The Shadow Pivot: How a Trump Truth Social Post Reshaped US Housing Finance

Explore how a single Truth Social post by Trump in 2026 unleashed a $200 billion executive intervention in the mortgage market, bypassing the Federal Reserve and dramatically lowering interest rates. Uncover the financial mechanisms, legal justifications, and critical implications for inflation and

|  |  |

The Shadow Pivot: How Trump ReWrote Housing Finance with a Single Post

January 8th, 2026. This date marks a profound shift in American housing finance, not through traditional political channels, but via a sole social media post on Truth Social. This seemingly innocuous action effectively fractured the established norms between the White House and Wall Street, triggering the most aggressive executive intervention in the mortgage market since the Great Financial Crisis.

This event unveiled a $200 billion surprise that bypassed the Federal Reserve, sent shockwaves through the bond market, and instantaneously reshaped mortgage costs for millions. To truly grasp its magnitude, we must delve beyond the headlines into a forensic audit of financial mechanisms and constitutional interpretations.

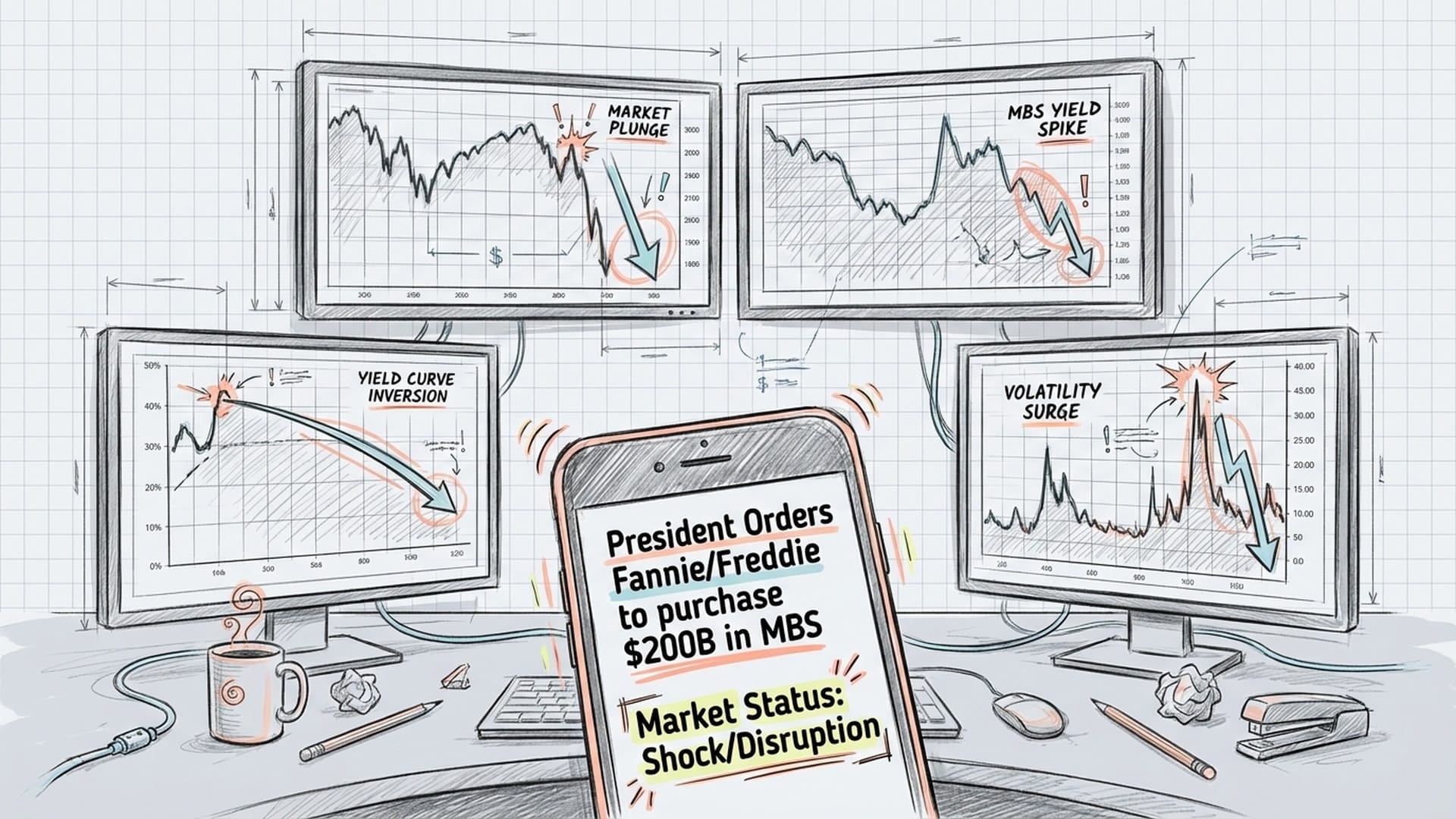

Imagine being a bond trader, accustomed to the Federal Reserve's consistent messaging of sustained high-interest rates to combat inflation. You anticipate a calm trading day. Then, a presidential notification buzzes: a directive for Fannie Mae and Freddie Mac to acquire$200 billionin mortgage-backed securities. For a trader, this isn't just news; it's an earthquake. Suddenly, aprice-insensitive whalewith seeminglyinfinite pocketshas entered your trading pool. The market's reaction was immediate and visceral.

Within hours, the thirty-year fixed mortgage rate plummeted a staggering 22 basis points, breaching the psychological six percent barrier to settle at 5.99 percent. This wasn't merely a move on a chart; it was a seismic shift.

This unprecedented move immediately raised critical questions:

- Legality: Can a President unilaterally command such financial institutions?

- Feasibility: Did Fannie and Freddie actually possess the capital for such a massive undertaking?

- Economic Impact: What are the consequences of injecting such stimulus during an inflationary period when the Federal Reserve aims to tighten the economy?

To understand these dynamics, we need to peel back the layers, starting with the immediate skepticism.

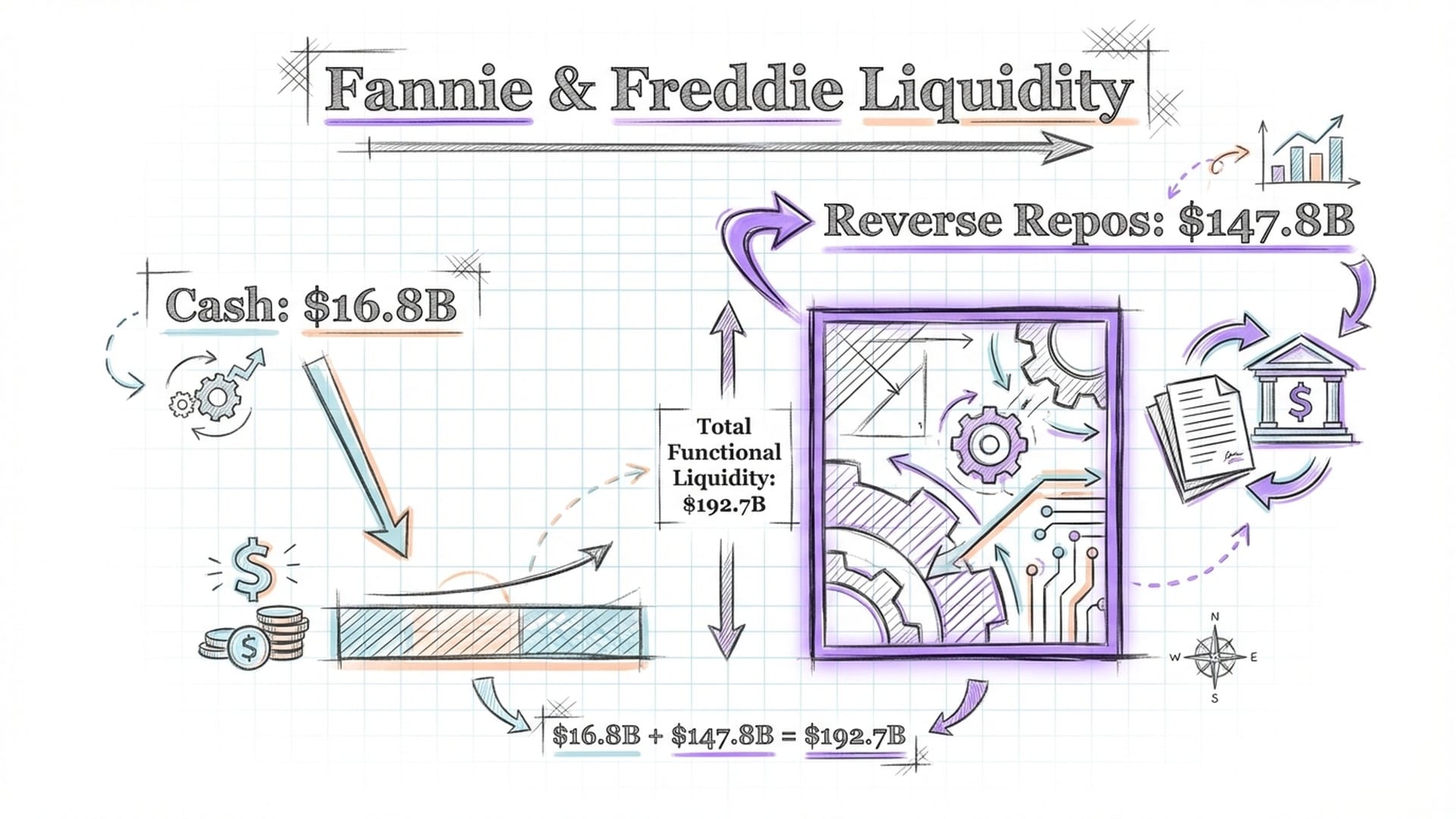

The Myth of the Empty Bank Account: Unpacking Fannie and Freddie's True Liquidity

When the presidential post went live, financial analysts immediately scoured the latest quarterly filings (10-Qs) for Fannie Mae and Freddie Mac. Their initial conclusion, based on the "Cash and Cash Equivalents" line item, was dismissive. Fannie Mae showed $12.2 billion in cash, Freddie Mac $4.6 billion – a combined total of less than $17 billion. Critics scoffed, declaring the $200 billion target impossible with such meager liquid assets.

"At a surface level, those critics were right. If you look at cash, the cupboard is bare."

However, this perspective overlooks a crucial insight known to every corporate treasurer: sitting on actual cash is a financial sin. Cash yields nothing and erodes with inflation. Sophisticated financial institutions, therefore, don't hoard cash. Instead, they hold highly liquid assets that behave like cash but generate interest. Enter Reverse Repurchase Agreements, or Reverse Repos.

The Power of Reverse Repos

A reverse repo is essentially an overnight loan. Fannie Mae, for example, lends its cash to another financial institution for 24 hours, receiving a government bond as collateral. The next morning, the transaction reverses, with Fannie Mae earning a tiny slice of interest. These are among the safest, most liquid assets globally, capable of being converted to physical currency almost instantly.

When looking at the "Securities purchased under agreements to resell" – the accounting term for reverse repos – a different picture emerges:

- Fannie Mae:

$61.5 billionin reverse repos. - Freddie Mac:

$86.3 billionin reverse repos.

Adding restricted and operational cash, the total functional liquidity available amounts to a staggering $192.7 billion. This figure is remarkably close to the $200 billion target, indicating a sophisticated understanding within the White House of the Government-Sponsored Enterprises' (GSEs) exact financial capacity.

This revelation highlights a critical advantage: speed. Had Fannie and Freddie needed to raise new capital by issuing bonds, it would have taken weeks and flooded the market with debt. By leveraging existing reverse repos, they could execute the trade instantly. They merely chose not to renew the overnight loans, reclaimed their cash, and used it to purchase mortgage bonds. This was an asset swap, exchanging low-yield, safe assets for higher-yield, slightly riskier mortgage bonds. Crucially, as a portfolio rebalancing, it bypassed the need for Congressional approval or budget appropriation.

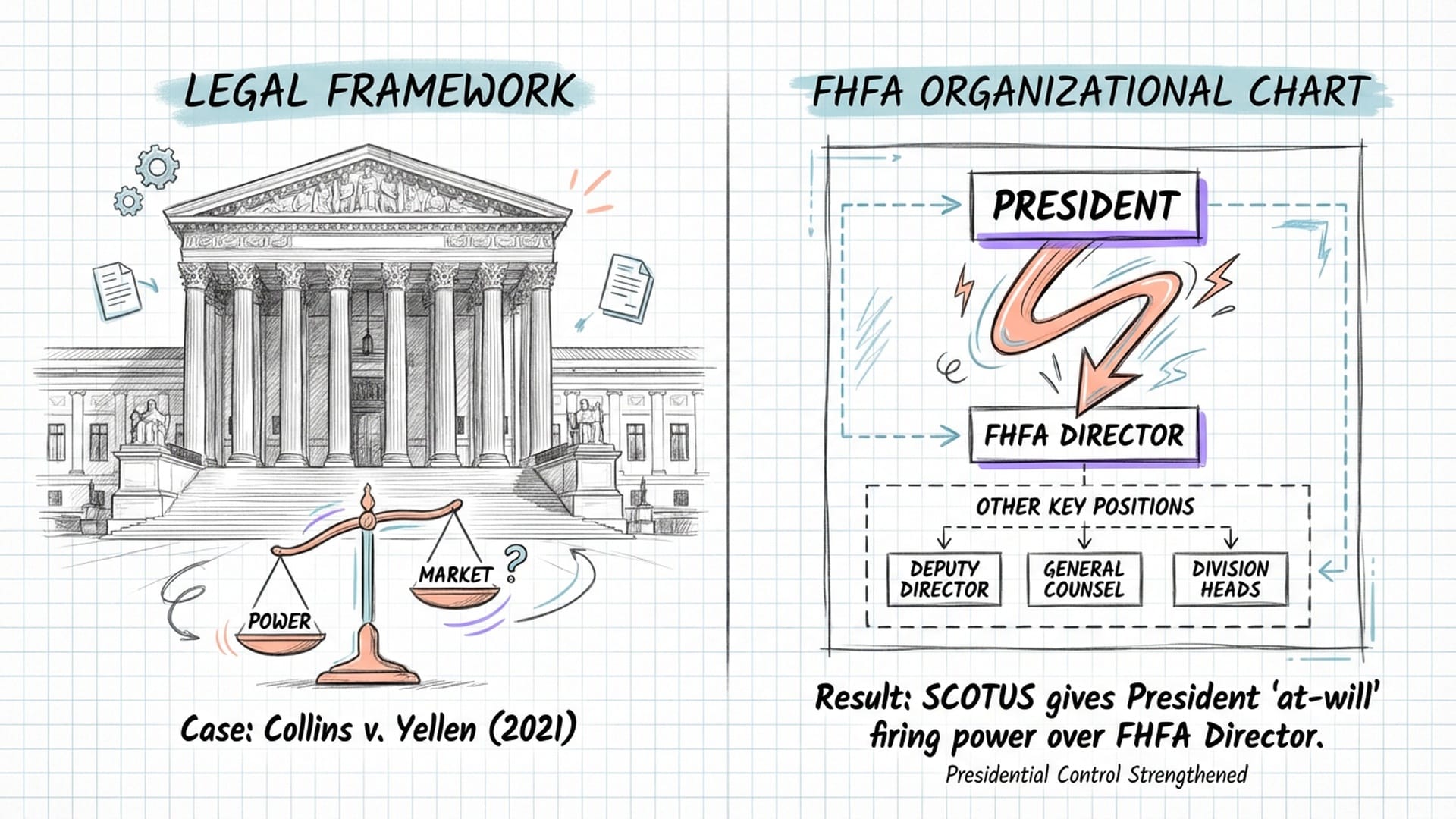

The Legal Framework: From Independence to Executive Control

The feasibility established, the next question is legality. The framework for this intervention hinges on a seemingly obscure 2021 Supreme Court decision: Collins v. Yellen.

For years, the Federal Housing Finance Agency (FHFA), which oversees Fannie and Freddie, was designed to be independent. Its Director enjoyed a protected term, fireable only "for cause"—a safeguard against political manipulation of the housing market. However, Collins v. Yellen dismantled this independence, ruling that the President could fire the FHFA Director at will.

This ruling transformed the FHFA from an independent watchdog into an arm of the Executive Branch. The Director now serves at the pleasure of the President, making explicit that when the President issues a directive, compliance is essentially mandatory.

This legal shift coincided with a strategic appointment in March 2025: William J. Pulte as FHFA Director. Pulte, the grandson of a prominent homebuilder, is known for his philosophy of direct intervention and "Twitter Philanthropy"—a belief in immediately deploying capital to solve problems. This alignment—a President seeking a win, a Supreme Court ruling granting executive control, and a regulator predisposed to direct action—created the perfect storm for the Shadow Pivot. When the order came, Pulte swiftly confirmed on social media, signaling a regime change where housing finance became a tool for social and economic engineering.

One final legal hurdle: the Preferred Stock Purchase Agreements (PSPAs) from the 2008 bailout, which cap the amount of portfolio debt Fannie and Freddie can hold. Critics argued the $200 billion purchase would breach the $225 billion limit. However, a loophole exists: this limit primarily applies to the "Retained Mortgage Portfolio," not the "Liquidity Portfolio" held for operational stability. The administration could simply reclassify these purchases as liquidity support to stabilize the market. Furthermore, with the Treasury Secretary also a presidential appointee and a party to the PSPA, a one-page memo could amend or waive the limit, as has been done before.

Thus, the money is available, and the legal path, though contentious, appears clear.

The Transmission Mechanism: How $200 Billion Impacts Your Mortgage

The true brilliance of this strategy lies in its transmission mechanism: how a Wall Street trade directly translates into savings for homeowners.

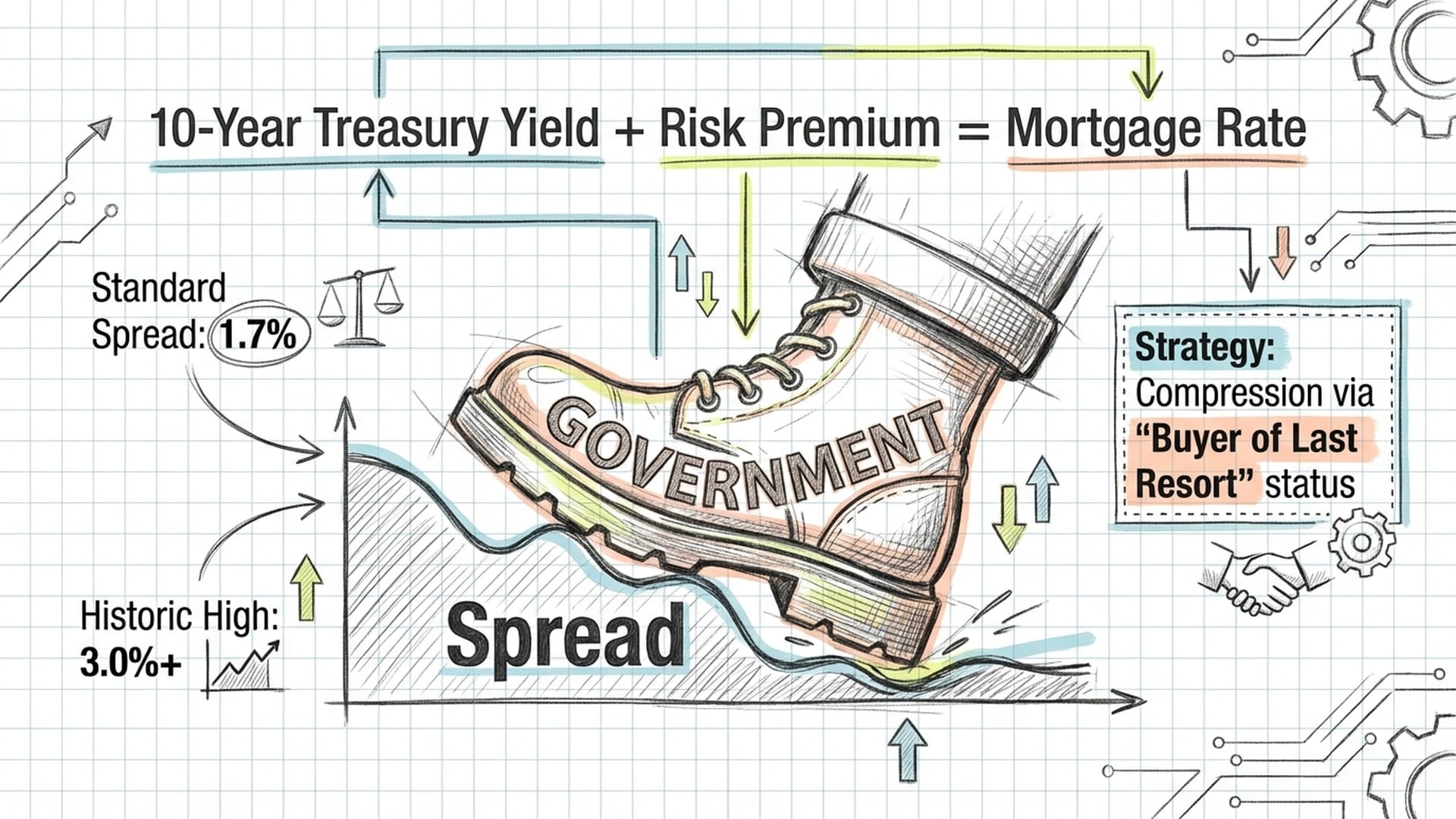

Most people mistakenly believe the Federal Reserve sets mortgage rates. In reality, the Fed influences short-term rates, while long-term mortgage rates typically track the ten-year US Treasury yield plus a spread to cover risk (historically around 1.7 percent). For the past three years, this spread had ballooned to 3 percent or more as the Fed ceased mortgage purchases, increasing volatility and making banks demand a higher premium.

The President's strategy was elegant: attack the spread. By directing Fannie and Freddie to buy $200 billion in mortgage product, the government effectively became the "Buyer of Last Resort." This instantly crushed the risk premium.

The process unfolds rapidly in the To-Be-Announced (TBA) market, where lenders hedge:

- Fannie Mae's trading desk places a massive buy order for a specific

Fannie Mae 5.5% Coupon. - The bond's price surges, causing its yield to plummet.

- The price reaches

par(100 cents on the dollar). - A loan officer nationwide sees an updated rate sheet, instantly able to offer a

5.99 percentrate without additional fees.

The impact for real people is tangible. Consider a $750,000 loan. At the pre-announcement rate of 6.5 percent, the principal and interest payment was $4,740. At 5.99 percent, it drops to $4,491, saving approximately $250 per month, or $3,000 annually.

While $3,000 might not be "life-changing," it’s crucial for market psychology. Years of lock-in effect saw homeowners reluctant to trade a 3 percent mortgage for 7 percent. Six percent is a psychological threshold—a rate at which people are willing to re-enter the market. This policy aims to thaw a frozen market, enabling life events—job transfers, family changes—to occur without prohibitive housing costs.

Winners, Risks, and the Collision Course

This policy creates immediate winners:

- Non-bank lenders like Rocket Mortgage and loanDepot, who starved during high-rate periods, are now set for a refinancing boom. loanDepot's stock surged

16 percentimmediately after the announcement. - Homebuilders like Lennar and D.R. Horton, who previously subsidized rates to move inventory, now see the government effectively doing it for them, boosting their margins.

However, this People's QE comes with a substantial dark side. It places the White House on a direct collision course with the Federal Reserve.

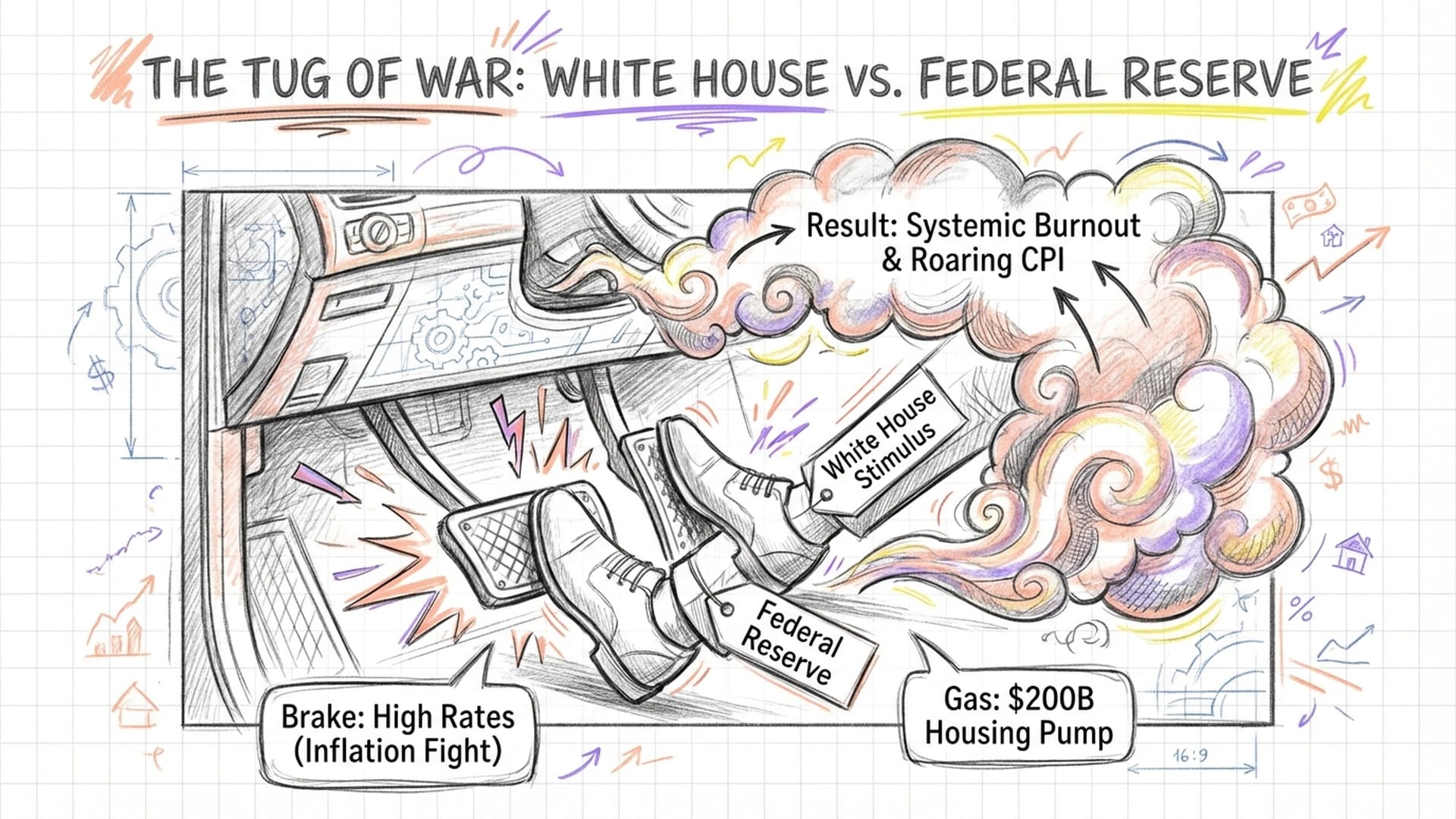

Think of the economy as a car. The Federal Reserve is activelyslamming the brakeswith high interest rates to curb inflation and cool housing prices. Simultaneously, the President isslamming the gasby injecting$200 billioninto the housing market, aiming to boost home sales and prices. What happens when you press both pedals simultaneously? You riskburning out the engine.

The primary concern is inflation, particularly Owner's Equivalent Rent, a significant component of the Consumer Price Index (CPI). The U.S. housing market faces a supply shortage of approximately four million homes. Injecting demand without increasing supply will inevitably cause home prices to explode. If prices rise 5-10 percent in 2026 due to this stimulus, inflation will roar back, forcing the Fed to raise rates even higher, leading to a precarious battle between the nation's two most powerful economic institutions.

Beyond immediate inflation, there's the insidious risk of Moral Hazard, known as the "Trump Put." By signaling a six percent line in the sand, the administration communicates that the government will prevent mortgage rates from exceeding a certain level. This removes risk from the system, encouraging reckless investment and excessive leverage, eventually leading to market bubbles.

Furthermore, the politicization of Fannie and Freddie, once considered boring, stable utilities, turns them into political weapons. This precedent means future administrations, regardless of party, will face irresistible temptation to use this "Shadow Pivot" for political or economic ends, irrespective of long-term consequences.

The Unseen Bill

The Shadow Pivot of January 2026 is more than a financial story; it's a narrative about the shifting dynamics of power. It exposes the fragility of once-assumed guardrails—the independence of regulators, the separation of fiscal and monetary policy.

For a family in Ohio, the immediate benefit is a lower monthly mortgage payment, making the "American Dream" slightly more attainable. However, this discount is subsidized by the government's balance sheet, paid for with increased systemic risk.

The feasibility is validated. The legality, interpreted through the Supreme Court's lens, is affirmed. The immediate impact of lower rates is undeniable. But the hidden cost of this intervention has yet to materialize. It may arrive as reignited inflation, a market perpetually addicted to government stimulus, or a housing market that ultimately becomes a government program, subject to the whims of the next Truth Social post.

The pivot has occurred. The shadow bank is fully operational. The critical question remains: how long can an economy drive with one foot on the gas and one on the brake before something inevitably snaps?

|  |  |