Barclays' Secret Bet: How Banks Are Building Crypto's Trillion-Dollar Future

Discover how major banks like Barclays are quietly investing in and building the foundational infrastructure for stablecoins and tokenized assets, signaling a profound shift in global finance. This isn't about hype, but owning the plumbing of the future economy.

|  |  |  |

The Invisible Hand: How Barclays' 'Secret' Bet Unveils the Future of Finance

Imagine a financial landscape where transactions of trillions settle in mere seconds, far outpacing the speed of thought. This isn't a futuristic fantasy, but an emerging reality being quietly constructed by the world's largest financial institutions. While retail markets often chase speculative trends, a much more profound transformation is underway: the very infrastructure of global finance is being rebuilt, drawing in billions from institutional players.

As of early January 2026, the crypto markets are navigating a "recalibration" phase after a turbulent Q4 last year. Bitcoin, against all expectations and persistent FUD (Fear, Uncertainty, and Doubt), has remarkably maintained its position above ninety thousand dollars. However, the true story isn't just about price charts or speculative highs. It's about how traditional financial behemoths, such as Barclays, are not merely observing the crypto revolution but are actively investing in and building the foundational infrastructure that will enable stablecoins and tokenized assets to move vast sums across the global financial system. This is less about speculative trading and more about owning the plumbing of future finance.

Beyond ETFs: The Quiet Institutional Inflow

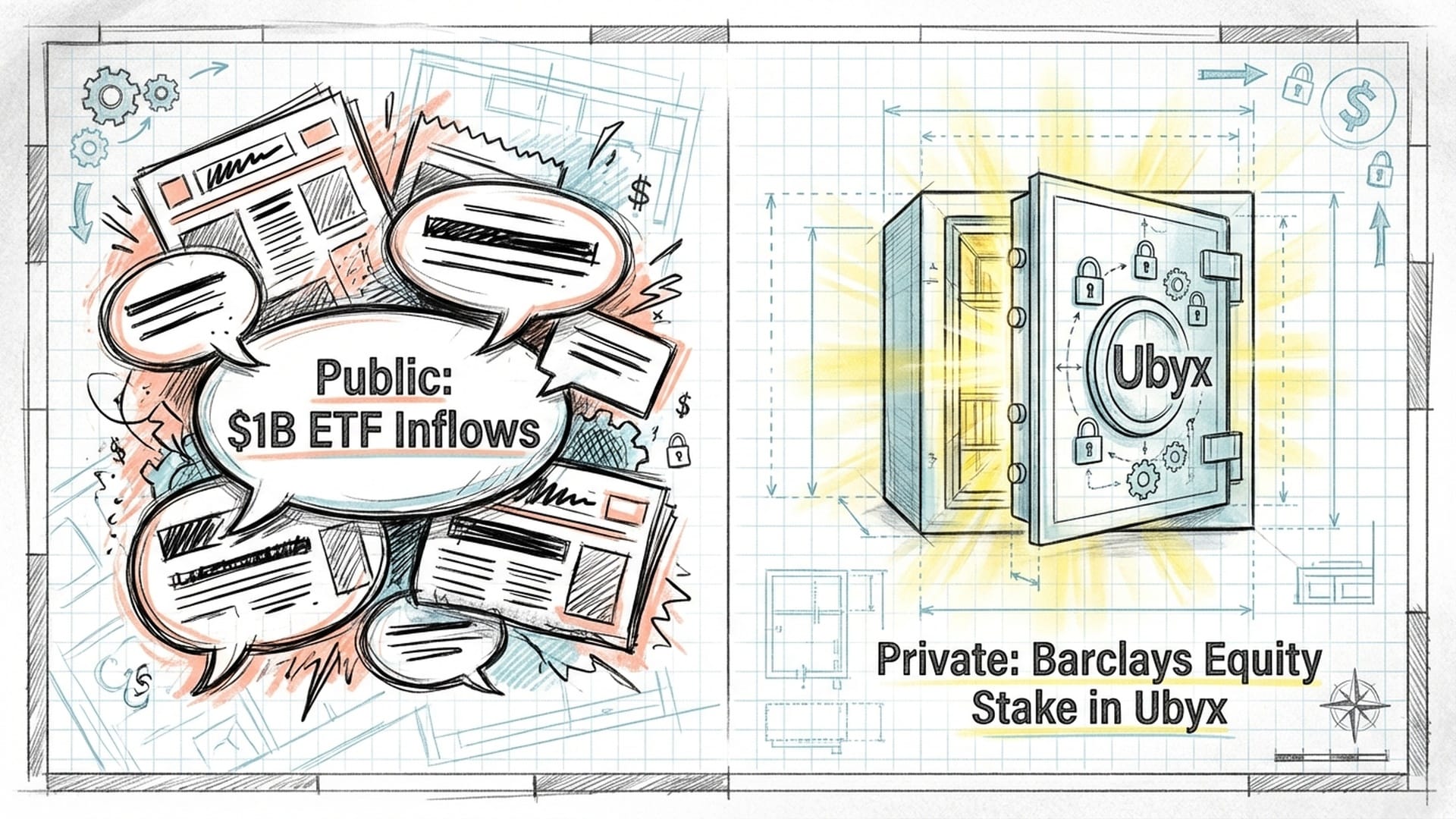

Institutional capital is increasingly flowing into the crypto space through various, often less publicized, channels. While U.S. spot Bitcoin ETFs made headlines by vacuuming up over a billion dollars in net inflows during late 2025 and early 2026, a truly groundbreaking development occurred with far less fanfare. Barclays, a venerable institution in traditional banking, made its inaugural direct equity investment in stablecoin settlement infrastructure through a startup named Ubyx.

This move by Barclays to invest directly in Ubyx, a company dedicated to stablecoin-based settlement rails for institutions, signifies a critical shift. It's not a pilot program or a proof-of-concept; it's an outright acquisition of a piece of the foundational crypto plumbing. This illustrates that financial giants are moving beyond theoretical discussions and into direct ownership of the infrastructure that will define the future of money.

"This is Barclays buying a piece of the foundational crypto plumbing itself. What does that tell us? It tells us that these financial giants are moving beyond theoretical discussions and into outright ownership of the infrastructure that will define the future of money."

Ubyx: Optimizing the Back-End of Trillions

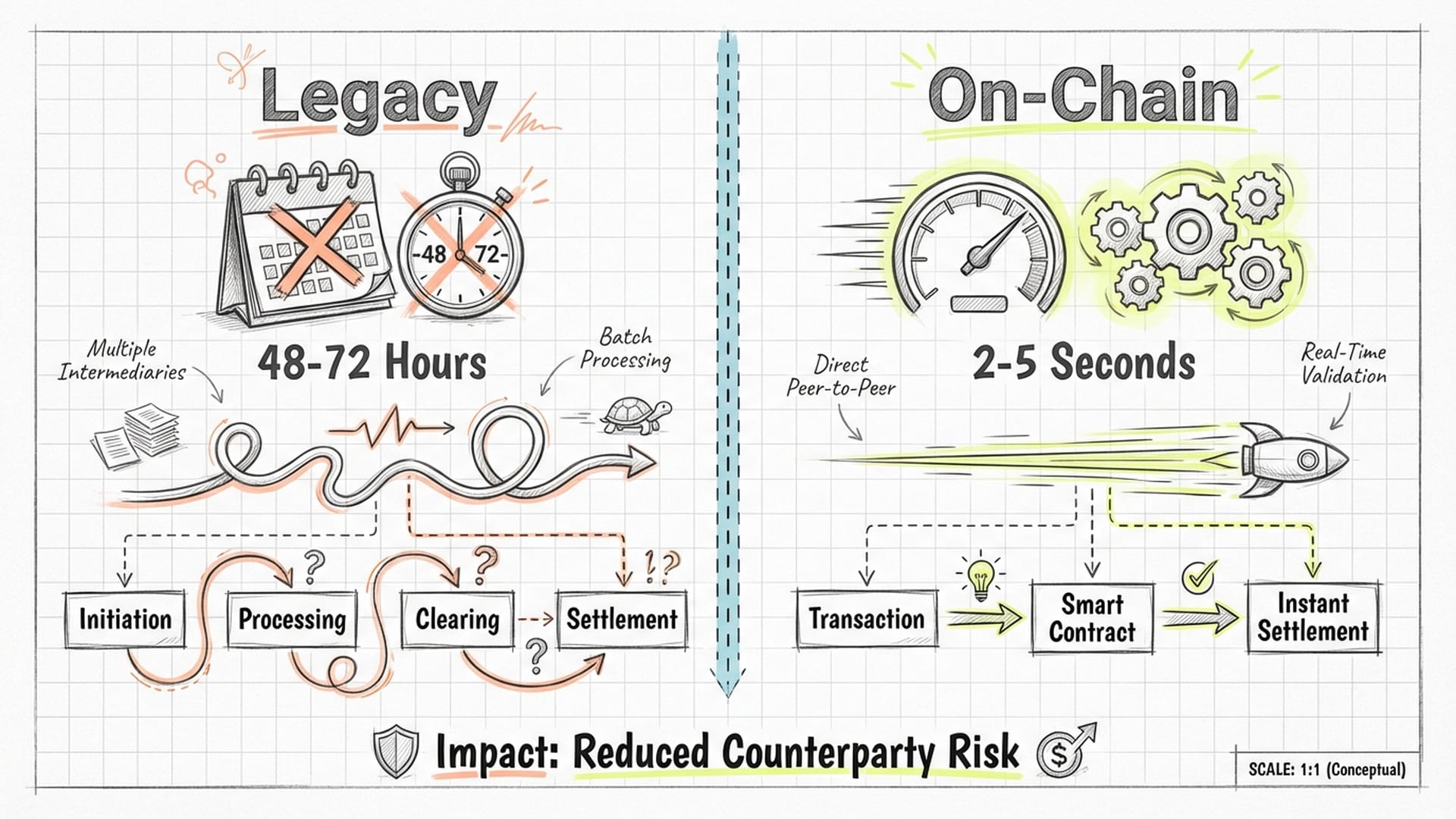

Ubyx's mission is elegantly simple: to construct the underlying pathways for banks, brokers, and fintechs to settle payments and trades using tokenized cash and stablecoins. Imagine a world where settlement cycles, traditionally taking days through antiquated systems, are compressed to near-instantaneous speeds. This drastically reduces risk and slashes costs, particularly for high-volume institutional flows.

This isn't about chasing the next "10x token" but about optimizing the crucial, albeit often overlooked, back-end mechanisms for moving immense amounts of money and assets between colossal institutions. They are establishing tokenized settlement networks that route transactions on-chain while seamlessly integrating with existing compliance frameworks, established custodians, and legacy messaging systems.

The Broader Implications for the Financial Landscape

Why should this matter to the individual investor or anyone observing the evolving financial world?

- Validation of Stablecoins: This development profoundly validates the long-standing thesis that stablecoins and tokenized fiat are not just for retail traders or niche DeFi applications. They are becoming integral to institutional settlement, marking a structural inevitability rather than a fleeting trend.

- Banks' Economic Exposure: It clearly demonstrates that major banks are seeking more than just fees from servicing ETFs or providing custody. They desire economic exposure and a direct stake in the infrastructure layer that underpins this financial evolution.

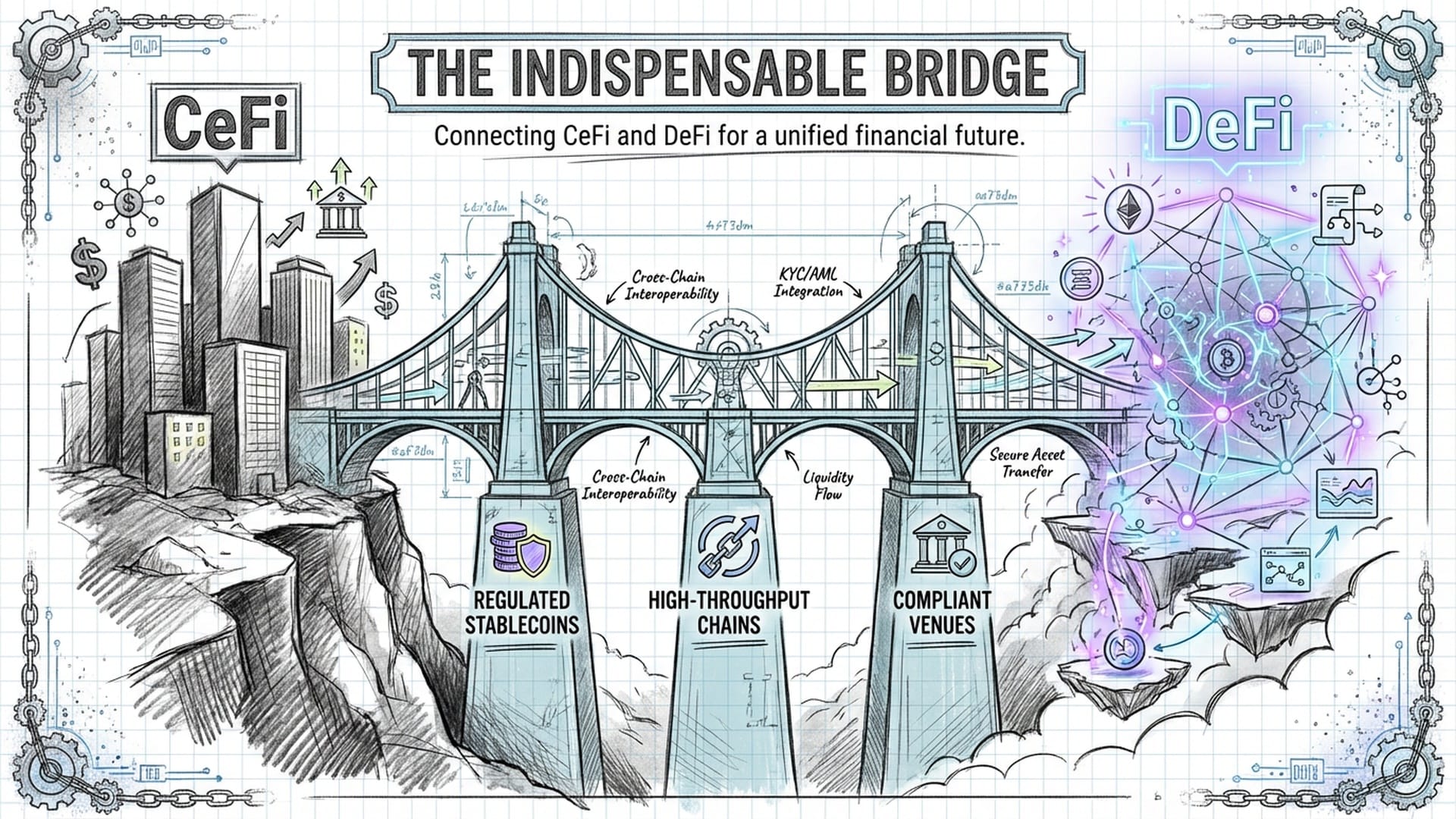

- Bridging CeFi and DeFi: Crucially, this creates an indispensable bridge between traditional foreign exchange, securities, and payments workflows and the burgeoning world of on-chain liquidity. It connects the established balance sheets of Centralized Finance (CeFi) with the dynamic, permissionless rails of Decentralized Finance (DeFi).

As this cutting-edge infrastructure matures, it will inevitably drive a surge in demand for high-quality, regulated stablecoins, compliant on-chain venues, and blockchain networks capable of handling high-throughput settlement efficiently with predictable, low fees. This provides a fundamental structural tailwind for tokenization, Real World Asset (RWA) platforms, and stablecoin ecosystems that can meet stringent institutional standards.

"This isn’t just good news for a single token; it's a fundamental structural tailwind for tokenization as a whole, for real-world asset (RWA) platforms, and for stablecoin ecosystems that can genuinely meet the stringent demands of institutional standards."

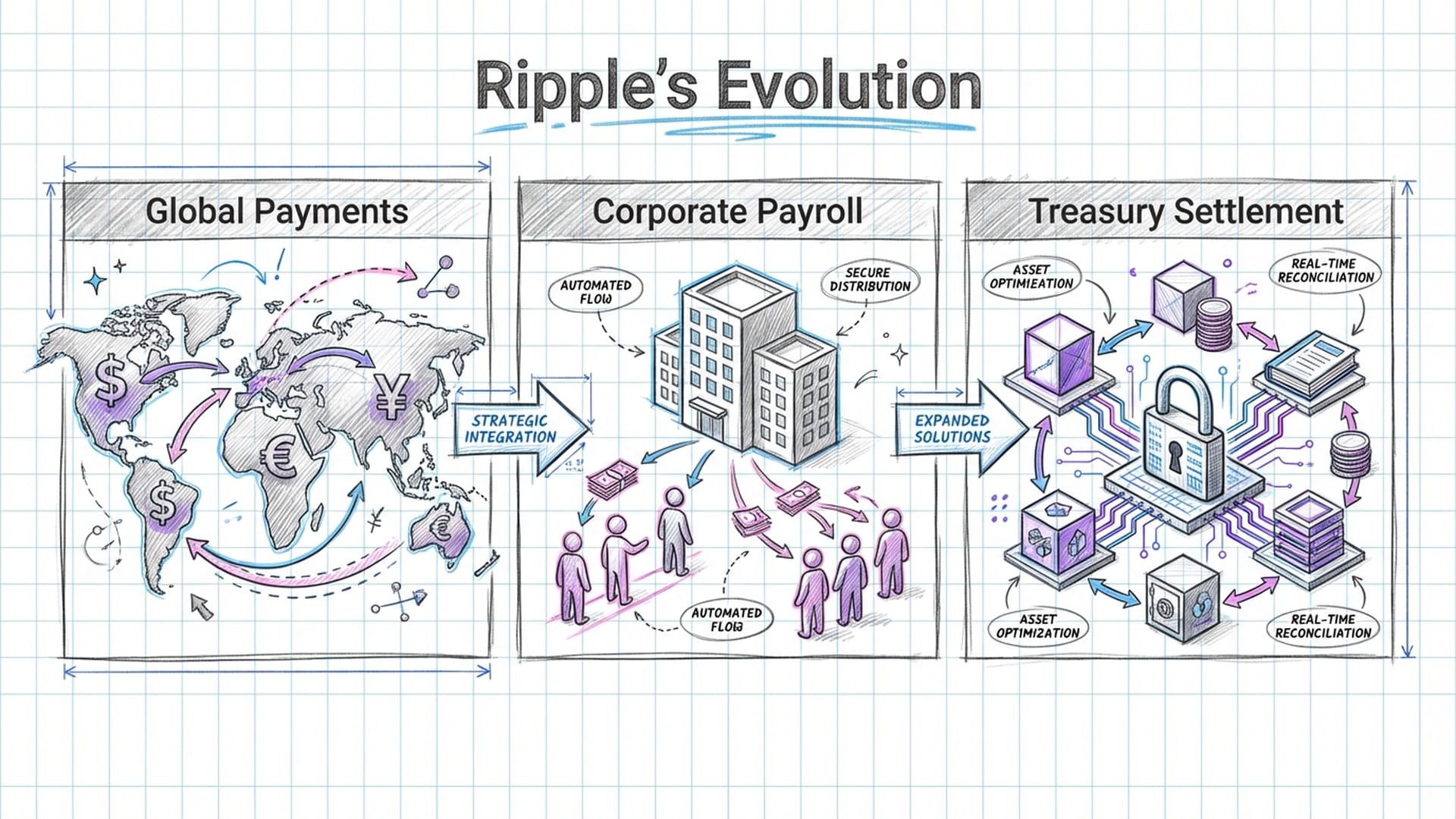

Ripple's Ambitious Redirection: Beyond Cross-Border Payments

Shifting focus, another major player actively shaping this landscape is Ripple. Historically known for pioneering cross-border remittances using XRP, Ripple's 2026 strategy is far more ambitious. They are aggressively venturing into stablecoins, tokenized payments, and, notably, enterprise payroll rails. Their vision transcends their original niche, aiming to power recurring fiat and stablecoin-denominated flows for businesses—encompassing salaries, vendor payments, and treasury movements—all built upon crypto-native infrastructure.

This is a radical reframe: Ripple is positioning stablecoins and tokenized balances as the fundamental rails for day-to-day money movement, not just speculative assets. They are embedding on-chain settlement discreetly, ensuring user-facing experiences remain familiar and intuitive for CFOs, HR teams, and payroll providers. This constitutes the ultimate stealth adoption strategy.

Consider the practical implications: global companies can pay distributed workforces across continents using stablecoins as near-instantaneous bridge assets, bypassing sluggish traditional banking rails. Freelancers and contractors could receive payments faster, with fewer intermediaries and lower fees. Platforms could automate complex payout logic, programmatically splitting payments across various currencies and jurisdictions. Ripple's pivot reinforces the broader theme that major players are prioritizing infrastructure and settlement over purely speculative products. The long-term conviction is clear: real-world payment volume will increasingly traverse tokenized rails, whether users are consciously aware of it or not.

The Visible Surface: ETF Flows and Tactical Rotations

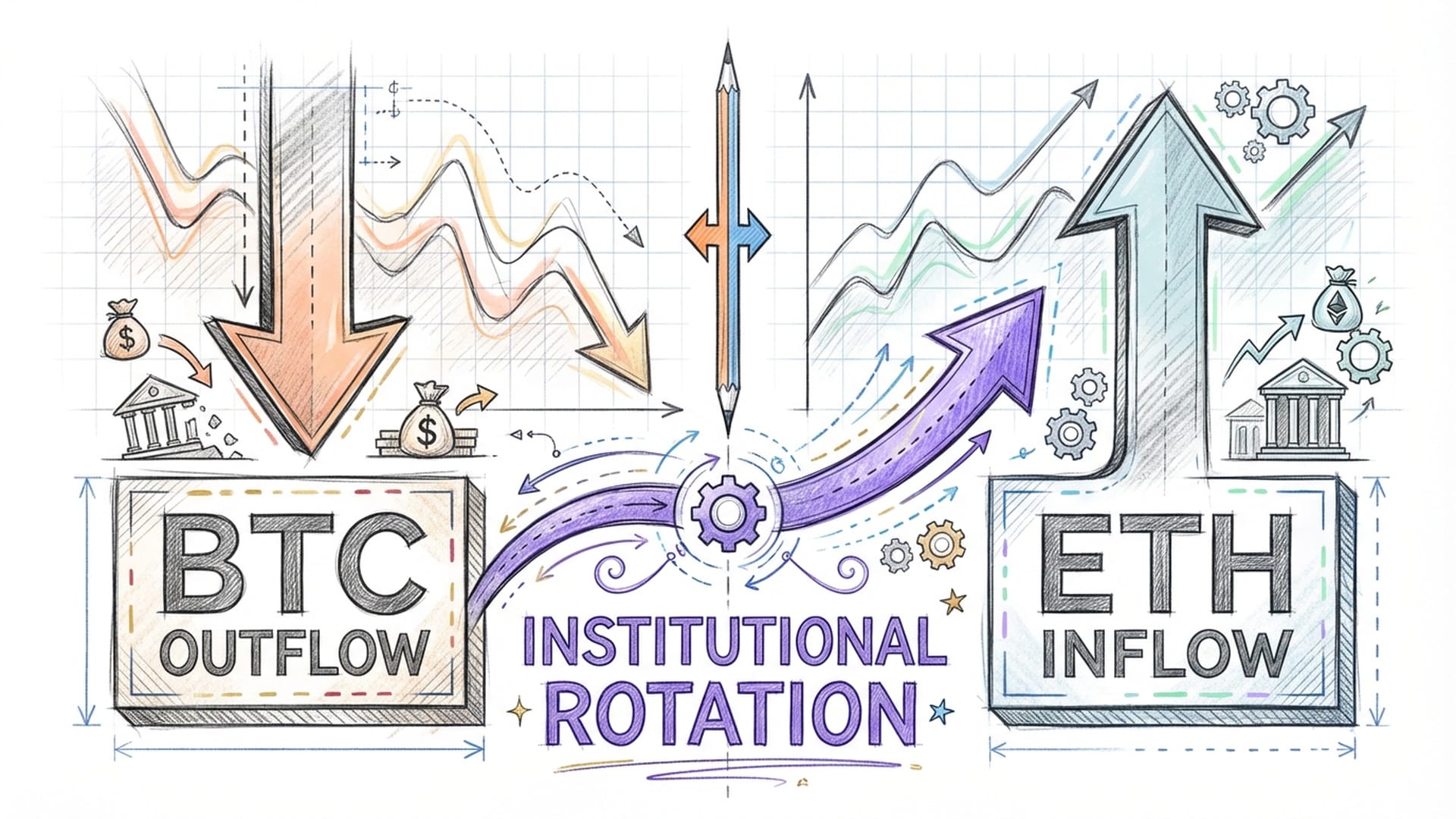

On a more visible front, institutional participation is evident in ETF flows and tactical "recalibration" trades. U.S. spot Bitcoin ETFs began 2026 with over a billion dollars in net inflows, providing a crucial anchor for Bitcoin's stability above the $90,000 mark. However, these flows are far from one-directional.

Single-day snapshots frequently reveal simultaneous Bitcoin ETF outflows and strong Ethereum ETF inflows. This isn't random market noise but rather a sophisticated pattern of tactical positioning by institutions. They are not merely adding or subtracting broad crypto risk; they are strategically rotating exposure between Bitcoin and Ethereum based on dynamic market conditions and evolving narratives.

This observation aligns with the growing consensus that the Q4 2025 sell-off was a necessary "recalibration" rather than the onset of a multi-year bear market. Esteemed research houses like Bernstein are now openly framing recent price action as a bottoming process, giving long-term allocators a crucial anchor.

It's vital to distinguish between two tracks of institutional engagement:

- The liquid, ETF-based exposure to large-cap digital assets like Bitcoin and Ethereum, which is widely discussed.

- The direct equity and venture exposure to foundational building blocks such as tokenization, stablecoin infrastructure, and settlement rails—exemplified by Barclays' investment.

These two tracks, while distinct, are interconnected, both signaling a deepening integration of crypto into traditional finance.

Cutting Through the Noise: Actionable Signals

To extract meaningful signals from this complex environment, a data-first approach is essential:

- Track issuer-level ETF flows: Flows can vary significantly between issuers, offering clues about institutional preferences and strategies.

- Monitor Bitcoin vs. Ethereum flow splits: Consistent Ethereum inflows simultaneous with Bitcoin outflows can indicate tactical rotation towards ETH-centric narratives like yield opportunities and DeFi.

- Map macro research calls to actual flows: Observe whether market reactions to major financial houses' upgrades or downgrades align with actual fund flow data.

- Deprioritize headline price targets: Generic price predictions without clear catalysts offer little analytical edge compared to tangible data like real-time flows, Total Value Locked (TVL) in DeFi, and product launches.

"Price predictions without context are just noise. For active traders navigating this complex environment, a data-first approach is paramount."

A Quiet Revolution Underway

The overarching theme is clear: the current crypto cycle is less about narrative-driven hype and more about the quiet, relentless build-out of infrastructure and distribution channels. Bitcoin benefits from sustained ETF demand, while Ethereum gains from tactical rotations and renewed institutional interest in its DeFi ecosystem. Crucially, the world's largest financial institutions are diligently wiring up the essential tokenized settlement and payment rails.

While market volatility is inherent, the highest-signal developments to watch include new moves by banks into stablecoin and tokenization infrastructure, significant shifts in Bitcoin versus Ethereum ETF flows, and the growth or stagnation of on-chain yield opportunities and real-world stablecoin usage tied to concrete payment flows.

For longer-term allocators, the fundamental message is constructive. Crypto's core value proposition—fast, programmable, and global settlement—is gaining consistent institutional backing. This strengthens the underlying foundation compared to previous cycles, which were often fueled more by excessive leverage and retail speculation.

Please note: This analysis is for informational purposes only and should not constitute financial advice. Any investment decisions should align with your individual risk tolerance, investment horizon, and overall portfolio strategy.

|  |  |  |