The Essence of Finance: Understanding Today's Bubble Risks Through 5,000 Years of History

From clay tablets 5,000 years ago to today's digital finance, the essence of finance remains unchanged—it's a time machine that moves value across time and space. Learn from the South Sea Bubble, Mississippi Bubble, and reflect on current market risks.

When people think of finance, images of Wall Street elites in expensive suits, dizzying stock market indices, or complicated banking products often come to mind. But these aren't the essence of finance.

After reading Yale Professor William Goetzmann's The Origins of Value: The Financial Innovations That Created Modern Capital Markets, I discovered a mind-blowing truth: Finance is not a modern invention—it's as ancient as human civilization itself, a core technology that laid the foundation for our civilization.

Yes, finance is a technology—as important as writing, law, and the wheel.

The Essence of Finance: A Time Machine

The essence of finance isn't money, but the manipulation of time. It's a tool that moves economic value back and forth along the timeline.

Imagine you're a Sumerian farmer 5,000 years ago. Spring planting season arrives, but your grain stores are depleted. What do you do? You borrow a bag of barley from a wealthy neighbor, promising to return one and a half bags after the autumn harvest. This simple act is finance—you're moving future value (autumn's grain) forward to spring. The extra half bag is interest, compensation for the time cost and risk.

This promise across time is the fundamental logic of finance.

The True Origin of Writing

But verbal promises aren't enough—what if someone reneges? So humans invented writing.

Archaeologists discovered cuneiform clay tablets in ancient Uruk. Most weren't myths or epics, but financial contracts: "So-and-so borrowed 5 sheep from so-and-so on such date, agreeing to return 6 sheep in one year." Both parties stamped the wet clay with their seals, then fired it—making the contract indestructible.

This small clay tablet is a time machine, fixing future promises in the present, making them credible and enforceable.

More intriguingly, Sumerians developed the complex sexagesimal (base-60) system. Our 60 minutes in an hour, 60 seconds in a minute, and 360 degrees in a circle all originate from this. Why such complex mathematics? To calculate interest, especially compound interest.

How Advanced Were Ancient Financial Innovations?

Ancient Athens: The "VC + Insurance" Combo

Athenian merchants wanted to trade in the Black Sea but lacked capital for ships and cargo. They invented bottomry loans: borrow from a wealthy investor, and if the voyage succeeds, repay with high interest (20-30%); but if a shipwreck causes total loss, the debt is forgiven—nothing needs to be repaid.

Sound familiar? This is essentially a combination of modern venture capital and insurance!

Venice's Tradable Bonds

Medieval Venice, to maintain its navy, forced wealthy citizens to lend money to the state, paying fixed annual interest. Better yet, these debt claims could be freely traded in markets. This is the prototype of modern bond markets.

Dutch Perpetual Annuities

16th-17th century Netherlands invented "perpetual annuities"—the government never repays principal but promises to pay interest forever, and this income right can be freely traded. Goetzmann found a Dutch perpetual annuity issued in 1648 that still pays interest today to Yale University. A 377-year-old financial contract remains valid.

Joint-Stock Companies: The Financial Tool That Changed the World

In 1602, the Dutch East India Company (VOC) became humanity's first true joint-stock company. Its revolutionary features:

- Open to all investors—from nobles to servants

- Limited liability—maximum loss is your stock investment

- Tradable shares—need money? Sell your shares

This design greatly dispersed risk while pooling society's wealth, profoundly changing world history.

Famous Historical Bubbles

The South Sea Bubble (1720, England)

South Sea Company stock surged nearly 10x in months. Absurd bubble companies emerged: "extracting gold from sunlight," "a great undertaking to be announced"—people invested in both!

When profits couldn't support valuations, stocks crashed. Even Newton lost heavily, leaving his famous quote: "I can calculate the motion of heavenly bodies, but not the madness of people."

The Mississippi Bubble (1720, France)

Simultaneously, France experienced an even crazier bubble. Scottish banker John Law created a state bank issuing paper money and the Mississippi Company. After wild speculation, confidence collapsed, banks faced runs, paper money became worthless, and the entire financial system paralyzed.

The Great Divergence: Why East and West Differ

China during Tang-Song dynasties had thriving finance: flying money (promissory notes), jiaozi (paper currency), Shanxi draft banks.

But after the Song dynasty, East-West financial paths diverged:

- Europe: Political fragmentation, constrained royal power, spawning independent private financial markets.

- China: Centralized power, state-dominated finance, suppressing private financial institution growth.

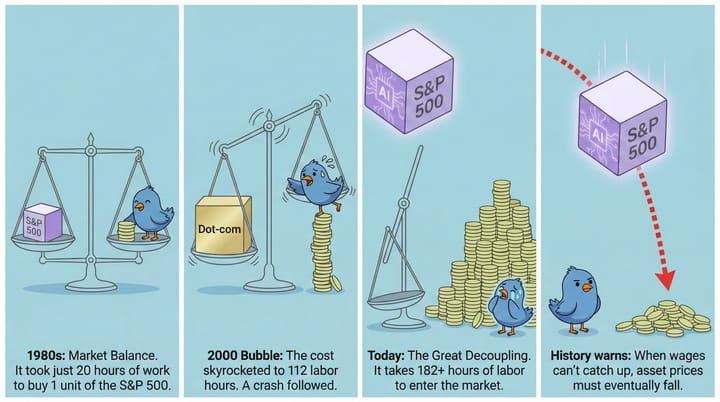

Reflection: Today's Bubble Risks

Reviewing 5,000 years of financial history, we see: Financial bubbles cyclically recur with striking similarities.

Common Bubble Characteristics:

- Rampant optimism: Belief that "this time is different"

- Rapid leverage expansion: Massive debt speculation

- Prices detached from reality: Valuations severely disconnected from fundamentals

- Rationality abandoned: Even smart people get swept up

- Sudden collapse: Panic selling destroys confidence

Current Risk Signals:

- Historic low interest rates: Pushing up all asset prices

- Record valuations: Stocks, real estate, cryptocurrencies

- Retail speculation frenzy: Social media amplifying herd behavior

- Unprecedented debt levels: Government, corporate, personal debt all high

- "This time is different": AI revolution, clean energy... but human nature never changes

What Should Ordinary People Do?

- Maintain humility: Financial markets are extremely complex

- Understand cycles: Boom and bust eternally cycle

- Beware of mania: Most dangerous when everyone's talking about it

- Diversify risk: Don't put all eggs in one basket

- Long-term perspective: Focus on long-term value creation

- Live within means: Leverage is a double-edged sword

Conclusion

From clay tablets 5,000 years ago to today's digital finance, humans have used finance to solve one problem: how to allocate value across time and space.

Finance is civilization's mirror, both an engine driving societal progress and potentially a source of catastrophe. Like Prometheus's fire, it brings both light and warmth, but misused, can ignite destructive flames.

We stand at a critical historical moment. Asset prices are elevated, debt is accumulating, new technologies promise a bright future, but uncertainty is also increasing.

History doesn't simply repeat, but it rhymes remarkably. Stay clear-headed, keep learning, maintain humility—this is the most valuable lesson from 5,000 years of financial history.

Data Sources: The Origins of Value: The Financial Innovations That Created Modern Capital Markets by William N. Goetzmann View Original Book

Author: Leo Wang (王利杰), Angel Investor | leowang.net | PreAngel Fund