The Killing Line: Unmasking America's Hidden Poverty Crisis

Nearly half of American households are teetering on a financial precipice, unacknowledged by outdated federal poverty metrics. Discover the 'ALICE' threshold – Asset Limited, Income Constrained, Employed – revealing the true cost of economic vulnerability for millions of working families.

|  |  |  |

The Killing Line: Unraveling America's Hidden Poverty Crisis

The common perception of poverty in America is deeply flawed. While official statistics might paint a picture of economic growth, a sobering reality persists beneath the surface: nearly half of all American households are financially precarious, constantly battling to stay afloat. These are families where both parents often work full-time, in roles deemed "essential," yet basic necessities remain out of reach. They are not classified as "poor" by governmental standards, but they are undoubtedly struggling. This isn't merely an observation; it's an unraveling of the myth that hard work inherently guarantees a decent life in America. It's a deep dive into what is increasingly being recognized as "The Killing Line" – the ALICE threshold.

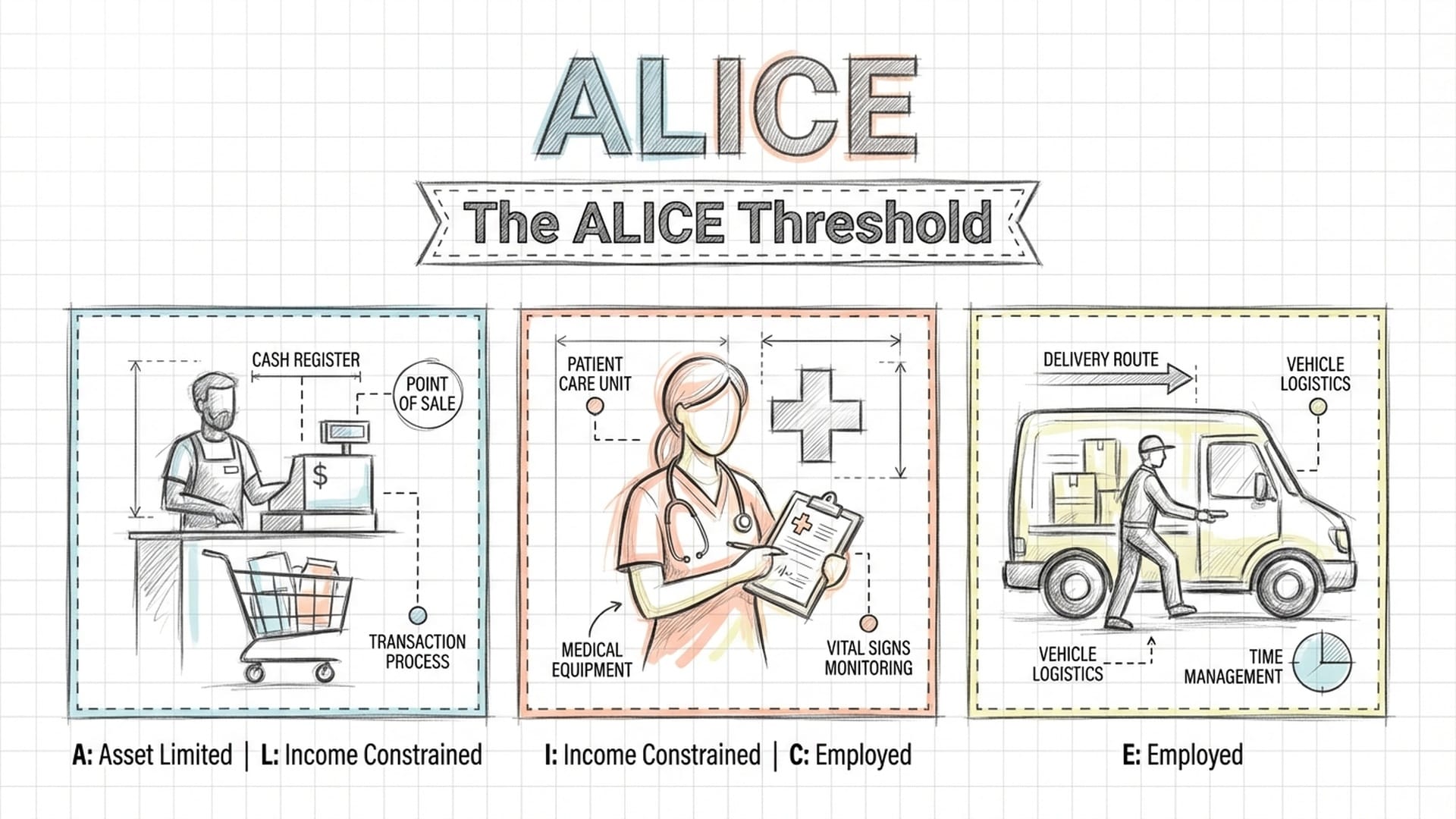

Understanding ALICE: Asset Limited, Income Constrained, Employed

The acronym ALICE stands for Asset Limited, Income Constrained, Employed. These individuals and families are not a fringe group; they are the backbone of our communities – the cashiers, nurses, childcare providers, and essential workers who keep the country running. Their struggles reveal profound fault lines in American society, exposing the true cost of economic vulnerability and the hidden poverty silently eroding the American dream.

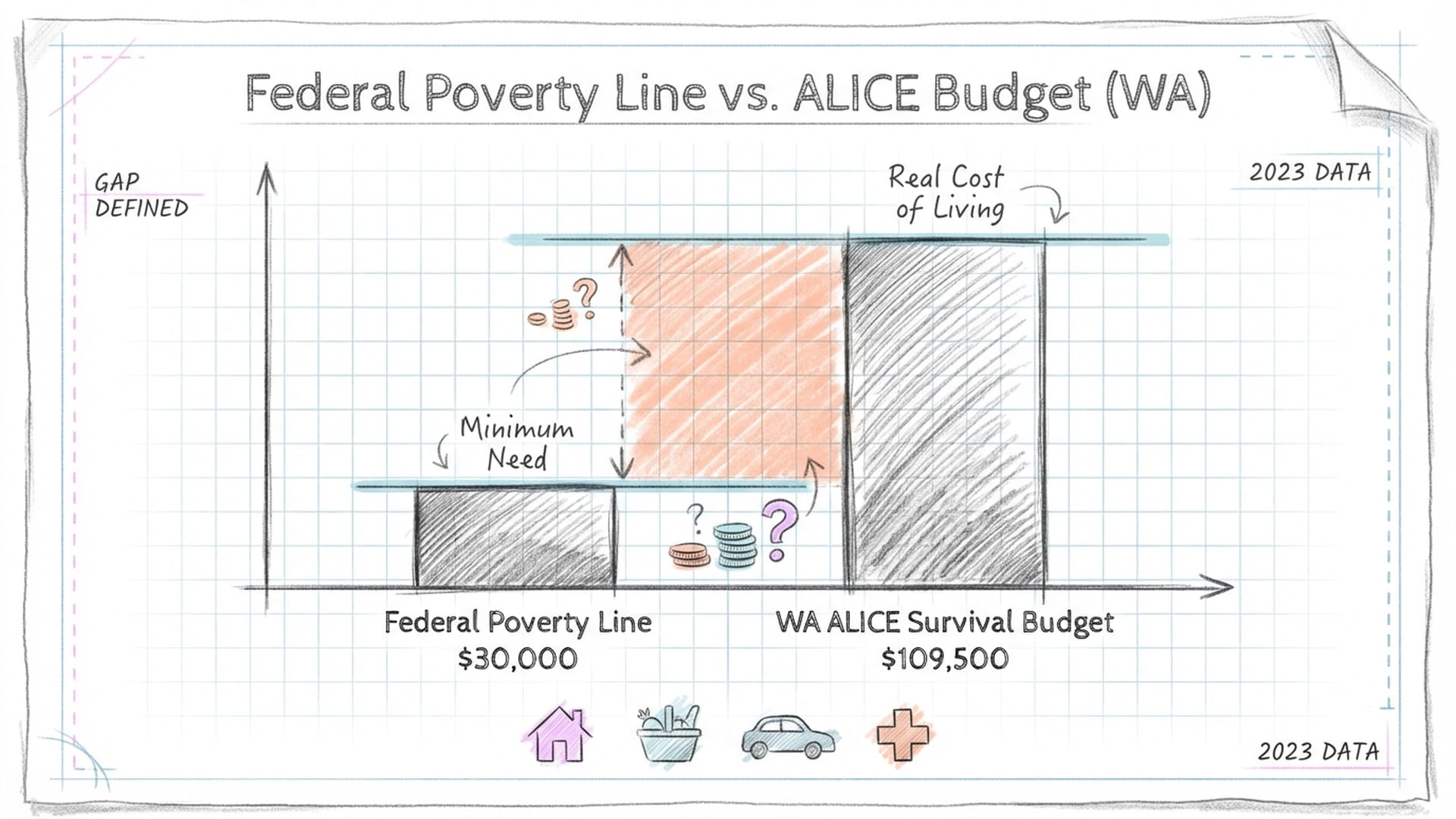

For far too long, our understanding of poverty has been tethered to an outdated metric: the Federal Poverty Line (FPL). Conceived in the 1960s, the FPL was based on the premise that families spent approximately one-third of their income on food. Thus, a basic "economy food plan" was multiplied by three to establish the poverty threshold.

However, our spending habits have undergone a seismic shift since the 1960s. While food costs have become relatively cheaper, expenses such as housing, childcare, healthcare, and transportation have skyrocketed, becoming the dominant financial burdens for modern families. Childcare, once an afterthought with robust community support systems, is now often the single largest expense for many young families, frequently exceeding rent or mortgage payments. The FPL utterly fails to account for this fundamental change in household economics.

"The FPL, a relic of the 1960s, tragically misses the mark in today’s economic landscape. Its one-size-fits-all approach ignores the escalating costs of housing, childcare, and healthcare, leaving millions in a statistical blind spot."

Another critical flaw of the FPL is its uniformity across 48 states. In 2023, the federal poverty line for a family of four hovered around $30,000. While this might barely suffice in a rural part of Mississippi, it’s woefully inadequate in high-cost-of-living areas like San Francisco, Seattle, or New York City, where $30,000 often wouldn't even cover a year's rent. Millions of families in these metropolitan areas earn above the FPL, technically making them "not poor," yet they are drowning in debt, chronic anxiety, and impossible financial choices. The FPL doesn't just fail to reflect reality; it actively distorts it, obscuring the struggles of countless individuals.

Deconstructing ALICE: The Three Pillars of Precarity

The ALICE framework offers a more accurate, nuanced portrait of American working-class struggles. Let's break down its components:

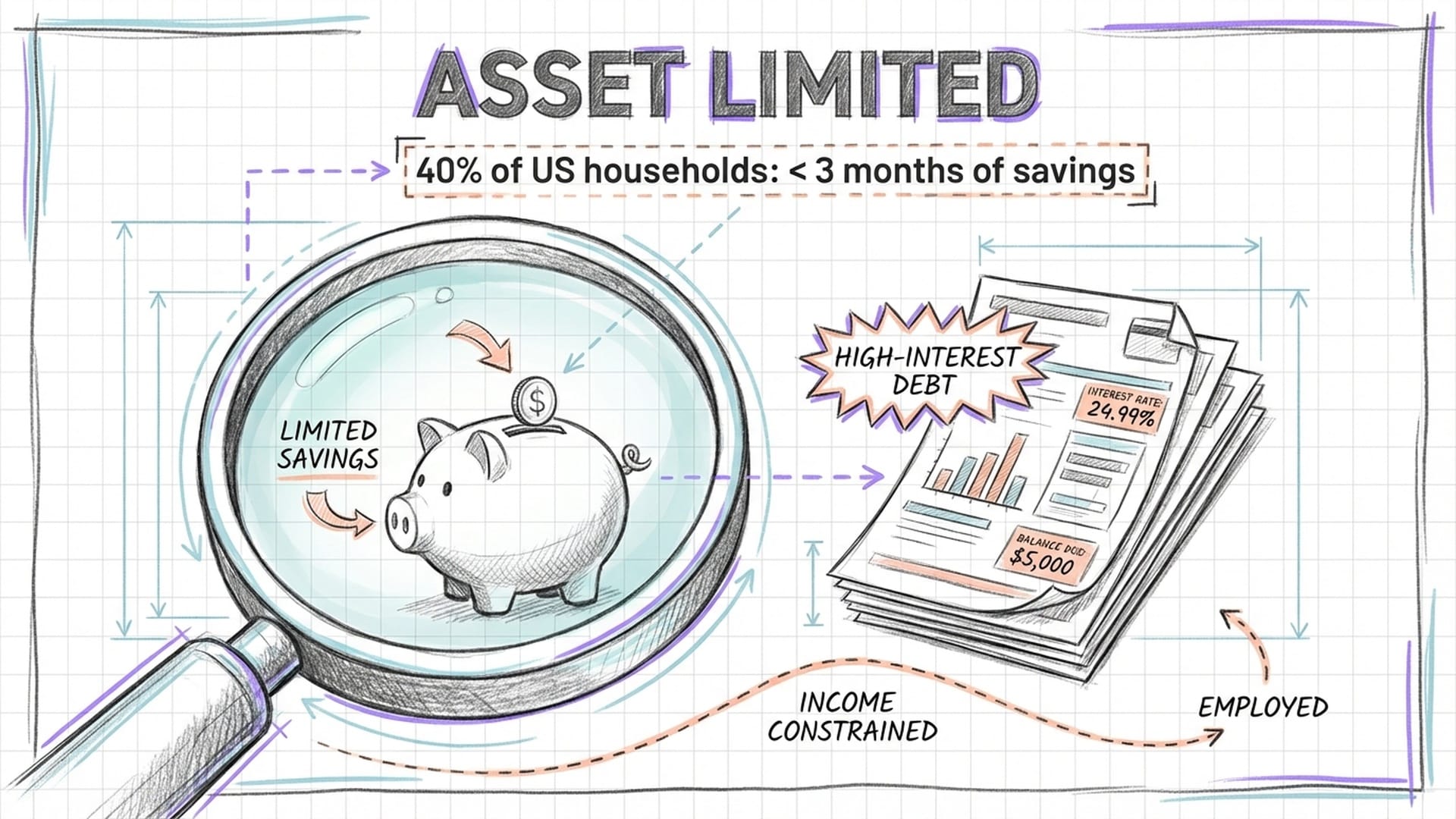

1. Asset Limited

This pillar highlights a critical, yet often overlooked, aspect of financial stability: net worth and liquid assets. ALICE families, despite having some income, possess very little to no financial cushion. They might own a car or even a home (with a significant mortgage), but they lack the liquid assets crucial for weathering unexpected financial shocks.

Consider this: a sudden car repair, an unforeseen medical bill, or a broken household appliance can trigger a catastrophic ripple effect. Without savings, these families are forced into high-interest loans, maxing out credit cards, or falling behind on other essential payments. Research indicates that approximately 40 percent of American households lack sufficient savings to cover three months of basic living expenses if their income abruptly stops. This is the stark reality of liquid asset poverty.

2. Income Constrained

This is perhaps the most cruelly ironic aspect of the ALICE predicament. Because their income is above the FPL, ALICE families are officially deemed "not poor." This supposed advantage, however, is a deceptive trap, as it often excludes them from vital government assistance programs. They earn too much to qualify for SNAP food stamps, Medicaid, or housing subsidies, yet earn too little to afford these basic services at market rates.

They are caught in a "benefits cliff" paradox, where a modest increase in income can lead to a disproportionate loss of benefits, ultimately making them financially worse off. This system disincentivizes ambition and traps families in a perpetual cycle of financial instability.

3. Employed

The most heartbreaking detail of the ALICE definition is the word "Employed." These are not individuals reliant on government handouts; these are people working diligently, often full-time, sometimes juggling multiple jobs. They are the indispensable workforce at our grocery stores, office buildings, delivery services, and childcare centers. While lauded as "essential workers," they often bear the brunt of economic injustice due to low wages, part-time hours, and minimal or non-existent benefits such as paid sick leave, health insurance, or retirement plans. Their unpredictable schedules further complicate financial planning and childcare arrangements, creating a vicious cycle of time poverty and stress.

"ALICE households are defined by their status as Asset Limited, Income Constrained, and Employed. This isn't a demographic of those unwilling to work; it's a testament to a system where hard work no longer guarantees stability."

The Household Survival Budget: A Stark Reality Check

The Household Survival Budget forms the analytical core of the ALICE threshold. This isn't a budget designed for comfort or even a typical middle-class lifestyle; it represents the bare-minimum, physically necessary expenses for survival. It meticulously accounts for local market costs down to the county level, acknowledging the vast difference in living expenses between, say, Des Moines and Washington D.C. Every component is calculated with an excruciating attention to frugality:

- Housing: Based on the 40th percentile of Fair Market Rent, assuming a family rents one of the cheapest homes available, typically a two-bedroom apartment for a family of four. This provides purely functional shelter, often in less desirable neighborhoods.

- Child Care: Utilizes the lowest registered market rates for family childcare homes, not the generally more expensive licensed centers. For families with two children, these costs can range from $1,200 to $2,500 monthly. This is a monumental omission from the FPL.

- Food: Relies on the USDA's

Thrifty Food Plan, designed for short-term emergency nutrition. It assumes every meal is cooked from scratch, with no processed foods, takeout, or dietary considerations. - Transportation: Often assumes car ownership due to limited public transit, covering gas, basic maintenance, and minimum liability insurance, but rarely car loan payments. A car is often a lifeline for ALICE families, not a convenience.

- Healthcare: Covers the cost of the cheapest

bronze planhealth insurance on the Affordable Care Act marketplace, plus estimated out-of-pocket expenses, frequently excluding dental, vision, or long-term care. - Technology: Includes a basic smartphone plan and internet access, recognizing these as modern essentials for job searches, education, and banking.

- Miscellaneous & Taxes: A meager 10% of all other expenses is allocated for clothes, cleaning supplies, and minor repairs, leaving absolutely no room for error or unforeseen circumstances. Taxes include federal, state, and FICA.

Consider the stark contrast: In Washington state, the ALICE survival budget for a family of four is an astonishing $109,500. The federal poverty line? Just $30,000. This massive disconnect illustrates how families earning over three times the official poverty line can still face a constant deficit. This chasm is the very essence of hidden poverty.

The Staggering Scope of ALICE

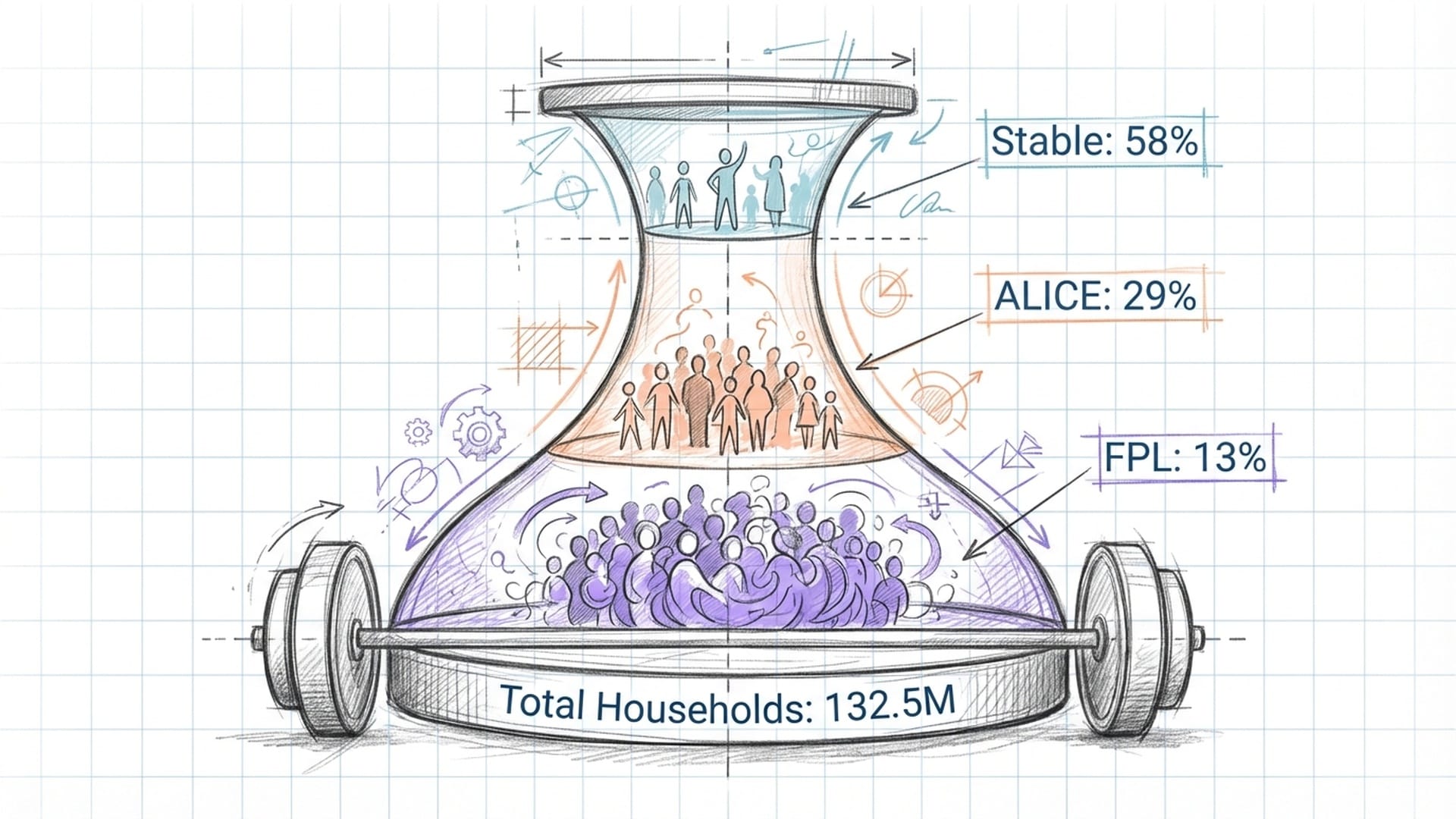

According to the latest report from United For ALICE (2022-2023), a staggering 42 percent of American households fall below the ALICE threshold. Out of 132.5 million U.S. households:

- 13 percent are below the federal poverty line.

- A massive 29 percent are ALICE households.

That's 55.5 million households – over a third of the nation – struggling to afford basic living costs. This situation is worsening; pre-pandemic data from 2019 showed 50.4 million households below the threshold, a number that has increased by over 5 million despite temporary COVID-era aid. The end of stimulus checks and expanded child tax credits, coupled with surging inflation, has plunged millions back into precarity.

This data fundamentally challenges the traditional three-tiered view of American society (poor, middle class, rich). Instead, we are witnessing a "barbell-shaped" society, with explosive wealth at the top and a massive, insecure population at the bottom and in a shrinking middle. The 29% of ALICE families, often mislabeled "middle class," are economically much closer to those officially living in poverty. One unexpected expense—a flat tire, a sick child, a missed shift—can send them into a financial freefall.

Systemic Inequalities Magnified

The ALICE data also lays bare the enduring impact of systemic inequality:

- Racial Disparities: While ALICE households span all demographics, their distribution is highly uneven. 60% of Black households nationwide are below the ALICE threshold, and 50-60% of Hispanic households face similar circumstances, often due to overrepresentation in low-wage industries. While a lower percentage, white Americans still constitute the largest absolute number of ALICE families due to their larger population share, underscoring that economic vulnerability, though exacerbated by race, is fundamentally a class issue.

- Family Structure: Single-parent households, particularly those headed by single mothers, face immense risks. In Louisiana, an alarming 82% of single female-headed households with children live below the ALICE threshold, highlighting the near-impossible task of a single income covering high childcare and housing costs without robust social support.

- Aging Population: A growing number of seniors are becoming ALICE. In many states, almost half of households over 65 live below the threshold. Social Security often pushes them just above the FPL, but it's woefully inadequate for soaring healthcare and long-term care expenses, forcing many to work past retirement or make impossible choices between food and medicine.

The Cruel Deception of CPI: The ALICE Essentials Index

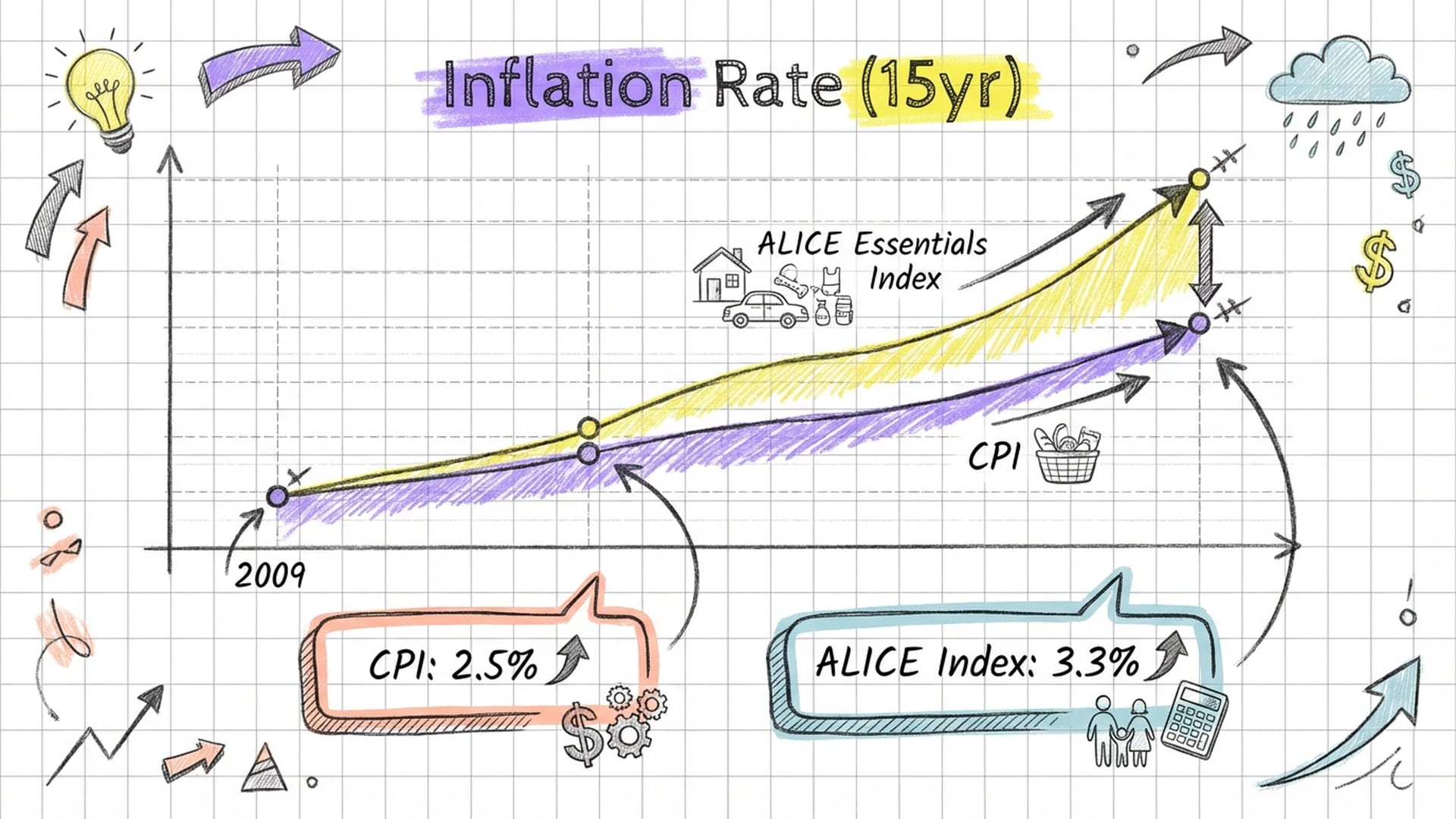

When discussing inflation, the Consumer Price Index (CPI) is the go-to metric. However, for ALICE families, CPI is a cruel deception. It's an aggregate measure for a basket of goods that includes new cars, electronics, and entertainment – items often irrelevant to low-income households. While CPI might reasonably track purchasing power for wealthier families, it masks the specific, brutal inflationary pressures on the working poor.

United For ALICE developed the ALICE Essentials Index to track the prices of the six core budget categories relevant to ALICE households: housing, childcare, food, transportation, healthcare, and technology. What it reveals is deeply unsettling: the poorer you are, the higher your actual rate of inflation.

Over the past 15 years, the ALICE Essentials Index has grown by 3.3% annually, compared to the CPI's 2.5%. This long-term inflation scissor means that even if ALICE workers receive raises that track CPI, their real standard of living continues to erode year after year. The pandemic amplified this disparity, with the Essentials Index soaring to 7.3% annually from 2021-2023, while CPI was 6.1% for the same period. Housing and childcare were primary drivers. This phenomenon represents an invisible tax on the poor – the less you have, the more expensive your life becomes.

"The ALICE Essentials Index tells a chilling truth: the traditional CPI doesn't reflect the brutal reality of inflation for low-income families. For them, every dollar buys less, eroding their purchasing power year after year."

The impact is profound. A retail salesperson, for instance, has seen their cumulative purchasing power plummet by approximately $26,000 between 2007 and 2022, despite wage increases. This is almost an entire year's pre-tax income, gone. It exemplifies how "working hard" for ALICE individuals often leads not to a better life, but a grueling race on an accelerating treadmill.

Geographic Realities: ALICE Across America

Location dramatically shapes the ALICE experience, revealing diverse economic landscapes with shared struggles:

- Florida: With 47% of households below the ALICE threshold, Florida embodies the "low-tax, low-welfare, low-wage" model. Its tourism-driven economy creates abundant low-wage jobs, but surging housing costs and spiraling home insurance (due to natural disasters) create a

Sunshine Taxfor the working class. In Miami-Dade County, 54% of households are ALICE, with a survival budget near $90,000, three times the FPL. - California: Forty-six percent of California households are ALICE. Despite being the world's fifth-largest economy and home to immense wealth, the state grapples with the nation's most severe housing crisis. Nearly 40% of families spend over 30% of their income on housing, a figure that exceeds 50% for low-income families. ALICE families often resort to

overcrowdingto cope, demonstrating that poverty here is often not about a lack of effort, but a fundamental mismatch between wages and costs. - Washington State: Thirty-eight percent of households are ALICE, but the survival budget for a family of four is an astonishing $109,500 – one of the highest in the nation. Seattle, home to tech giants, exemplifies how high-paid tech workers can drive up costs for everyone else, pushing service workers into distant suburbs, increasing transportation costs and

time poverty. The chasm between the $30,000 FPL and the $109,500 reality starkly illustrates the inadequacy of federal aid.

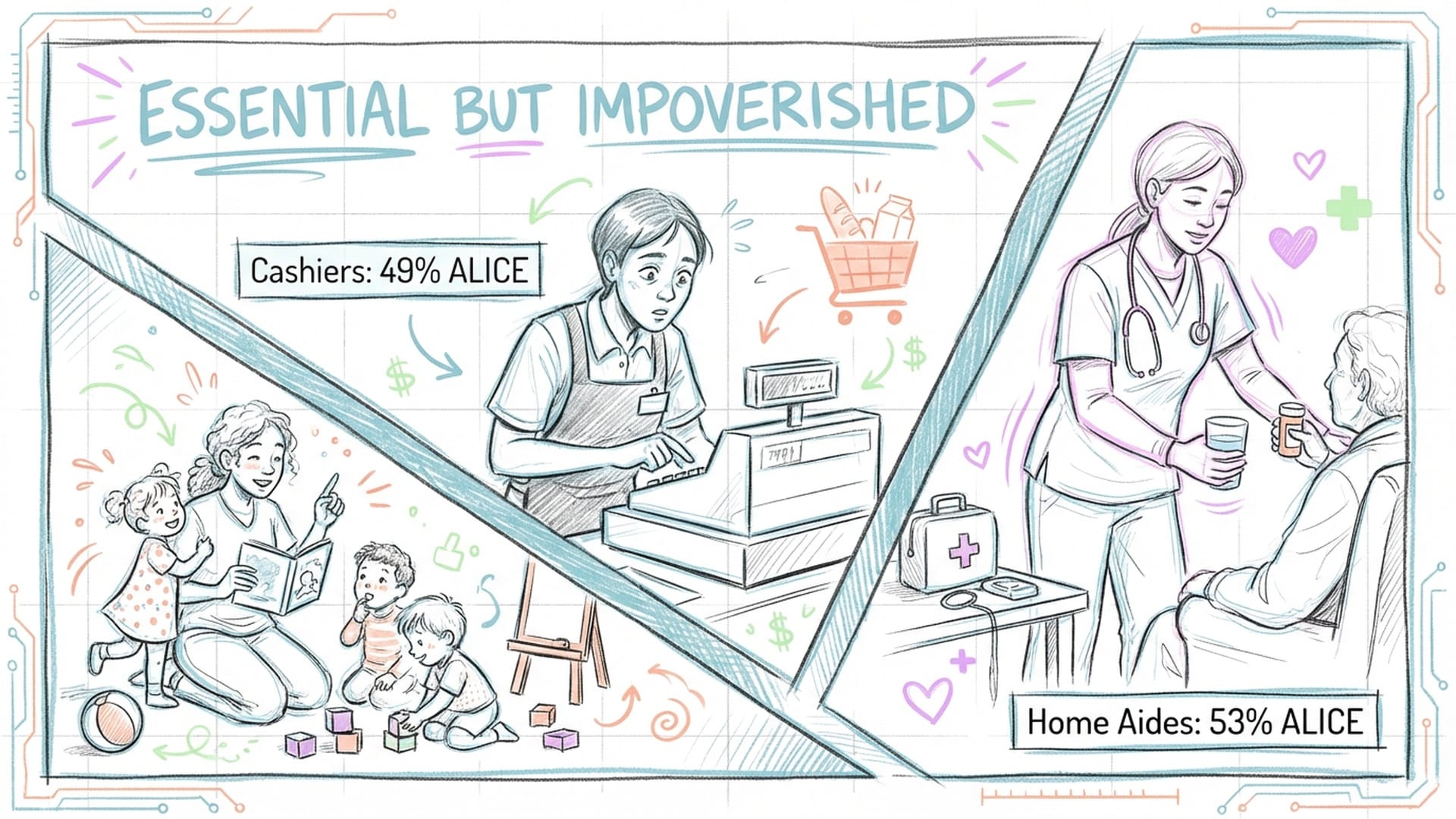

The Essential but Impoverished Paradox

Who are the faces of ALICE? They are not invisible; they are all around us, often occupying roles we depend on daily:

- Cashiers: 49% live below the ALICE threshold, with median wages barely above federal minimum wage. They scan thousands of items they often cannot afford.

- Home Health and Personal Care Aides: Over 53% of these critical workers, predominantly women of color, are ALICE. They care for our most vulnerable, performing emotionally and physically demanding work deemed "unskilled," often without health insurance or paid sick leave.

- Childcare Workers: Ironically, these individuals who enable other parents to work often earn median wages (below $15/hour) insufficient to afford childcare for their own children. Their purchasing power has shrunk over the last decade due to spiraling housing and childcare costs.

During the pandemic, these individuals were hailed as "essential workers." Yet, the ALICE data reveals the hollowness of that praise. Once pandemic subsidies ended, their economic situation, far from improving, worsened. Society relies on their labor, but refuses to pay the "true cost" of their survival. This "essential but impoverished" paradox defines America's broken labor market.

Structural Traps: Benefits Cliffs and Liquidity Crises

ALICE families are not struggling due to a lack of effort but are trapped by systemic issues:

- The Benefits Cliff: Many social welfare programs have strict income caps (typically 130-200% of the FPL). Earn just one dollar over that line, and benefits don't gradually reduce; they vanish instantly. A single mother accepting a $3,000 raise might find herself losing $8,000 in childcare subsidies and $2,000 in food stamps, resulting in a net loss of $7,000. This forces ALICE workers to refuse raises, overtime, or promotions – a rational survival strategy that actively prevents upward mobility.

- The Liquidity Crisis: Beyond income, ALICE families face a profound

asset crisis. The Federal Reserve reports that approximately 37% of adults couldn't cover a $400 unexpected expense without borrowing or selling something. ALICE families walk a financial tightrope; a car breakdown means no work, no pay, delayed bills, a hit to their credit score, high-interest loans, and a debt spiral. This complete absence of a financial buffer makes the so-called "middle class" incredibly fragile, perpetually on the brink of destitution.

The Far-Reaching Consequences: A Public Health and Social Crisis

The ALICE phenomenon extends far beyond economics; it's a public health crisis and a social development crisis. Chronic financial stress inflicts irreversible damage on individuals and communities:

- Physical Health: Financial insecurity directly correlates with declining physical health. ALICE families often

delay care, ignoring minor ailments until they become emergencies, leading to higher long-term healthcare costs and reduced productivity. - Toxic Stress: Constant worry about rent and food keeps the body flooded with stress hormones. For children, this

toxic stressdamages brain development, impacting cognitive abilities, emotional regulation, and leading to long-term mental health challenges and poorer earning potential as adults. - Food Insecurity: Despite having income, food insecurity is rampant among ALICE groups. In Hawaii, 46% of ALICE households struggle to get enough food. Lacking the budget and time for healthy, fresh food, they often rely on cheap, high-calorie processed options, contributing to higher rates of obesity and diabetes, creating a vicious cycle of poverty and disease.

Reshaping America's Future: Beyond the Tipping Point

The ALICE data definitively proves that the American social structure is undergoing a fundamental transformation. The post-WWII ideal of a "football-shaped" society with a large, stable middle class is giving way to a "dumbbell-shaped" society. The traditional "middle class dream" – homeownership, savings, annual vacations – is becoming an unattainable fantasy for many. In high-cost states, earning $100,000 might merely be the baseline for survival, not a mark of comfort.

The "truly poor" and the ALICE classes are merging into a massive new underclass, comprising 40-50% of the population – people with jobs, but no wealth accumulation and no upward mobility. This 42% of households living on the financial precipice represents an immense macroeconomic risk. Their limited purchasing power actively restricts non-essential spending, throttling the consumer-driven U.S. economy. Their zero-sum resilience means another pandemic, natural disaster, or economic recession could instantly decimate half the population's ability to pay bills, triggering mass foreclosures, evictions, and a collapse in demand. Our societal resilience has been critically weakened.

The ALICE threshold is more than a statistical line; it's a societal fault line. It exposes the true crisis hidden by official poverty data: in one of the wealthiest nations on Earth, nearly half of all families live in perpetual, structural financial anxiety. For the working class, the core promise of the American dream – that hard work leads to a decent life – is shattered.

If we fail to fundamentally rethink our social safety nets, address the benefits cliff, drastically increase minimum wages to match the ALICE index, and use public policy to aggressively lower housing and childcare costs, this endemic hidden poverty will continue to corrode the foundations of American society. This will inevitably lead to deeper political polarization, social instability, and generational poverty.

The story of ALICE is the story of America's future sustainability. The decision of whether to continue ignoring the struggles of half our population or to choose to reshape an inclusive economic system will ultimately determine the future direction of this nation.

|  |  |