolution. While the bubble may not burst as dramatically as in 2000, an adjustment and re-evaluation of valuations are inevitable.

Remember: Making money in a bubble is easy; the hard part is knowing when to exit.

Data Sources

- Federal Reserve FRED Database - Unemployment Data

- NASDAQ Composite Index Historical Data

- Reuters - Amazon Layoff Reports

- Bloomberg - Tech Company Capex Analysis

- Anthropic - AI Adoption Research

- McKinsey - Enterprise AI Survey