Michigan Consumer Sentiment Index: The Economic Storm Barometer

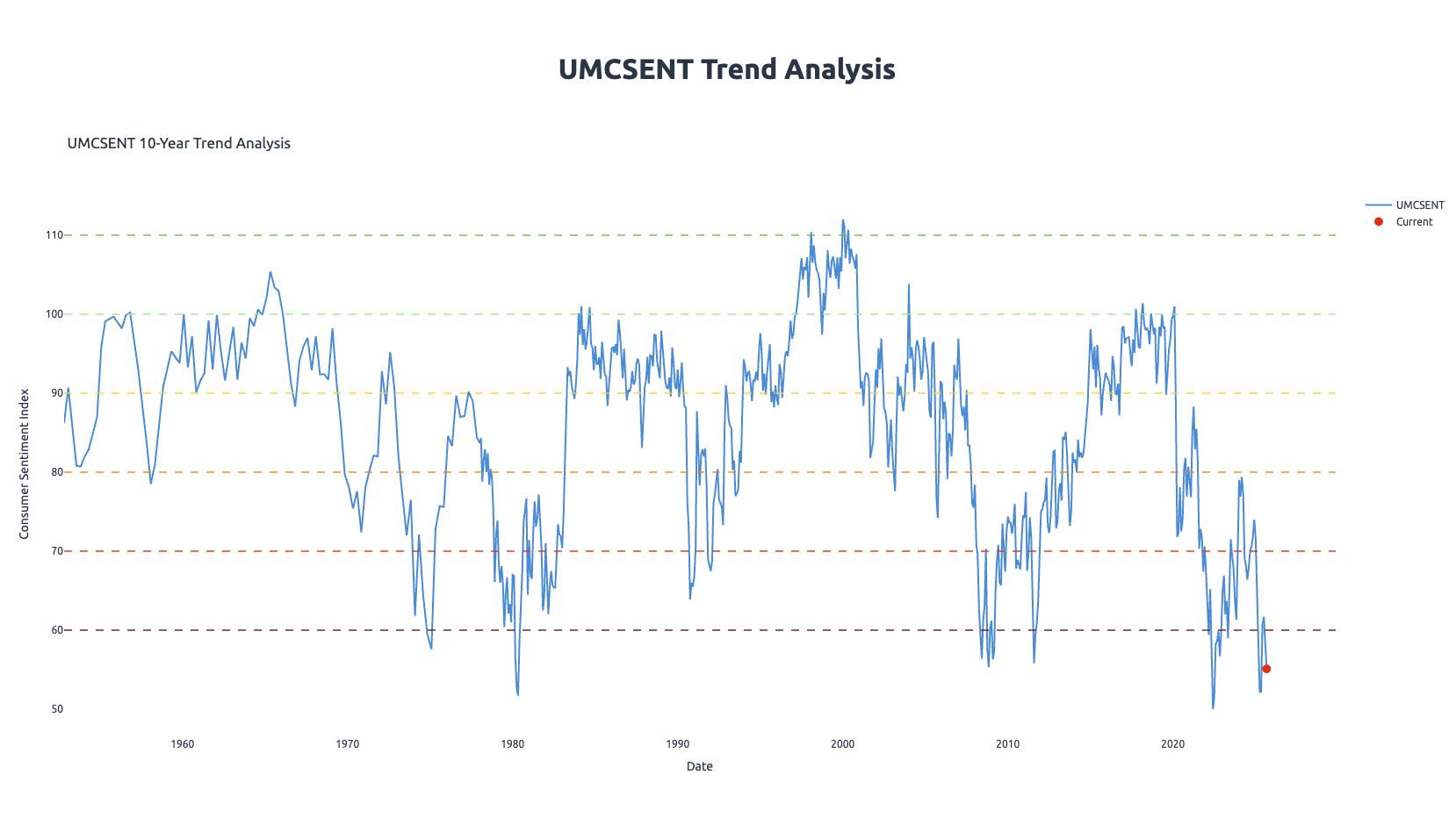

Deep dive into the UMCSENT index: How does it predict economic crises? What does the current reading of 55.1 mean? Let's decode this crucial economic indicator in plain English.

中文版

Imagine if we could peek into the minds of American consumers and see whether they're optimistic or pessimistic about the economy. That's exactly what the University of Michigan Consumer Sentiment Index (UMCSENT) does!

Every month, the University of Michigan calls about 500 American households and asks them five simple questions:

- Is your family better or worse off financially than a year ago?

- Will your family be better or worse off a year from now?

- What about business conditions in the next 12 months?

- What about the economy over the next 5 years?

- Is now a good time to buy major household items?

Their answers are compiled into a single number—the Consumer Sentiment Index. Higher numbers mean more confidence; lower numbers mean more worry.

Why Does This Index Matter So Much?

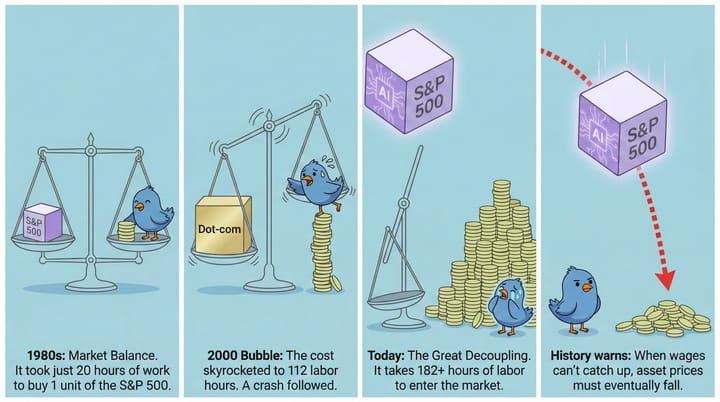

Think of the economy as a car, and consumers as the engine. Consumer spending drives 70% of the U.S. economy. When people worry about the future, they tighten their belts and stop spending. Less spending leads to businesses earning less, which can result in layoffs, and then even less spending. This creates a vicious cycle leading to recession.

Conversely, when confidence is high, people buy houses, cars, dine out, and travel—the economy thrives. This index is like the economy's "thermometer," giving us early warning signs of economic "fever."

How to Read the Numbers?

Based on historical patterns, here's a simple guide to interpreting the index:

- Above 100: Great economy, everyone's optimistic (bull market vibes)

- 90-100: Normal economy, people feel good

- 80-90: Some concerns, but manageable

- 70-80: Warning! Economic troubles ahead

- 60-70: Danger! Recession likely approaching

- Below 60: Red Alert! Major economic crisis

Historical "Fever" Episodes

Let's examine how this index performed during major economic crises, proving its predictive power:

1. Early 1980s Recession

- Low Point: 51.7 (May 1980)During this period, inflation hit a staggering 14%, prompting the Federal Reserve to raise interest rates to 20% to combat it. Imagine facing 20% mortgage rates! The economy effectively froze, and unemployment soared, exceeding 10%. The index's sharp drop accurately reflected the widespread economic distress.

2. 2008 Financial Crisis

- Low Point: 55.3 (November 2008)The collapse of Lehman Brothers sent shockwaves across the globe, bringing the financial system to the brink of implosion. The Consumer Sentiment Index plummeted from over 90 in 2007 to 55, providing a stark and early warning of this once-in-a-century crisis.

3. COVID-19 Pandemic

- Low Point: 71.8 (April 2020)While the index didn't drop below the critical 60-mark during the initial pandemic shock, the sudden cliff-dive from 101 to 71.8 was undeniably alarming. Fortunately, massive government stimulus packages helped the economy rebound quickly, mitigating a deeper, sustained downturn.

4. 2022 Inflation Crisis

- Low Point: 50.0 (June 2022)This marked the lowest reading ever recorded! With inflation hitting a punishing 9%, consumers were genuinely terrified by soaring prices across nearly all sectors. This historic low clearly indicated profound anxiety among American households.

Current Situation: 55.1 - Should We Worry?

As of September 2025, the Consumer Sentiment Index stands at 55.1. What does this deeply concerning number signify for the immediate future?

The Bad News:

- We are firmly in the "Red Alert" zone (below 60), signaling severe economic distress.

- There has been a steady decline from 71.7 at the start of 2025.

- April and May of 2025 saw readings hit 52.2, near historic lows.

- Current levels tragically match those seen during the peak of the 2008 financial crisis.

Key Concerns:

- Multiple consecutive months below 60 indicate persistent and deeply entrenched consumer pessimism, not just a fleeting dip.

- Historically, sustained readings below 60 have predicted a recession with over 80% accuracy.

- The current reading is even lower than during the peak of the initial COVID-19 panic, suggesting deeper underlying issues.

What Should Regular People Do?

If you're an average investor or household, now is a time for caution and strategic planning:

- Cash is King: Hold adequate cash reserves. Liquidity is crucial during periods of economic uncertainty.

- Careful with Debt: Avoid taking on major new loans for houses, cars, or other large purchases right now, if possible. High interest rates and job insecurity can amplify risks.

- Diversify: Don't put all your eggs in one basket. Ensure your investments are diversified across different asset classes to mitigate risk.

- Job Security: Prioritize stable income. In tough times, having a secure job or multiple income streams matters most.

- Skill Up: Invest in yourself. Make yourself indispensable in your role or acquire new skills that are in demand, enhancing your career resilience.

Limitations of This Index

No single indicator is perfect, and the UMCSENT has its own nuances:

- It primarily measures "feelings" and perceptions, not hard economic data like GDP or employment figures.

- Sometimes, the collective sentiment of the crowd can be overly pessimistic or optimistic, leading to false signals.

- The sample size of 500 households, though statistically significant, may still have inherent biases.

- Never make major financial decisions based on one indicator alone. Always cross-reference with other economic data.

Conclusion

The Michigan Consumer Sentiment Index is like the economy's "mood ring." The current 55.1 reading is genuinely concerning, sitting at historic lows and strongly suggesting serious economic challenges ahead.

But remember, panic is your worst enemy. History shows that every crisis eventually passes. The key is preparation, rationality, finding opportunities when others fear, and staying cautious when others are greedy.

As Warren Buffett famously says: "Be fearful when others are greedy, and greedy when others are fearful." With consumer sentiment this low, perhaps smart money is already positioning for the future?

Data Source: Federal Reserve Economic Data (FRED) - UMCSENT

Disclaimer: This article is for reference only and does not constitute investment advice. Investing involves risk; make decisions carefully.