Bank Lending Standards Tightening: The Leading Indicator of Economic Storms

A deep dive into the bank lending tightening indicator (DRTSCILM), analyzing its role as an economic recession warning signal through historical data comparisons, helping ordinary investors understand and respond to potential financial risks.

中文版

Have you ever wondered what signals economists watch to predict the next major economic shift? There's a crucial, yet often overlooked, indicator that offers a unique glimpse into the health of our economy: the DRTSCILM.

What is DRTSCILM?

Imagine you're a business owner looking to borrow money from a bank. Usually, banks might be happy to lend you money, but sometimes they become very cautious, demanding more collateral or simply refusing to lend. The DRTSCILM indicator measures what percentage of banks are tightening their lending standards for commercial and industrial loans.

When this number is positive (say 50%), it means half of all banks are making it harder to get loans. Conversely, when it's negative (like -20%), banks are actually loosening their standards and are more willing to lend. Think of it as the economy's "thermometer" — when banks are reluctant to lend, it often signals that the economy might be getting "sick."

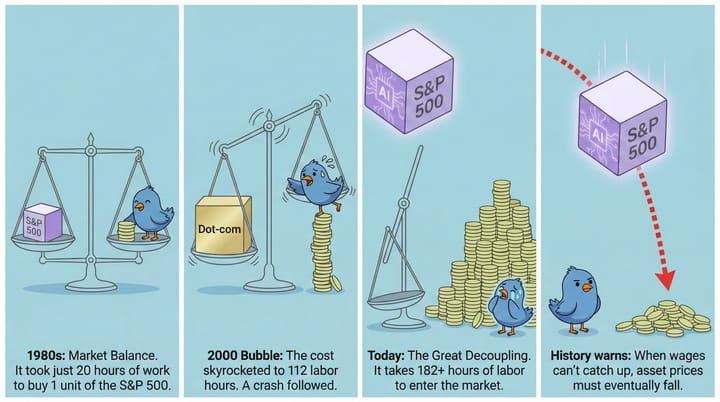

What History Teaches Us

Let's examine how this critical indicator behaved during major economic crises, providing valuable context for its significance:

1990-1991 Savings & Loan Crisis

During this period, the indicator hit an alarming 54.4%. The collapse of many savings and loan institutions made banks extremely cautious, leading to widespread tightening of lending standards. It was a classic case of banks being "once bitten, twice shy."

2000-2001 Dot-Com Bubble Burst

The indicator soared to 59.6% as the dot-com bubble burst. Countless internet companies had burned through cash without turning a profit. Banks, realizing they had been overly optimistic, quickly tightened their purse strings, severely impacting nascent tech ventures.

2008 Financial Crisis

This crisis marked the historical peak for the DRTSCILM, reaching a staggering 83.6%. Nearly all banks were tightening lending standards, creating an unprecedented credit crunch. Even fundamentally sound companies struggled to secure loans, pushing the entire economy to the brink. It was as if "all the faucets were turned off simultaneously, leaving the economic tree without water to nourish it."

2020 COVID-19 Pandemic

The indicator reached 71.2% during the initial phase of the COVID-19 pandemic. The extreme uncertainty surrounding global lockdowns and their economic repercussions made banks exceptionally cautious, worried that businesses would be unable to repay their loans amidst widespread disruption.

2023 Banking Crisis

More recently, the indicator hit 50.8% following the collapse of Silicon Valley Bank and other regional institutions. This event put the entire banking sector on edge, leading to a significant, albeit temporary, tightening of lending conditions as confidence wavered.

Why This Indicator Matters

Banks are often described as the economy's blood vessels, businesses as the organs, and loans as the blood itself. When banks tighten lending, it's akin to blood vessels constricting — blood flow slows, and organs don't receive enough nutrients, inevitably leading to systemic problems.

More importantly, this indicator frequently serves as an "early warning signal" for impending economic recessions. Typically, the DRTSCILM starts rising 3-6 months before the broader economy begins to show explicit signs of trouble. This foresight comes from banks' professional risk assessment teams, who are often among the first to "smell danger" before it becomes apparent to the average person or the general market.

What's the Current Situation?

As of July 2025, the latest data shows the DRTSCILM indicator at 9.5%. This represents a significant drop from the 50.8% peak observed during the 2023 banking crisis. This decline is generally good news, suggesting that banks are less worried about the immediate economic outlook and are increasingly willing to continue supporting business growth through lending.

However, we must remain vigilant. Historical experience tells us that this indicator can change rapidly and dramatically. For instance, in Q2 2007, it stood at a low -3.8% (indicating banks were loosening standards), but by Q4 2008, it had skyrocketed to its all-time high of 83.6%. This demonstrates just how quickly economic conditions can turn upside down, often within the span of a single year.

What Should Regular People Do?

Understanding the DRTSCILM indicator empowers individuals to make more informed personal and financial decisions. When this indicator shows a significant rise, it typically means:

- Businesses will find it harder to borrow: If you run a business, it's crucial to prepare your cash flow in advance rather than waiting until you desperately need money to approach banks. Proactive financial planning is key.

- The economy may slow down: When businesses can't borrow, they can't expand, and may even reduce hiring or resort to layoffs. As an employee, this is a prime time to enhance your competitiveness and skills.

- Invest cautiously: Stock markets often decline as companies struggle to secure financing and growth prospects dim. During such times, maintaining a healthy cash cushion becomes particularly important for stability.

- Crisis brings opportunity: While challenging, economic crises often create unique opportunities for astute investors. Those who prudently bought houses and stocks after the 2008 financial crisis, for example, largely earned solid returns. Patience and strategic thinking are vital.

How to Keep Track?

The DRTSCILM indicator is updated quarterly, with data typically released around the sixth week after a quarter ends. You can consistently check its latest values on the Federal Reserve's website.

Remember these key thresholds to interpret the data effectively:

- Below 0%: Generally a good economic environment, indicating banks are very willing to lend.

- 0-20%: A period worth monitoring, but typically no immediate cause for panic.

- 20-40%: Alert level, suggesting that economic problems may be emerging or gathering pace.

- Above 40%: A significant danger signal, indicating a high risk of an impending economic recession.

Investment and economic decision-making is much like driving a car — you need to watch the road ahead, but also meticulously monitor various dashboard indicators to understand the vehicle's underlying condition. The DRTSCILM is one such profoundly important gauge, helping us detect potential economic "fault signals" well in advance, giving us time to prepare.

Data Source: Federal Reserve Economic Data (FRED) - DRTSCILM