Kevin Hassett: The Revolutionary Who Could Reshape the Federal Reserve

Explore the potential implications of Kevin Hassett's Federal Reserve chairmanship, from his unique economic philosophy to his impact on monetary policy and the future of the US economy.

|  |

The Kevin Hassett Fed: A Potential Paradigm Shift in American Economic Policy

The U.S. Federal Reserve, for over a century, has largely operated under a consensus prioritizing price stability. But what if the institution at the heart of American finance were to undergo a fundamental re-engineering, shifting its very DNA? We are on the cusp of a potential watershed moment in American economic history: the prospective Federal Reserve chairmanship of Kevin Allen Hassett. This isn't merely about a new face in a powerful position; it signifies a complete reorientation of how America's central bank might operate, influencing everything from mortgage rates to the price of groceries.

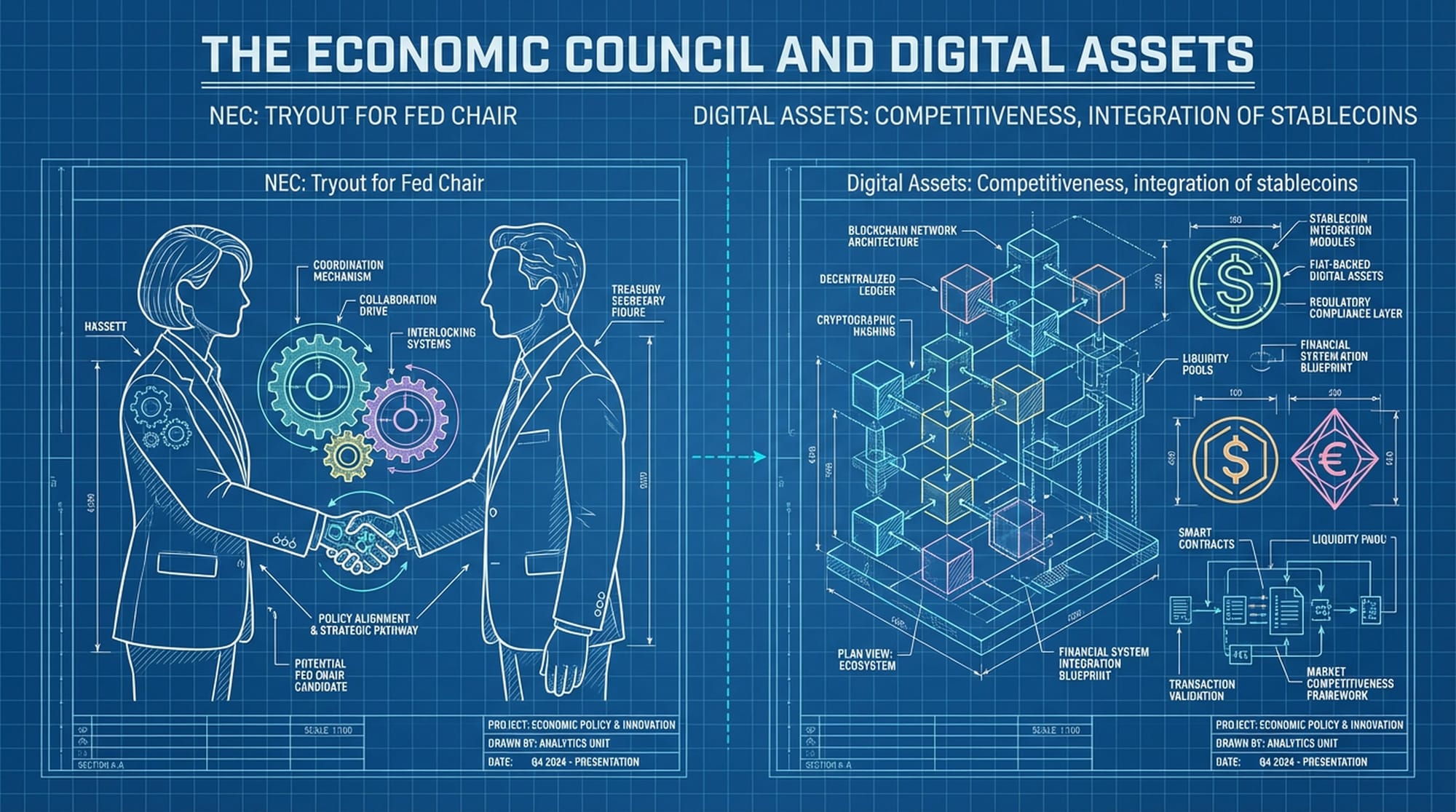

The urgency of understanding this potential shift is magnified by unprecedented economic changes. A global pandemic, resurgent geopolitical tensions, and ongoing debates about inflation and growth have created a complex arena. Into this steps Kevin Hassett, an economist whose trajectory suggests a profound philosophical realignment. Currently serving in a high-profile role, his close alignment with the current administration's economic goals is evident. Prediction markets have assigned him probabilities as high as 86% for the Fed Chair nomination, indicating a strong belief in his unique blend of academic credentialing and ideological alignment.

Redefining Central Bank Independence

A Hassett chairmanship would likely challenge the post-Volcker consensus that regards central bank independence as sacrosanct. While he publicly defends this independence, his body of work hints at a functional shift towards a coordinated fiscal-monetary regime.

"The central bank might act more as an accelerator for the executive branch's economic strategy rather than a counterbalance."

This means the Fed could become less of an independent arbiter and more of a strategic partner to the executive branch, aligning monetary policy directly with fiscal goals.

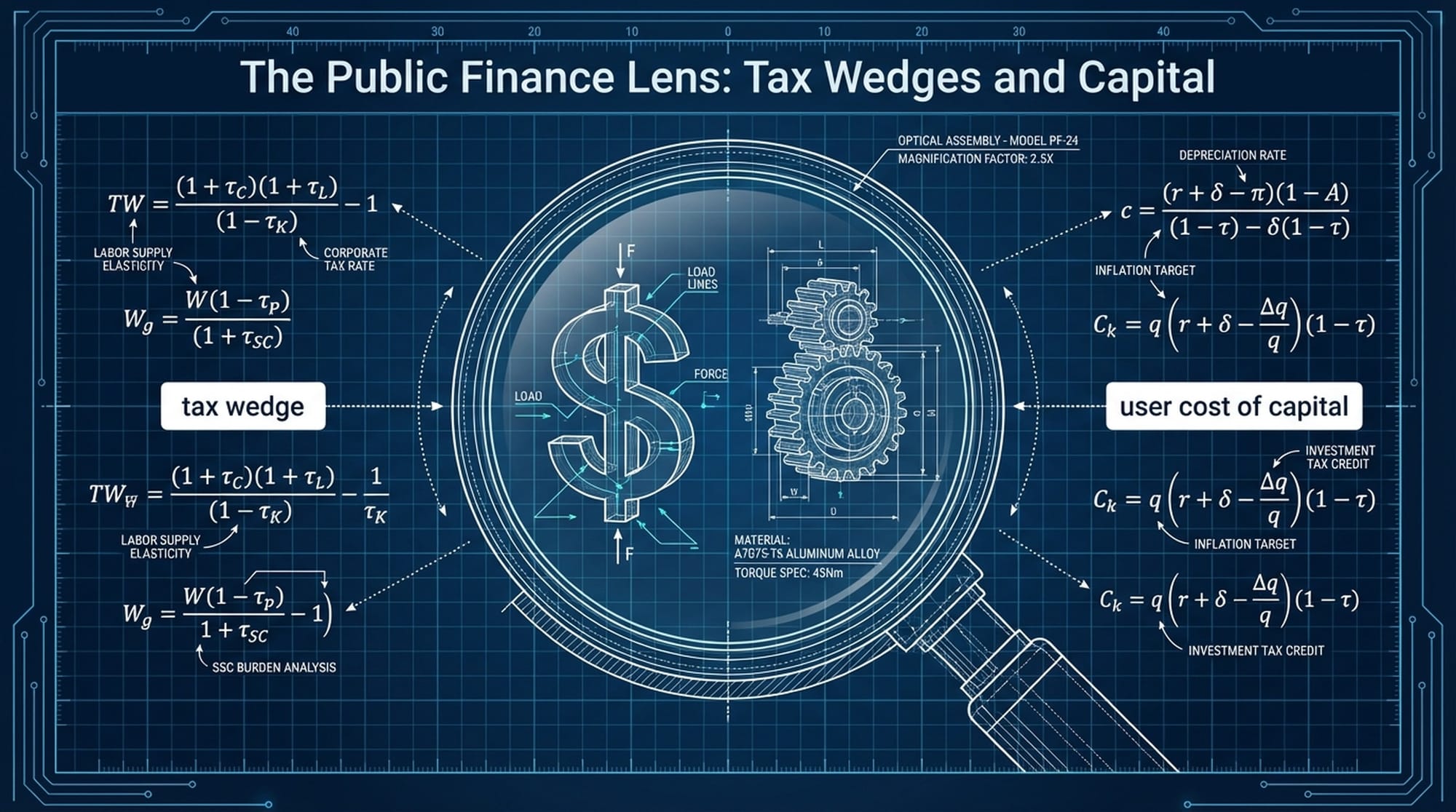

The Public Finance Lens: Tax Wedges and Capital

To understand Hassett's potential actions as Fed Chair, one must first grasp his intellectual foundations. Unlike recent Fed chairs whose careers were rooted in macro-labor economics or monetary theory, Hassett is a product of the public finance tradition. His primary lens for viewing the economy isn't the traditional interest rate channel, but rather the tax wedge and the user cost of capital. This distinction is crucial and changes everything.

Hassett's economic philosophy was forged at the University of Pennsylvania, where he earned his Ph.D. in 1989. His early research was supervised by Alan J. Auerbach, a titan in public finance. The "Auerbachian" influence is profoundly evident in Hassett's focus on the user cost of capital. This framework posits that the primary driver of business investment is not nominal interest rates, but the after-tax cost of acquiring new machinery and equipment.

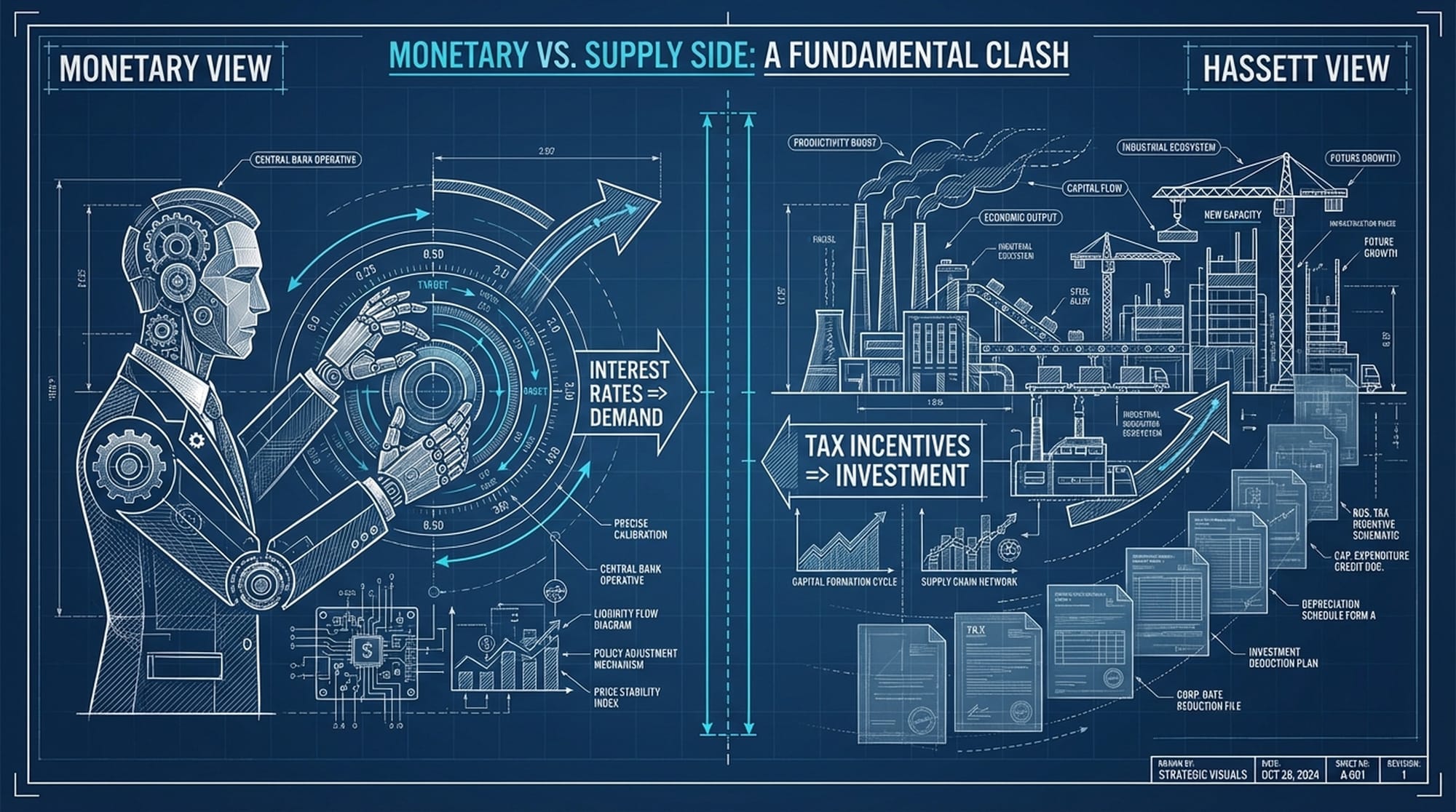

Consider the contrasting views:

- Traditional Monetary View: Lower interest rates stimulate demand by making borrowing cheaper.

- Hassett/Public Finance View: Investment is driven by tax incentives and regulatory certainty. Monetary policy's role is primarily to accommodate growth created by fiscal incentives.

This academic background suggests that as Fed Chair, Hassett might be less confident in the "fine-tuning" power of interest rates, focusing instead on creating a monetary environment that amplifies supply-side fiscal reforms.

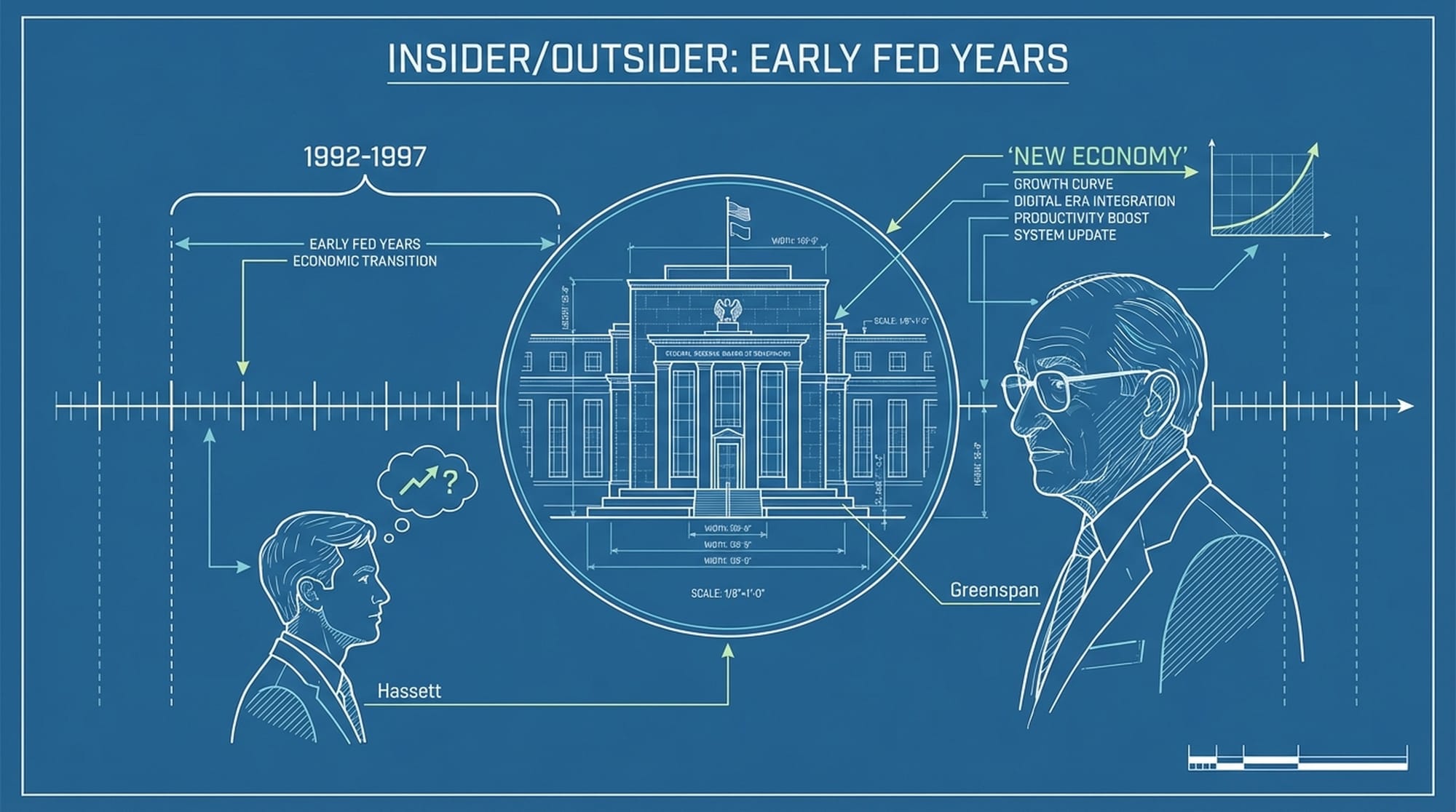

Insider/Outsider: Early Fed Years and AEI Influence

Despite potential criticisms regarding partisanship, Hassett's resume includes a significant tenure as a technocrat. From 1992 to 1997, he served as an economist at the Federal Reserve Board of Governors. This period was critical for several reasons:

- Institutional Memory: He worked at the Fed during Alan Greenspan's tenure, observing the "soft landing" of 1994-1995 and the "New Economy" productivity boom.

- Research Focus: His research remained squarely on tax policy and investment, not purely monetary mechanics.

- Unique Status: He possesses an insider/outsider status, understanding the Fed's internal workings while critiquing it from the outside.

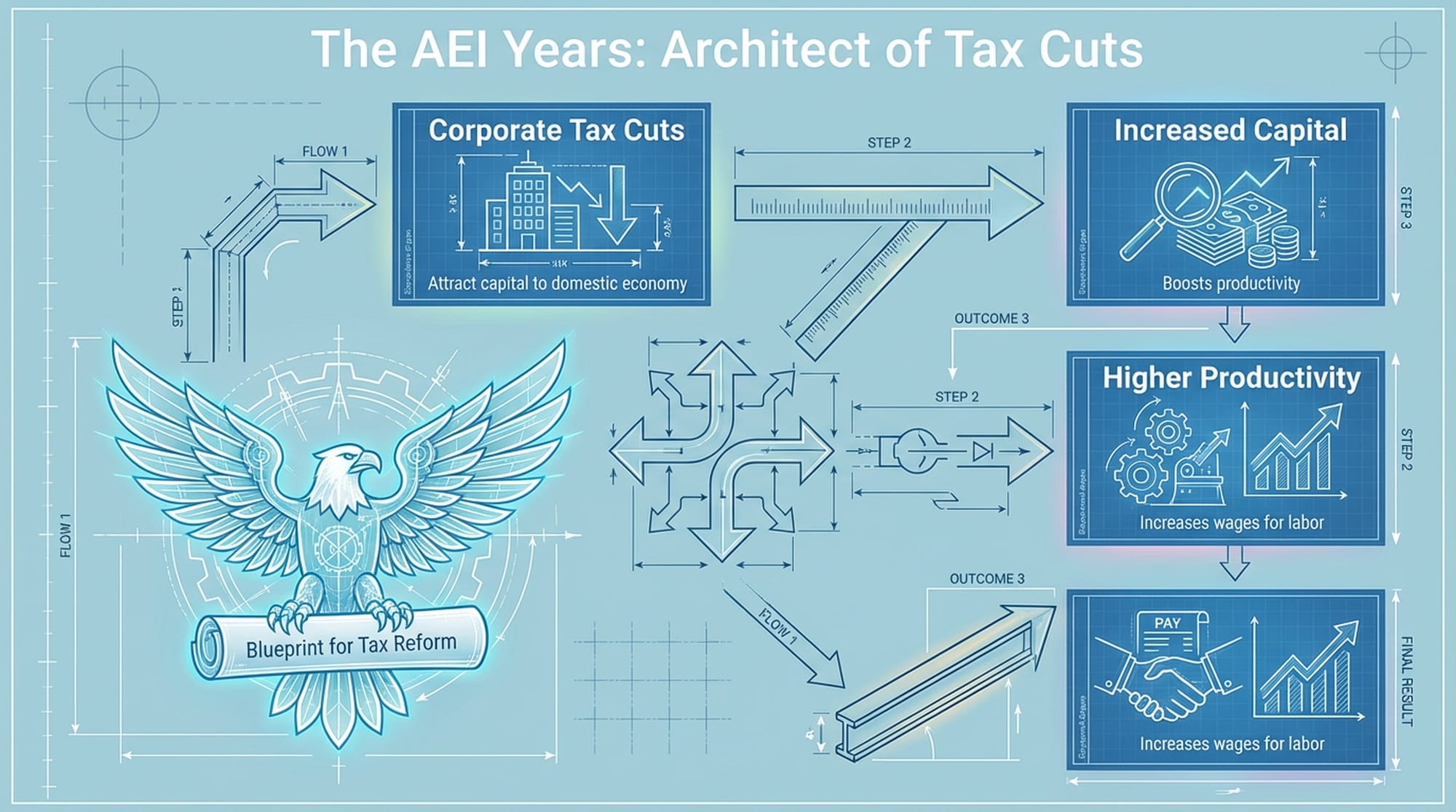

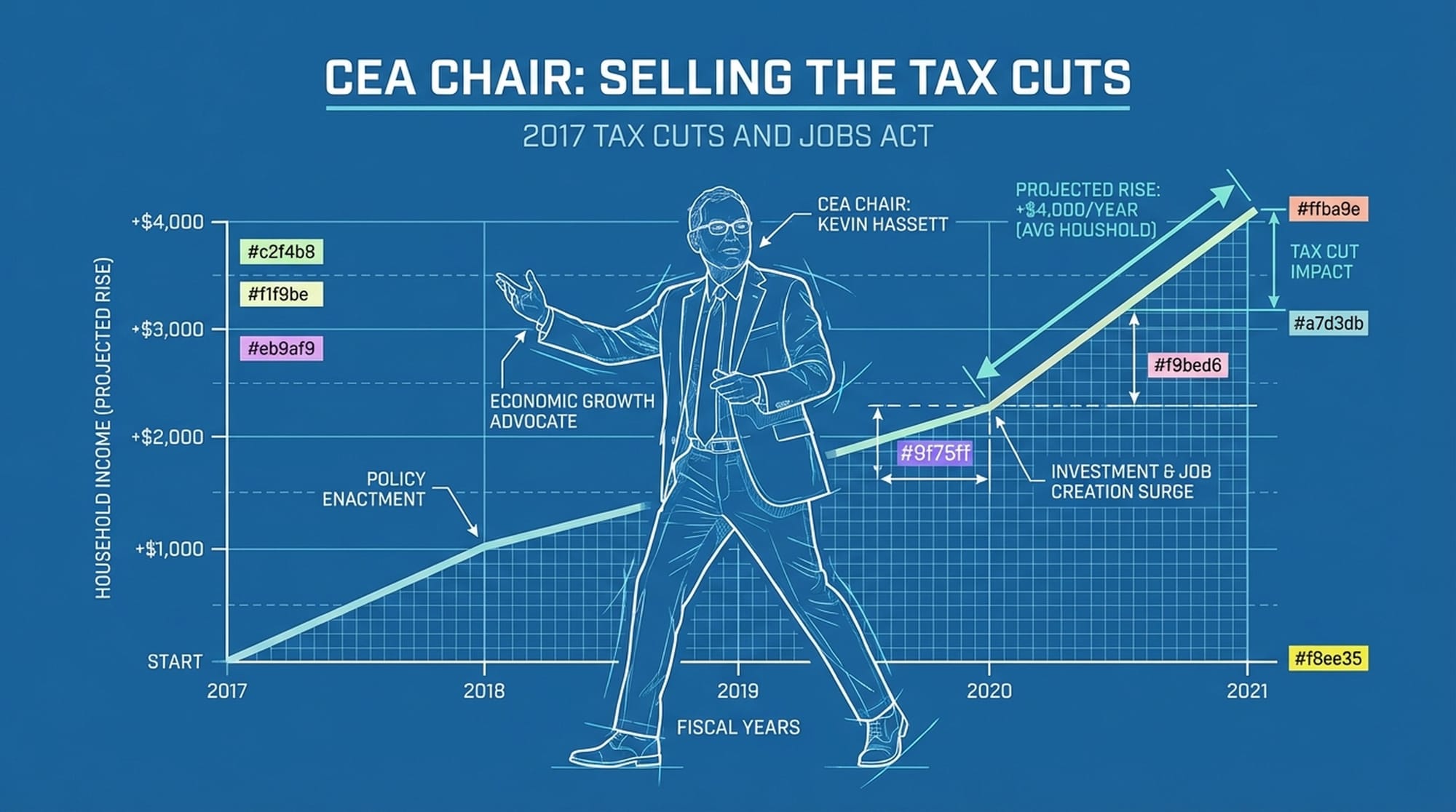

After his time at the Fed, Hassett joined the American Enterprise Institute (AEI) in 1997, where he became the Resident Scholar and Director of Economic Policy Studies. This platform allowed him to refine arguments that would later underpin the 2017 tax cuts. His prolific academic output at AEI heavily focused on the interaction between corporate taxation and labor markets. A seminal contribution was his argument that corporate tax cuts raise wages.

In a globalized economy, capital is mobile but labor is not. High corporate taxes drive capital abroad, reducing the capital-to-labor ratio at home and depressing wages. Conversely, cutting corporate taxes attracts capital, boosting productivity and ultimately, wages.

Dow 36,000: A Glimpse into Structural Optimism

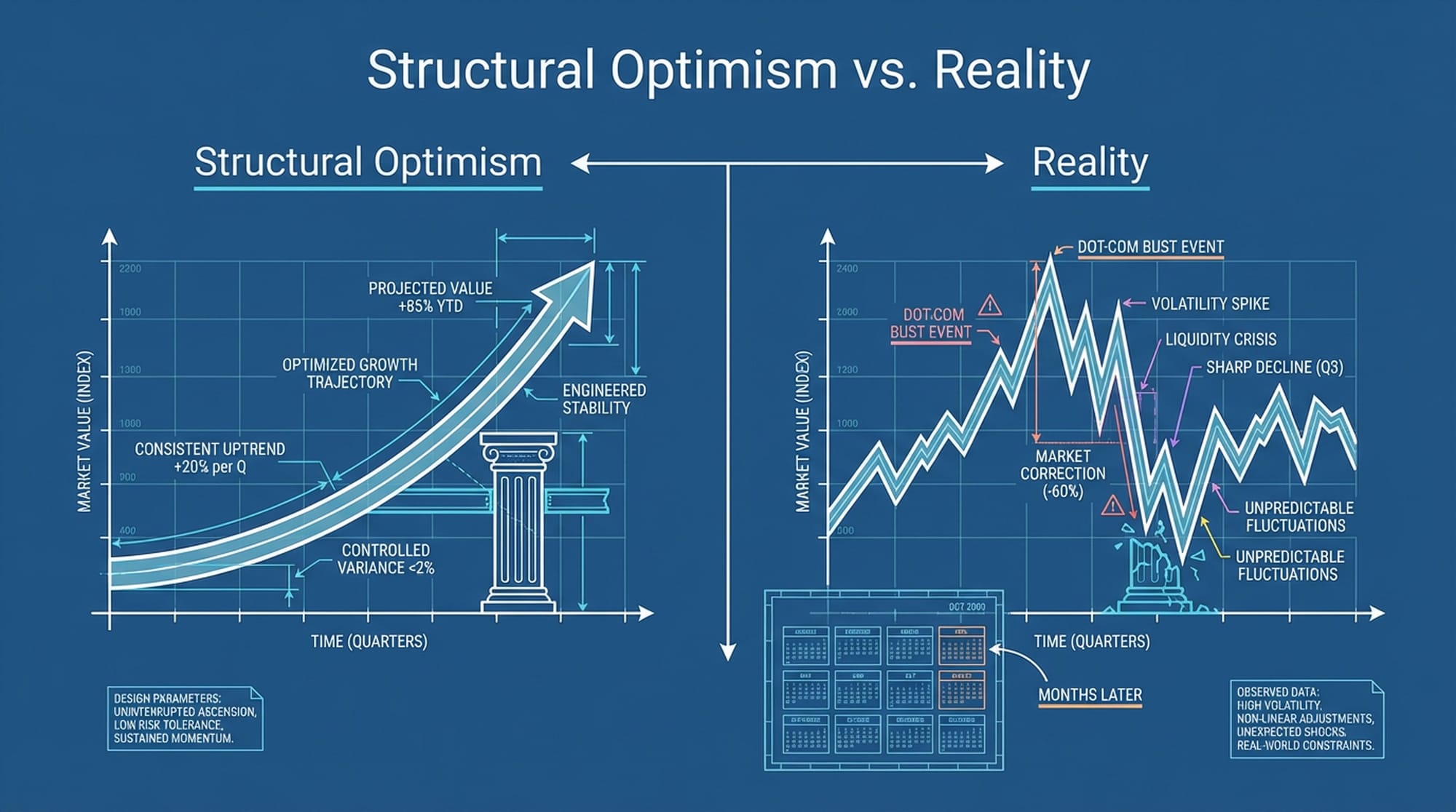

No analysis of Kevin Hassett would be complete without addressing his most famous, and perhaps infamous, public work: his 1999 book, Dow 36,000: The New Strategy for Profiting from the Coming Rise in the Stock Market. Co-authored with James K. Glassman, this book has become a Rorschach test for Hassett’s analytical judgment.

The core argument was theoretical: the equity risk premium—the extra return investors demand to hold stocks over risk-free Treasury bonds—was an irrational artifact disappearing from the market. They postulated that stocks, long-term, were no riskier than bonds, and investors were finally realizing this "truth." Once the risk premium fell to zero, price-to-earnings ratios would re-rate massively upward, justifying a Dow Jones Industrial Average of 36,000 as a "rational" valuation.

As fate would have it, the timing could not have been worse. The dot-com bubble burst months later, and the Dow entered a "lost decade," not reaching the 36,000 level until November 2021—twenty-two years later. The controversy was underscored by a public wager in The Atlantic, which Hassett definitively lost.

Why does a twenty-five-year-old book matter for a future Fed Chair?

- It reveals a cognitive predisposition toward structural optimism.

- A Fed Chair who believes high valuations are justified by "structural shifts" is less likely to use monetary policy to "lean against the wind" of financial excesses.

- Under a Hassett Fed, the "wealth effect" of rising stock markets would likely be viewed as a feature, not a bug, and certainly not a reason to hike interest rates.

- It also demonstrates a willingness to adhere to a theoretical construct even when empirical reality contradicts it, a trait that could be dangerous in a crisis.

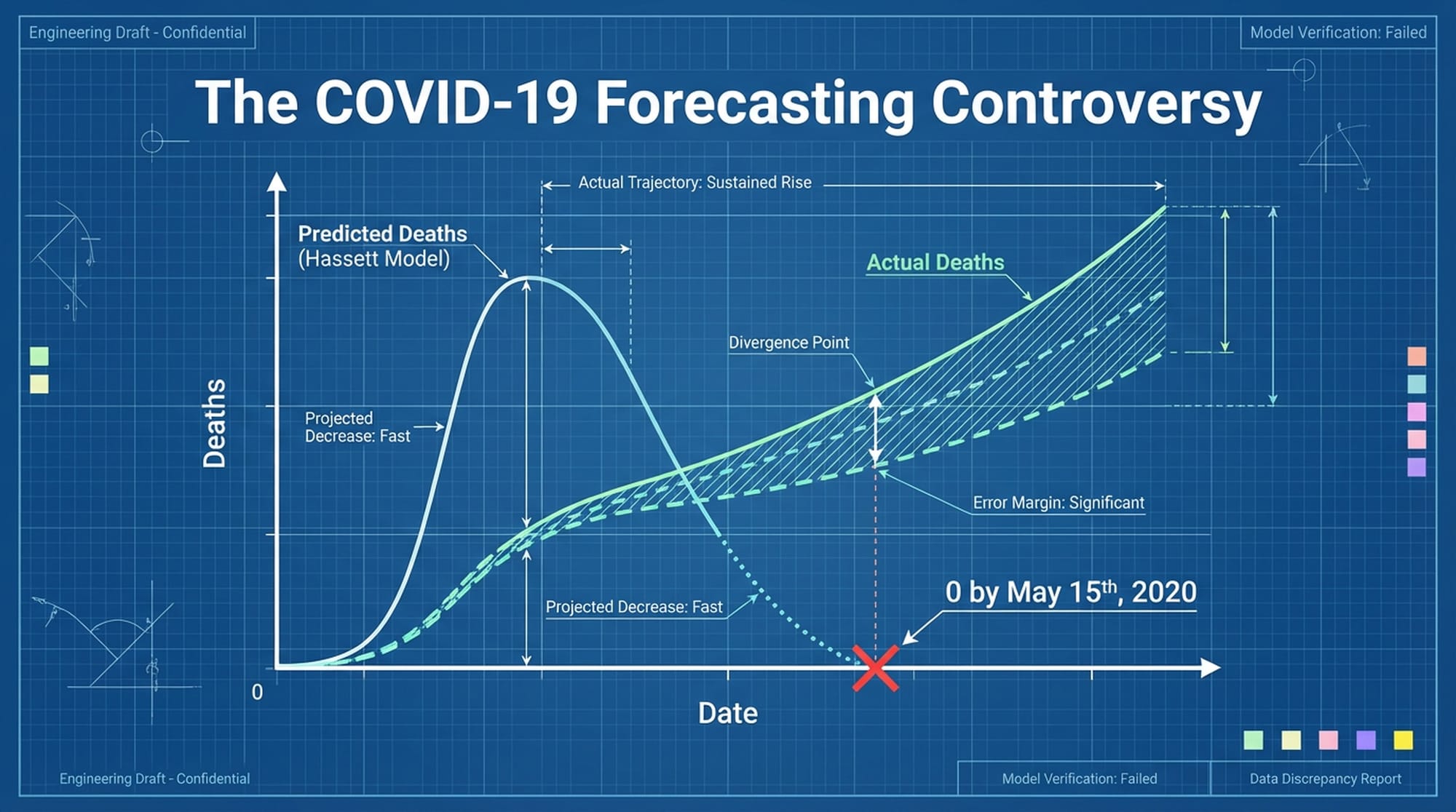

The COVID-19 Forecasting Controversy: A Credibility Risk

A different incident from May 2020 raised profound concerns about Hassett's use of data during crises. Returning to the White House as a Senior Advisor during the COVID-19 pandemic, Hassett led a team that produced an econometric model predicting the virus's trajectory. The Council of Economic Advisers controversially released a chart showing daily deaths dropping precipitously to zero by mid-May 2020. This model utilized a cubic regression, which, as data scientists and epidemiologists pointed out, has no relationship to disease transmission mechanics and is notorious for rapid divergence outside its training data. The model predicted deaths would hit zero by May 15th, 2020; in reality, the pandemic continued, claiming over a million American lives.

"If a Hassett-led board were to reject staff forecasts in favor of 'optimistic' curve-fitting exercises that support a political narrative, the credibility of the central bank could be severely damaged."

This incident highlights a potential risk for the Federal Reserve: analytical politicization. The Fed relies on robust forecasts to set interest rates. Imagine predicting inflation will vanish without rate hikes based on a flawed model—this could severely damage the central bank's credibility.

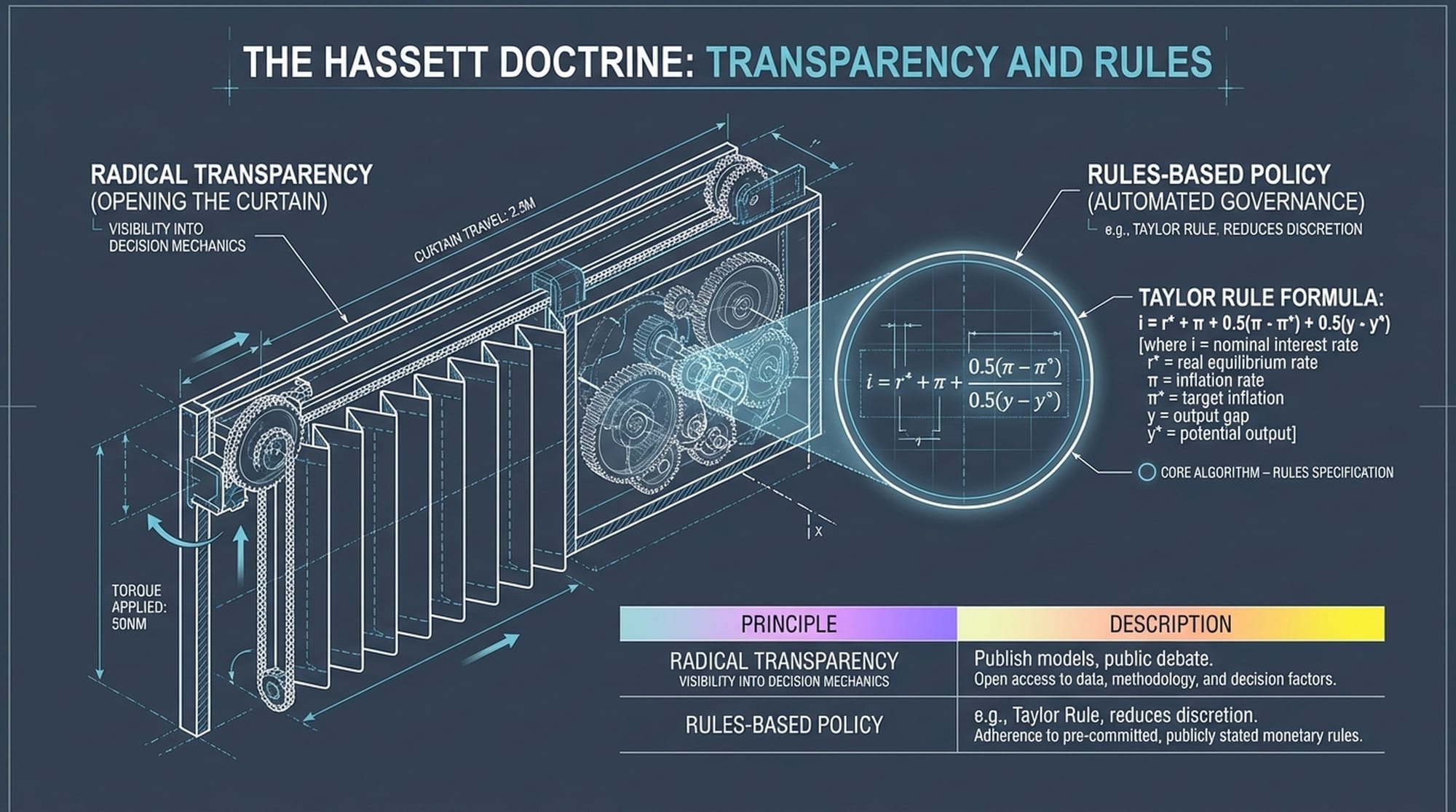

The Hassett Doctrine: Transparency, Rules, and a Monetary Dove

While not a career monetary economist, Hassett's public statements outline a distinct "Hassett Doctrine." He has been a vocal critic of the Federal Reserve’s opacity, describing it as a "Wizard of Oz" operation—a "black box" where unelected officials make decisions based on undisclosed models. He advocates for radical transparency, believing the Fed should publish its specific economic models and subject them to public debate. While this sounds democratic, it could expose the Fed’s internal deliberations to intense political lobbying.

Hassett aligns himself with the "rules-based" school of monetary policy, frequently citing the Taylor Rule as a superior alternative to the discretionary "constrained discretion" of the Powell Fed. His support for rules is fundamentally a mechanism to strip the "bureaucratic discretion" he distrusts.

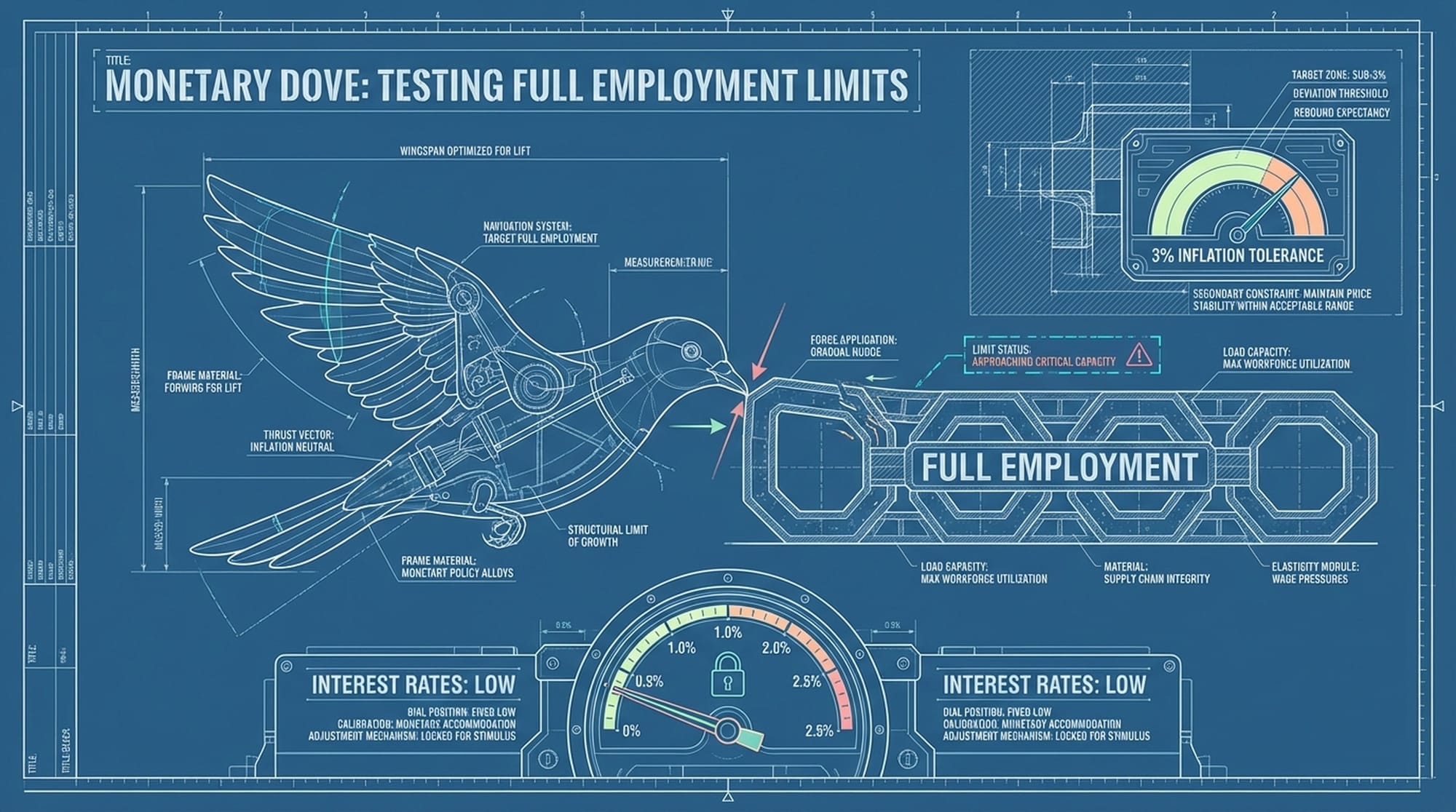

Despite his conservative credentials, Hassett is functionally a monetary dove. He has consistently argued that the Powell Fed was too slow and that the "neutral rate" is lower than the Fed believes. He adheres to the belief that supply-side growth, driven by deregulation and AI, is disinflationary. Therefore, the economy can sustain much faster growth rates without overheating. A Hassett Fed would likely test the limits of full employment, resisting rate hikes until inflation is explicitly visible and entrenched, rather than acting preemptively.

Three Key Shifts Under a Hassett Chairmanship

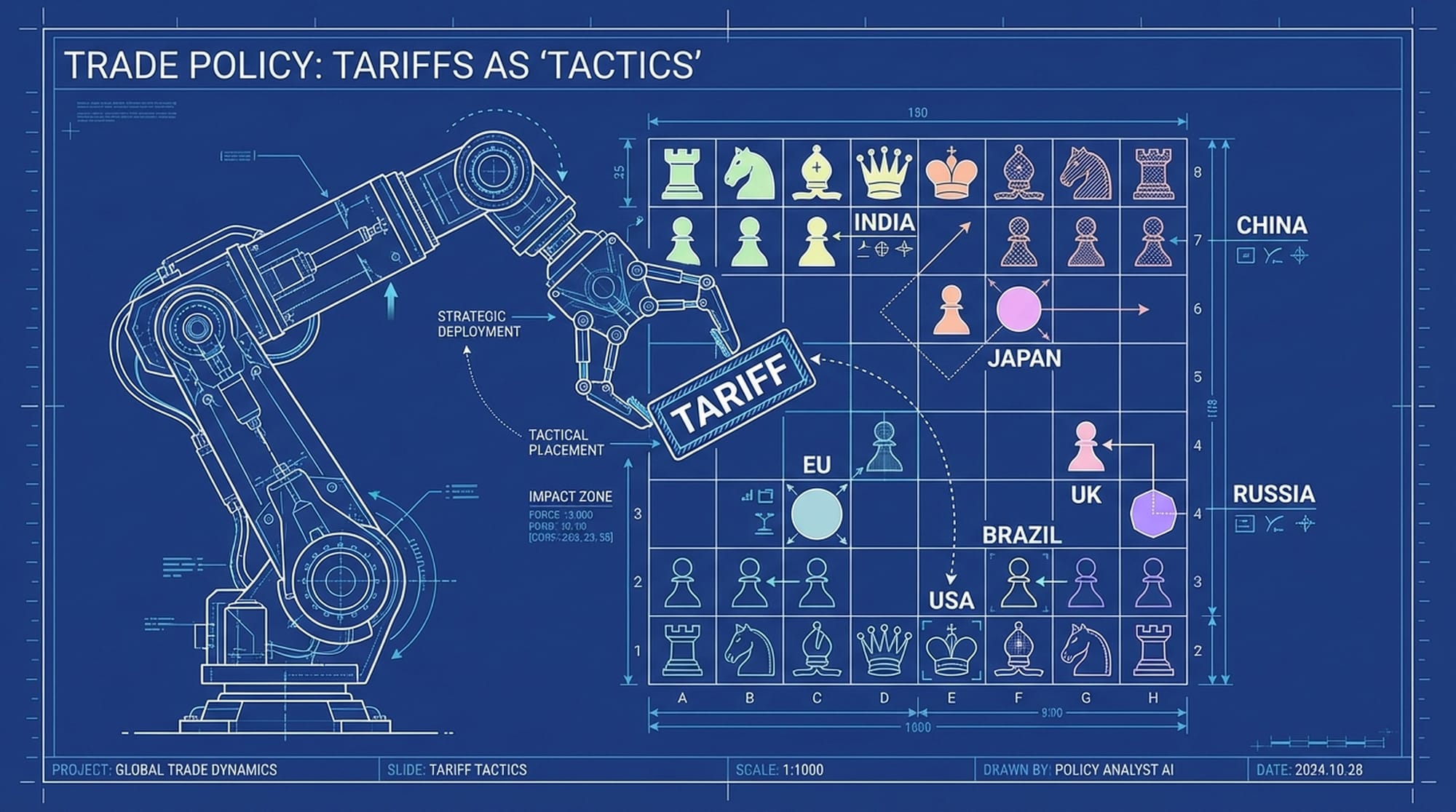

If confirmed, a Hassett chairmanship would likely alter the economic landscape in three distinct ways:

- The "High-Pressure" Regime: Hassett would likely institute a "High-Pressure Economy" framework. The bias for interest rates would be permanently lower, even as the economy strengthens, arguing that "productivity gains" allow for low rates to persist. While officially maintaining a 2% inflation target, the de facto tolerance might shift to 3%, rationalized as a necessary lubricant for relative price adjustments in a tariff-heavy world.

- Institutional Deconstruction: Hassett has threatened to "clean house" at the Fed. The massive staff of Ph.D. economists at the Board, often viewed by conservatives as ideologically captured, could see their influence significantly curtailed. Hassett might rely more on a small circle of appointed advisors than on career staff consensus forecasts. He might also support reforms to reduce the influence of regional Federal Reserve Banks, centralizing power where it can be more democratically accountable (i.e., responsive to the White House).

- The Bond Market Confrontation: The greatest risk to a Hassett tenure is a revolt by the bond market. Ironically, the co-author of Dow 36,000 might oversee a regime where the inflation risk premium on bonds explodes. If investors perceive the Fed has lost its will to fight inflation in favor of political growth targets, long-term yields (e.g., ten-year and thirty-year Treasury rates) could spike, steepening the yield curve aggressively. Traders are already pricing in what they call a "Hassett Steepener"—low short-term rates controlled by the Fed, and high long-term rates controlled by inflation fears. This could counteract the stimulus of rate cuts by pushing up mortgage rates.

Kevin Hassett represents the antithesis of the technocratic central banker we've grown accustomed to. He is a brilliant communicator, a creative theorist, and a devoted supply-sider who views the economy not as a machine to be cooled down, but as a garden to be fertilized with capital and incentives. His nomination would signal the end of the "data-dependent" era of Jerome Powell and the beginning of a "theory-driven" era.

The "Hassett Gamble" is that the U.S. economy has undergone a structural shift, driven by artificial intelligence, deregulation, and tax cuts, that allows it to defy the traditional Phillips Curve trade-offs between unemployment and inflation. If he is right, he could preside over a golden age of non-inflationary growth, vindicating his Dow 36,000 optimism. If he is wrong—if the supply side is constrained and his "cubic models" of growth fail to materialize—his tolerance for loose money could unanchor inflation expectations in a way that takes a generation to fix. For the market, the Hassett era promises one thing above all: the end of the "Fed put" as a safety net for falling prices, and its replacement with a "Fed push" for aggressive expansion.

|  |