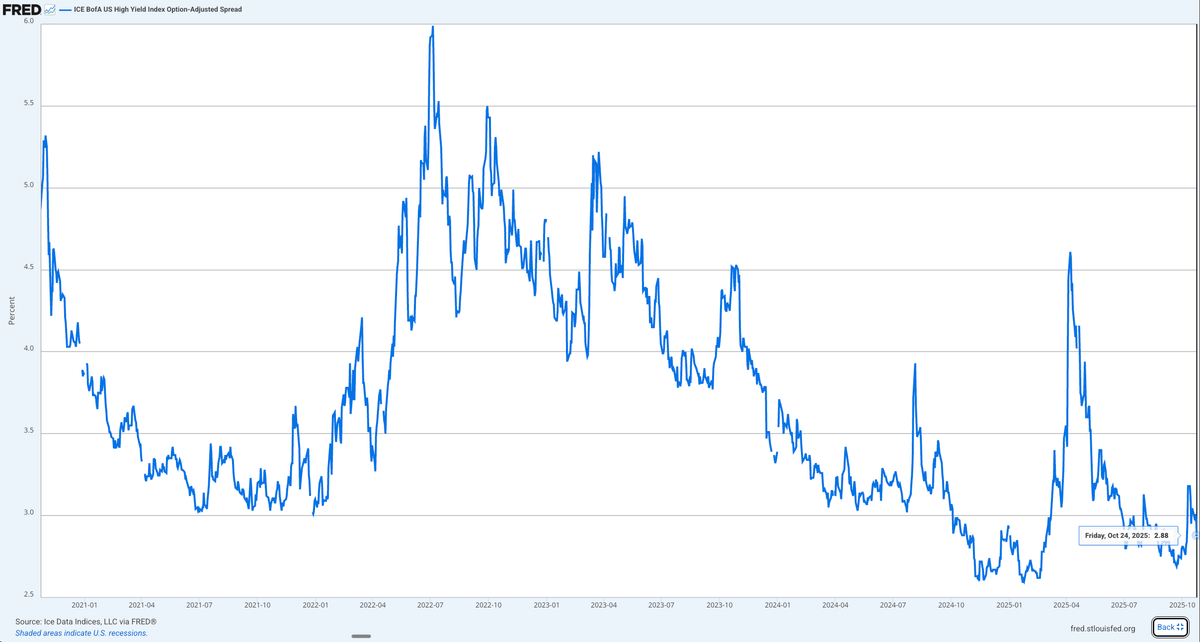

High Yield Credit Spreads Hit Historic Lows: Market Complacency or Calm Before the Storm?

US high yield credit spreads have dropped to just 2.88%, a level 87% lower than the 2008 financial crisis peak. This extreme compression signals dangerous market complacency and potential systemic risks ahead.

中文版 CHINESE VERSION

The high yield credit spread can be thought of as the financial market's "thermometer." Simply put, it measures the interest rate gap between risky junk bonds and safe government treasuries. Imagine lending money to a friend with bad credit – you'd definitely demand higher interest than a bank would, right? That "extra interest" is the credit spread.

When this spread is narrow, it signals that investors are optimistic about risk, believing that even high-risk investments won't cause problems. But history tells us that excessive optimism is often a dangerous signal.

Current Situation: Historic Lows Trigger Alarm Bells

As of October 24, 2025, the US high yield credit spread stands at just 2.88% – a truly shocking figure. Why shocking? Let's look at historical comparisons:

Credit Spread Levels During Major Crises:

- 2008 Financial Crisis: Peaked at 21.82% (December 2008)

- 2020 COVID Pandemic: Reached 10.87% (March 2020)

- Current Level: Only 2.88%

What does this mean? Current credit spreads are 87% lower than during the financial crisis and 73% lower than during the pandemic panic. The market seems to believe the world is safer now than it was pre-COVID in 2019. Does that make sense?

Why Should We Monitor This Indicator?

High yield credit spreads are a "leading indicator" of economic recessions and market crashes. Historical data shows:

Common Pre-Crisis Characteristics:

- Credit spreads drop to extremely low levels (investor overconfidence)

- Everyone believes "this time is different"

- Risks are severely underestimated

- Then - crash

Current Risk Signals

While the current 2.88% spread appears "stable," this stability itself represents the greatest risk:

🔴 Danger Signals from Ultra-Low Spreads:

- Blind Investor Optimism: Severe mispricing of risk

- Excess Liquidity: Too much money chasing limited opportunities

- Bubble Formation: Asset prices detached from fundamentals

- Increased Fragility: Any shock could trigger chain reactions

What Should Investors Do?

🛡️ Defensive Strategies:

- Reduce High-Risk Exposure: Appropriately lower allocations to stocks, high-yield bonds, and other risky assets

- Increase Cash Reserves: Maintain sufficient liquidity for market volatility

- Diversify Investments: Don't put all eggs in one basket

- Focus on Quality: Choose financially robust companies and funds

📊 Historical Context Matters

Looking at the data from major crashes:

- 2008 Crisis: Spreads exploded from ~6% to over 20% in months

- 2020 Pandemic: Spreads spiked from ~3.5% to nearly 11% in weeks

- Current: At 2.88%, we're in even more compressed territory than pre-pandemic

The Bottom Line

The current ultra-low credit spreads don't reflect genuine safety - they reflect complacency. History shows that when everyone feels safe, that's precisely when we should be most cautious.

Key Takeaway: This isn't about timing the market crash (impossible), but about recognizing when risk-reward is unfavorable. At current spread levels, investors are being compensated very little for taking substantial risks.

Remember: The goal isn't to predict when the storm will hit, but to have an umbrella ready when it does.

Data Source: Federal Reserve Economic Data (FRED) - ICE BofA US High Yield Index Option-Adjusted Spread