The Manufacturing Illusion: Unpacking US vs. China Productivity

Explore the paradox of global manufacturing power as we challenge conventional productivity metrics. Discover how China's structural advantages in physical output redefine industrial leadership beyond mere 'value-added' measurements.

|  |  |

The story we've been told for years about global manufacturing—a narrative positioning the United States with a significant lead in labor productivity over China—might just be an illusion, a distorted reflection of how we truly understand global power in production. This isn't merely an academic discussion; it’s about discerning who genuinely manufactures goods and where the true engine of global production resides.

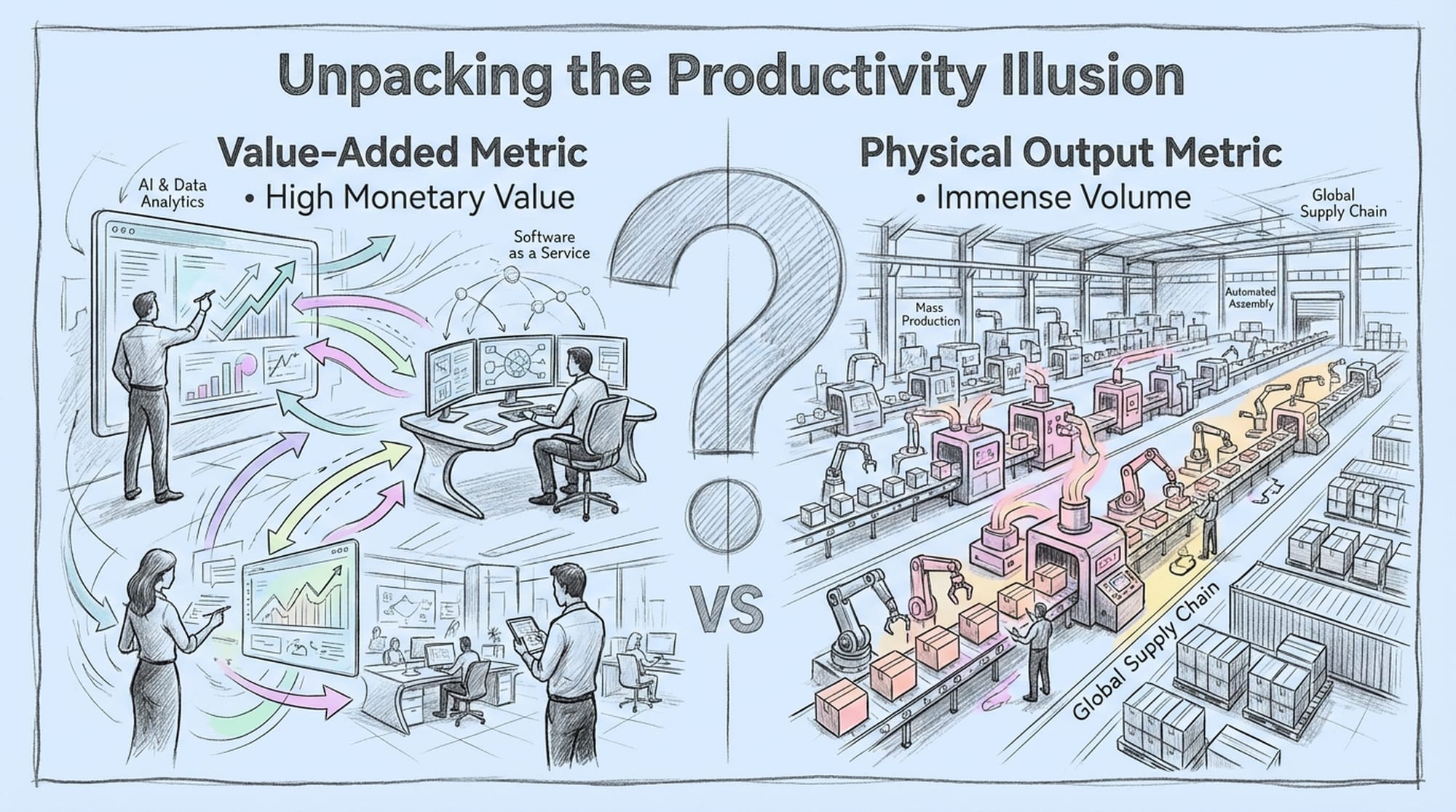

Unpacking the Productivity Illusion

Understanding this involves first scrutinizing our measurement methods. The prevailing approach, value-added, quantifies the monetary value generated by each worker. In economies like the US, where services command higher prices, this monetary value appears inflated. Consequently, an American worker might register more value on paper, even if their Chinese counterpart is physically producing ten times the volume of the exact same product. This discrepancy highlights a fundamental divergence in economic structures and outputs.

The value-added metric, while useful, can create a misleading impression of labor productivity, especially when comparing economies with vastly different cost structures and industrial focuses. It often prioritizes financial over physical output.Tesla: A Tale of Two Gigafactories

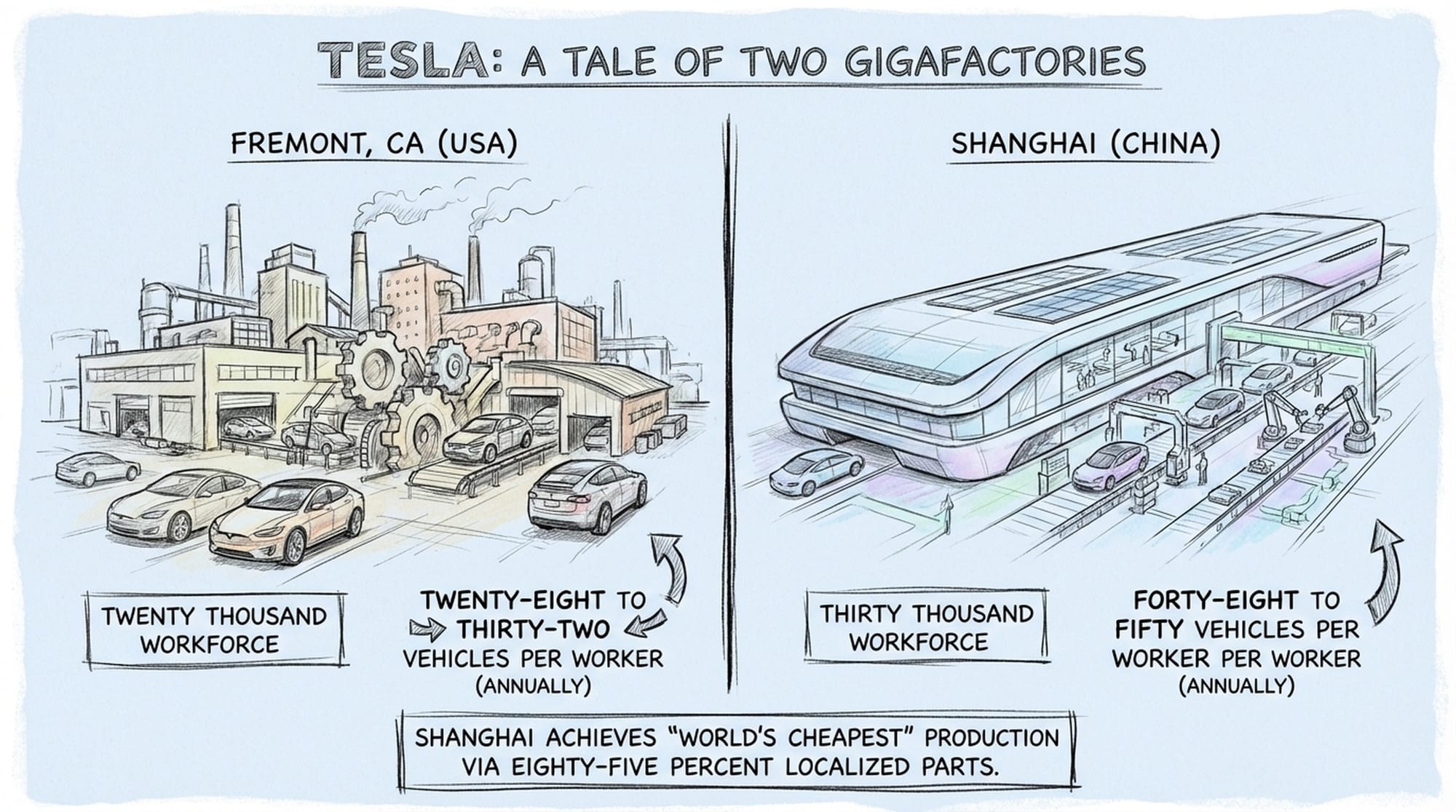

Let's consider Tesla, a truly global corporation, as a prime example. Tesla operates manufacturing facilities in both California and Shanghai, utilizing identical technology to produce the same vehicles. A direct comparison between these two locations offers a compelling insight into the nuances of manufacturing productivity.

In 2024 and 2025, Tesla's Shanghai Gigafactory, staffed by approximately 19,000 workers, is projected to produce nearly 1 million vehicles annually. This translates to an impressive 48 to 50 vehicles per worker. In contrast, the Fremont factory, with 20,000 workers, produced between 560,000 and 650,000 vehicles during the same period, yielding 28 to 32 vehicles per worker.

The significant difference in per-worker output isn't attributable to a variance in worker dedication or effort. Instead, it points to deeper structural advantages. The Shanghai Gigafactory achieves some of the world's cheapest production costs, remarkably, through an 85% localization of parts within its supply chain. This localization fosters unparalleled efficiency and cost-effectiveness.

"The Tesla example starkly illustrates that identical products and technology do not guarantee identical productivity. Structural factors, especially localized supply chains, play a pivotal role."

Shipbuilding: A Chasm of Capacity

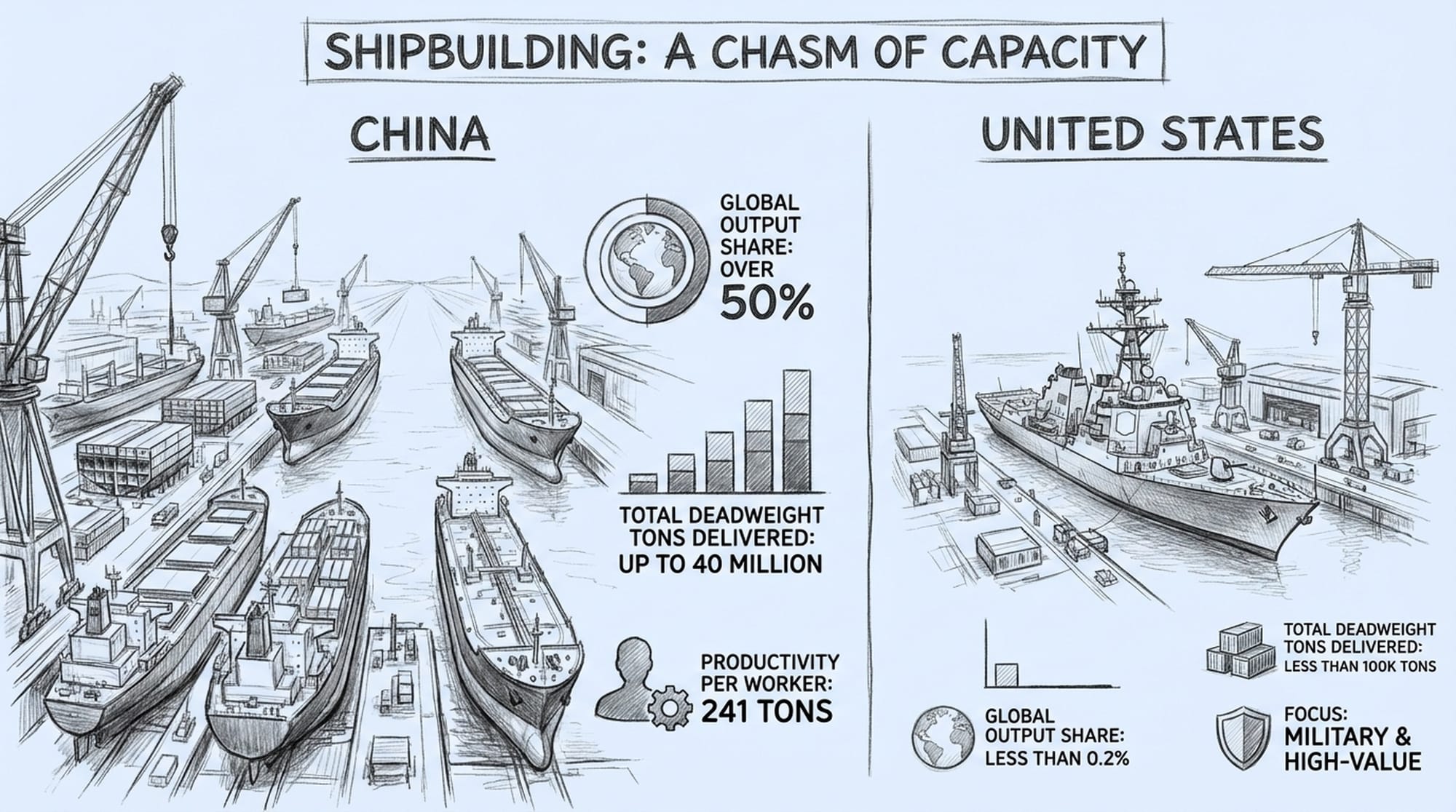

The shipbuilding industry provides an even more pronounced illustration where the prevailing narrative of American manufacturing prowess completely unravels. In 2024 and 2025, China literally dominated the global shipbuilding landscape, accounting for over 50% of worldwide output. They delivered approximately 40 million deadweight tons of shipping, with a workforce of about 162,000 laborers. This equates to an extraordinary 241 tons per worker.

To put this into perspective, the China State Shipbuilding Corporation (CSSC) alone produces more commercial tonnage annually than the entire US industry has managed in decades. The United States, in stark contrast, produced a negligible amount of commercial tonnage—less than 0.2% of the global aggregate, specifically less than 100,000 tons. The US shipbuilding industry largely focuses on military vessels and specialized, high-value, low-volume projects.

This isn't merely a productivity gap; it's a chasm.

"When it comes to sheer physical output in critical industries like shipbuilding, China's capacity isn't just ahead; it's on an entirely different scale, signifying a profound structural advantage."

Beyond Output: Structure, Infrastructure, Policy

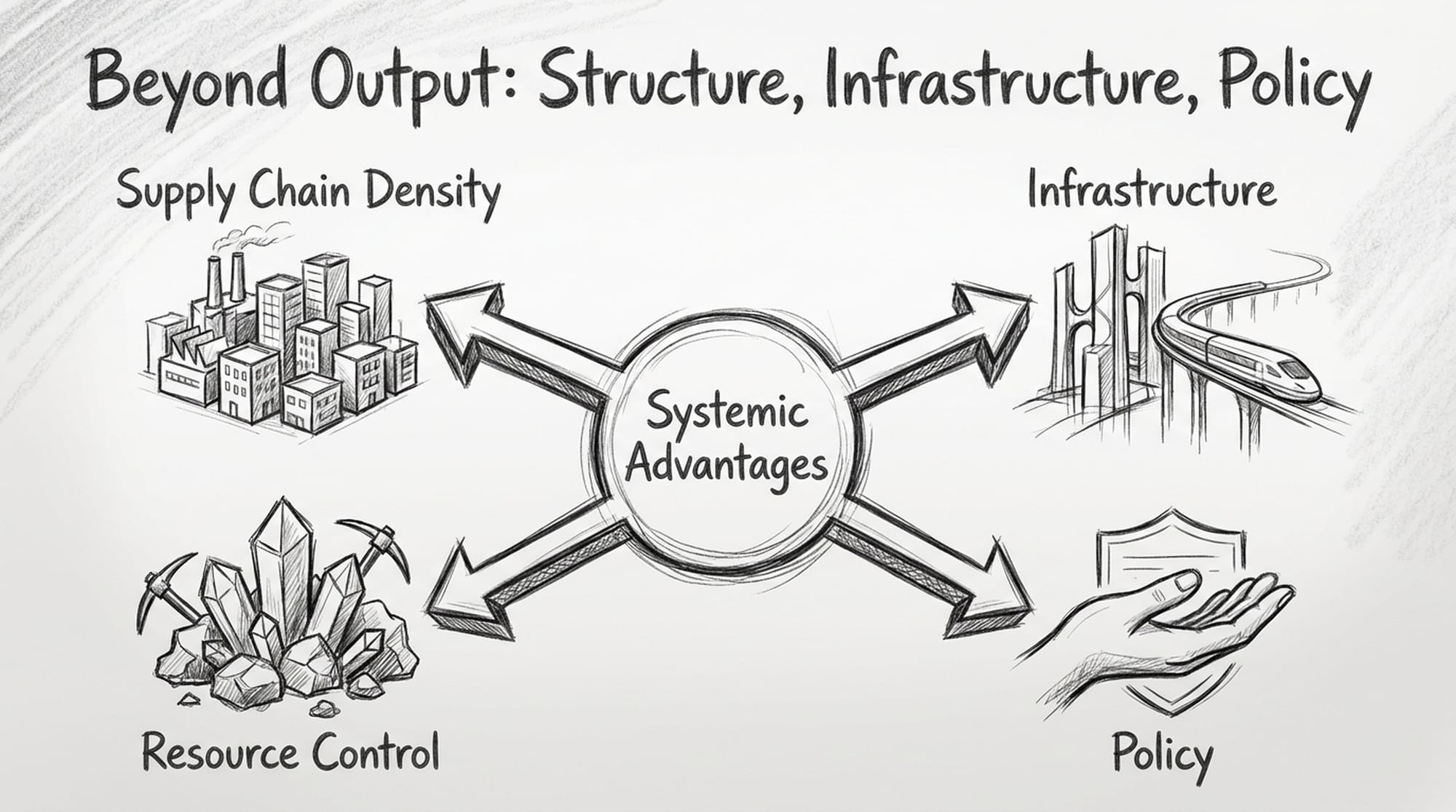

If the differential isn't solely about cheap labor—given that Chinese wages have doubled in the last decade—what then explains this colossal manufacturing capability? The answer lies in a confluence of structural advantages that China has meticulously cultivated.

- Supply Chain Density: China has developed industrial clusters where suppliers and assemblers are co-located, often within close proximity. This geographical concentration significantly reduces costs and drastically cuts down lead times, enhancing overall efficiency.

- Infrastructure: Years of strategic investment have endowed China with world-class infrastructure. Its new, state-of-the-art ports and extensive high-speed rail networks ensure goods move seamlessly and rapidly across the country and to global markets.

- Resource Control: Critically, China controls a significant portion of the world's essential raw materials and critical minerals, including lithium, cobalt, and rare earths. This control provides a considerable strategic advantage in manufacturing.

- Policy: China's industrial policies, notably

Made in China 2025, have fostered an ecosystem of state support. This allows companies to prioritize gaining market share over short-term profits, leading to aggressive expansion and production. This ambitious policy, in part, has contributed to theovercapacityobserved in specific sectors, driving global prices for goods like Electric Vehicles (EVs) and solar panels to record lows.

These elements combine to create an environment where high-volume manufacturing thrives, demonstrating that modern industrial leadership is built on far more than just labor costs.

Realigning Our Understanding

The common perception of a massive US productivity lead over China is largely an artifact of how we choose to measure productivity. While China is often perceived as a labor-intensive economy, it is aggressively embracing automation, installing more than half of the world's industrial robots annually. Their efficiency is increasingly driven by capital investment and advanced technology, not solely by labor.

Meanwhile, the US retains a distinct edge in areas such as:

- High-end design

- Software development

- Specialized, high-margin production

The American manufacturing model is shifting towards high-value, low-volume production. Conversely, China remains the undisputed global leader in high-volume, standardized production.

"We must acknowledge thatproductivitymeans different things in different economic contexts. The US excels invalue capturethrough innovation and specialized goods, while China dominates inphysical scaleandcost-efficiency."

A New Reality: Value vs. Scale

When we move beyond monetary metrics and look at the actual physical output, the sheer capability to manufacture, the deeply integrated supply chains, and the unparalleled cost-effectiveness of mass industrial goods, it becomes clear that the physical engine of global manufacturing is firmly rooted in China.

The productivity gap we often hear about is not a reflection of Chinese inefficiency. It is, instead, a reflection of two fundamentally different economic systems:

- One system, characteristic of the US, is built for value capture, focusing on intellectual property, premium pricing, and high-margin products.

- The other system, exemplified by China, is built for immense physical scale and unparalleled cost-efficiency in producing standardized goods.

It's time our understanding of global manufacturing caught up to this evolving reality. The world needs both innovation and mass production, and recognizing where each excels is crucial for informed global economic discourse. The illusion of a singular productivity leader dissolves when we examine the distinct strengths and strategic alignments of these economic superpowers.

|  |  |