US on a Tightrope: Fiscal Experiment & Trade Wars in 2025-2026

Explore the unprecedented US economic policy experiment of 2025-2026, combining massive fiscal expansion with trade protectionism. Discover how this dual strategy, amidst Fed's efforts to control inflation, risks debt spirals, persistent inflation, and global instability.

|  |

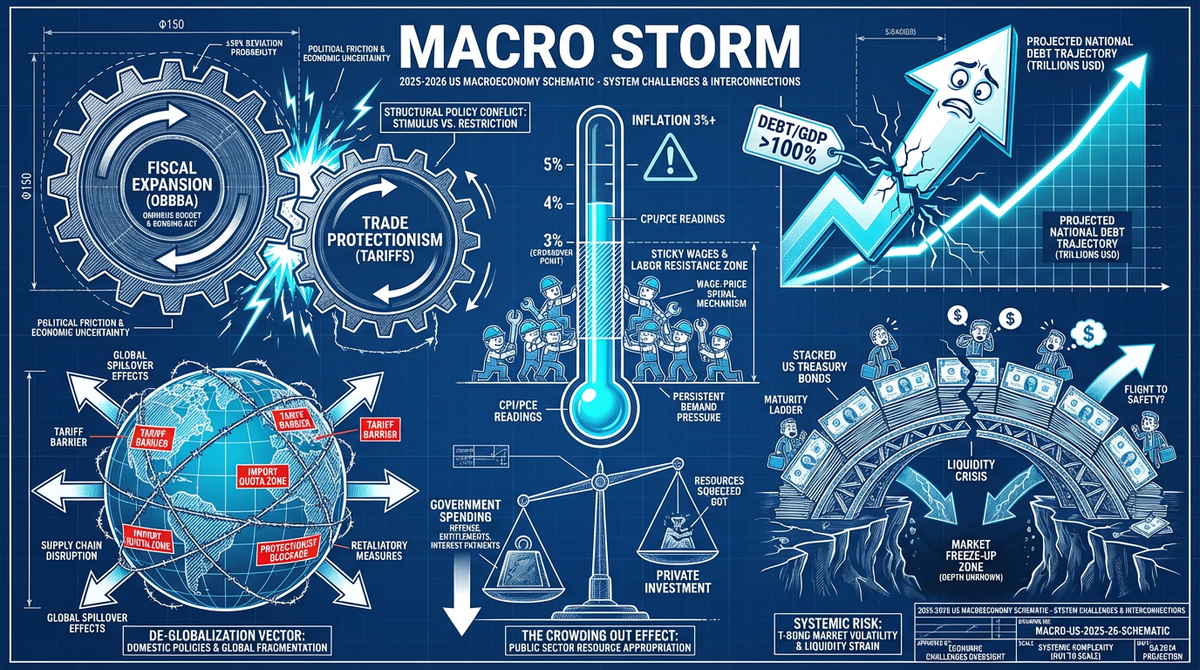

The US economy is embarking on an unprecedented and audacious policy experiment between 2025 and 2026. This isn't a speculative scenario from a sci-fi novel; it's a reality unfolding before our eyes. Imagine a high-speed train, with its driver attempting a controlled, soft landing. Simultaneously, passengers in the coach cars decide to activate rocket boosters and seal off windows, obstructing airflow. This bewildering combination epitomizes the current US economic policy landscape: a blend of aggressive fiscal expansion and trade protectionism, all while the Federal Reserve strives to maintain stability. The critical question is: where will this unique experiment lead the global economy?

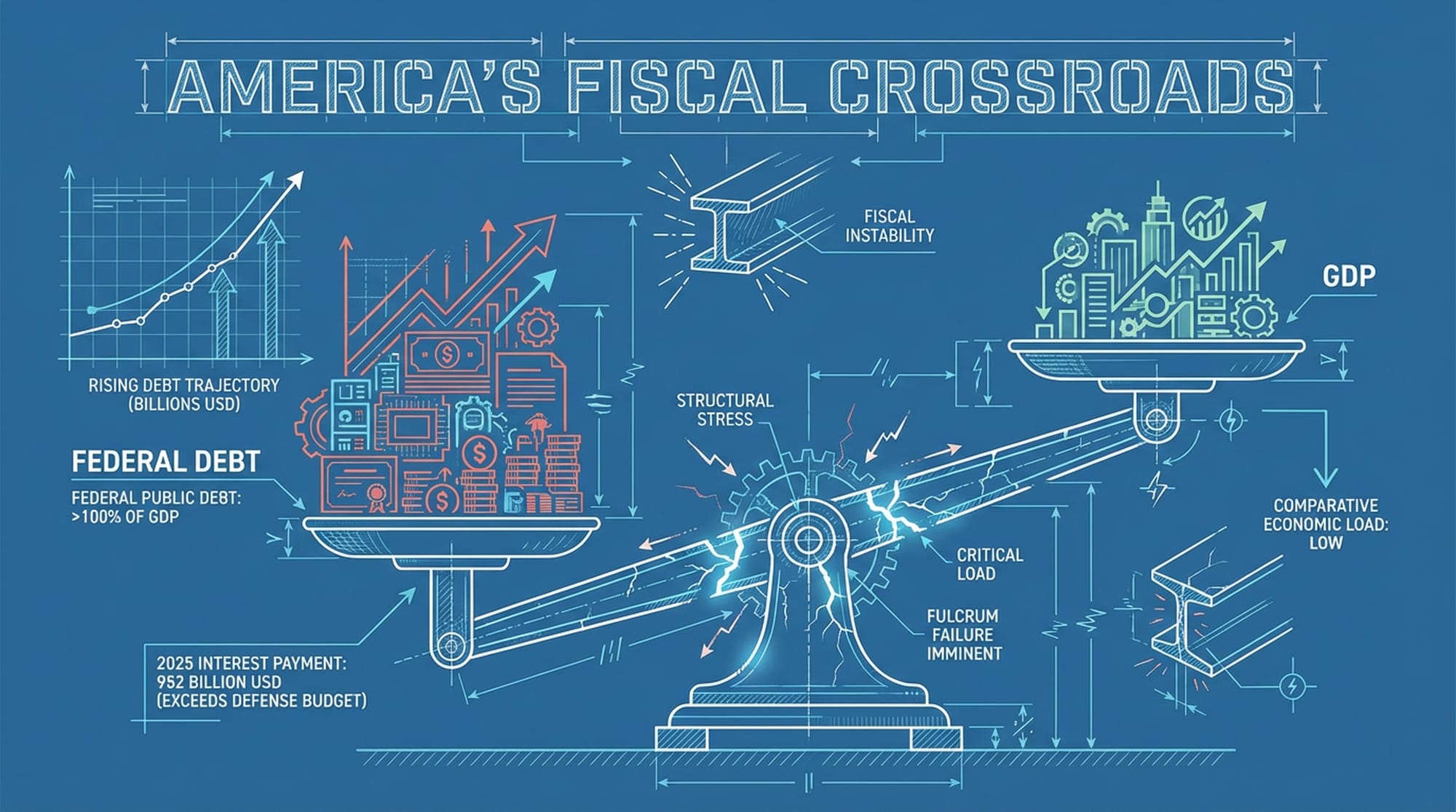

America's Precarious Fiscal Crossroads

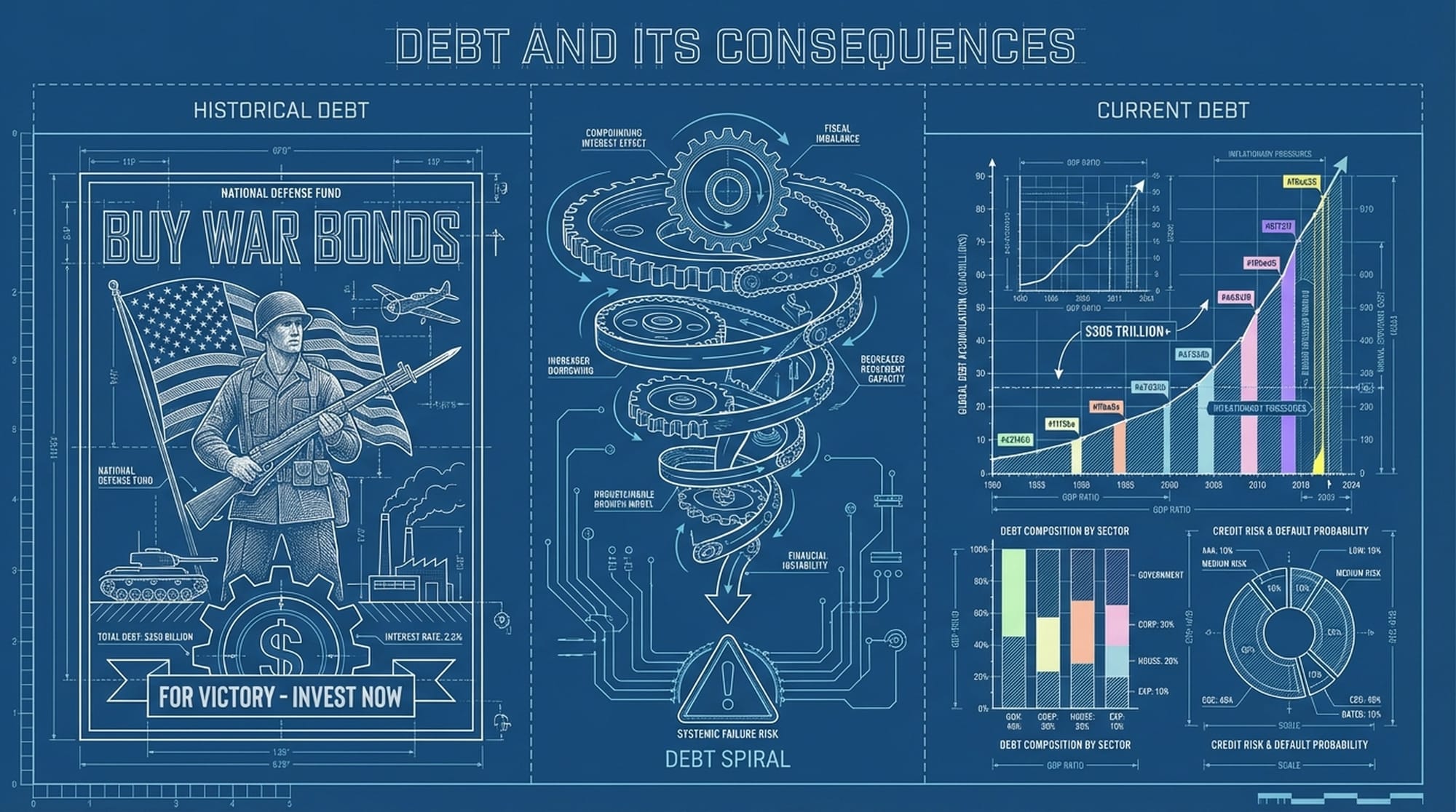

We are truly at a historic juncture. The United States' federal public debt has officially surpassed 100% of its GDP. Crucially, this isn't a consequence of war or a fleeting crisis; it represents a structural deficit emerging during peacetime. This signals a new era of fiscal dominance, where national spending is escalating dramatically, and the cost of borrowing is reaching staggering levels.

By 2025, interest payments alone will cost the US government an estimated $952 billion, a figure that exceeds the defense budget.

The risk of a self-perpetuating debt spiral is no longer a distant threat but a tangible reality.

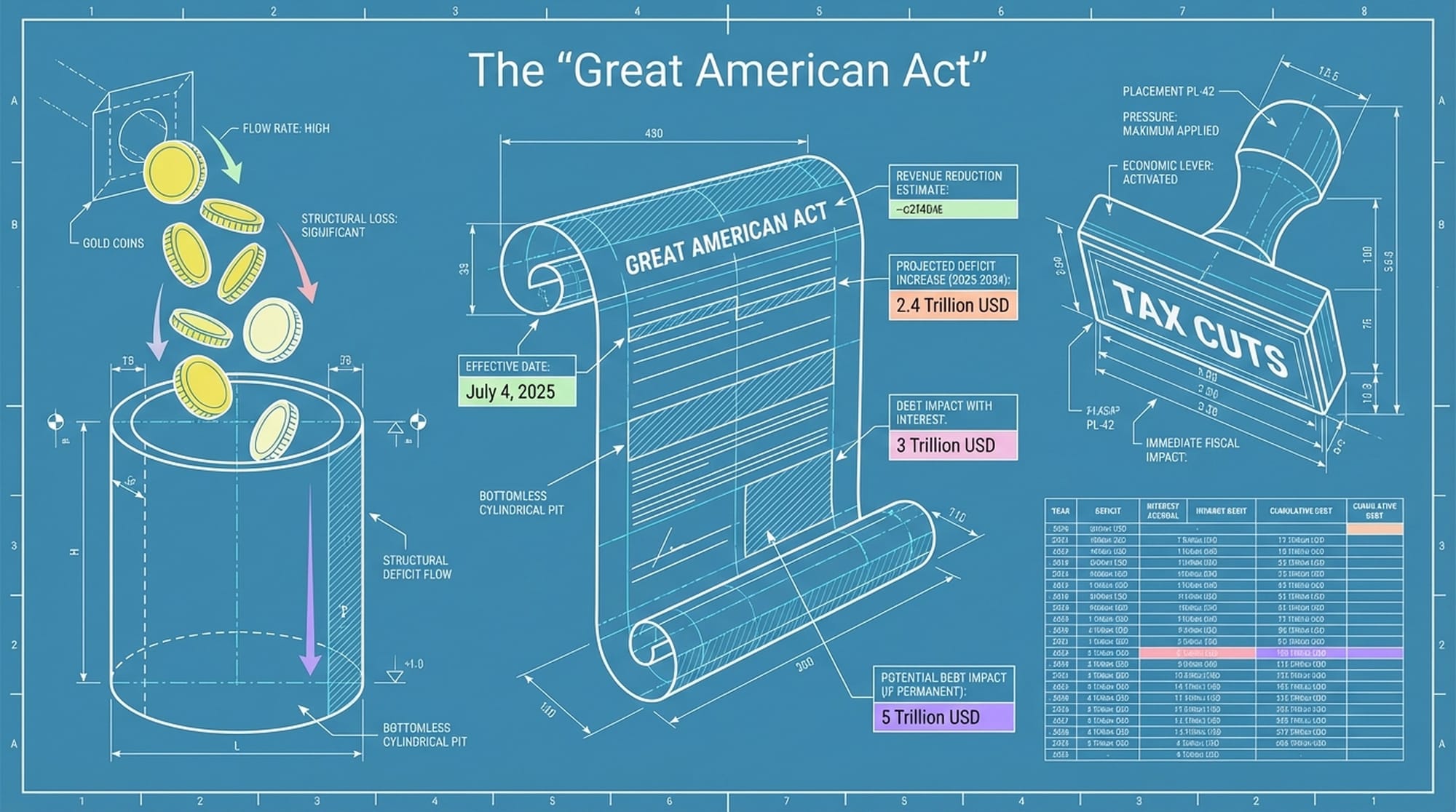

The Great American Act: A Fiscal Game Changer

How did we arrive at this point? A significant driver is the Great American Act, which officially took effect on July 4, 2025. This isn't a typical stimulus package; instead, it's a massive pro-cyclical fiscal injection into an economy already operating near full capacity. By extending the 2017 tax cuts and introducing new, politically appealing populist tax measures, it fundamentally alters America's medium-term fiscal trajectory.

The sheer scale of this act is alarming. Estimates suggest it will directly inflate the US baseline deficit by approximately $2.4 trillion between fiscal years 2025 and 2034. When factoring in borrowing interest, the total impact on national debt could reach $3 trillion. Even more concerning, if the act's temporary provisions are made permanent—a common pattern in US legislation—the cumulative debt impact could skyrocket to $5 trillion.

These colossal deficits are largely due to tax cuts far outweighing any compensatory measures. Policies like tax exemptions for tips and overtime pay exemption, while popular, lead to substantial revenue loss. They not only erode the tax base but also risk distorting labor markets, encouraging income reclassification to evade taxes, making actual revenue losses potentially far greater than initial projections.

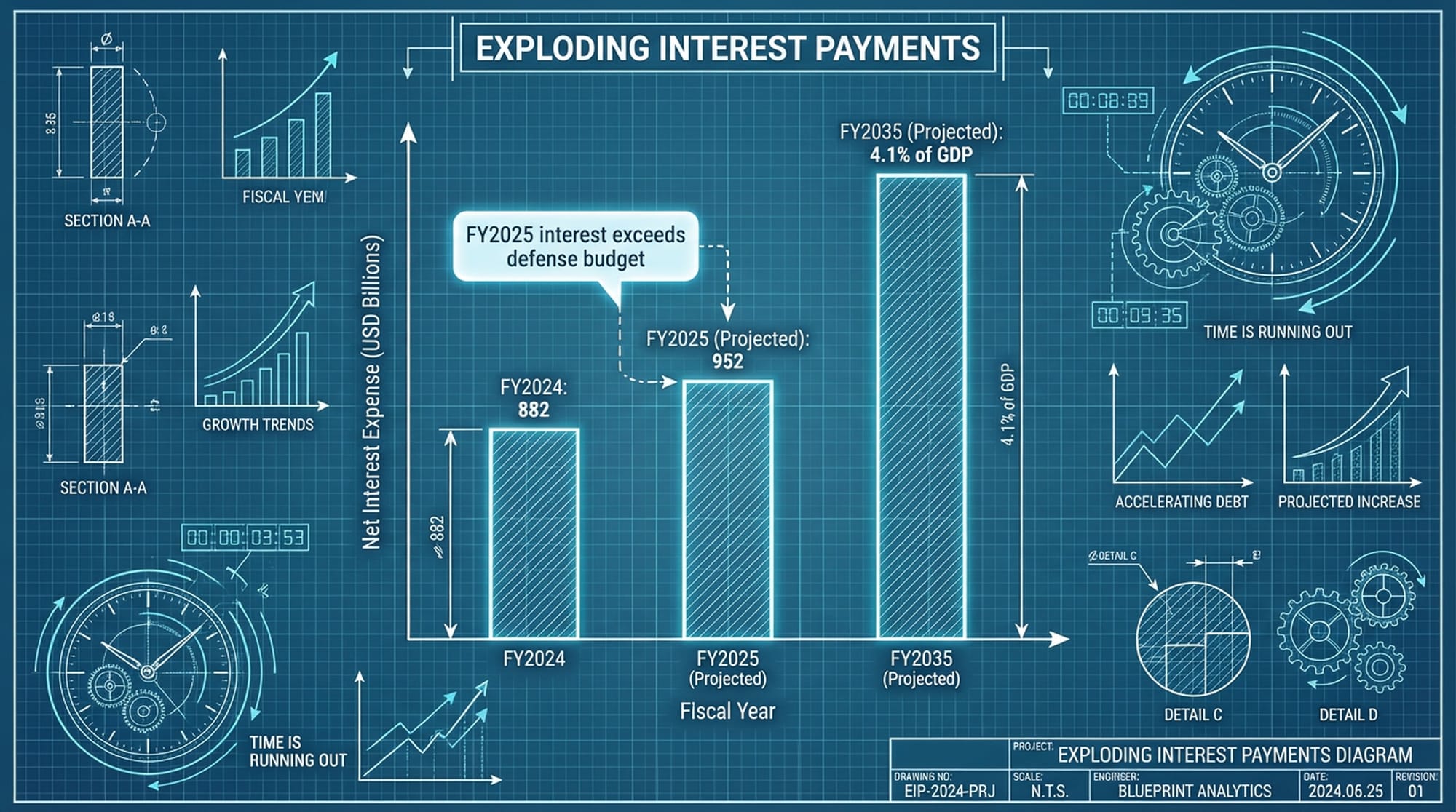

Exploding Interest Payments and Fiscal Crowding Out

The astronomical deficits directly fuel an explosion in interest expenditures.

- In fiscal year 2024, net interest expense hit $882 billion, nearly tripling in just four years.

- By 2025, this is projected to surge to $952 billion, representing 3.2% of US GDP.

- This figure surpasses the defense budget and is rapidly catching up with Medicare spending.

This surge in interest costs is not a fleeting phenomenon. By 2035, interest expenses are projected to consume 4.1% of GDP, making it the fastest-growing component of the federal budget. This leads to substantial fiscal crowding out. Every dollar spent on interest means one less dollar available for critical investments in infrastructure, education, or research, or necessitates further borrowing to maintain existing spending. We are ensnared in a borrowing-to-pay-interest vicious cycle. When interest payments consume nearly a fifth of fiscal revenue, the government's capacity for counter-cyclical adjustments during future economic downturns becomes severely limited.

The fact that publicly held US federal debt officially surpassed 100% of GDP in 2025 is particularly stark. Historically, this threshold was only crossed during World War II. However, the post-WWII debt reduction benefited from economic prosperity, inflation eroding debt, and massive demobilization. Today, we are accumulating immense debt in peacetime, compounded by the rigid increases in social security and healthcare due to an aging population. This high leverage renders US fiscal policy exceptionally sensitive to interest rate fluctuations; even a slight rise can swiftly translate into an additional fiscal burden, intensifying the deficit.

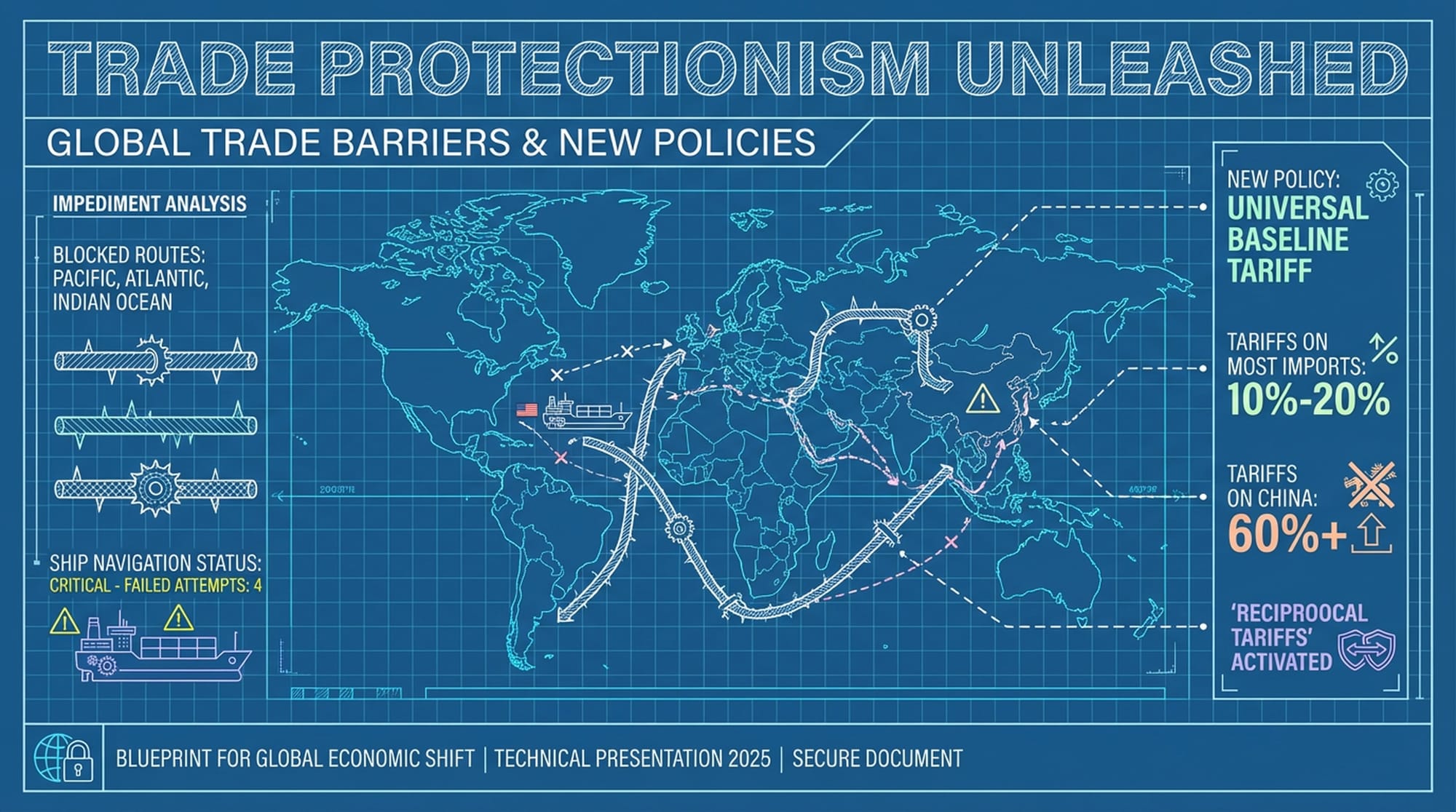

Trade Protectionism Unleashed: A New Global Order

Parallel to this fiscal expansion is a fundamental shift in US trade policy: the rise of trade protectionism. In 2025, the US government not only continued its strategic competitive tariffs but also implemented universal baseline tariffs. This means tariffs are no longer specific to certain goods but apply as a basic tax on almost all imported goods.

The core of this policy involves imposing a baseline tariff of 10% to 20% on most imports. The stated goal is to stimulate domestic production by increasing import costs and, incidentally, generate tax revenue. Tariffs against China could potentially soar to over 60%, alongside reciprocal tariffs—where the US imposes equivalent tariffs if other countries maintain high import duties. This marks a significant multilateralization of global trade friction.

Tariffs' Unintended Consequences: The Backfire Effect

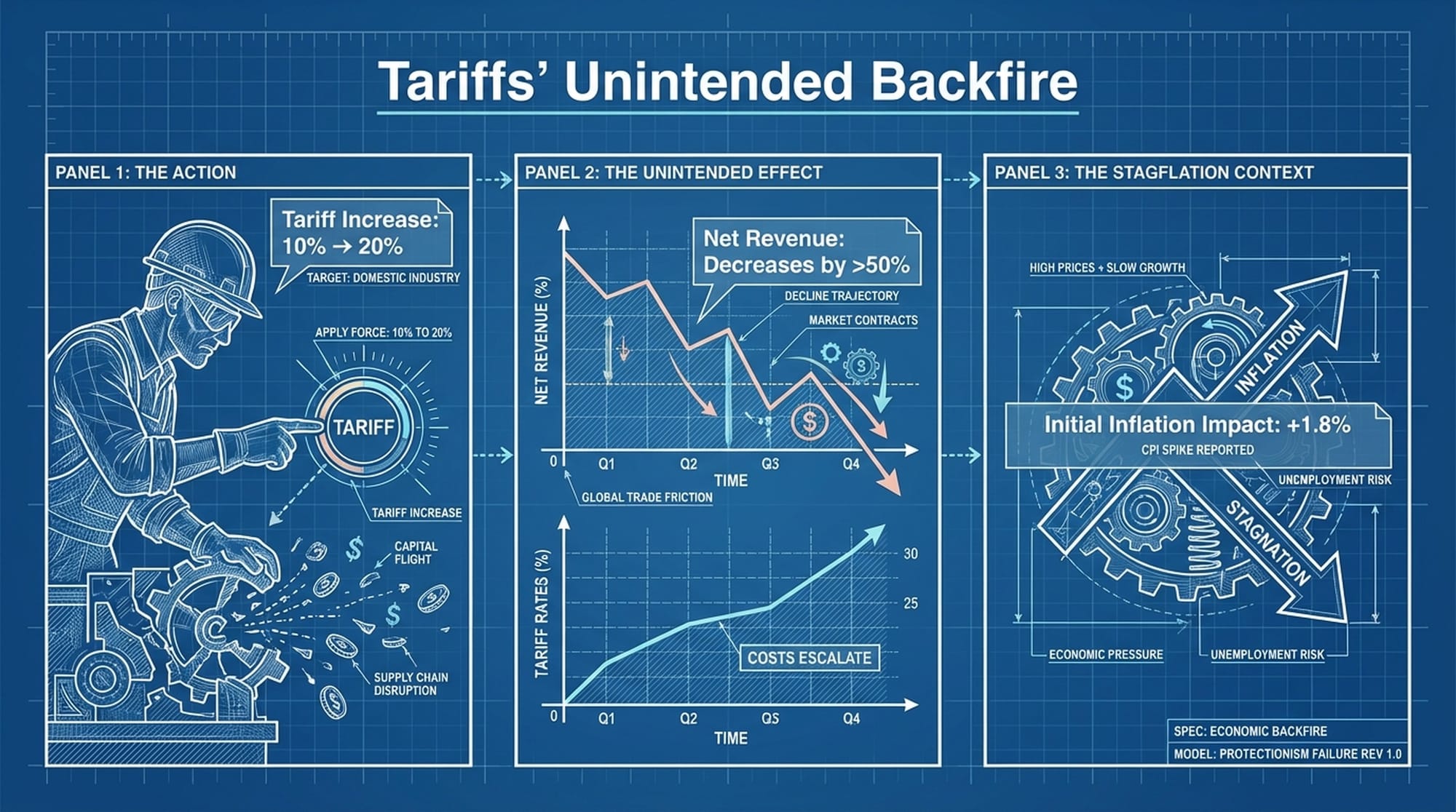

Policymakers hoped that tariff revenue would offset the tax cuts from the Great American Act. However, reality often diverges from expectation. Research indicates that tariffs are essentially a consumption tax with a significant contractionary effect.

When tariff rates increased from 10% to 20%, net revenue paradoxically dropped by over half.

This occurs because high tariffs drastically reduce import volumes, shrinking the tax base. Simultaneously, supply chain disruptions and escalating costs negatively impact domestic GDP, leading to decreased personal income tax and corporate tax revenues, ultimately negating any direct tariff revenue gains.

More critically, trade protectionism will lead to inflationary transmission through supply chains. The 2025 tariff shock is occurring during a period when global supply chains are already highly vulnerable. Universal tariffs mean importers cannot easily circumvent duties by shifting procurement locations, as baseline tariffs apply broadly. This significantly increases the rate at which tariffs are passed on to consumer prices. Studies suggest tariffs could initially boost inflation by approximately 1.8% above the baseline. While theoretically a one-time price level increase, in an environment of sticky wages, this can easily evolve into sustained inflationary pressure.

Financial Market Instability: The Looming Crisis

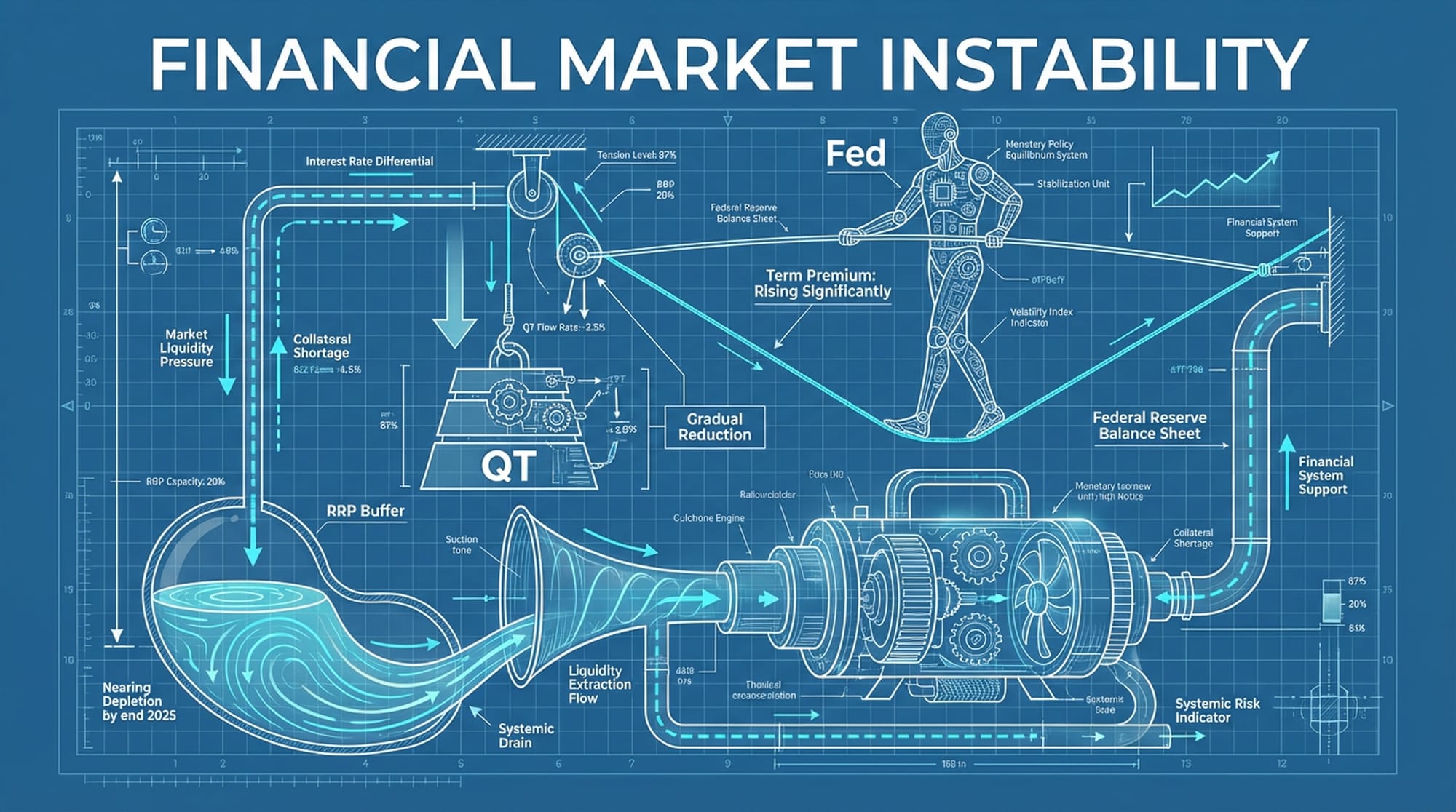

The combination of a massive fiscal black hole and trade barriers spells trouble for financial markets. Fiscal expansion necessitates enormous bond issuance, a demand that coincides with an inflection point in the Federal Reserve's balance sheet policy.

From 2023 to 2024, the Fed's overnight reverse repurchase mechanism acted as a massive liquidity buffer, successfully absorbing large issuances of short-term Treasury bills. However, by the end of 2025, this buffer will be largely depleted. This implies that every new dollar of debt must either directly draw reserves from the banking system or be purchased by price-sensitive private investors.

Liquidity pressure will surge, potentially triggering interest rate volatility in the repo market, reminiscent of the 2019 liquidity crisis.

In response, the Fed is compelled to adjust the pace of its balance sheet reduction, gradually lowering the monthly cap for Treasury bond reductions. This effectively signals the end of aggressive quantitative tightening. The Fed must acknowledge that, given the Treasury's colossal issuance, the market cannot absorb the bonds sold by the Fed without provoking severe turmoil. This policy shift is essentially passive yield management, aimed at preventing long-term interest rates from spiraling out of control and causing financial instability. This is an early indication of fiscal dominance over monetary policy.

Driven by supply-demand imbalances, investors are demanding higher compensation for holding long-term US Treasuries, leading to a significant rebound in term premium. This is a critical signal: the market is pricing in long-term inflation risk and fiscal unsustainability. The tail risk of digestion problems or even failed auctions for future Treasury issuances is increasing significantly.

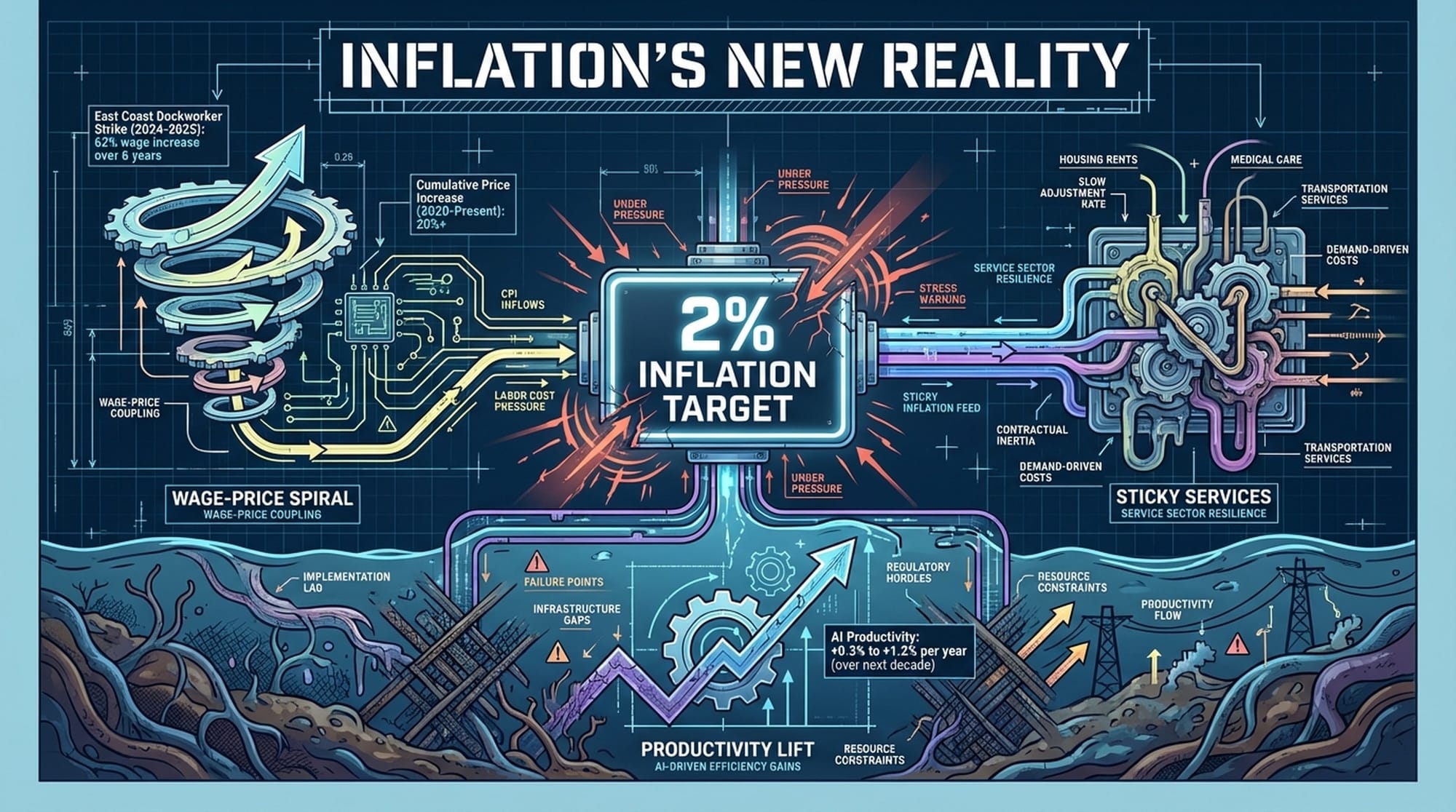

Inflation's New Reality: Beyond the 2% Target

Despite potential Fed rate cuts in 2025-2026, the fundamental dynamics of inflation have shifted. A spiraling increase in wages and prices, persistent service inflation, and lagging productivity improvements collectively forge a structural high-inflation environment.

Consider the East Coast dockworker strike from late 2024 to early 2025, which concluded with a historic contract: a 62% wage increase over six years! An average annual increase exceeding 10% far surpasses the Fed's 2% inflation target. This isn't merely about higher wages; it deeply intertwines wage growth with future inflation expectations. Docks are critical logistics hubs, and rising labor costs will directly translate into higher shipping fees, ultimately embedding into the price of all imported goods. Such high settlements also set a new benchmark for labor negotiations across other industries, making service sector wages easy to rise, hard to fall, thus making core inflation more stubborn.

Another notable phenomenon is the emergence of a sentiment recession. In 2025, a significant divergence exists between macroeconomic data and public sentiment. While GDP growth remains positive and unemployment low, consumer confidence is remarkably subdued. This disconnect arises because, despite potential decreases in the inflation rate, price levels have cumulatively risen over 20% since 2020. While tax cuts boosted nominal income, rising living costs due to tariffs have eroded actual purchasing power.

Finally, while Artificial Intelligence is often hailed as a savior that could offset inflationary pressures through productivity gains, its short-term impact might be neutral or even inflationary. Currently, companies are making massive investments in AI infrastructure—data centers, chips, energy—which paradoxically increases aggregate demand. The optimization of production processes and labor substitution through AI will take time to translate into widespread cost reductions. In the short term, we observe increased demand rather than a significant decrease in supply costs. Distant water cannot quench immediate thirst.

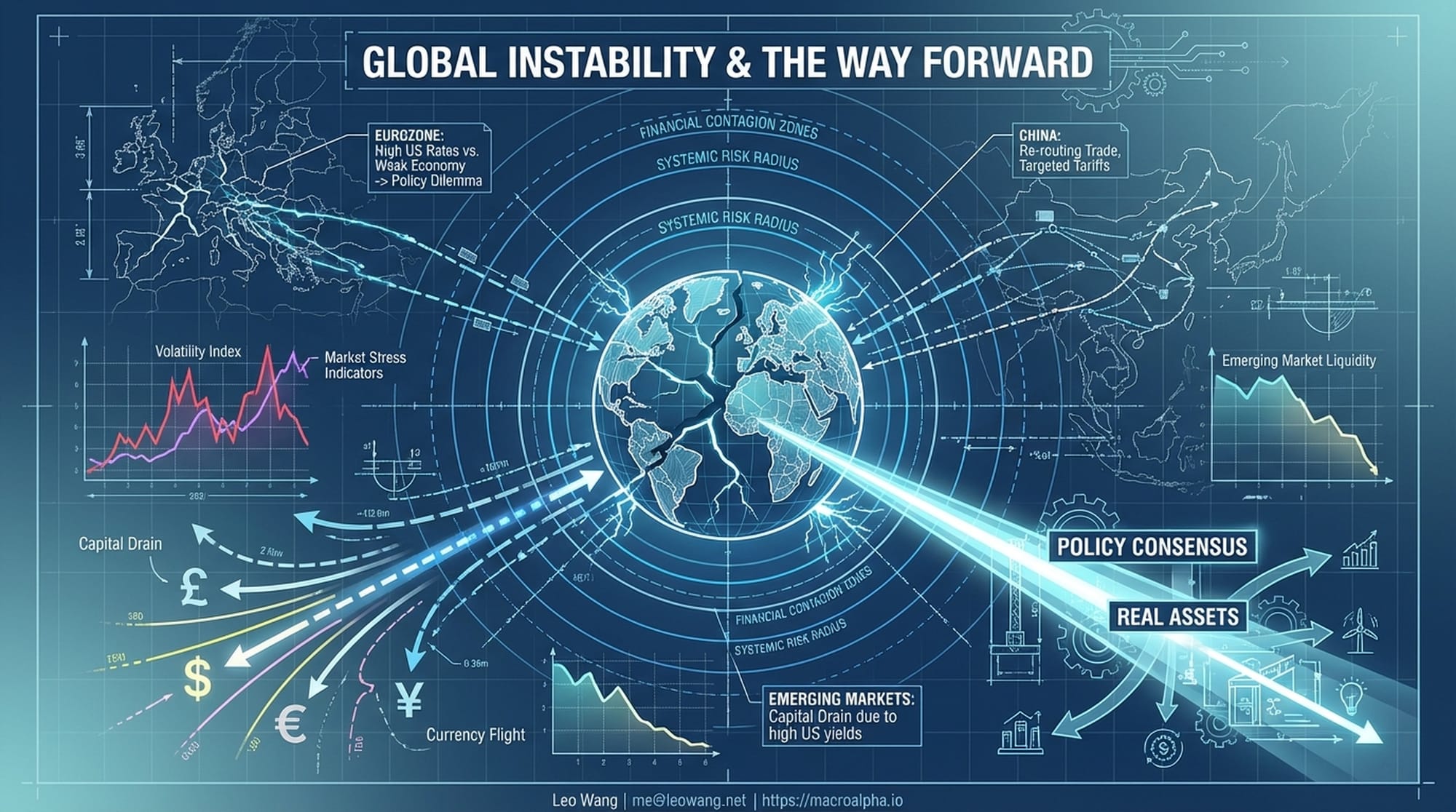

Global Instability and the Path Forward

How will the real economy respond to this intricate situation? While the Federal Reserve might cut interest rates, long-term rates, such as the ten-year US Treasury yield, are projected to remain high (4.1% to 4.5%) due to massive deficit expectations and term premium. This creates a bifurcation of financing costs:

- Large corporations with long-term low-interest debt and substantial cash reserves are largely immune to high rates and may even profit.

- Small and medium-sized enterprises (SMEs) and homebuyers directly bear the brunt, stifling real estate recovery and SME capital expenditures.

The sharp expansion of fiscal deficits absorbs vast amounts of social savings. To attract capital for government bonds, yields must rise, increasing the financing threshold for the private sector. Viable private investment projects may be shelved due to prohibitive financing costs, with resources diverted to less efficient government-led sectors or for interest payments.

Universal tariffs, while intended to protect domestic manufacturing, increase intermediate goods costs, reducing the competitiveness of downstream industries. Resources shift from high-productivity, export-oriented sectors to less efficient import-substitution industries, ultimately decreasing overall economic total factor productivity.

Global Implications

The US policy mix is exporting instability globally through interest rates, exchange rates, and trade flows:

- Eurozone Dilemma: High US deficits maintain high interest rates, while a weak Eurozone economy requires more significant rate cuts. This widens the interest rate differential, strengthening the dollar against the euro. A depreciating euro increases the cost of imported energy and raw materials, exacerbating inflation. The European Central Bank faces a difficult choice: maintaining high rates with the Fed stifles its economy, while significant cuts lead to capital outflow and steep currency depreciation. US tariffs on European exports further weaken Europe's growth engines.

- China's Response: Rather than a

nuclear optionof mass selling US Treasuries, China adopts flexible strategies, such as re-exporting through Mexico and Vietnam to circumvent tariff barriers, and imposing targeted tariffs on US agricultural products for asymmetrical pressure. - Emerging Markets: The high risk-free return of US Treasury bonds acts as a

giant vacuum cleaner, attracting global capital. To prevent capital flight, emerging markets are forced to maintain higher real interest rates than their economic fundamentals warrant, suppressing investment and growth, and exacerbating global development imbalances.

Conclusion: A Dangerous Tightrope

Evaluating the US macroeconomic policy mix for 2025-2026, a clear conclusion emerges: the US is attempting to walk a very dangerous tightrope. It seeks to sustain nominal growth through fiscal expansion and reshape supply chains via trade protectionism, all built upon an already fragile debt foundation.

The core findings are:

- Unsustainable Debt Path: The US debt path is unsustainable. A debt-to-GDP ratio exceeding 100%, coupled with interest costs above 4%, is creating a self-compounding deficit machine. The

Great American Actaccelerates this, prematurely closing the window for fiscal consolidation. - Unrealistic Inflation Target: The 2% inflation target is unrealistic under the current policy mix. Tariffs, wage stickiness, and fiscal stimulus collectively suggest that the inflation midpoint will remain around 3% in the coming years.

- Increased Market Fragility: Market fragility is increasing. The Treasury market has become the epicenter of systemic risk. The disappearance of liquidity buffers means any unexpected shock—a failed auction or geopolitical crisis—could force the Fed to abandon its inflation target and resort to

yield curve controlto rescue fiscal policy, effectively moving towardsfiscal dominance.

For us, the defining theme of 2026 will be the return of volatility. The era of low inflation, low interest rates, low volatility is definitively over. In investment strategy, it is prudent to avoid interest-rate-sensitive long-term assets and increase allocation to real assets and high-tech companies with monopolistic pricing power to navigate inflation and tariff costs. For policymakers, acknowledging the costs of trade wars and forging political consensus for fiscal consolidation will be the only viable path to avert a sovereign debt crisis in the late 2020s.

This future is fraught with uncertainty, yet understanding these potential risks is crucial for finding our anchor in this massive macroeconomic experiment.

|  |