ByteDance: The Undervalued AI Giant Hiding in Plain Sight

Is ByteDance, the company behind TikTok, the most terrifyingly effective AI company on the planet? Discover why its valuation makes no sense and how it's poised to become an unrivalled global tech leader.

|  |  |

Decoding the Alpha: Why ByteDance is the Unseen AI Powerhouse

Most discussions about leading AI companies quickly gravitate towards obvious players like OpenAI or Google. OpenAI, with its transformative ChatGPT, redefined what we thought AI could do. Google, as the architect of much of the internet, naturally commands respect in the AI space. Even hardware giants like NVIDIA get a mention, driven by their critical role in supplying the computational backbone for AI development.

But what if the true "Alpha" of the AI world operates not in the realm of robotics or cosmic colonization, but is cleverly disguised behind a vibrant, teenage dance app? Yes, we're talking about ByteDance, the parent company of TikTok. While many might dismiss it as mere "brainrot" or trivial 15-second videos, this dismissive perception is precisely why they are winning.

While the rest of the tech industry loudly proclaims the future, ByteDance has quietly, yet significantly, constructed one of the most profitable and data-rich AI infrastructures in history. This monumental achievement unfolded while the world was absorbed in an endless scroll. We are witnessing a valuation anomaly that defies conventional logic – a veritable glitch in the matrix.

"If you think this is just a story about social media, you are missing the point. This is a story about the biggest arbitrage opportunity in the history of private tech."

The Algorithmic Grip: Losing to a Supercomputer

Consider a common scenario: it's late, you pick up your phone for "just a minute," and suddenly, hours have vanished. You feel a pang of guilt, a sense of lacking self-control. But here's a crucial insight: that wasn't a lack of willpower. That was you losing a chess match against a supercomputer.

The alluring "feed" presented to you isn't random. It's a meticulously crafted feedback loop, powered by one of the most aggressive and sophisticated recommendation algorithms ever developed. This algorithm is the engine of a high-performance Ferrari, currently being valued at the price of a modest Honda Civic.

The Unjustifiable Valuation Anomaly

In the opaque world of secondary markets, where significant financial movements truly occur, ByteDance is currently trading like a distressed asset – a company on the brink of obsolescence. Its valuation hovers around $300 billion. While this might sound substantial, a deeper look at the numbers reveals a stark contrast.

In 2024 alone, ByteDance generated an astounding $155 billion in revenue. This figure places them in direct competition with tech behemoths like Meta, breathing down Zuckerberg's neck in terms of sheer financial scale.

However, the valuation disparity is staggering:

- Meta typically trades at roughly 8 to 9 times its revenue.

- ByteDance, despite its comparable scale and superior engagement metrics, is trading at a mere 2 times revenue.

This incongruity begs the question: why? The answer lies in fear – specifically, geopolitical concerns.

"The market is staring at a diamond and calling it a piece of glass."

This situation forces investors and analysts to confront a critical query: Is the market's assessment accurate, or is it misinterpreting a genuinely valuable asset? The financials provide a compelling narrative that transcends mere speculation.

Printing Cash and Building an AI Fortress

ByteDance isn't just generating revenue; it's printing cash. In 2024, the company is estimated to have achieved a net profit of $33 billion. What's more remarkable is that this figure is intentionally suppressed. ByteDance deliberately smashed its own margins, not due to poor performance, but by aggressively reinvesting.

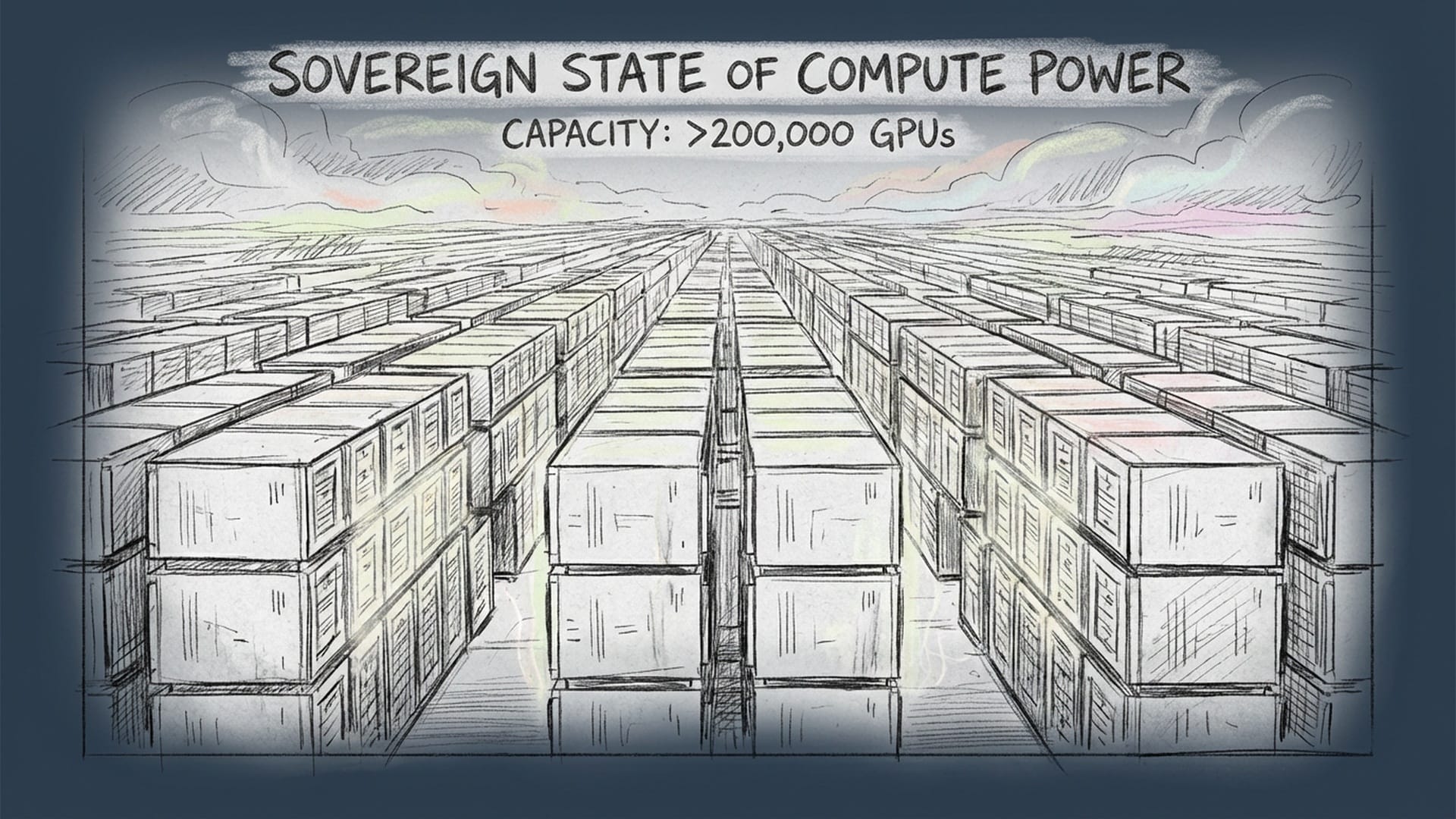

Where did this capital go? Straight into CAPEX (Capital Expenditure), primarily focusing on AI infrastructure. While companies like OpenAI and Google were scrambling for H100 chips and begging NVIDIA for allocations, ByteDance had already anticipated the landscape. They adopted a "prepper" mentality, recognizing the looming export controls, and effectively locked in their supply.

A technical paper from September 2025, buried in the archives of Arxiv, quietly revealed a crucial detail about ByteDance's production clusters: a total capacity exceeding 200,000 GPUs. This isn't just a social media company; it's a sovereign state of compute power.

Most so-called "AI companies" today are essentially wrappers, renting APIs and "drop-shipping intelligence." ByteDance, however, owns the entire stack:

- The factory

- The supply chain

- The data

This integrated control establishes an "AI Fortress" for ByteDance. It's time to move beyond the simplistic label of a "content company." Just as Amazon evolved far beyond being a "bookstore," ByteDance has transformed into an advanced applied AI lab.

Doubao and Jimeng: AI Dominance Beyond the Western Gaze

In China, ByteDance has launched Doubao, an AI assistant that has quickly become a "Main Character." It's the number one AI assistant by monthly active users, having surpassed competitors like Baidu's Ernie Bot.

Doubao's success underscores a fundamental understanding within ByteDance that many Western tech giants, including Google, are still grappling with: AI is not about having the smartest model; it's about having the most useful application.

Beyond AI assistants, ByteDance is also a leader in video generation. While OpenAI's Sora captured headlines with its impressive demos, ByteDance already has Jimeng (also known as Dreamina) in active use. This tool generates video from text with a terrifying degree of quality and at scale.

Why is ByteDance so far ahead in video AI? Think about the source material:

- Who possesses the largest dataset of short-form video on Earth?

- Who has billions of humans continuously tagging, captioning, and reacting to video content every second of every day?

TikTok isn't just an app; it's the world's most advanced data labeling farm for video AI. We are all, in effect, working for them for free.

"TikTok isn't just an app. It’s a data labeling farm for the world’s most advanced video AI. And we are all working for them for free."

The Geopolitical Shadow and the "Trump Put"

Given such advanced technology and compelling financial performance, why is ByteDance's valuation so suppressed? The answer invariably points to the geopolitical boogeyman – the "Trump Put." The pervasive fear of a ban or executive orders that could effectively zero out ByteDance's Western operations is a tangible and valid concern. No investor wants to "catch a falling knife."

However, a closer look at the political landscape in 2025 and 2026 suggests a shift in winds. The era of "ideological banning" appears to be yielding to one of "transactional deal-making." Future administrations are likely to prioritize pragmatic agreements. Would it truly make sense to delete a platform upon which millions of American small businesses rely? Or would it be more logical to force an IPO, restructuring the company to allow US investors a substantial stake? The continuous extensions on divestiture deadlines are not mistakes; they are negotiations in progress.

The Repricing Event and Asymmetric Risk

The market's current pricing assumes a total ban as the primary outcome. Yet, all signals suggest a much higher probability of a settlement – perhaps a US IPO, a Hong Kong split, or a governance overhaul. If this scenario materializes, particularly with an IPO in 2026 or 2027, we are looking at a repricing event of monumental proportions.

Consider the impending global liquidity: as the Federal Reserve potentially enters a rate-cutting cycle, global capital will be actively seeking high-yield, high-growth opportunities. Would investors flock to slow-growth utilities, or to a company that rivals Meta in scale but still exhibits startup-like growth?

Even if an IPO doesn't happen, ByteDance has pioneered a "Synthetic IPO." With its immense cash reserves, the company is conducting continuous buyback programs for employees and early investors, effectively creating its own liquidity. They are, in essence, saying, "If the market won't value us correctly, we will buy ourselves back." This is the ultimate demonstration of "Statement" capital allocation.

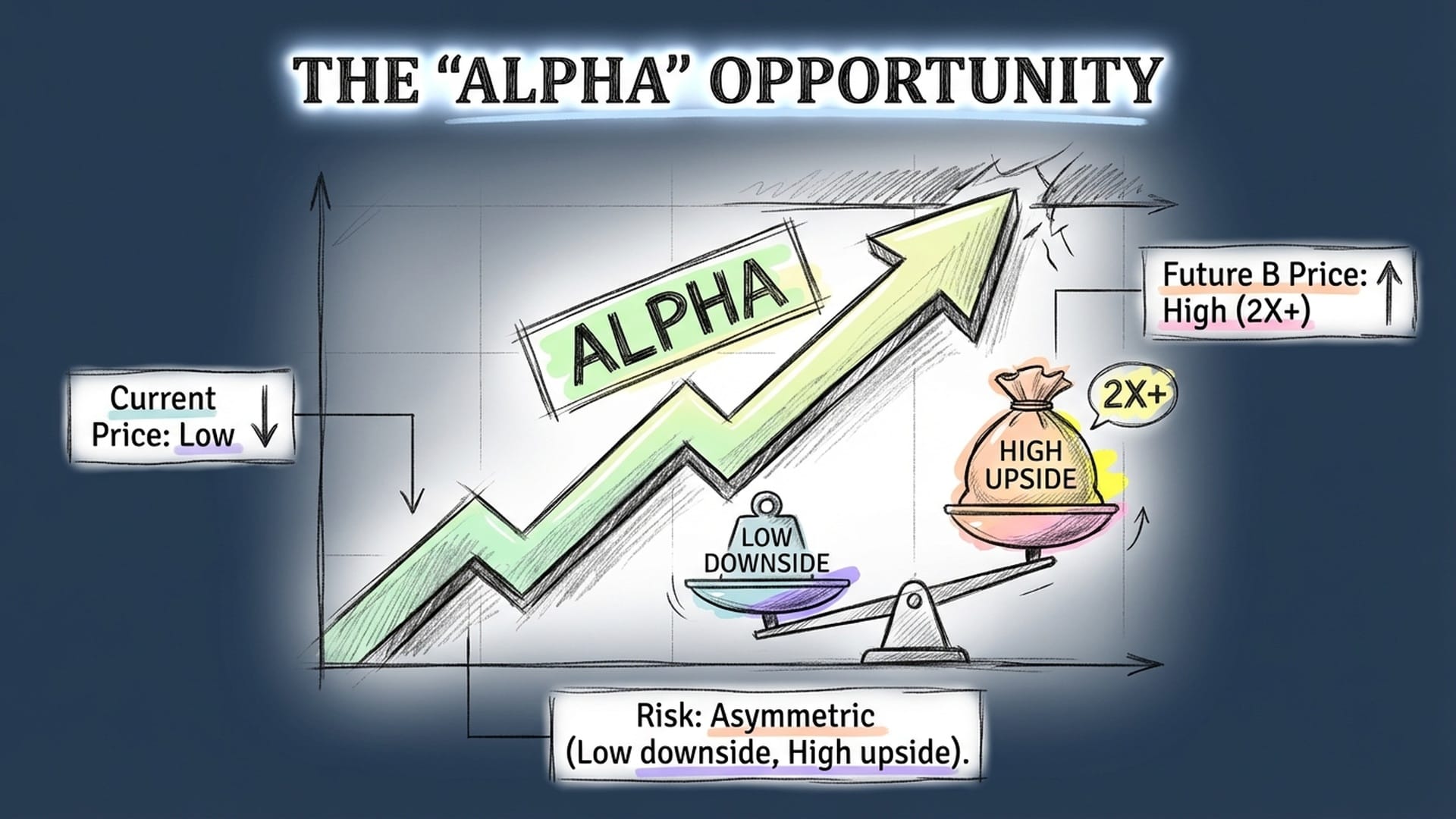

The Alpha Opportunity: Two Futures

We face two potential futures for ByteDance:

- Future A (Geopolitical Fear Wins): Walls go up, the internet fragments, and ByteDance is locked out of the West. Even in this scenario, the company would likely dominate the Global South and Asia, continuing to generate billions.

- Future B (Pragmatism Wins): A deal is struck, an IPO occurs, and ByteDance's AI tools are rolled out globally. In this future, ByteDance emerges not just as a participant, but as the leader of the next generation of the internet.

The substantial gap between the current valuation and the potential of Future B represents the true Alpha opportunity. This is not about asymmetric risk where the downside is substantial. Instead, it's an opportunity where:

- Heads: You might lose a bit of time.

- Tails: You could potentially double your money on one of the most robust and undervalued assets in the tech world.

So, the next time you scroll past a short video, pause. Look beyond the superficial layer of entertainment. Perceive the humming servers, the 200,000 GPUs diligently training the next super-intelligence, and the billions of dollars in cash flow. ByteDance isn't merely a social media company; it is an AI giant operating in plain sight, an immense opportunity for those willing to look closer.

|  |  |