When Seven Giants Equal All The World's Dollars: An Impending Liquidity Crisis?

The Magnificent Seven's combined market cap now nearly equals the entire global M2 money supply. This astonishing data point conceals enormous liquidity risks. History shows us that every time such extreme valuations appear, market corrections are brutal.

Imagine this scenario: If you sold all the stocks of Apple, Microsoft, Google, Amazon, Nvidia, Tesla, and Meta at current market prices, you could buy up every single US dollar circulating in the world.

Yes, you heard that right. This is the reality of today's US stock market.

A Shocking Data Comparison

According to the latest Federal Reserve data, the global M2 money supply (essentially all US dollars in circulation) stands at $22.2 trillion as of September 2025. Meanwhile, the combined market capitalization of the "Magnificent Seven" US tech giants has reached approximately $21 trillion.

What does this mean? Think of it this way:

- It's like having a swimming pool of water (dollars) and seven giant beach balls (stocks) that are almost as large as all the water

- If someone tries to convert all the beach balls into water, there simply isn't enough water in the pool

- Even more concerning, there are countless other stocks, bonds, and real estate also in this same pool

What History Tells Us

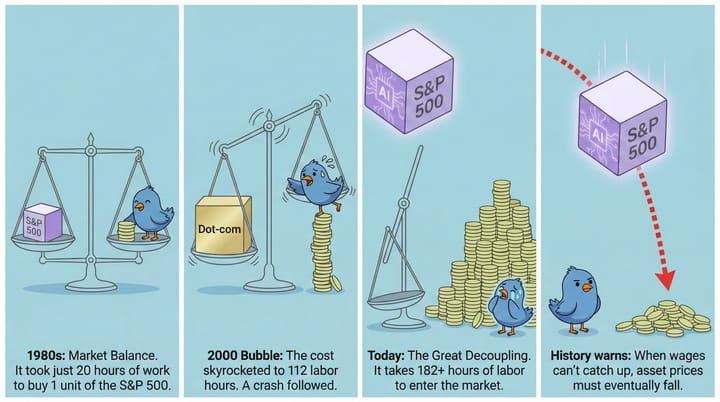

Let's review major market crashes in history and compare the data:

2000 Dot-Com Bubble

- M2 Money Supply: $4.9 trillion

- Buffett Indicator (Total Market Cap/GDP): 147%

- Result: NASDAQ crashed 78%, countless companies went bankrupt

2008 Financial Crisis

- M2 Money Supply: $8.2 trillion

- Buffett Indicator: 138% (2007)

- Result: Global financial system nearly collapsed, S&P 500 fell over 50%

Today in 2025

- M2 Money Supply: $22.2 trillion

- Buffett Indicator: Estimated over 200% (already 195% in 2020)

- Just seven companies' market cap equals nearly all M2

Why Is This Dangerous?

In simple terms:

- The Liquidity Trap Stock market value is "paper wealth." When everyone wants to sell simultaneously, there isn't enough cash to buy. It's like musical chairs - when the music stops, there aren't nearly enough chairs.

- The Stampede Effect Once major shareholders start cashing out, it triggers a chain reaction. With limited buyer funds, stock prices plummet dramatically. This causes more panic selling, creating a vicious cycle.

- Leverage Amplification Many investors buy stocks with borrowed money. Falling prices trigger forced liquidations, further intensifying selling pressure.

What Should Ordinary Investors Do?

This isn't about creating panic, but about recognizing risks:

- Don't put all eggs in one basket - Diversify investments, don't bet everything on tech stocks.

- Maintain cash reserves - In a crisis, cash is king.

- Avoid leverage - Don't borrow to invest, especially at these valuations.

- Focus on the real economy - Invest in companies with actual revenue and profits.

Conclusion

When seven companies' market value equals all the world's dollars, it's a massive warning signal. History doesn't repeat exactly, but it often rhymes. The 2000 dot-com bubble and 2008 financial crisis both occurred when markets were extremely optimistic and valuations severely detached from fundamentals.

The question now isn't whether there will be an adjustment, but when and how it will happen. Smart investors should start preparing for the potential storm ahead.

"Be fearful when others are greedy, and greedy when others are fearful." — Warren Buffett

Data Source: Federal Reserve Economic Data (FRED)