Will the AI Boom Repeat the Telecom Bubble of 25 Years Ago?

Deep comparison between the 2000 telecom bubble and today's AI boom reveals three dangerous similarities: excessive optimism, circular financing, and customer concentration. AI must reach automotive industry scale to justify current investments. History shows: technological revolutions and bubbles

Did you know? Just 25 years ago, a company called Lucent was once worth an astounding $240 billion — equivalent to over $500 billion today. Yet, within a mere few years, its stock price plummeted from $65 to less than $1, a staggering drop of over 98%! This isn't science fiction; it's the real story of the 2000 telecom bubble.

Today, as we witness AI companies signing hundred-billion-dollar deals and OpenAI's valuation soaring into the hundreds of billions, the historical parallels are chilling. Will AI be the next bubble? Let's break down this story that affects all our wallets in the simplest terms.

The Year 2000: A Disaster That Bankrupted Millions

How Did the Bubble Inflate?

Imagine this scenario: In 1996, the U.S. government passed a groundbreaking policy allowing anyone to start a telecom company. It was akin to suddenly telling everyone they could open a restaurant, and the government even compelled McDonald's to let them use their kitchens at cost!

The result was explosive. Within just a few years, over 300 new telecom companies emerged. Each one proclaimed: "Internet traffic doubles every 90 days! We need to lay more fiber!" Investors' eyes lit up with dollar signs, and money poured into the sector without restraint.

However, there were two fatal problems beneath this shimmering surface:

- Demand was grossly overestimated: The "doubles every 90 days" claim was a short-term, localized phenomenon. Real, sustainable growth was "only" doubling annually – which, while still very fast, was a far cry from the hyped projections.

- Technology advanced too quickly: New technological breakthroughs dramatically increased the data transmission capacity of a single fiber cable by dozens of times. The outcome? Companies laid enough fiber to circle the Earth 3,200 times, but a colossal 90% was never used – forever buried as "dark fiber."

It's like opening a restaurant, preparing food for 100 tables, but only 5 customers show up.

How Did It Collapse?

The collapse of the telecom bubble unfolded in several brutal phases:

- Phase 1: The Fed Raises Rates (Early 2000) Fed Chairman Greenspan suddenly declared: "The stock market is too crazy!" He then initiated a series of interest rate hikes. It was like attempting to cool an overheated hot pot, but doing it so quickly that the soup spills everywhere. After peaking in March 2000, the NASDAQ dropped 60% in just one year, eventually plummeting 78% at its lowest point. Those star internet companies? They lost 70-80% of their value in a single month!

- Phase 2: Order Collapse (2001) Telecom companies abruptly realized: "We're out of money!" Their stock prices crashed, and they could no longer issue bonds to raise capital. Consequently, they slashed their purchasing plans en masse. Equipment makers like Lucent and Cisco were blindsided. Yesterday, customers promised huge purchases; today, they were canceling orders. But it was too late – these manufacturers had already stockpiled massive inventory.

- Phase 3: Complete Collapse (2001-2002) The worst was yet to come. To secure orders, these equipment makers didn't just sell products; they lent money to customers to buy their equipment (a practice known as "vendor financing"). When customers went bankrupt, the equipment makers not only couldn't collect on the goods, but the loans also became worthless. Lucent, for instance, wrote off over $20 billion in bad debts in a single year! To make matters worse, many companies began revealing widespread accounting fraud. Giants like WorldCom and Enron collapsed one after another, and investors completely lost faith, triggering a market panic.

Today's AI: Three Dangerous Similarities

The echoes of the past are loud in today's AI landscape. Here are three striking similarities:

Similarity 1: Overly Optimistic Expectations

Back then, they said: "Internet traffic doubles every 90 days – we can't lay enough fiber!" Now, they say: "AI is the new electricity – the market will reach trillions of dollars!"

Jensen Huang (NVIDIA CEO) famously predicts the AI infrastructure market will reach $3-4 trillion in the next five years. OpenAI alone reportedly has procurement plans exceeding $1 trillion!

To put this into perspective: In 2024, all global corporate spending on equipment and facilities combined was only about $4 trillion. OpenAI's procurement plan alone accounts for a quarter of that entire sum! Such projections demand careful scrutiny.

Similarity 2: Crazy Circular Financing

This is perhaps the most dangerous parallel. Let me explain in plain English:

The old model (telecom bubble):

- Lucent to telecom companies: "Buy my equipment! No money? I'll lend you!"

- Telecom companies bought equipment, owing Lucent a mountain of debt.

- Lucent reported: "We sold so much equipment this year!" (But it was largely financed by their own money).

- Investors said: "Lucent is great!" and gave Lucent more money.

- Lucent then lent to even more customers...

The current model (AI boom):

- NVIDIA invests $100 billion in OpenAI: "Buy my GPUs!"

- AMD to OpenAI: "I'll give you 10% equity if you buy my chips!"

- CoreWeave says: "I'll give you equity too – use my cloud services!"

- These companies then use this money to... buy NVIDIA and AMD chips.

Do you see the pattern? Money is circulating rapidly among a few key companies, much like a high-stakes game of musical chairs.

Similarity 3: All Eggs in One Basket

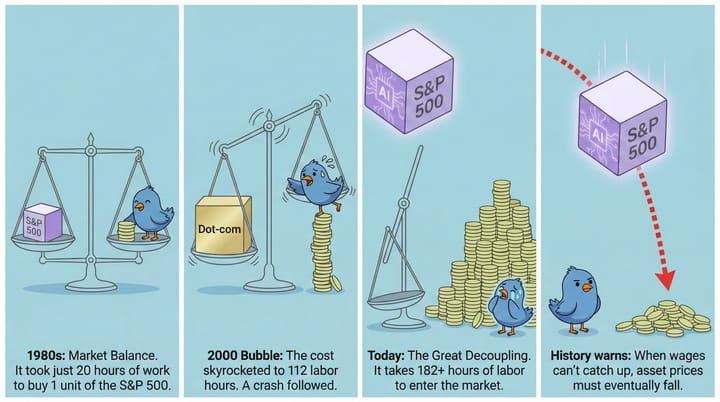

Back then: Lucent's top 3 customers accounted for 37% of its revenue. When these key customers went bankrupt, Lucent's financial stability was irrevocably shattered. Now: NVIDIA's top 4 customers account for 46% of its revenue. And OpenAI alone has purchased over 50GW of computing power – an amount equivalent to doubling the U.S. data center's total capacity!

If OpenAI were to face significant problems, the ripple effects would undoubtedly shake the entire AI supply chain to its core.

But There Are Four Reasons for Optimism

Don't be too scared yet! History doesn't simply repeat itself; it often rhymes. There are some real, crucial differences this time around that offer reasons for optimism:

- AI Companies Have Healthier Finances Back then, many telecom companies were essentially "negative cash flow + massive debt" entities, surviving only by continuous borrowing. Today's AI companies, while also burning through cash, generally have:

- OpenAI generating $13 billion in revenue this year, demonstrating rapid growth.

- Other prominent AI companies backed by "sugar daddies" (e.g., Anthropic has Amazon and Google; xAI has Elon Musk).

- Investments primarily in equity, not predatory loans (meaning no sudden, massive bad debt write-offs like before).

- No "Predatory Lending" In the telecom bubble, Lucent and Cisco, fiercely competing for market share, lent huge sums to companies that were clearly headed for bankruptcy, often with very loose terms. Current vendor financing, while substantial, is directed towards highly visible "star" companies like OpenAI – indicating a relatively more rational approach.

- The Fed Won't "Actively Pop the Bubble" In 2000, Fed Chairman Greenspan actively raised interest rates to cool down what he saw as an overheated market. Today, the Fed faces different circumstances:

- The job market is showing signs of weakening.

- Economic growth, however, remains robust (largely driven by AI investment).

- Therefore, the Fed might lean towards staying accommodative, rather than actively "bursting" bubbles.

- No "Dark GPUs" This is arguably the most important distinction! Back then, a staggering 90% of newly laid fiber went unused, becoming "dark fiber." In stark contrast, current GPU utilization is at 50-70% and still in short supply. This critical indicator suggests that the underlying demand for AI computing power is real, not an illusion!

The Ultimate Question: Can AI Make Back This Money?

Let's do the math. If the AI industry spends $3 trillion on infrastructure:

- Annual depreciation needed: ~$900 billion (considering GPUs become obsolete in roughly 3 years).

- If investors demand 30% returns.

- The AI industry needs to generate a staggering $2 trillion in annual profit!

Assuming a profit margin of 30-60%, the AI industry would need to create an annual revenue of $3.3-6 trillion.

What does this mean in real terms?

- Global automotive industry annual revenue: $4-5 trillion

- Global advertising industry annual revenue: $800 billion - $1 trillion

- Global mobile phone industry annual revenue: $500 billion

In other words, AI must be bigger than the entire global automotive industry and 5 times larger than the global advertising industry to justify current investment levels!

If we assume 1 billion global AI users, each person would need to spend $3,300-6,000 annually on AI. Think about how much you currently spend on phones, computers, and software each year. AI needs you to spend even more!

My Take: Cautiously Optimistic, But Vigilant

Short-term (1-2 years): The AI craze will likely continue its momentum. GPUs remain in short supply, the Fed isn't actively raising rates, and the Fear Of Missing Out (FOMO) sentiment is strong. However, undeniable bubble signs are already appearing.

Long-term (3-5 years): AI must conclusively prove its ability to create sufficient, tangible value to justify these massive investments. If it fails to do so, it risks repeating the tragedy of the 2000 telecom bubble.

The enduring lesson from history is clear: Technological revolutions are real, but so are bubbles. They always seem to come hand-in-hand.

Advice for Ordinary Investors

- Don't go ALL IN: No matter how bullish you are on AI, never bet everything you have.

- Watch cash flow: Companies in the AI sector that are already generating positive cash flow are generally safer bets.

- Diversify: Do not solely invest in AI stocks. Spread your investments across different sectors.

- Long-term perspective: If you genuinely believe in AI's future, prepare to hold your investments for 10 years or more, rather than chasing short-term momentum.

- Stay alert: When people with no prior investment experience (like taxi drivers) start discussing AI stocks, it might be a significant warning sign to exercise extreme caution.

Remember: Be fearful when others are greedy, and greedy when others are fearful.

History doesn't repeat itself exactly, but it often rhymes. The 2000 telecom revolution was real, but it also contained a devastating bubble. Today's AI revolution is undeniably real, but what about the bubble?

Time will tell.

Data Sources

- Lucent Technologies Annual Reports

- Cisco Systems Annual Reports

- NVIDIA Investor Relations

- Federal Reserve Economic Data (FRED)

- GMF Research Reports

- Publicly disclosed partnership agreements from major tech companies

Disclaimer

This article represents personal views and historical analysis only. It does not constitute investment advice. Investing involves inherent risks; please make your financial decisions carefully and after thorough research.

Author: Leo Wang (王利杰)

Angel Investor | PreAngel Fund

Website: leowang.net