The Fed's Stealth Pivot: From QT to RMP and the New Financial Gravity

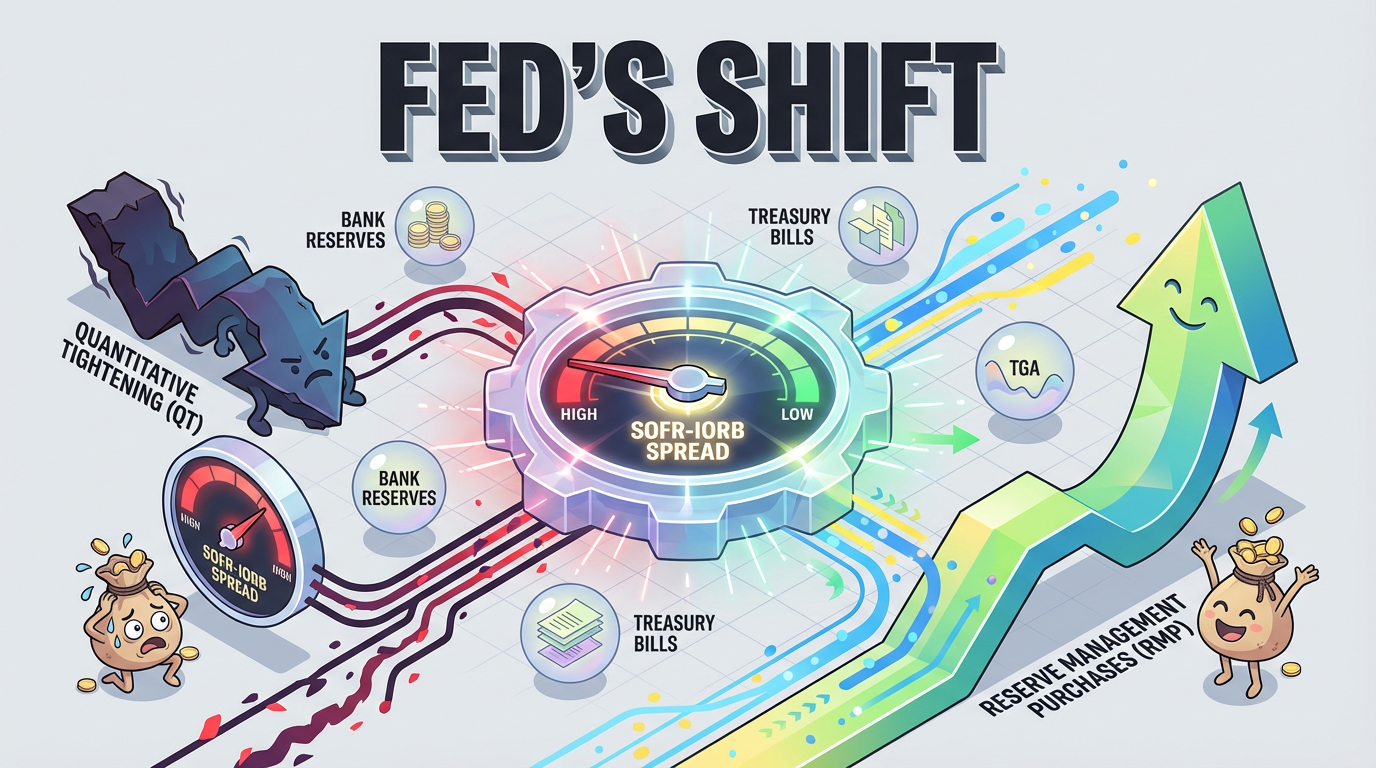

The Federal Reserve is shifting from Quantitative Tightening to Reserve Management Purchases. This marks a profound redefinition of financial rules, impacting liquidity, asset prices, and the future of investing.

|  |  |  |

The Invisible Hand: Redefining Financial Gravity

For years, the financial world has felt the inexorable pull of Quantitative Tightening (QT), a deliberate effort by central banks to drain liquidity from the system. But a seismic shift is underway, one that promises to redefine the very rules of the game. We are moving from a period of deliberate contraction to a new phase of strategic liquidity management, a transition that will undoubtedly reshape investment landscapes.

The Era of Draining Taps: Quantitative Tightening

Imagine our global financial system as a vast, interconnected network of pipes and reservoirs. Since 2022, the Federal Reserve (Fed) has been systematically turning down the taps, allowing water – or rather, liquidity – to drain out. This process, known as Quantitative Tightening, was designed to shrink the monumental $9 trillion balance sheet accumulated during the pandemic. By late 2025, this deliberate contraction had successfully reduced the balance sheet by approximately $2.4 trillion.

Quantitative Tightening (QT): A monetary policy tool used by central banks to reduce the supply of money by selling off government bonds and other assets, or by allowing them to mature without reinvestment. This decreases the central bank's balance sheet and absorbs liquidity from the financial system.

However, this continued draining began to reveal cracks in the system. Not an outright collapse, but unsettling shudders that hinted at underlying stress.

From Draining to Managing: The Pivot to RMP

In a move that many interpret as a stealthy retreat, the Fed announced the end of QT by December 1, 2025. This was swiftly followed by the introduction of something entirely new in January 2026: Reserve Management Purchases (RMP). This isn't mere bureaucratic jargon; it signifies a critical turning point. The Fed is abandoning its draining strategy and committing to actively managing, or potentially even expanding, liquidity in the financial system.

Why this sudden pivot? The official narrative from the Fed frames RMP as a technical operation aimed at ensuring ample bank reserves. However, market participants are hearing a different melody – the subtle hum of a printing press gearing up.

Signals from the Plumbing: Market Stress Indicators

The distress signals from the financial system became increasingly evident in late 2025. A critical indicator, the spread between SOFR and IORB, exploded to 32 basis points. This jump, from a typical 5-15 basis points, signaled acute cash scarcity among banks. Despite approximately $3 trillion in reserves, banks were hoarding cash, indicating that liquidity was not flowing efficiently.

The SOFR-IORB spread serves as a vital barometer for liquidity conditions in the interbank market. An escalating spread suggests that banks are hesitant to lend reserves, often due to heightened counterparty risk or a systemic reduction in available cash.

Simultaneously, another powerful force was at play: a collateral tsunami. To finance its ever-growing deficit, the US Treasury was issuing record amounts of government bonds. These bonds flooded the repo market, demanding vast amounts of cash to absorb them. Yet, QT had drained that very cash. This created a classic supply-demand mismatch: too much high-quality collateral chasing too little liquidity. The primary dealers, crucial intermediaries in this process, reached their capacity limits, and the system began to cry for help.

RMP vs. QE: A Crucial Distinction?

So, RMP is the Fed's proposed solution. But how does it differ from the infamous Quantitative Easing (QE)?

The Fed insists RMP is a pure liquidity management tool, with the modest goal of maintaining ample reserves by offsetting the natural growth of non-reserve liabilities like currency in circulation. It's pitched as neutral, not stimulative.

However, the distinction becomes blurry. While QE aimed to stimulate the economy and boost asset prices by purchasing various types of bonds (including long-term), RMP focuses almost exclusively on short-term T-bills. Ostensibly, this avoids messing with long-term rates. Yet, this choice of T-bills is crucial for the Treasury’s borrowing needs, raising questions about the true neutrality of the operation.

Quantitative Easing (QE): A large-scale asset purchase program designed to lower long-term interest rates, increase money supply, and stimulate economic activity during crises. Reserve Management Purchases (RMP): A liquidity management tool focused on purchasing short-term Treasury bills to ensure ample bank reserves and smooth market functioning.

The Great Divide: How Much Will the Fed Buy?

The central question now is: how much will the Fed truly buy? Wall Street analysts are significantly divided on this.

- The Maintenance Camp suggests a modest purchase of around $3.5 billion per month. Their rationale is that current reserves are already ample, and this level of purchases merely

keeps the lights on. If they are correct, RMP might largely be a non-event for asset prices. - Conversely, the Refill Camp predicts a staggering $45 billion per month in purchases. This isn't just

plumbing repair; it's interpreted as Stealth QE, implying significant market impact.

The implications of this divergence are immense for financial markets.

Understanding RMP's Impact on Risk Assets

Even if RMP focuses solely on T-bills, it's not truly neutral for risk assets. The market’s laws of physics still apply.

1. The Portfolio Balance Channel

Consider Money Market Funds (MMFs), major buyers of T-bills. If the Fed becomes a heavy buyer, T-bill yields will be suppressed. To maintain returns for their investors, MMFs will inevitably shift into slightly riskier assets. This could include:

- Commercial paper

- Repo lending to corporations

- Short-term corporate bonds

This subtle but powerful re-allocation of liquidity moves capital away from the government sector and into the private credit markets, providing a tailwind for riskier investments.

2. Primary Dealer Balance Sheets

Primary dealers are essential banks that underwrite government debt. Quantitative Tightening had severely squeezed their capacity, making it harder for them to absorb new Treasury issuance. RMP effectively frees up their balance sheets. With increased capacity, these dealers can facilitate more trading, more lending, and more market-making across a broader spectrum of assets, from stocks to corporate bonds. This improved intermediation capacity provides a significant boost to risk assets.

3. Regulatory Dominance: The 'Liquidity Bailout'

Fed Governor Stephen Miran highlights Regulatory Dominance. Post-financial crisis rules like LCR (Liquidity Coverage Ratio) and Basel III mandate that banks hold high-quality liquid assets. For regulatory compliance, reserves are often superior to even Treasuries. This means banks hold reserves not just for economic reasons, but because regulators demand it. RMP effectively becomes a regulatory bailout, supplying the central bank liquidity necessary to meet these regulatory demands. This reduces systemic risk, which in turn lowers the risk premium across the entire financial system.

4. Fiscal Dominance: The Elephant in the Room

Finally, we confront the elephant in the room: Fiscal Dominance. The US federal deficit remains persistently high, necessitating massive borrowing. This borrowing is increasingly concentrated in T-bills. When the Treasury issues T-bills and the Fed consistently buys them through RMP, it bears a striking resemblance to monetization. The Fed becomes the marginal buyer of government debt, effectively suppressing the government's short-term borrowing costs. This fuels suspicions about eroding central bank independence.

For investors, this narrative screams one thing: inflation. It pushes money into real assets like gold and inflation-resistant assets like Bitcoin.

Investment Implications: Navigating the New Financial Gravity

The shift from QT to RMP carries profound implications for various asset classes.

Fixed Income: Bull Steepening Ahoy!

The most direct impact will be on the short end of the yield curve. Repo rates and T-bill yields will be suppressed. We are likely to see a bull steepening of the yield curve, where short-term rates drop while long-term rates remain firm or even rise, driven by inflation expectations and deficit fears. The term premium on long bonds, which had all but disappeared, could make a notable comeback.

Equities: The Return of the Liquidity Put

For equities, this marks the return of the liquidity put. Historically, there's a strong correlation between the Fed's balance sheet expansion and the S&P 500's P/E multiple. RMP signals that the Fed will not tolerate a liquidity crisis, reducing the equity risk premium and providing structural support for valuations.

- Look for small caps (e.g., Russell 2000), which rely heavily on short-term floating-rate debt and benefit from ample liquidity.

- Tech and growth stocks (e.g., Nasdaq) also thrive in such environments.

- Even banks, particularly regional banks, stand to benefit from improved liquidity.

Forex: A Weaker Dollar Ahead?

RMP essentially increases the supply of US dollar base money. The dollar, which benefited from the scarcity created by QT, will likely face structural headwinds, trending modestly weaker against currencies where central banks are still tightening. The global stage is set for a rebalancing as dollar liquidity becomes more abundant.

Anti-Fiat Assets: Gold and Bitcoin to Shine

For the ultimate anti-fiat assets, Gold and Bitcoin, the outlook is strong. The narrative of fiscal dominance and debt monetization drives central banks and long-term investors toward gold. Bitcoin, an asset uniquely sensitive to liquidity, typically outperforms when money supply growth rebounds. RMP restarting the proverbial printers, however technically, will be an undeniable bullish signal for crypto. These assets often serve as a crucial hedge against the very expansion of central bank balance sheets.

The New Paradigm: How Much to Print?

As we look towards 2026 and beyond, we face a critical juncture. The Fed’s shift from QT to RMP is not merely a fine-tuning of monetary policy; it's an acknowledgment of a deeper systemic reliance on central bank liquidity. It's a compromise born from the twin pressures of regulatory demands and colossal fiscal deficits.

In this new paradigm, the central question for investors will no longer be: How much will the Fed hike? Instead, it will emphatically become: How much money does the Fed need to print to keep the system running?

"Liquidity is once again set to become the decisive force in asset prices. The ebb and flow of central bank balance sheets will increasingly dictate market movements, steering capital towards or away from various sectors."

Understanding this dynamic is no longer optional; it is fundamental to successful investing in the coming years. This is the new financial gravity.

Navigating this changing landscape demands a new understanding, a new set of lenses through which to view market signals. We must move beyond traditional indicators and recognize that the central bank’s balance sheet – its very willingness to expand or contract liquidity – has become the primary market driver. This isn't just about economic cycles; it's about structural shifts.

The path forward requires strategic adaptation. It means identifying not just what assets will perform, but why they will perform in this novel, liquidity-driven environment. It's about anticipating the Fed's next moves, not just in terms of interest rates, but in the subtle yet profound shift of its balance sheet operations. This knowledge empowers investors to make informed decisions.

Understanding this shift, its mechanics, and its profound implications is not just an academic exercise. It is the key to navigating the financial landscape of the coming years.

|  |  |