Robinhood's Radical Reinvention: From Meme Stocks to Financial Super-App

Forget meme stocks and day-trading frenzies. Robinhood is quietly engineering a new financial ecosystem through prediction markets, generative AI, and a potential government-subsidized growth spurt, aiming to redefine wealth management for a new generation.

|  |  |

Robinhood's Radical Transformation: Beyond Meme Stocks

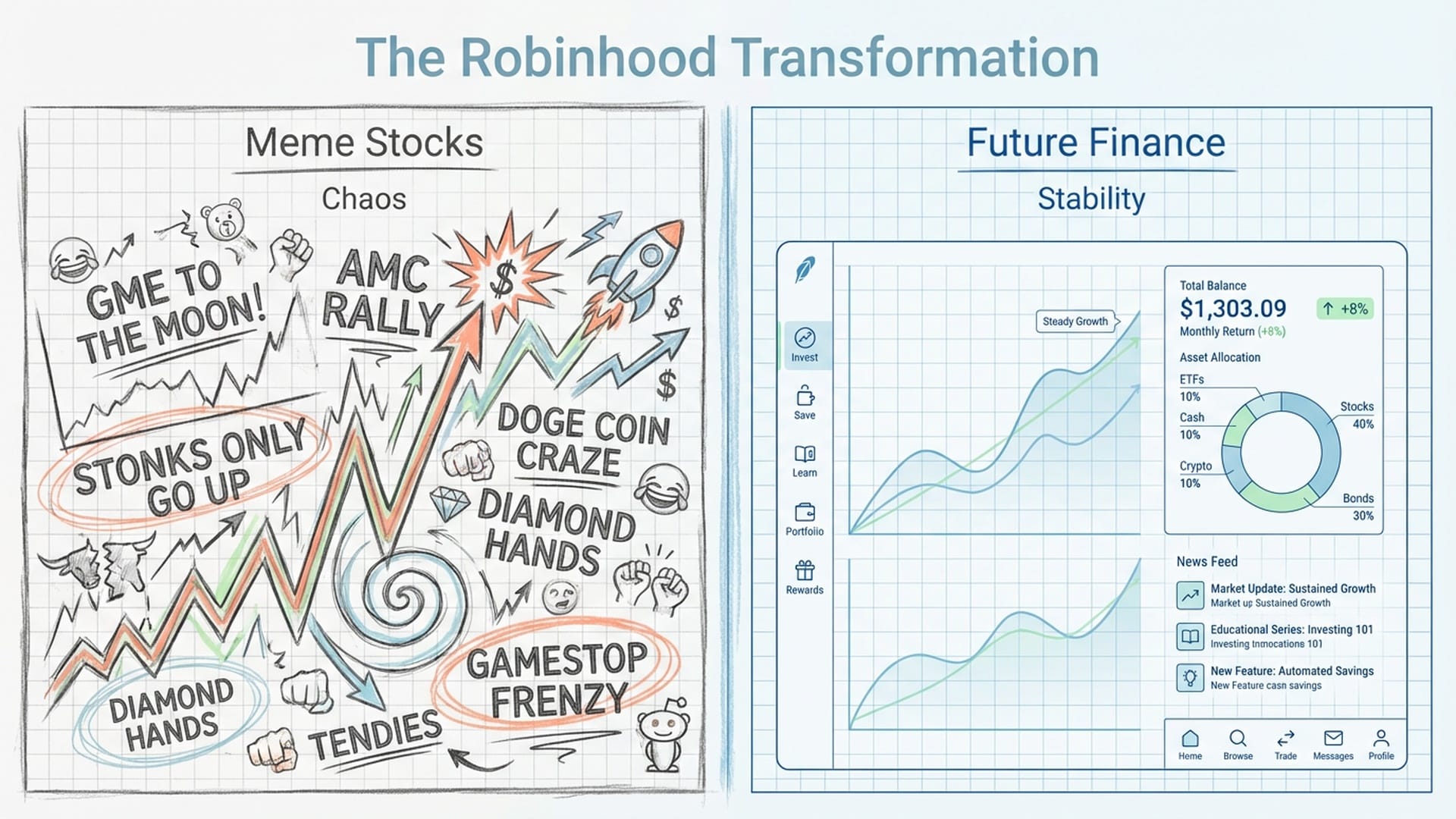

For years, Robinhood was synonymous with meme stocks and the day-trading frenzy, often painted as a platform catering to "gamified" investing. The headlines frequently highlighted its role in market volatility. However, beneath this widely publicized image, Robinhood has been orchestrating a quiet yet radical transformation, evolving into a financial super-app poised to redefine wealth management for a new generation.

The meme stock era, while a period of explosive user growth and profitability, also exposed a fundamental fragility in Robinhood's revenue model. Its heavy reliance on transaction volume made it highly susceptible to market whims, creating a rollercoaster of earnings. This realization prompted a strategic shift, moving away from being solely a disruptive trading platform to engineering a more robust, diversified financial ecosystem.

"Robinhood isn't just trying to survive; it's trying to engineer nothing less than a completely new financial ecosystem."

The Three Pillars of Robinhood's Super-App Strategy

Robinhood's metamorphosis is driven by three audacious plays, each designed to foster engagement, asset retention, and long-term stability:

- Prediction Markets: Diving headfirst into "event contracts,"

- Cortex AI: Deploying a sophisticated generative AI for active intelligence,

- Government-Subsidized Growth: Positioning itself for a potential influx of new customers through initiatives like "Trump Accounts."

This isn't mere evolution; it's a strategic metamorphosis aimed at creating an integrated financial experience.

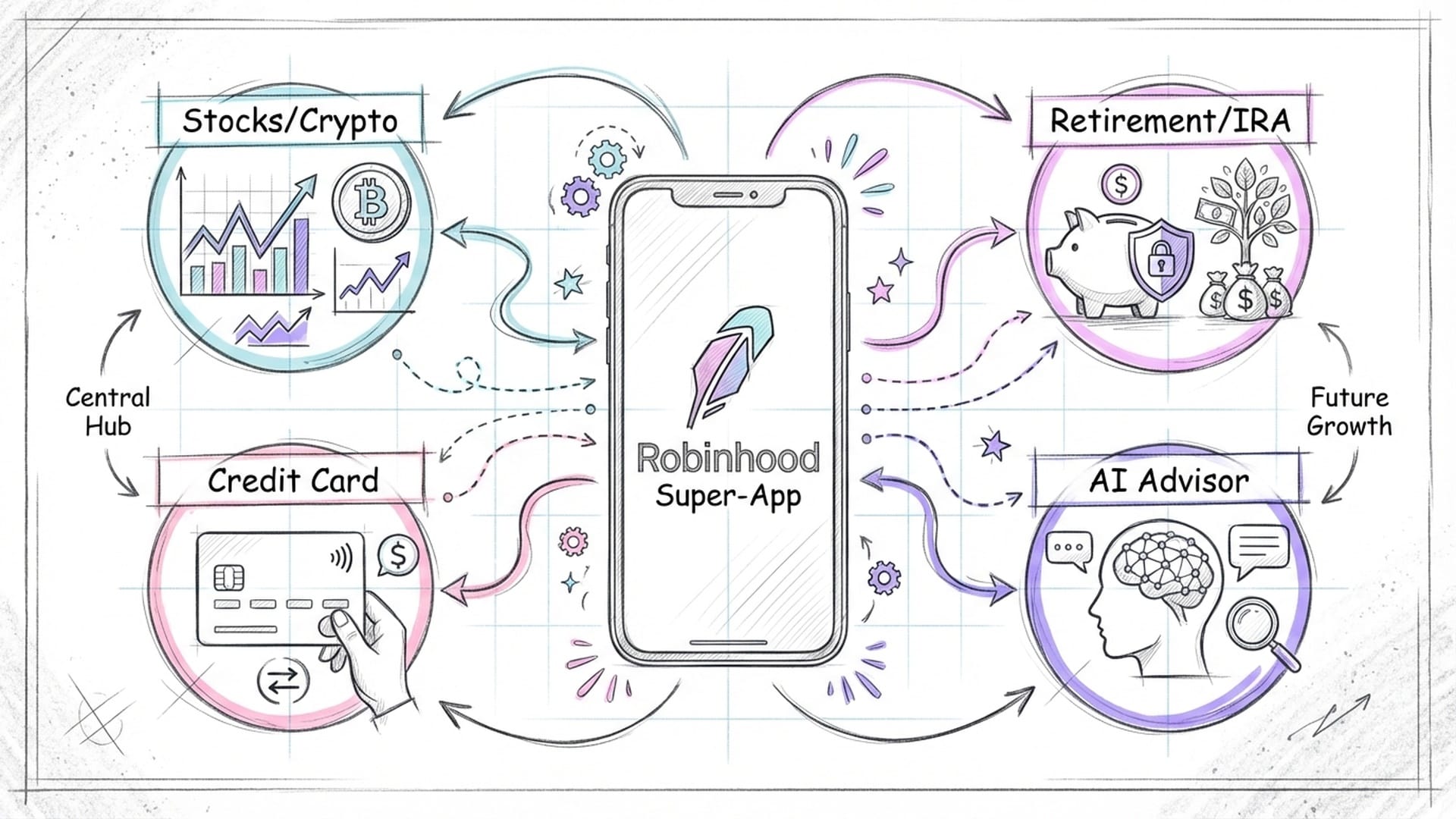

The Super-App Blueprint: A Seamless Financial Ecosystem

The concept of a "super-app," popularized by Asian giants like WeChat and Alipay, aims to consolidate various financial services into a single, seamless digital platform. Robinhood's vision is to bring together spending, investing, borrowing, and saving, allowing them to interconnect and optimize users' financial lives.

This aspiration is built upon three interconnected pillars, each reinforcing the others, creating a powerful flywheel effect for engagement and, crucially, asset retention.

Pillar 1: Expanded Trading and Speculation

While traditionally known for stock trading, Robinhood’s first pillar has expanded significantly beyond a handful of equities. The platform now offers:

- Options trading

- Cryptocurrency trading

- Prediction markets, or "event contracts"

This expansion serves two key purposes: it retains high-velocity, active traders who generate significant payment for order flow revenues, and it introduces new, uncorrelated asset classes that attract diverse speculative capital. Users can now bet on everything from political outcomes to pop culture events.

Pillar 2: Wealth and Income Management

To counterbalance the inherent churn associated with high-risk trading, Robinhood has aggressively built features focused on long-term stability:

- High-yield cash sweeps: Monetizing uninvested cash.

- Retirement suite: Including matching contributions for IRAs.

- The Robinhood Credit Card: A strategic move to embed Robinhood into users' daily financial lives, transforming it from an occasional destination into a ubiquitous utility.

"The genius of a credit card? It weaves Robinhood directly into your daily financial life. It turns Robinhood from a destination you visit maybe once a day during market hours, to a utility you use for every transaction."

This move is both subtle and brilliant, significantly increasing user stickiness and engagement.

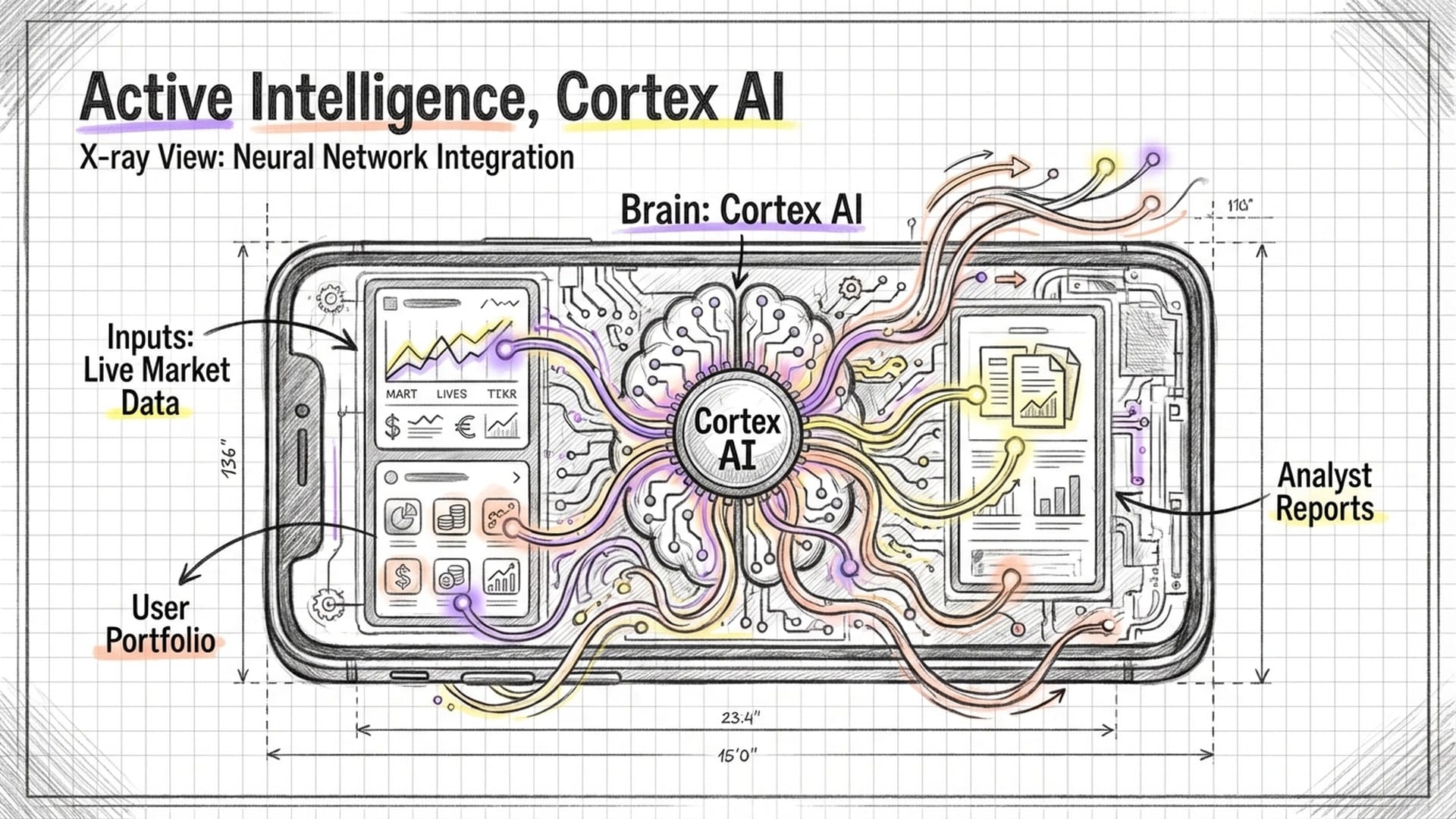

Pillar 3: Active Intelligence, Powered by Cortex AI

Perhaps the most revolutionary aspect of Robinhood's transformation is Cortex AI, their active intelligence platform. Far from being a simple chatbot, Cortex acts as the connective tissue and brain of the operation, interpreting data across a user's entire financial portfolio.

Cortex is designed to be an active participant in decision-making, providing personalized context for market moves. Its primary goal is to bridge the "financial literacy gap" by transforming speculative traders into sophisticated, long-term investors. Robinhood's democratization strategy positions Cortex as an "analyst in the pocket" of the retail user, a distinct advantage in a landscape where competitors either offer basic navigational tools or use AI to merely enhance human advisors.

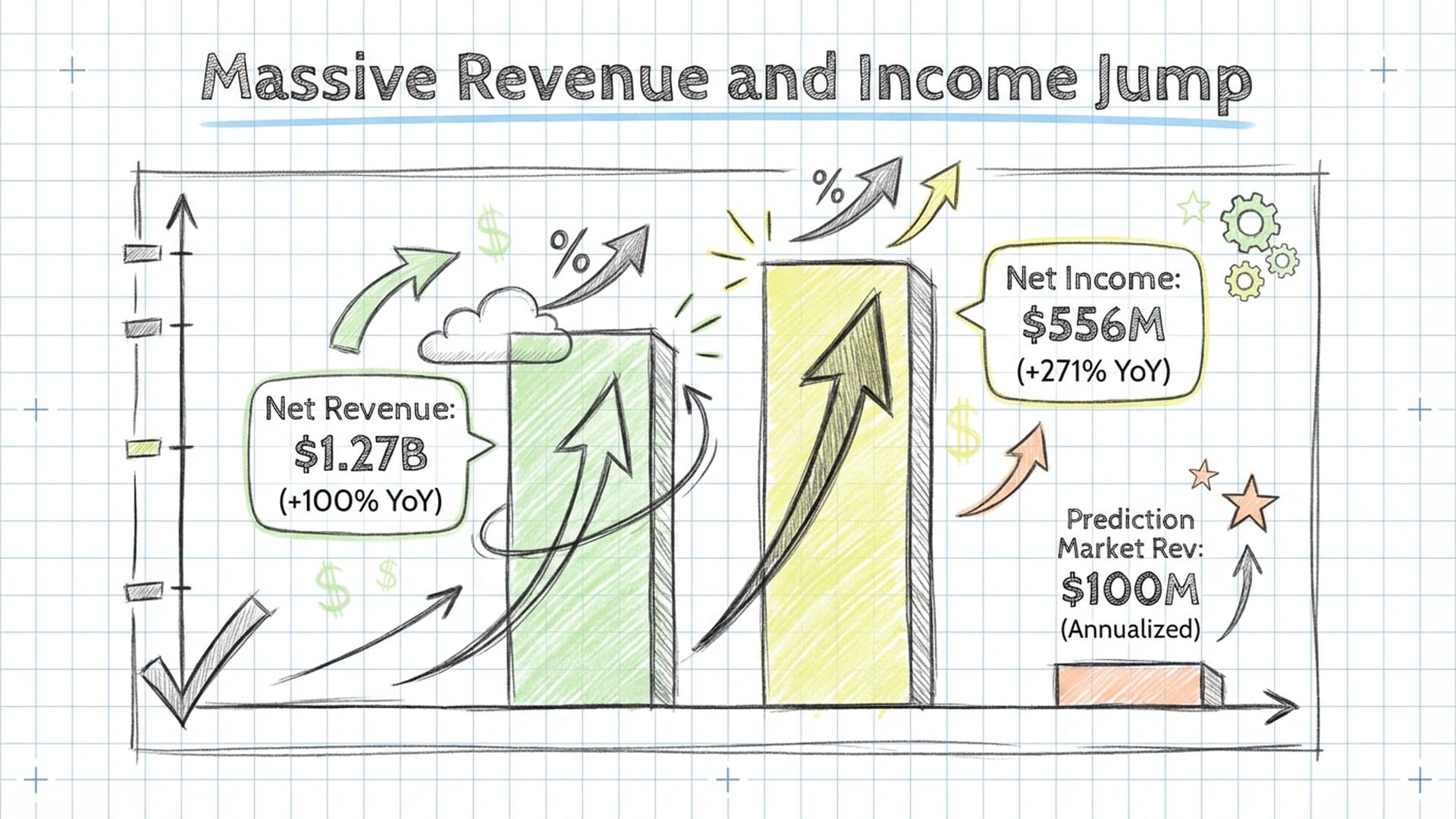

Screaming Financial Results: Q3 2025

The success of this pivot is evident in Robinhood's Q3 2025 financial results:

- Total net revenues: $1.27 billion, a 100% year-over-year surge.

- Net income: $556 million, rocketing up an astounding 271%.

- Prediction markets: Already generating approximately $100 million in annualized revenue in just two years.

These figures unequivocally demonstrate that this isn't a fluke but a meticulously executed strategic shift.

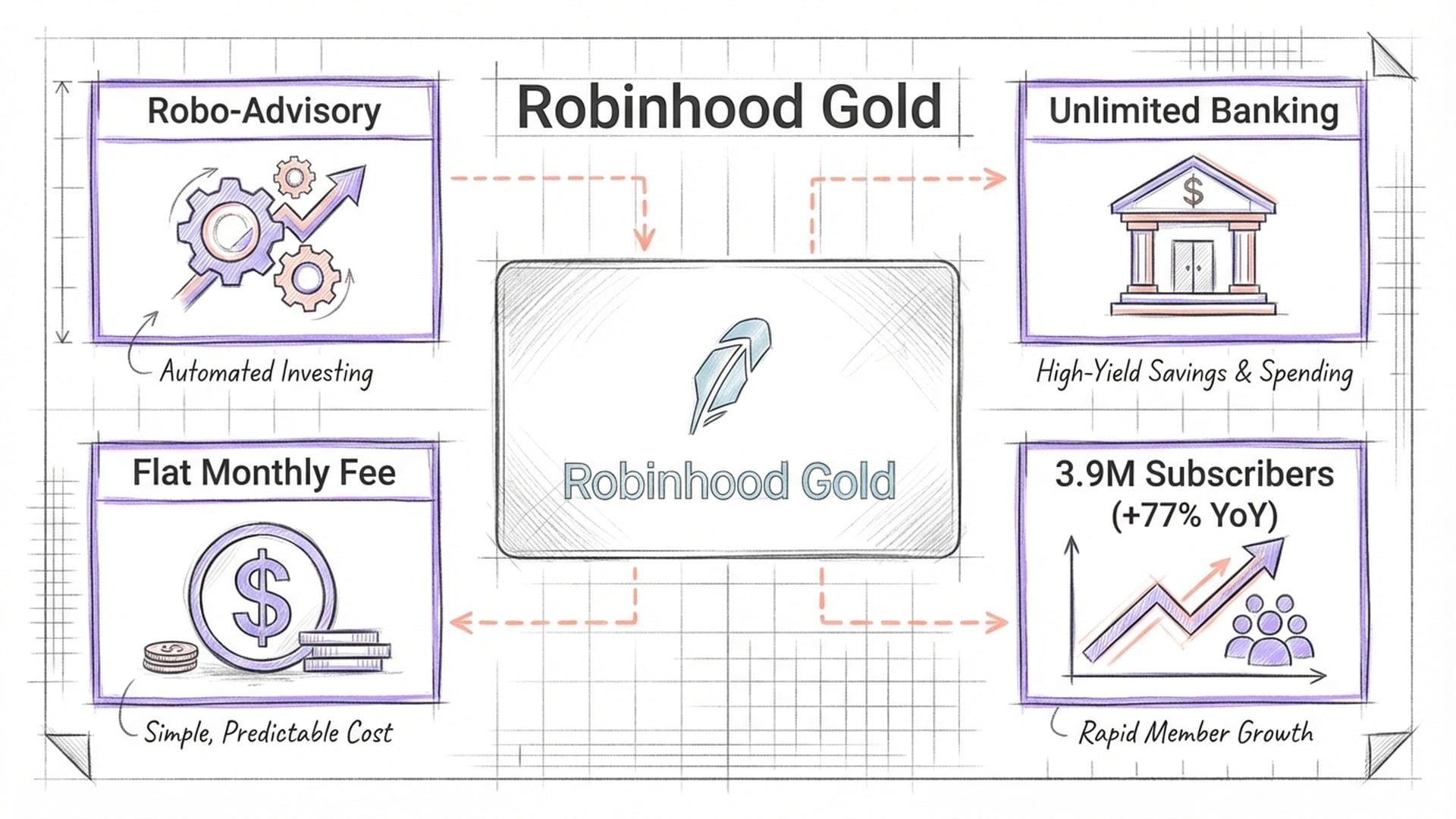

The Robinhood Gold Evolution: A Comprehensive Financial Membership

Central to this pivot is the repositioning of Robinhood Gold. Once a simple add-on for margin trading, Gold is now a comprehensive financial membership.

- Subscriber Growth: Gold subscribers hit 3.9 million in Q3 2025, a 77% increase year-over-year.

- Enhanced Value Proposition:

- Robinhood Strategies: A fully integrated robo-advisory service.

- Robinhood Banking: Capped advisory fees for Gold members.

This transformation allows Robinhood to commoditize private wealth management services, offering them for a flat monthly fee instead of the traditional 1% of assets under management. This creates a powerful lock-in effect and, more importantly, a stable, recurring revenue stream that insulates the company from trading volume fluctuations, leading to smoother earnings and a higher valuation.

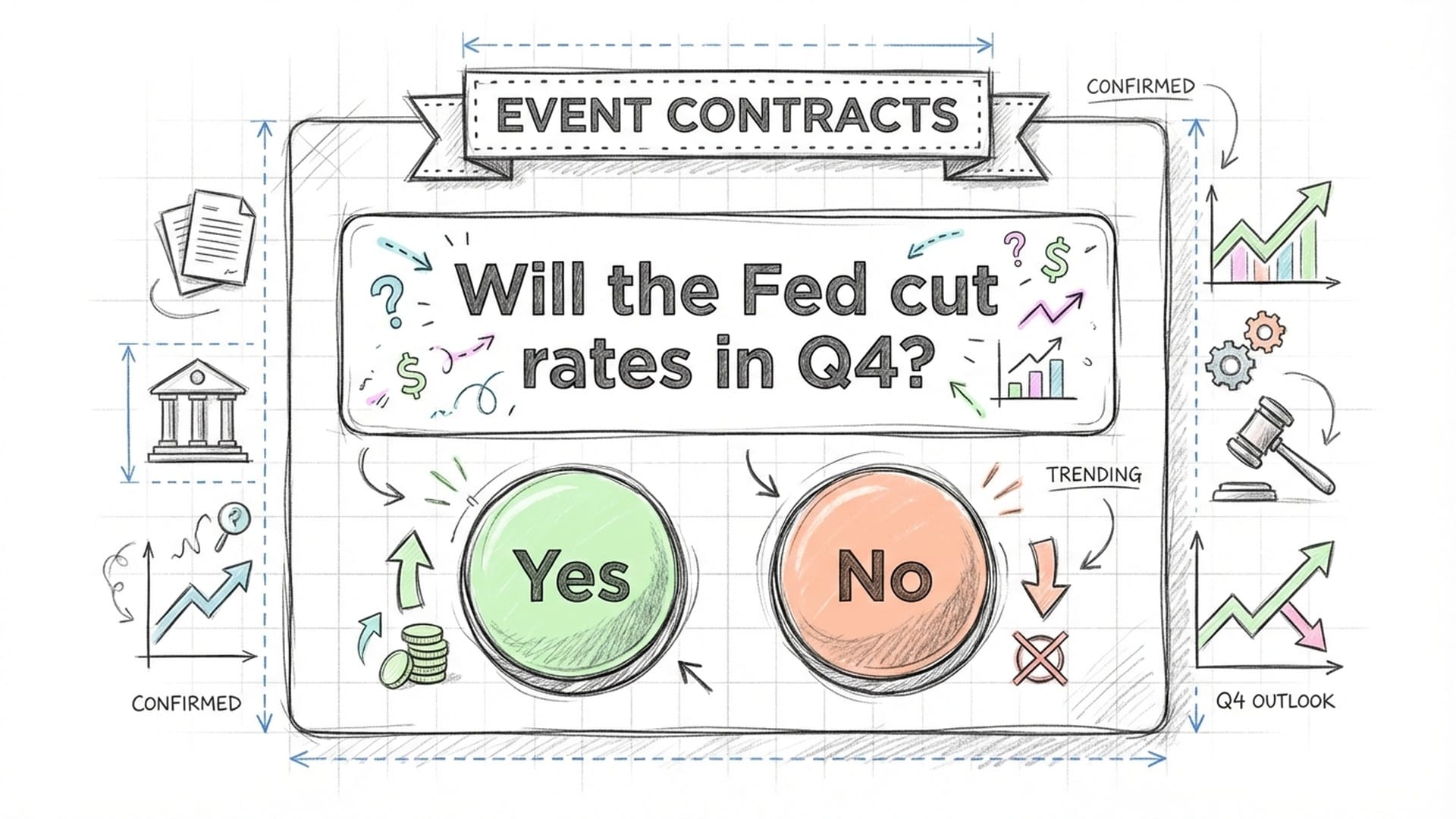

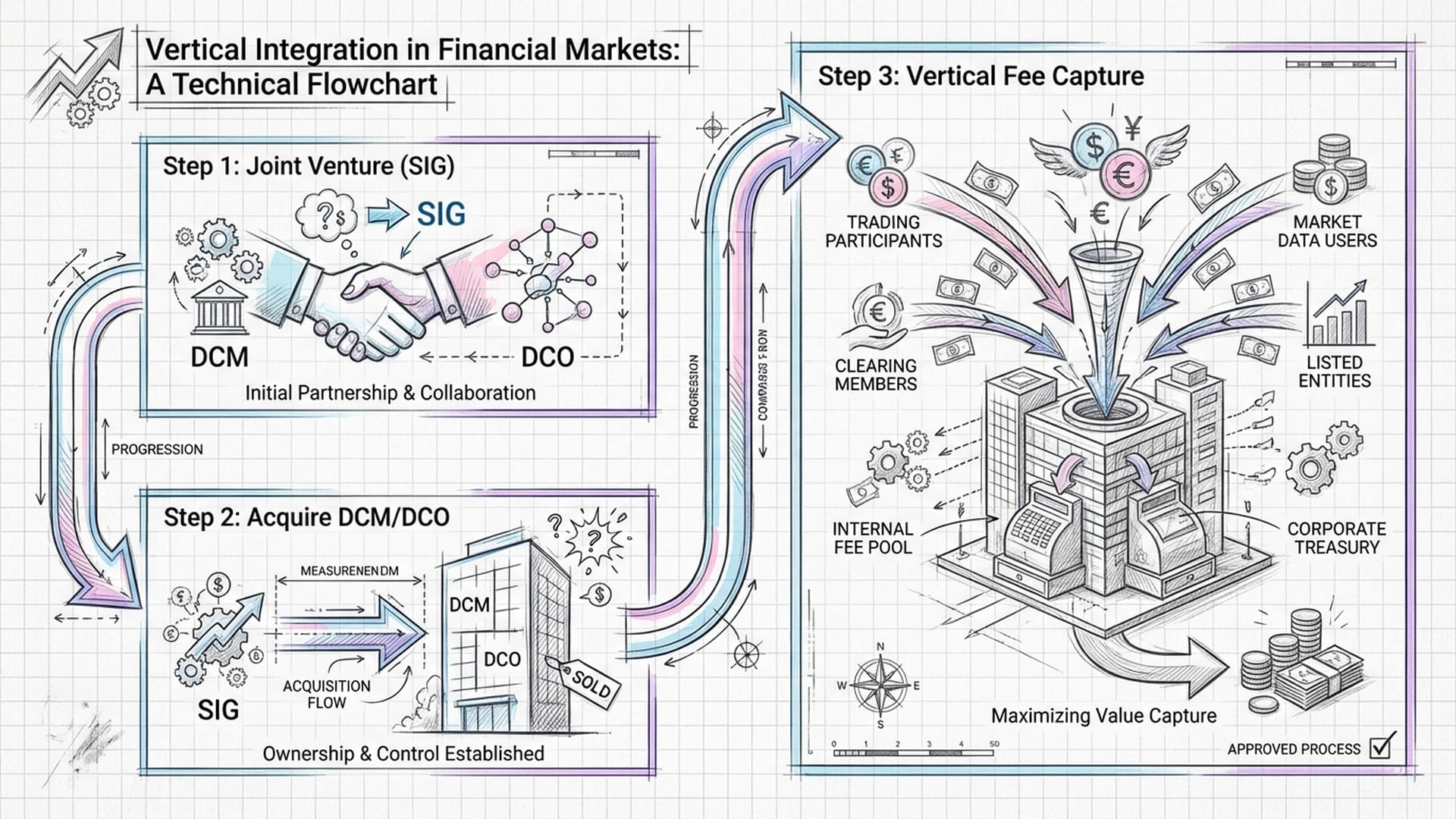

Prediction Markets: Defining a New Asset Class

Robinhood's foray into prediction markets, particularly "Event Contracts," represents an audacious move to define a new asset class for retail investors. This intersects financial hedging with recreational speculation.

Initially acting as an introducing broker, Robinhood realized the need to vertically integrate to capture the full economic value. They formed a joint venture with Susquehanna International Group (SIG) to operate a CFTC-licensed exchange and clearinghouse, acquiring MIAXdx (formerly LedgerX). This provides them with both Derivatives Clearing Organization (DCO) and Designated Contract Market (DCM) status.

Key advantages of this vertical integration include:

- Economic Capture: Robinhood and SIG retain all exchange and clearing fees, benefiting from market-making spreads.

- Product Agility: Owning the DCM allows Robinhood to design and list its own contracts rapidly, crucial for timely engagement driven by pop-culture events or breaking news.

This independent exchange, expected to be fully operational in 2026, will also serve as a B2B infrastructure provider to other Futures Commission Merchants.

The Disruptive Power of Prediction Markets

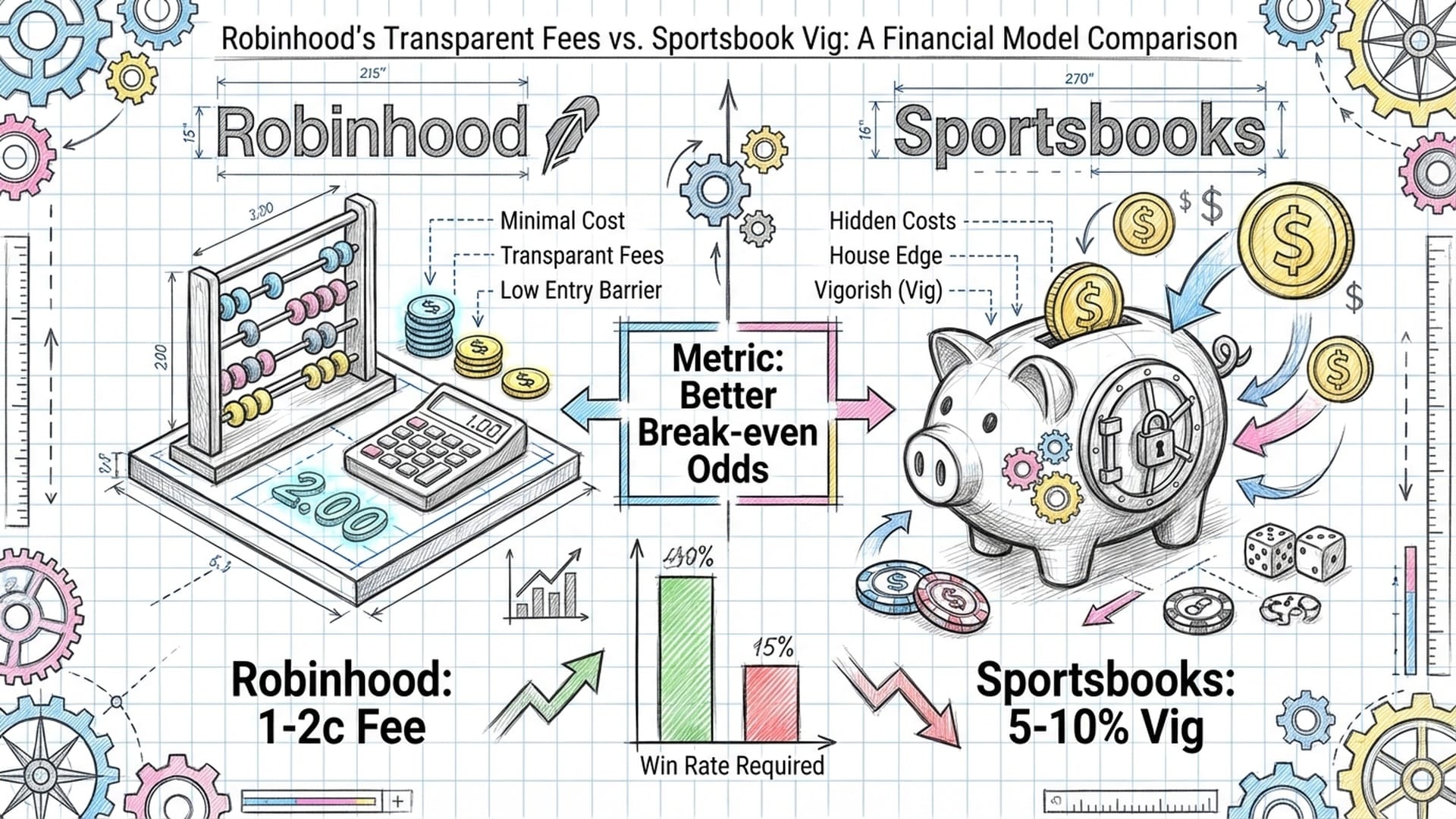

These markets operate on a binary options pricing model (0 to 100) and boast a distinct economic advantage over traditional sports betting. Robinhood charges a transparent commission of 1-2 cents per contract, significantly lower than the 5-10% "vig" embedded in traditional sportsbooks like DraftKings or FanDuel. This makes Robinhood the low-cost provider for speculative capital, echoing their disruption of equity trading commissions in 2013.

The velocity is staggering: $100 million in annualized revenue and over 9 billion contracts traded within a year of launch. To compete further, Robinhood has introduced features like "Preset Combos" and the upcoming "Custom Combos" (functionally identical to sports gambling "parlays"), blurring the line between hedging and recreational gambling to drive engagement and margins.

The Regulatory Battleground

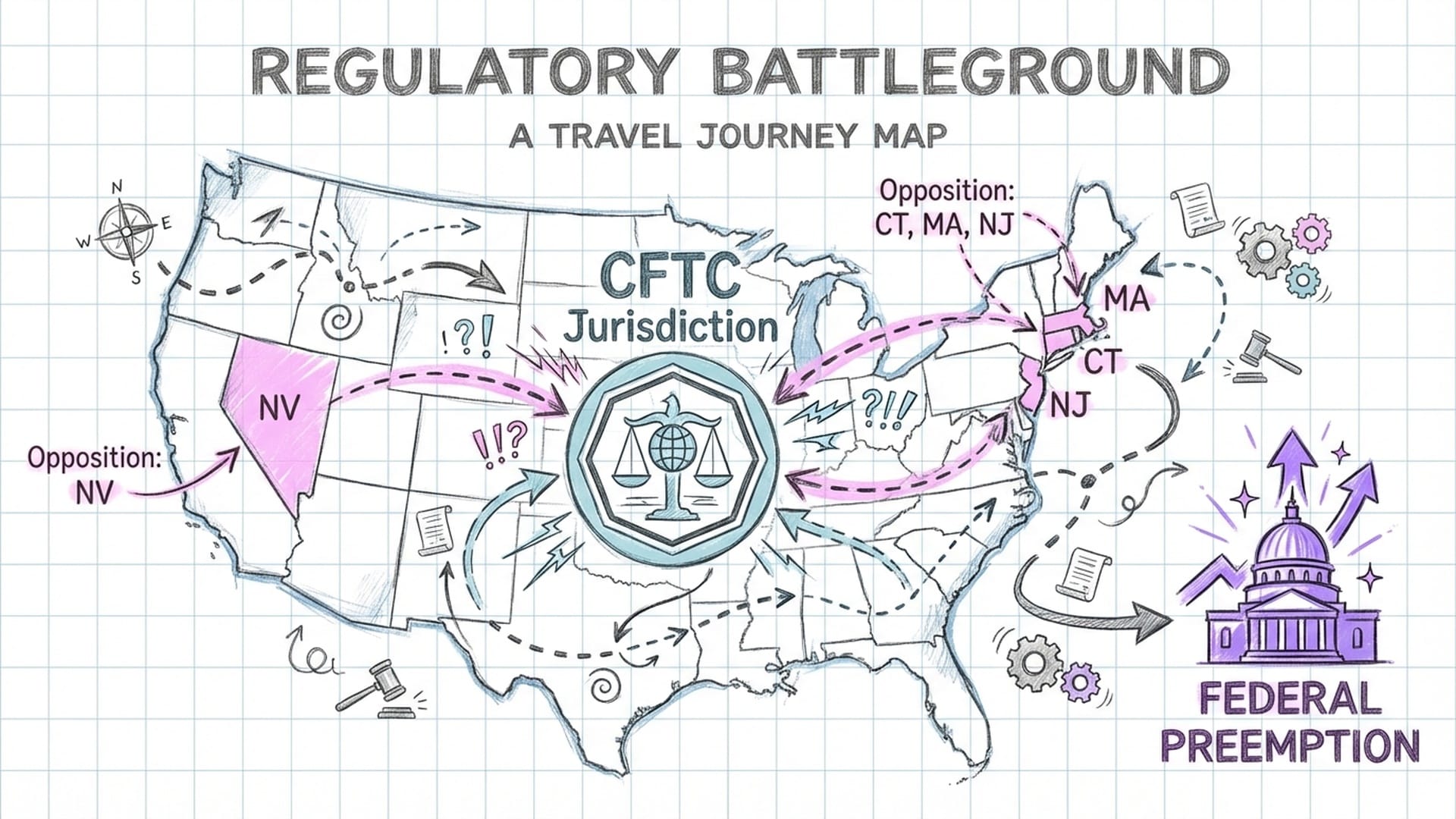

This rapid expansion into prediction markets has ignited a fierce jurisdictional conflict between the Commodity Futures Trading Commission (CFTC) and state gaming regulators.

- Federal Position (CFTC): Argues event contracts are "swaps" or "futures" used for hedging economic risk, citing legal precedent where Kalshi successfully allowed election betting markets.

- State Opposition: A coalition of state attorneys general (e.g., CT, MA, NV, NJ) contends that contracts based on sports or election outcomes are functionally identical to sports betting, violating state gambling monopolies and consumer protection laws.

To counter this, the "Coalition for Prediction Markets" (including Robinhood, Coinbase, Kalshi, Crypto.com, and Underdog) lobbies for federal preemption, asserting the CFTC's exclusive jurisdiction over derivatives. Success would allow Robinhood to operate a unified national platform, avoiding a debilitating patchwork of 50 state regimes. Failure, however, could shatter Robinhood's prediction market business, rendering its exchange model unprofitable.

Cortex AI: A Domain-Specific Investment Assistant

Robinhood Cortex is not just about volume but about long-term retention and asset gathering. It’s a domain-specific investment assistant designed to solve the "blank page" problem for new investors.

Cortex leverages a Retrieval-Augmented Generation (RAG) architecture built on Amazon AWS Nova and Bedrock models. Its critical feature is "grounding," which prevents AI hallucinations by retrieving real-time data from trusted sources (live market feeds, proprietary user data, vetted analyst reports) and constraining the generative model to use only this retrieved context.

To operate cost-effectively for millions, Robinhood employs "Model Distillation," training smaller models on the outputs of larger ones, ensuring real-time, low-latency insights. The flagship "Cortex Digests" summarize stock movements in plain English, personalized to a user's portfolio. For instance, a Fed rate cut explanation would automatically contextualize its impact on their specific holdings.

The "Trump Accounts" Initiative: A Potentially Transformative Tailwind

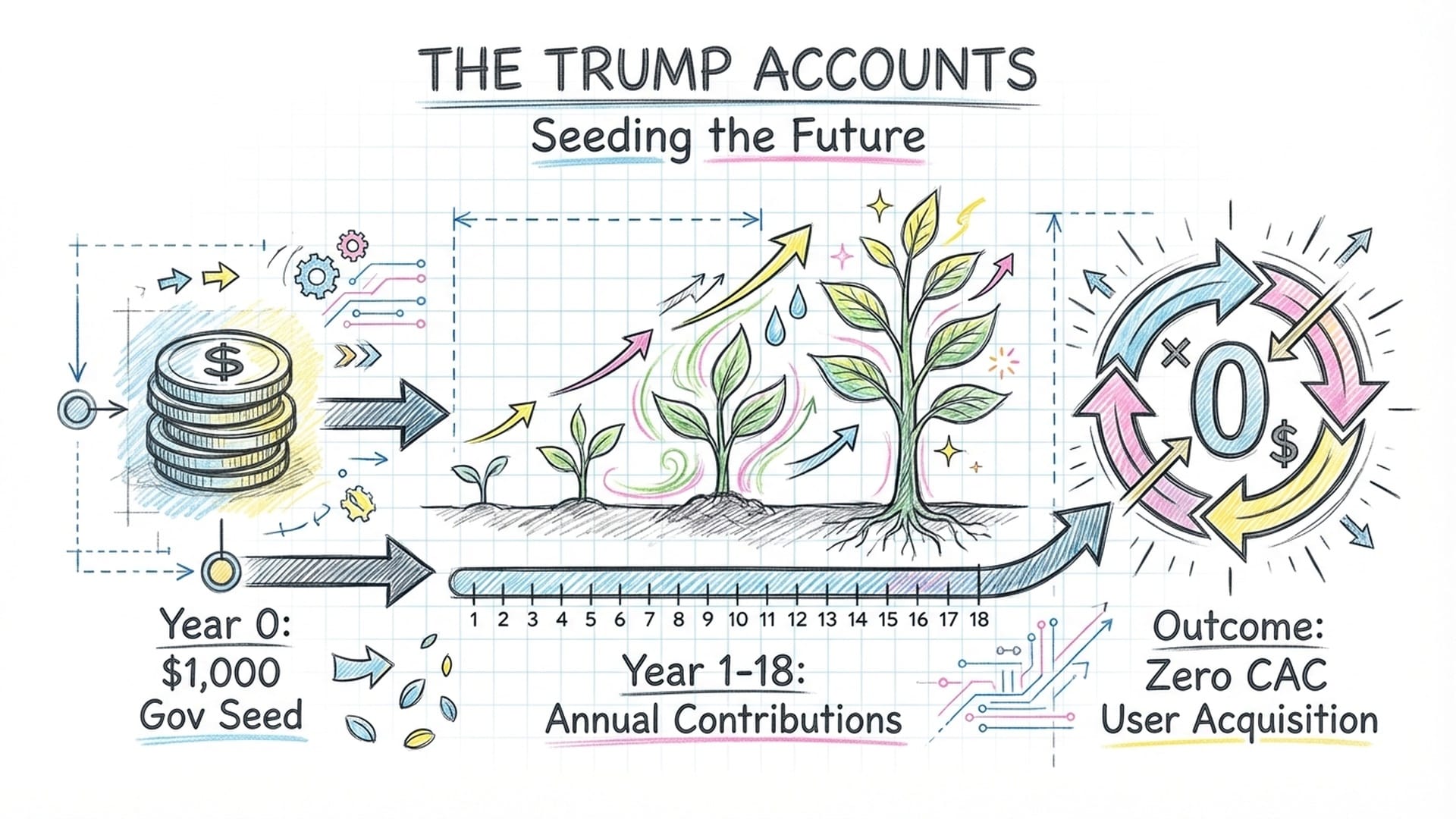

A highly political yet potentially transformative tailwind for Robinhood is the proposed "Trump Accounts" initiative. This legislation aims to create tax-deferred savings accounts for all American children born between 2025 and 2028, seeded with a $1,000 government deposit.

With 3.6 million births annually, this would inject billions of dollars into the market, requiring long-term custodial management. Robinhood is aggressively lobbying to be a primary administrator. If successful, the implications are profound:

- Zero Customer Acquisition Cost (CAC): Robinhood would acquire new generations of investors at birth, with the government covering the entry fee.

- Intergenerational Lock-in: Parents managing these accounts until age 18 creates incentive to consolidate their own assets on Robinhood, fostering "Family Accounts."

- Massive Cross-Sell Potential: Opportunity to cross-sell 529 plans, crypto wallets, and credit cards to account guardians.

However, risks include resistance from consumer advocacy groups due to Robinhood's "gamified" trading image, and the potential for strict capital requirements and compliance costs.

The Balancing Act: Risks and Opportunities

Robinhood finds itself at a significant strategic inflection point. Its transformation into a comprehensive financial powerhouse relies on navigating a complex legal landscape while maintaining user trust.

The Bull Case:

- Federal Preemption: If the Coalition for Prediction Markets secures federal preemption, Robinhood could scale its exchange globally without state interference.

- Cortex AI & Gold Subscriptions: If Cortex drives Gold subscriptions past five million, it establishes a stable, recurring revenue floor and deepens user retention.

- "Trump Accounts" Mandate: Securing this mandate would guarantee a steady stream of new users and assets for decades.

The Bear Case:

- Regulatory Crackdown: State regulators could successfully enjoin Robinhood's event contracts, forcing a shutdown and write-down of its LedgerX acquisition.

- Political Backlash: The "Trump Accounts" proposal could fail or be awarded to legacy institutions.

- Market Manipulation: Inefficiencies in prediction markets could lead to scandals or manipulation, triggering harsh CFTC crackdowns.

For institutional investors, Robinhood is no longer just about retail trading volume; it’s a play on regulatory arbitrage in prediction markets and AI-enabled financial services. While the legal risks are undeniably high, the structural economics of owning the exchange (through LedgerX) and the AI interface (through Cortex) offer a significantly higher upside than its past pure brokerage model. The success of this transition hinges on Robinhood's ability to delicately balance innovation with regulatory compliance and user confidence.

|  |  |