Crypto's Mainstreaming: 2020-2025, The Political & Financial Revolution

Explore how cryptocurrency transformed from niche speculation to a core component of the U.S. financial system between 2020-2025, driven by political policies and regulatory shifts. Uncover the GENIUS Act, Bitcoin Reserves, and the ethical dilemmas of rapid integration.

|  |  |  |

The year 2025 marked a definitive epoch in the mainstreaming of cryptocurrency, transforming it from a fringe speculation into a central pillar of the U.S. financial system. This wasn't merely a technological evolution; it was a high-stakes, meticulously orchestrated convergence between the nascent digital asset industry and the machinery of the U.S. federal government.

From the Fringes to Financial Policy: 2020-2025

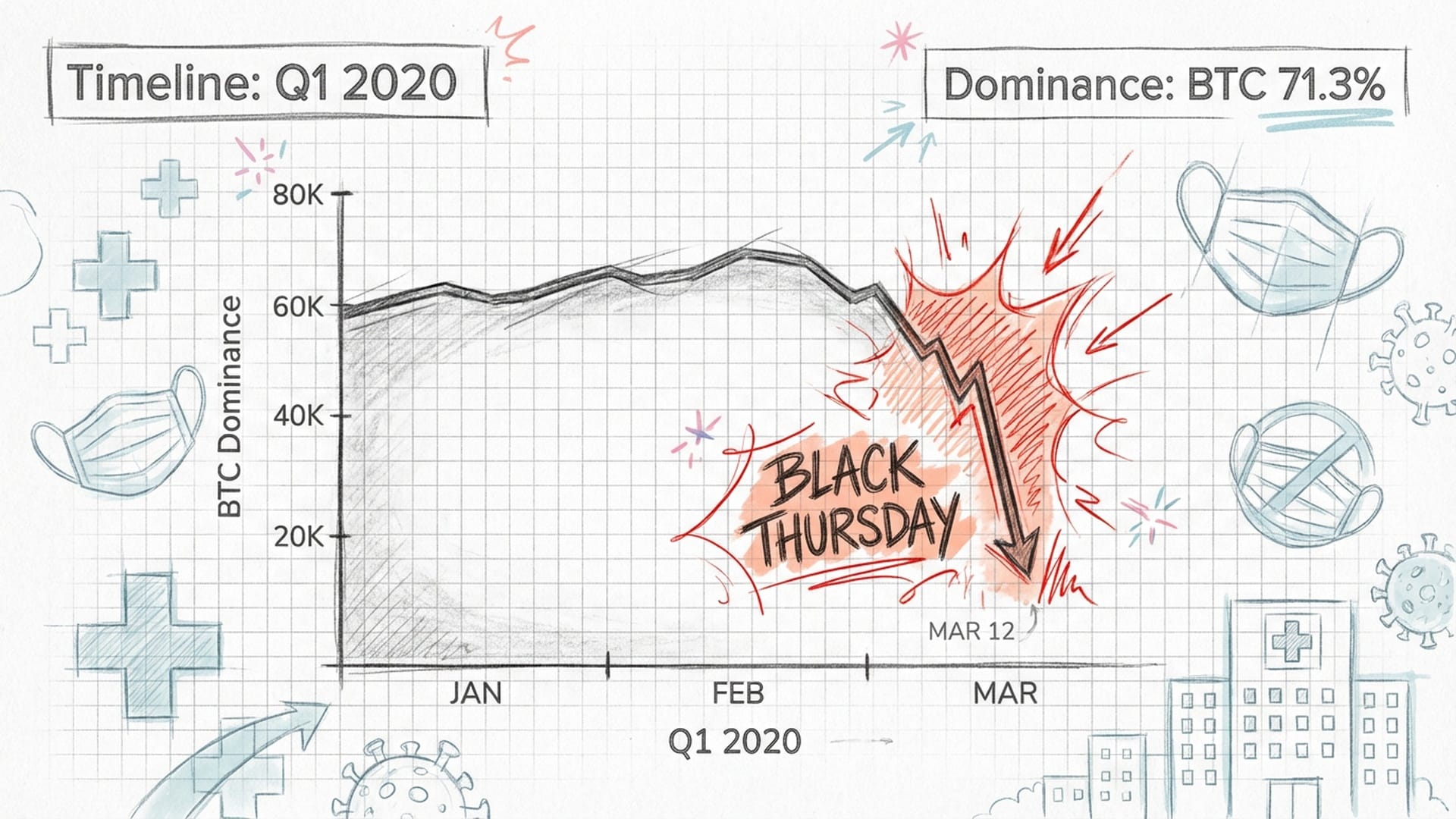

Rewind to early 2020: the crypto market was a volatile beast, reeling from the pandemic's liquidity crises. Its total market capitalization barely clung to the $200 billion threshold, a mere fraction of earlier highs.

"The data from that period paints a grim picture: total global crypto market capitalization clung precariously between 192 billion and 250 billion dollars. That was a mere fraction of its previous highs. A stark reminder of just how vulnerable this nascent sector was to macro-economic shocks."

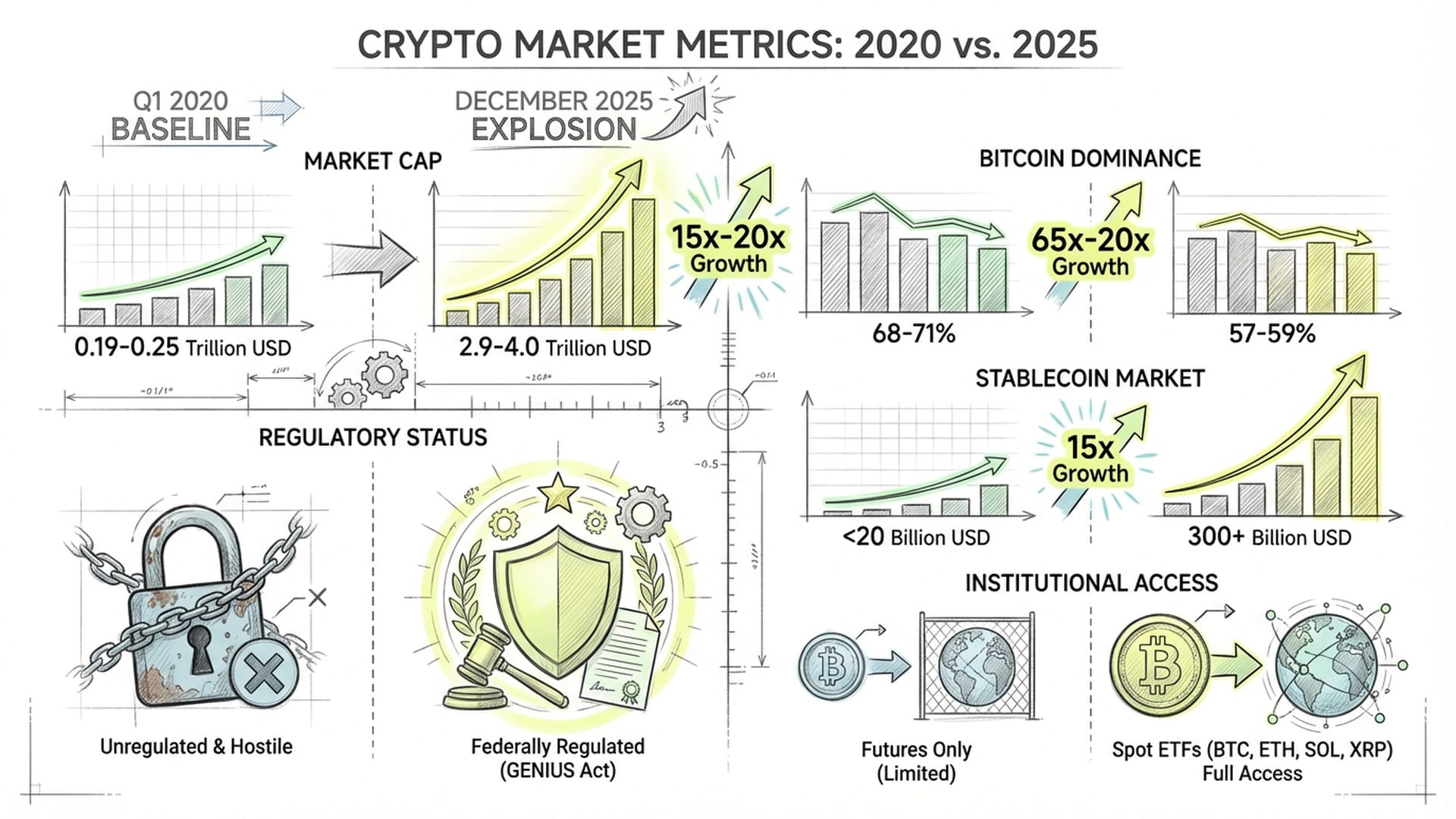

Bitcoin dominated, holding between 67.8% and 71.3% of the market, signifying concentration rather than diversification. Altcoins were largely stagnant, and decentralized finance (DeFi) was still nascent. Stablecoins, now a multi-hundred-billion-dollar systemic component, were then an afterthought, with a total circulation of perhaps $5 billion to $20 billion, primarily used for lubricating offshore exchange trading.

Fast forward to December 2025: the landscape was unrecognizable. The total market capitalization of crypto swelled to between $3 trillion and $4 trillion. This wasn't solely magic or pure speculation; it was anchored by the institutionalization of the asset class through Spot Exchange Traded Funds (ETFs) and, most notably, by the legislative crystallization of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins).

This monumental shift was largely engineered by the second Trump administration, which initiated a full-blown "Crypto Capital" policy agenda. This agenda scrapped the prior "regulation by enforcement" doctrine, replacing it with a daring framework of "innovation exemption." Key appointees like SEC Chair Paul Atkins and Commerce Secretary Howard Lutnick spearheaded this revolution.

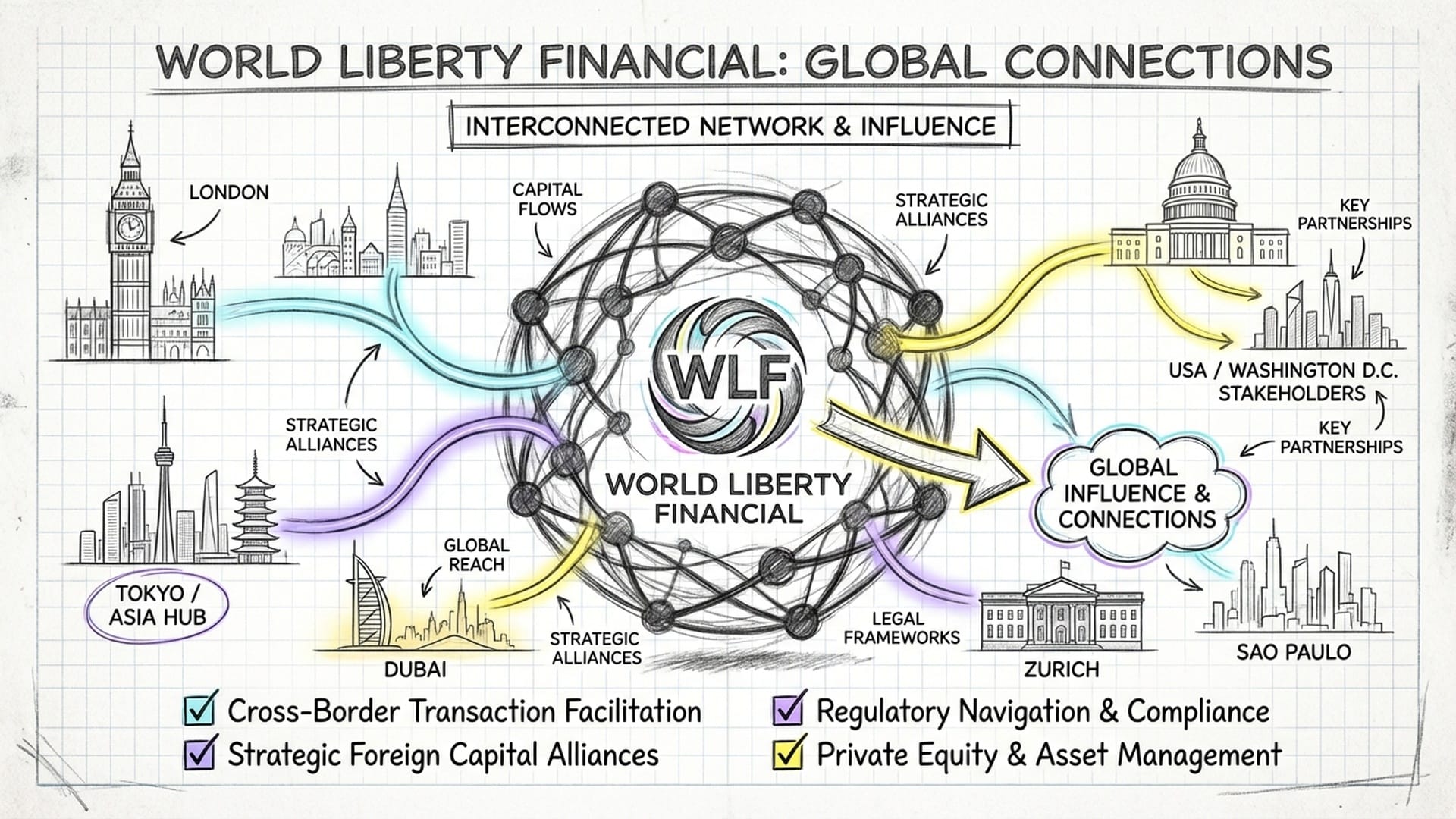

The Ethical Shadow: World Liberty Financial

However, with such rapid integration came profound ethical complexities. The line between public service and private profit blurred, becoming almost impossible to discern. The most glaring example was the President's own family venture, World Liberty Financial (WLF).

WLF became a nexus for foreign sovereign capital, regulatory arbitrage, and executive influence. The Trump family and their affiliates held substantial WLF tokens, with 75% of net protocol revenue flowing directly to them. This created a direct financial pipeline where the venture's success, explicitly tied to the administration's regulatory clarity, translated into the President's personal wealth – a stunning conflict of interest.

The significant influx of foreign capital into WLF was particularly alarming. Reports confirmed that Abu Dhabi and other UAE actors utilized WLF's stablecoin infrastructure for massive transactions, generating substantial fees. Moreover, crypto billionaire Justin Sun's investment in WLF suspiciously coincided with the SEC pausing an active investigation into his activities, raising questions about potential quid pro quo arrangements. These entanglements prompted Senate Democrats to launch investigations into WLF, citing national security risks and the bypassing of traditional diplomatic channels.

Hard Numbers: The 2020-2025 Repricing Event

To truly grasp the magnitude of political influence, one must understand the starting point. The journey from 2020 to 2025 is a story of a fundamental repricing, driven less by new code and more by a radical shift in crypto's perceived legitimacy and utility within the global financial system.

The market's composition also transformed:

- Bitcoin dominance dropped from 68-71% to 57-59%, even with its massive price increase, indicating a maturing ecosystem.

- Ethereum maintained around 12% dominance.

- Solana, boosted by ETF approvals, saw colossal capital inflows.

- The stablecoin sector experienced the most seismic structural shift, rocketing past $300 billion in market capitalization by late 2025, fueled by the GENIUS Act. It became a transactional layer for the global dollar economy, actively encouraged by U.S. Treasury policy.

This data screams correlation: a stark synchronization between political milestones and valuation surges, validating the hypothesis that the 2025 bull market was fundamentally political. The "Trump Bump" was not just a sentiment rally; it was a structural repricing of regulatory risk. The market cap peaked near $4.4 trillion in October 2025, precisely coinciding with altcoin ETF approvals and the full implementation of the GENIUS Act.

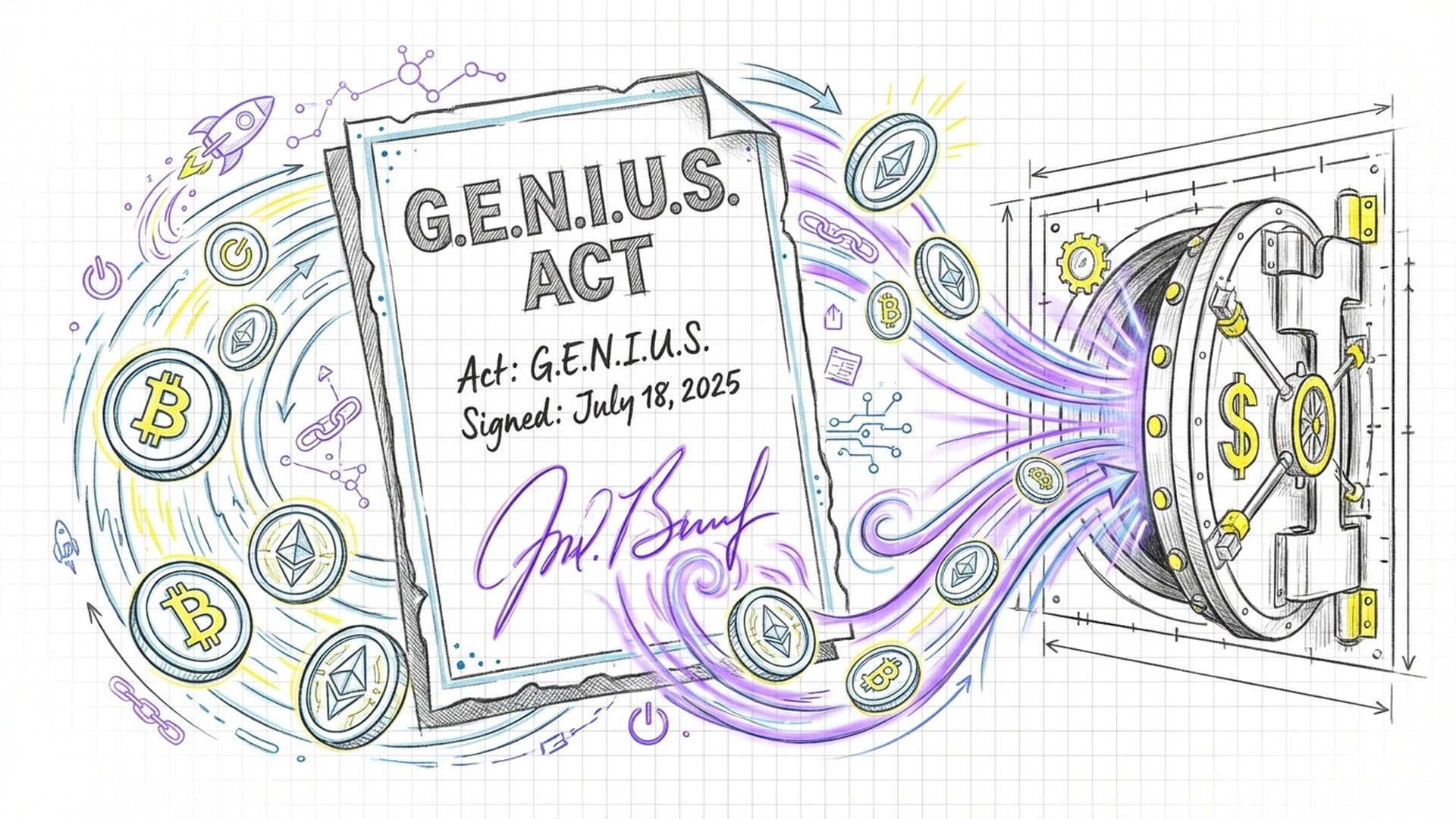

The Cornerstone: The GENIUS Act

The 2025 crypto boom was sparked by a new law: The Guiding and Establishing National Innovation for U.S. Stablecoins Act, signed by President Trump on July 18, 2025. This legislation comprehensively federalized the stablecoin market, replacing regulatory ambiguity with a clear framework designed to cement the U.S. dollar’s global dominance via digital rails.

The GENIUS Act established a robust "dual-banking" system for digital assets:

- Non-bank issuers (fintech firms like Circle, Paxos, and World Liberty Financial) could issue payment stablecoins, subject to strict

prudential standardsand oversight by the OCC and state regulators. This preserved the innovative spirit of the private sector. - Bank subsidiaries: Insured depository institutions could issue stablecoins through dedicated subsidiaries, overseen by the FDIC, adhering to rigorous safety and soundness standards.

Crucially, this dual structure explicitly forbade the Federal Reserve or the U.S. government from issuing a Central Bank Digital Currency (CBDC). This effectively privatized the digitization of the U.S. dollar, outsourcing its proliferation to the private sector while retaining regulatory control – a masterful political maneuver marketed as a shield for financial privacy.

Perhaps the most monumental component was Section 4's reserve requirement: all permitted payment stablecoins must be fully backed by eligible liquid assets, primarily U.S. Treasury bills and cash.

"This mandate transforms the stablecoin industry into an enormous, price-insensitive buyer of U.S. government debt. As the stablecoin market swells further into the trillions, these issuers are poised to become some of the largest holders of U.S. Treasuries..."

Treasury Secretary Scott Bessent envisioned stablecoins not as a threat, but as a vital mechanism to create "structural demand" for U.S. debt in an era of high fiscal deficits. The Act also imposed rigorous compliance and consumer protection standards, subjecting issuers to the Bank Secrecy Act (BSA) and mandating 1:1 reserves, subject to audits. It directly addressed systemic risks, establishing bankruptcy priority for stablecoin holders to instill public confidence.

The Crypto Cabinet and Strategic Bitcoin Reserve

The Trump administration's "Crypto Cabinet" systematically replaced crypto-skeptic regulators with industry proponents, fundamentally altering how existing securities laws were interpreted.

- SEC Chairman Paul Atkins: Launched "Project Crypto" to establish a clear taxonomy for digital assets. His declaration that "most crypto tokens trading today are not securities" effectively vaporized litigation threats for thousands of altcoins and paved the way for aggressive ETF approvals. He championed the "Innovation Exemption," a regulatory sandbox allowing crypto startups to raise capital without stringent public offering requirements.

- Commerce Secretary Howard Lutnick: Oversaw the Department of Commerce's initiative to publish U.S. GDP statistics directly on public blockchains (Ethereum, Solana, Bitcoin) starting July 2025. This highly symbolic move validated public blockchains as secure, immutable infrastructure for official state data, signaling the U.S. government's view of them as legitimate public utilities.

- Treasury Secretary Scott Bessent: Architected the integration of digital assets into sovereign debt management, endorsing stablecoins to "buttress the dollar's status" and implementing the "Strategic Bitcoin Reserve."

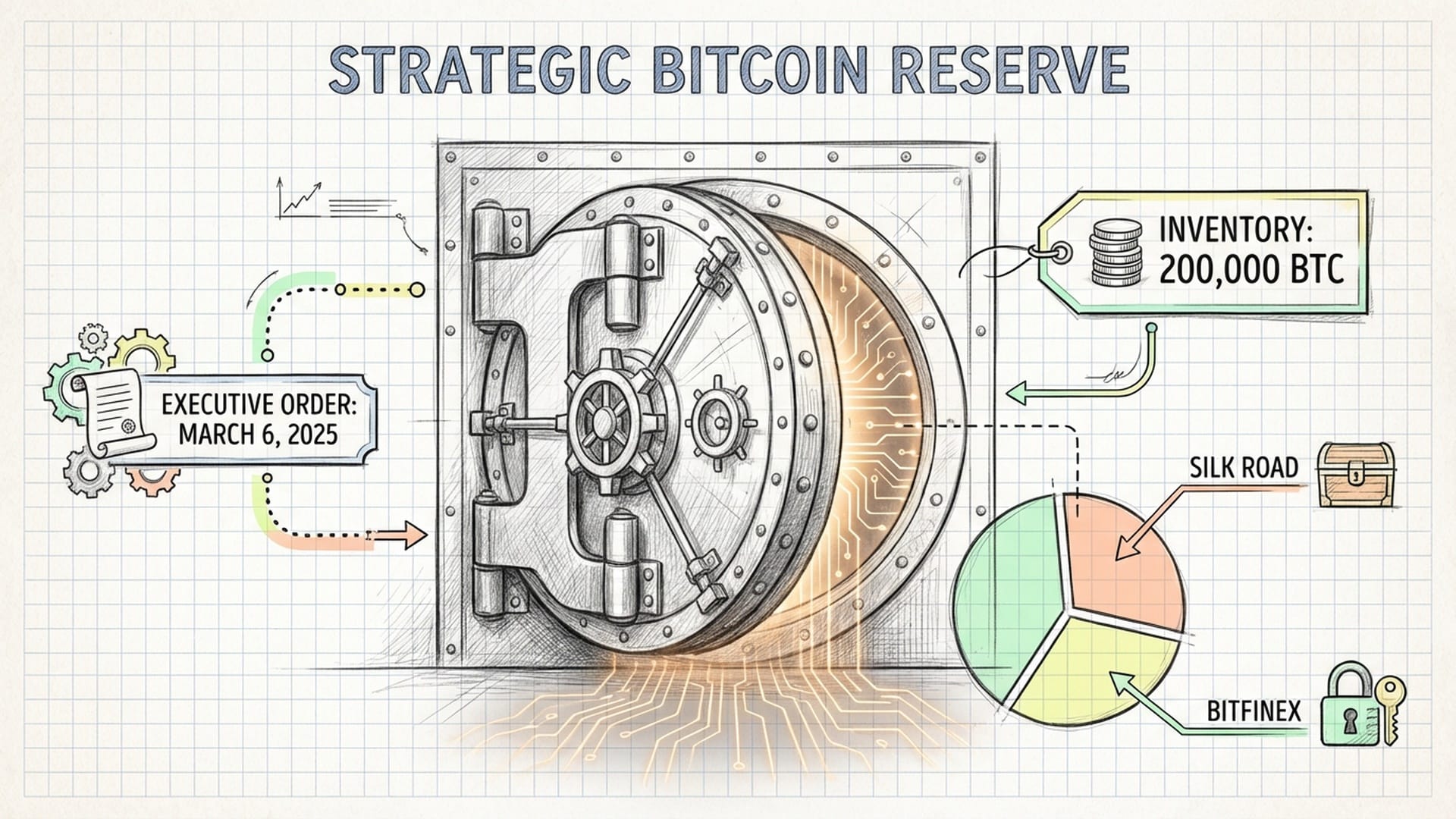

The Strategic Bitcoin Reserve (SBR)

On March 6, 2025, Executive Order established the Strategic Bitcoin Reserve (SBR), formally treating Bitcoin as a strategic reserve asset akin to gold or petroleum.

The SBR was initially capitalized through asset forfeiture, transferring over 200,000 Bitcoins seized from criminal enterprises to the reserve. This mandated a strict "HODL" policy, permanently removing a massive supply overhang from the market, injecting a supply shock, and effectively putting a floor under Bitcoin's price. The Order also authorized the Treasury to explore budget-neutral ways to acquire additional Bitcoin, hinting at future strategies like asset swaps or utilizing mining operations on federal lands. The concept of "Bitcoin-Enhanced U.S. Treasury Bonds" or "BitBonds" also emerged, proposing to defease federal debt via asset appreciation.

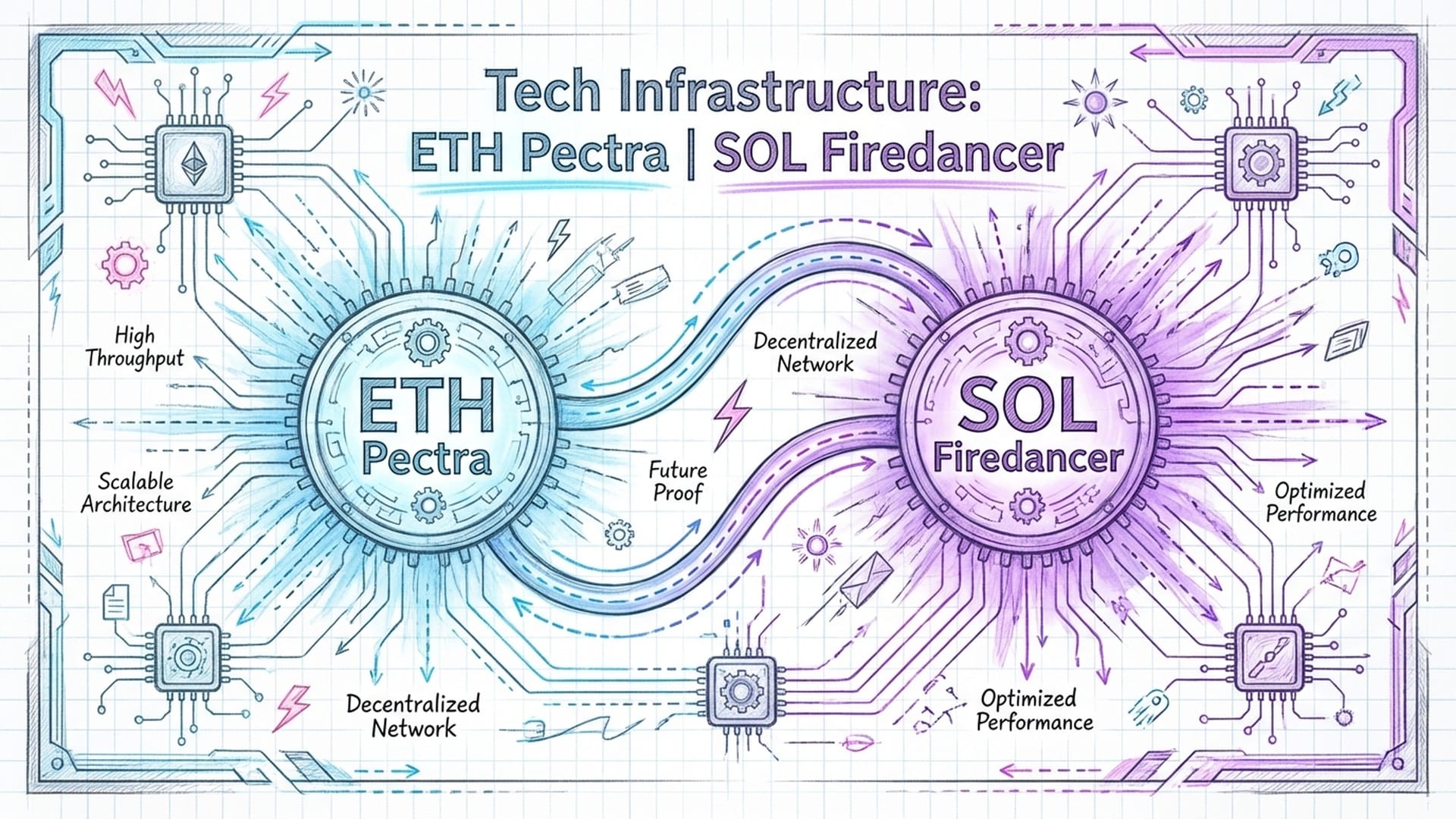

Technology: The Unsung Foundation

The political mainstreaming of crypto would have crumbled without robust underlying technology. 2025 delivered two critical technological milestones that enabled networks to handle institutional traffic.

- Ethereum's Pectra Upgrade (May 2025): This combination of Prague and Electra updates was pivotal for scalability, optimizing the consensus layer and effectively doubling capacity for Layer 2 (L2) rollups. This dramatically reduced data costs, making DeFi applications economically viable. Pectra also improved Account Abstraction (Smart Accounts), simplifying complex custody and automated payments for institutions.

- Solana's Firedancer Client (December 12, 2025): Built by Jump Crypto, Firedancer was a complete rewrite of the Solana validator code, designed to process over 1 million transactions per second (TPS) in test environments. More importantly, it eliminated the "single point of failure" risk that had plagued Solana, providing client diversity crucial for institutional investors and ETF issuers, and a major factor in SOL's ETF approval.

Global Ripples and Emerging Risks

The U.S. pivot to crypto sent ripples across the globe, especially among the Gulf Cooperation Council (GCC) states, sparking a race for digital asset dominance.

- The UAE meticulously positioned itself as a global hub for "Crypto-Fintech," leveraging its neutral regulatory stance and making direct investments, including a $2 billion purchase of Binance shares via its sovereign wealth fund, MGX.

- The Qatar Investment Authority (QIA) launched Qai, an AI and digital asset-focused subsidiary, pouring investments into blockchain infrastructure to diversify its energy-dependent economy.

- Saudi Arabia's Public Investment Fund (PIF) adopted an "AI-Crypto" thesis, investing heavily in the intersection of artificial intelligence and blockchain to support its Vision 2030 goals.

This interplay between U.S. policy (GENIUS Act) and Gulf capital is creating a "Petrodollar 2.0" dynamic, where Gulf sovereigns recycle capital into U.S.-regulated stablecoins, which then buy Treasuries. This modernizes the mechanism of dollar hegemony for the digital age, ensuring the underlying demand for U.S. debt remains constant.

While political influence was the primary accelerant, independent factors also contributed. Grassroots adoption in Asia, driven by remittance needs and currency devaluation, continued its march. Macroeconomic winds, like the Federal Reserve's interest rate cuts in late 2025, also played a crucial role, pushing investors towards risk assets.

However, this "mainstreaming" paradoxically led to centralization. The industry's reliance on U.S.-regulated custodians for ETFs, U.S. bank-issued stablecoins under the GENIUS Act, and a politically invested class has undeniably eroded the original ethos of decentralization. The market is now exquisitely sensitive to U.S. political shocks, and a change in administration could trigger a catastrophic repricing.

"The market, right now, is pricing in 'perpetual friendliness' from the U.S. government."

Furthermore, the concentration of stablecoin reserves in U.S. Treasuries creates a new systemic risk: a crisis in the U.S. sovereign debt market could instantly transmit shocks throughout the entire digital asset ecosystem. This is a double-edged sword.

Conclusion: A New American Political Economy

The transformation of the cryptocurrency sector between 2020 and 2025 profoundly confirms that political integration is the ultimate driver of mainstream adoption in the modern financial era. The explosive 15x growth in market capitalization was achieved not just through technological innovation, but through the deliberate dismantling of regulatory barriers and the symbiotic alignment of the state's financial needs with the industry's growth goals.

The "Crypto Capital" era, championed by the Trump administration, delivered on promises of deregulation and valuation growth. The GENIUS Act solidified the U.S. dollar's role in the digital economy, and ETF approvals seamlessly integrated crypto into everyday investment portfolios.

However, this growth comes at a high ethical price. The administration normalized the intermingling of presidential financial interests with national policy. World Liberty Financial stands as a glaring testament to this new reality—a complex, tangled web where foreign sovereigns, federal regulators, and the First Family interact, bypassing traditional ethical firewalls.

As the market approaches 2026, the primary risk is no longer regulatory bans; it is the potential for systemic corruption and the volatility that will undoubtedly arise if this fragile political-economic alliance is ever challenged. Cryptocurrency is no longer an "alternative" financial system; it has become a digitized, yet often ethically compromised, extension of the existing American political economy.

|  |  |