The Global Economy's Hard Landing: Beyond the Soft Landing Myth

The global economy is facing a structural downturn, not a soft landing. Driven by a bullwhip reversal in inventory and a liquidity air pocket, the manufacturing recession signals tough times ahead, especially for North America. Prepare for heightened volatility and a prolonged period of economic ad

|  |  |  |

Navigating the Structural Shift: Beyond the Myth of a Soft Landing

For too long, the global economy has clung to the comforting narrative of a "soft landing" – a gentle transition back to normalcy after periods of disruption. However, as we find ourselves in late 2025, the undeniable data presents a starkly different picture. The landing is not soft; it is unequivocally structural, impacting the global economy, particularly the North American trade bloc, with the twin forces of a bullwhip reversal and a sudden liquidity air pocket.

This is not a prophecy of doom, but rather an objective synthesis of hard facts emerging from factory floors, logistics hubs, and volatile financial markets. The signal is uniform and clear: demand has evaporated, and risk aversion is now the paramount concern. To truly comprehend this new economic reality, we must delve into the underlying mechanics at play.

Manufacturing in Reverse: The Engine Stalls

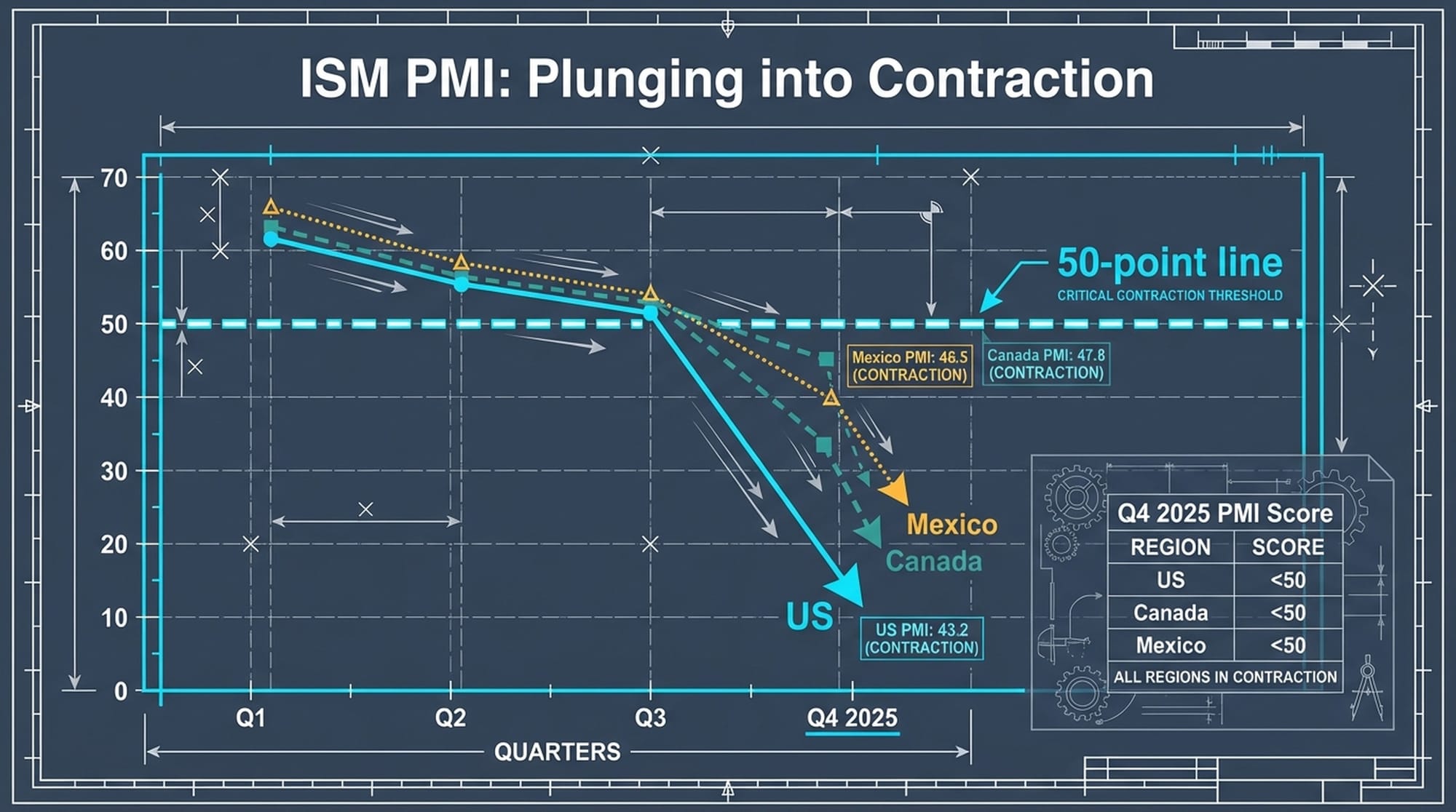

While often overshadowed by the service sector in developed economies, manufacturing remains the true engine of cyclical volatility. Currently, this engine is operating in reverse. The contraction observed in Q4 2025 is not a mere fluctuation but a fundamental misalignment between production capacity and actual market demand.

Data from the Institute for Supply Management (ISM) Manufacturing PMI for the United States, alongside S&P Global readings for Canada and Mexico, consistently show numbers plunging well below the 50-point threshold. This signals more than just a slowdown; it indicates a recessionary environment for industrial output across the region.

The Widening Chasm: New Orders vs. Inventories

Within this manufacturing data, a critical warning sign emerges: the widening gap between new orders and inventories. Historically, a decline in new orders coupled with swelling inventories foreshadows a future production cliff. Factories are compelled to cut output, not due to an inability to produce, but because they are inundated with existing stock.

"When new orders shrink while inventories swell, it’s a harbinger of a future production cliff. Factories must cut output, not because they can't make things, but because they’re drowning in what they’ve already made."

In November and December of 2025, new orders plummeted, resulting in a negative book-to-bill dynamic. This means factories are reliant on old orders, and as these backlogs deplete, the need for new production vanishes, leading inevitably to idle shifts and job reductions.

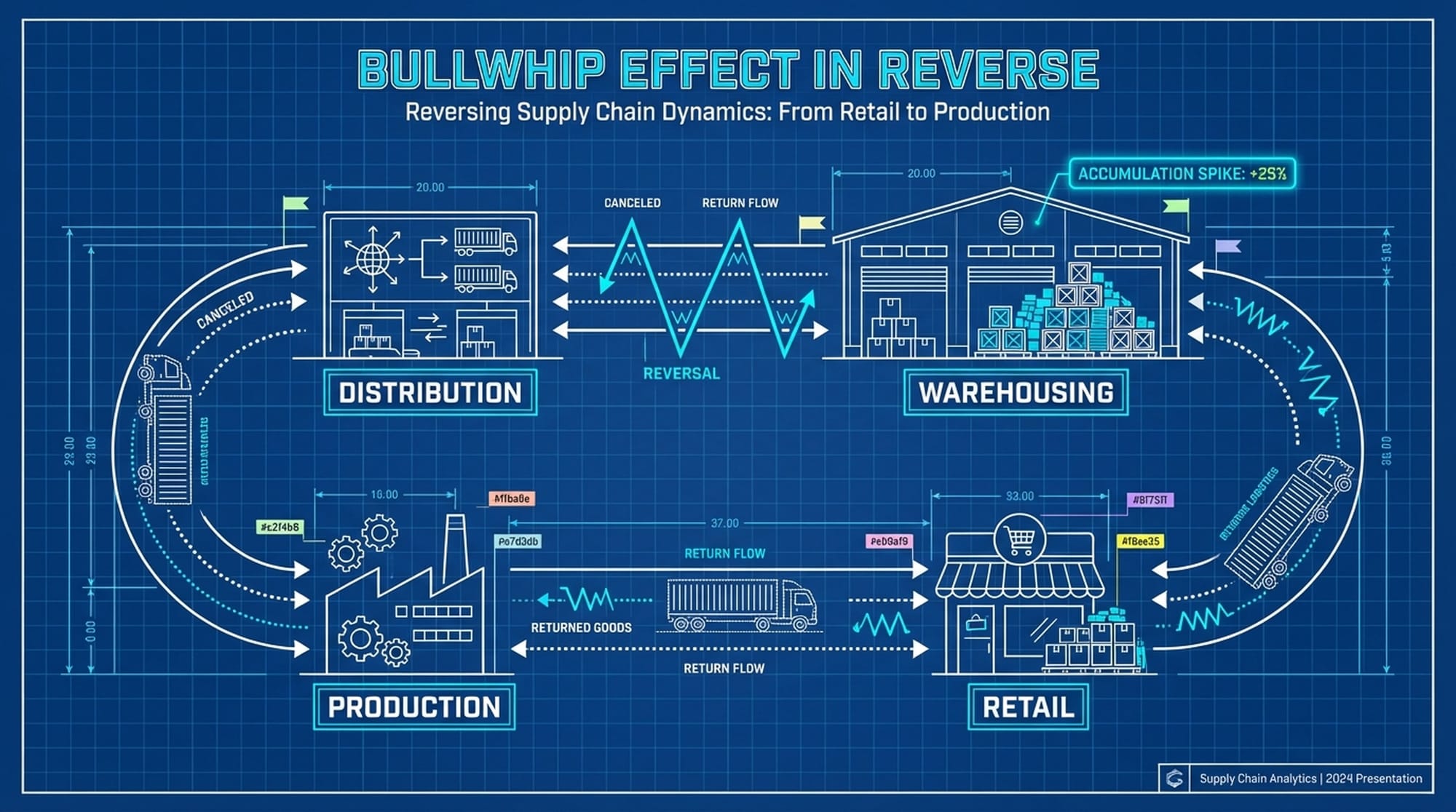

The Bullwhip Effect in Violent Reverse

The current situation is a vivid manifestation of the Bullwhip Effect in full, violent reversal. During the pandemic, procurement managers engaged in excessive ordering to secure supply against anticipated shortages. However, as lead times normalized in 2025, these same managers abruptly canceled future orders and rushed to de-stock. This sudden whiplash has caught manufacturers off-guard, leading to the sharpest drop in new orders since the pandemic's immediate aftermath.

This rapid shift highlights the profound impact of supply chain dynamics on economic stability.

Deflationary Pulse: Input Prices Collapse

Adding another layer of complexity is the collapse in the Prices Paid index. While inflation was a primary concern for years, late 2025 has seen a dramatic fall in the prices of key manufacturing inputs like copper, steel, and industrial chemicals. This might superficially appear positive, but in a low-demand environment, it signals a complete absence of pricing power.

Manufacturers are forced to liquidate inventory, sacrificing margins even with cheaper inputs. This deflationary pulse in the goods sector serves as a clear and ominous warning for corporate profitability in early 2026.

Regional Disparity: Pain Points Across North America

The economic weakness is not uniformly distributed but creates distinct regional pain points:

- American Midwest (Rust Belt): Highly dependent on auto and industrial machinery, this region is acutely sensitive to high interest rates.

- Canada: Faces a double bind of choked exports to the US and significant household payment shocks.

- Mexico: Experiences a paradox of nearshoring. While new factories are being built, older ones operate at low utilization due to dried-up US demand.

"This weakness isn't uniform. It's creating distinct regional pain points."

Global Linkages and External Pressures

This downturn is not confined to North America; it's a global phenomenon.

- China's Influence: Responding to its domestic property crisis, China is flooding global markets with cheap exports of steel, EVs, and solar components, effectively exporting deflation and compressing margins for manufacturers worldwide.

- Japan's Leading Indicator: A sharp drop in machine tool orders from North America, as observed in Japan, a key indicator for global capital expenditure, signifies a deeper issue. It suggests that factories are not only producing less today but are also canceling plans for future investment. This is not a temporary dip; it's a structural downturn.

The Inventory Supercycle: Unplanned Accumulation

A defining characteristic of this global economic fragility is unplanned inventory accumulation. This isn't a strategic decision but a defensive reaction to sales falling far below forecasts. This inventory overhang is the primary driver turning a demand slowdown into a production freeze.

Retailers, overwhelmed by softening consumer demand in Q3 2025, have drastically slashed orders for Q4 2025 and into 2026. This reduction is disproportionately larger than the actual drop in sales, creating a cascading effect throughout the entire supply chain.

Sector-Specific Gluts Amplifying the Crisis

The inventory crisis, while widespread, manifests differently across sectors:

- Automotive: Rapidly shifted from scarcity to glut. Dealer lots across the US and Canada are saturated, with Days Supply often exceeding the historical 60-day norm.

- Consumer Electronics and Retail: Facing similar challenges, leading to aggressive liquidation sales to clear warehouse space, albeit at the cost of destroying value.

- Industrial Components and Raw Materials: Warehouses are overflowing with essential materials like cold-rolled steel, copper wiring, and chemical feedstocks, underscoring the widespread nature of the inventory problem.

The Working Capital Trap and Corporate Distress

This pervasive inventory glut creates a working capital trap for corporations. Cash that should be allocated for investment, debt servicing, or shareholder returns is instead tied up in unsold goods. Small and medium enterprises (SMEs) are particularly vulnerable, struggling to repay short-term credit lines. Data from platforms like C2FO, which monitors working capital flows, reveals a surge in requests for early payments – a clear indicator of liquidity distress. Consequently, publicly traded companies should brace for a wave of earnings misses and lowered guidance for 2026.

The Divergent Labor Market: A Blue-Collar Recession

The labor market in late 2025 is exhibiting a striking divergence: a stark recession in goods-producing, blue-collar sectors contrasting with stagnation in service-producing, white-collar sectors. This masks the true severity of the downturn for specific demographics and regions.

For most of 2023 and 2024, manufacturers largely engaged in 'labor hoarding.' However, the depth and duration of this manufacturing contraction have reached a point where management's hand has been forced.

"The labor market in late two thousand and twenty-five is splitting in two: a stark recession in the goods-producing, blue-collar sectors, and a stagnation in the service-producing, white-collar sectors."

We are witnessing a tiered approach to workforce reduction:

- Temporary contract workers: The first to be let go.

- Elimination of overtime and reduction of shifts: The next phase.

- Permanent layoffs of core production staff: Increasingly visible as the crisis deepens.

The inventory destocking cycle has a direct and severe impact on transportation and logistics, leading to a freight recession characterized by plummeting trucking tonnage and rail carload volumes. Independent owner-operators are exiting the market at record rates, unable to cover operating costs.

Wage Pressure and White-Collar Stagnation

The weakness in the blue-collar labor market is exerting significant downward pressure on wage growth. The Phillips Curve, that historical economic relationship, is reasserting itself. Wage increases for manufacturing and logistics roles are gone, with new hire offers often lower than a year ago.

Even the white-collar sector, while not experiencing a mass-layoff crisis, is facing stagnation. The aggressive hiring seen in tech and finance has ceased. While AI advancements may be boosting stock prices, they are simultaneously contributing to hiring freezes in many administrative roles.

Financial Markets: Signals of Deep Trouble

Financial markets in late 2025 are acting as a sophisticated signaling mechanism, with observed volatility driven by the stark realization of structural economic weakness.

- Cryptocurrency Market: Serving as a highly sensitive liquidity gauge, the crypto sell-off indicates investors are moving to cash.

- Bond Market: The inverted yield curve, now steepening, is unequivocally "screaming recession."

- Corporate Bond Spreads: Widening significantly, reflecting an increase in perceived default probability.

Policy Constraints and Geopolitical Headwinds

The ability of policymakers to effectively respond to this economic weakness is severely constrained by the legacy of the previous crisis (inflation) and ongoing geopolitical tensions.

- The Federal Reserve's Dilemma: The US Federal Reserve is in a precarious position. Monetary policy acts with a lag, meaning the rate hikes of 2023 and 2024 are impacting now. The Fed fears cutting rates too early and reigniting inflation, risking a significant policy error.

- Geopolitical Friction: Trade barriers remain high, and the US, Europe, and China are locked in a subsidy race and tariff war, further exacerbating global economic fragility.

"The ability of policymakers to respond to this economic weakness is severely constrained by the legacy of the previous crisis – inflation – and current geopolitical tensions."

Crucially, China, unlike in 2008 when it provided global stimulus, is now focused on resolving its own domestic debt problems. The "China Put" that previously rescued the global economy is not coming to the rescue this time, leaving global markets without a significant external stimulus as they confront a structural downturn.

Outlook for 2026: The Downside Resolution

What does this comprehensive data analysis suggest for the first half of 2026? The most probable scenario is a two-speed economy that ultimately converges to the downside. The manufacturing recession is already a reality, representing a hard landing. The critical question now is whether it will drag the service sector down with it.

We anticipate this transmission will occur primarily via income effects. The inventory glut is expected to take at least two to three quarters to clear. Financial stress will likely compel the Federal Reserve to act, with a pivot to rate cuts anticipated in Q1 2026. However, a sustained recovery in asset prices is only likely to materialize once these rate cuts successfully stabilize the liquidity environment, probably in the latter half of 2026.

Here's a snapshot of the anticipated timeline:

- Manufacturing Recession: Here now, a hard landing.

- Service Sector PMI: Expected to drop below 50 in Q1-Q2 2026.

- Inventory Glut Clears: 2-3 quarters (H1 2026).

- Fed Rate Cut 'Pivot': Likely Q1 2026.

- Sustained Asset Recovery: Latter half 2026.

Conclusion: Time for Decisive Action

The global economic weakness of late 2025 is not theoretical; it is grounded in unequivocal data. It is the inevitable consequence of distortions from the pandemic and subsequent policy responses. The convergence of the Bullwhip Reversal in inventory and the Liquidity Air Pocket in finance has created a potent, unavoidable force in the goods economy.

For all stakeholders, the message is clear: the era of easy growth and pricing power is over. The focus must decisively shift towards balance sheet preservation, meticulous liquidity management, and navigating a period of heightened volatility. The data strongly suggests that the bottom of this cycle has not yet been reached, and the risks for early 2026 remain skewed to the downside.

The soft landing narrative has expired. The global economy is now bracing for the full impact of an industrial correction. The time for denial is over. The time for clear-eyed, decisive action is now.

|  |  |  |