France's Quiet Decline: The Fading European Dream

Beyond the romantic facade, France faces a profound economic decline. This analysis uncovers the structural issues, from de-industrialization and the 'Crisis of Labor' to mounting debt and a 'brain drain' that threaten its future as a global power.

|  |  |  |

France's Hidden Reality: Beyond the Postcard Facade

France, often romanticized with images of Parisian cafés and sun-drenched vineyards, presents a facade of enduring charm and cultural richness. However, a deeper look reveals a more complex and concerning picture: the quiet, yet profound, economic decline of a nation that was once a global powerhouse.

Imagine a grand old house, still stately and beautiful on the outside, its garden meticulously kept, its windows gleaming. But inside, unseen by casual visitors, the foundations are cracking, the plumbing is failing, and the electrical system is dangerously overloaded. This, arguably, is France today.

For decades, the French social model has been celebrated for its commitment to equality and an enviable quality of life. Yet, this high standard of living is increasingly decoupled from the nation's true productive capacity. It's akin to someone maintaining a lavish lifestyle not from their current earnings, but from rapidly dwindling savings and mounting debt.

The Erosion of Industry: A Shrinking Core

While countries like Germany, Italy, and even emerging economies such as Poland have maintained or expanded their industrial bases, France has undergone a "violent de-industrialization." In the early 2000s, manufacturing constituted 14% of its GDP. Today, that figure has plummeted to a mere 10%. In stark contrast, Germany's manufacturing sector still hovers around 20% of its GDP. This shift increasingly positions France as a services-only economy, with significant implications for its economic resilience and future stability.

This declining industrial capacity impacts France's trade balance significantly. Unlike Germany and Italy, which boast trade surpluses, France consistently runs a massive trade deficit in goods, essentially importing what it consumes and financing this imbalance through external debt.

The Illusion of Comfort: Debt-Fueled Lifestyle

The much-vaunted French lifestyle is currently supported by the Bouclier Tarifaire – a "tariff shield." This government intervention involves spending billions of euros to subsidize energy prices and buffer citizens from inflation. While this provides immediate comfort, it's not a sustainable solution. This comfort is financed by public debt, not by increased productivity.

"It’s like borrowing money to pay for your groceries every week. Eventually, that bill comes due."

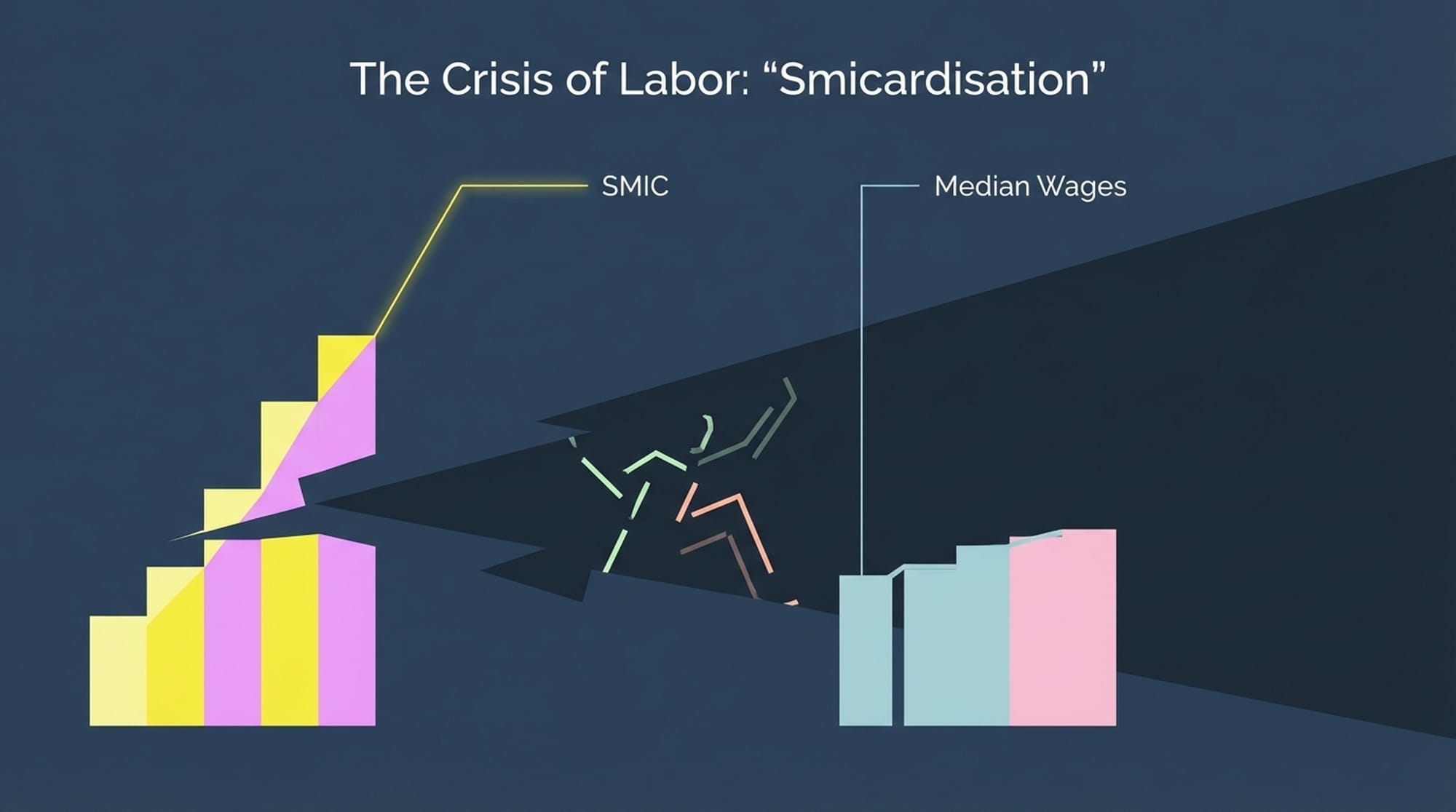

The Crisis of Labor: Smicardisation

France is grappling with a phenomenon known as smicardisation, a crisis of labor where an increasing proportion of the workforce is trapped at or near the minimum wage.

The SMIC, France's minimum wage, is indexed to inflation, which in principle seems fair. However, median and average wages are not. When inflation rises, the minimum wage climbs, while other wages lag, creating a widening gap.

Consider these figures for 2024:

- The net minimum wage is approximately €1,430 per month.

- The median net salary, which half of the private workforce earns less than, is only €2,190.

This means that 50% of private sector workers earn barely €770 more than the absolute minimum wage. Even more strikingly, the percentage of employees paid at the SMIC level has surged:

- In 2021: 12% of workers on minimum wage.

- By late 2023: 17.3% of workers on minimum wage.

Nearly one in five French workers are effectively trapped at the wage floor. This isn't merely an economic statistic; it's a social bomba, a ticking time bomb of discontent.

The Trap of Exemptions

This situation is not accidental; it is a direct consequence of France's fiscal structure. To encourage employment, governments have exempted employers from social security contributions for low wages. In theory, this is a good incentive. However, it creates a significant trap. If an employer wishes to pay an employee just €100 more above the SMIC, their total cost can jump by €400 to €500, because those valuable exemptions are removed.

This disincentivizes companies from raising wages above the minimum, structurally embedding the economy in a low-wage equilibrium.

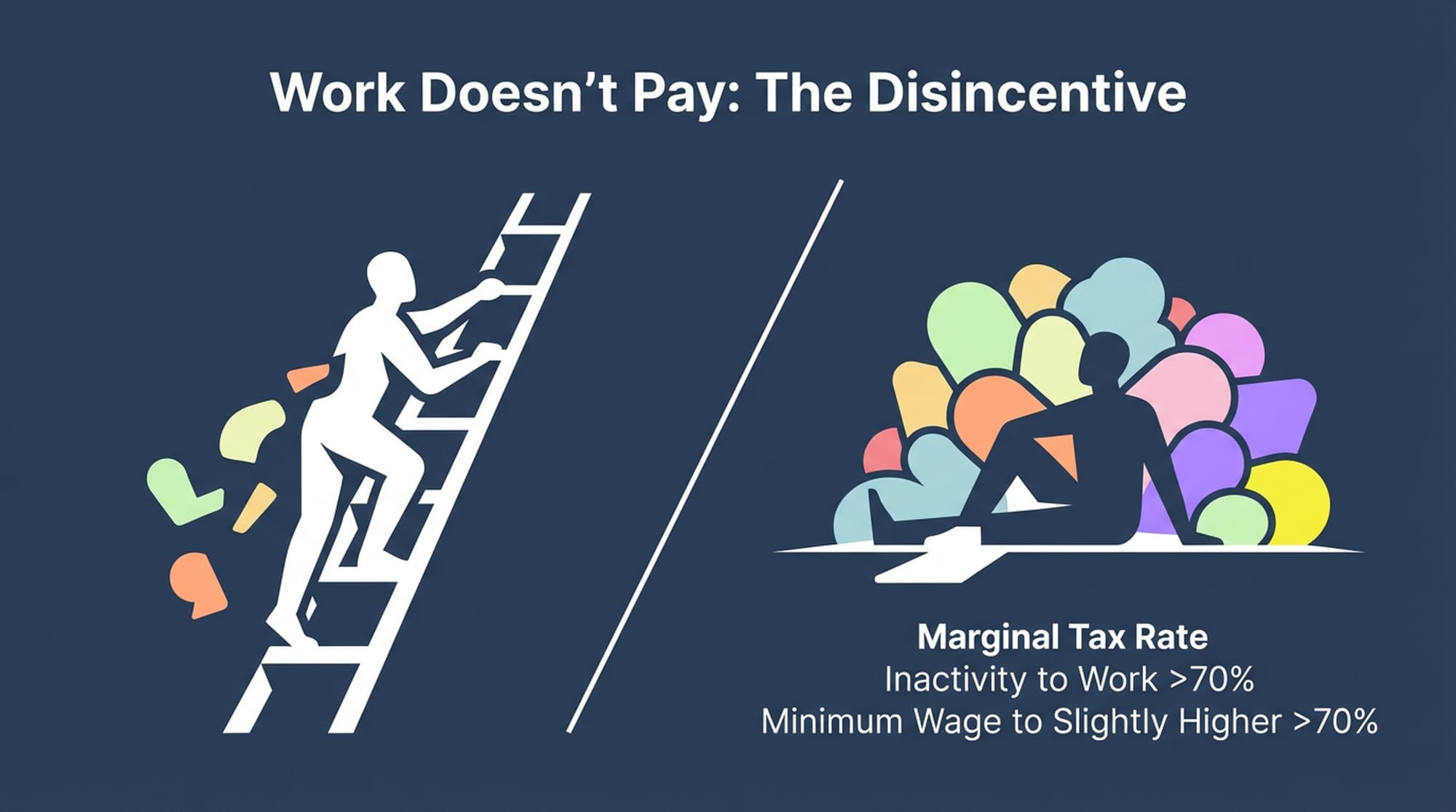

When "Work Doesn't Pay"

For a worker, the implications are equally bleak. Earning the SMIC comes with a raft of benefits:

- Housing subsidies

- Activity bonuses

- Reduced public transport rates

However, if a worker receives a slight raise, for instance, to €1,800 net, they begin to lose these benefits and start paying income tax. The effective marginal tax rate for moving from inactivity to work, or from minimum wage to a slightly higher one, can exceed 70%.

This sends a clear message: Work doesn't pay. It fosters a perception that there's minimal difference in quality of life between someone on welfare and someone working a full-time job. This sentiment is a breeding ground for social resentment, as witnessed in movements like the Gilets Jaunes (Yellow Vests).

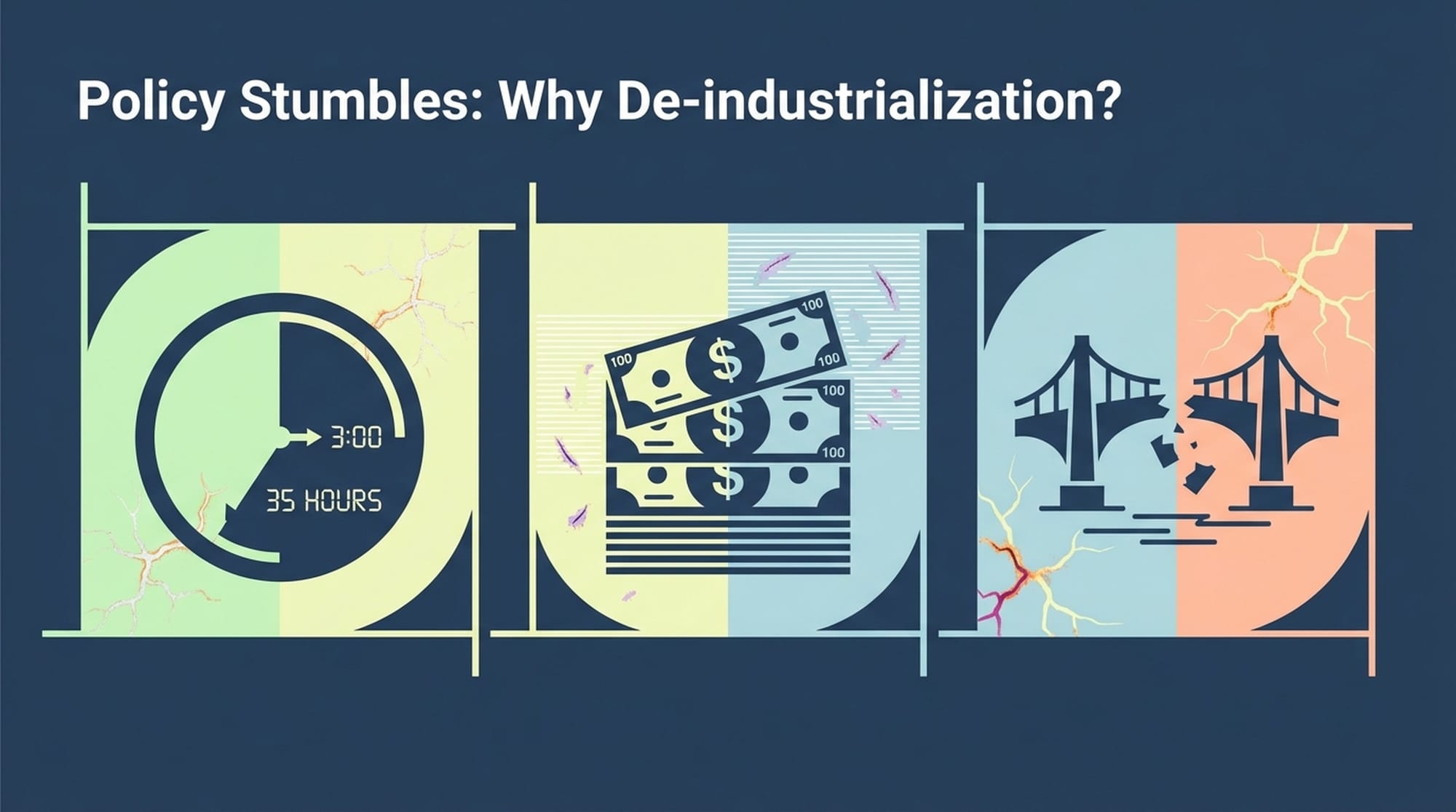

Policy Stumbles and De-industrialization

France's rapid de-industrialization can be attributed to several key policy decisions:

- The 35-Hour Workweek (2000): Intended to boost employment, it often led to increased labor costs and offshoring.

- Production Taxes: Unlike other nations that primarily tax profits, France heavily taxes production—on turnover, value added, and land. These are significantly higher than in comparable economies like Germany, making domestic production uncompetitive.

- Competitiveness Gap: French industry found itself squeezed between high-quality German goods and low-cost Asian products, struggling to produce mid-range goods affordably at home.

The result is a persistent and massive trade deficit in goods, forcing France to finance consumption through external debt.

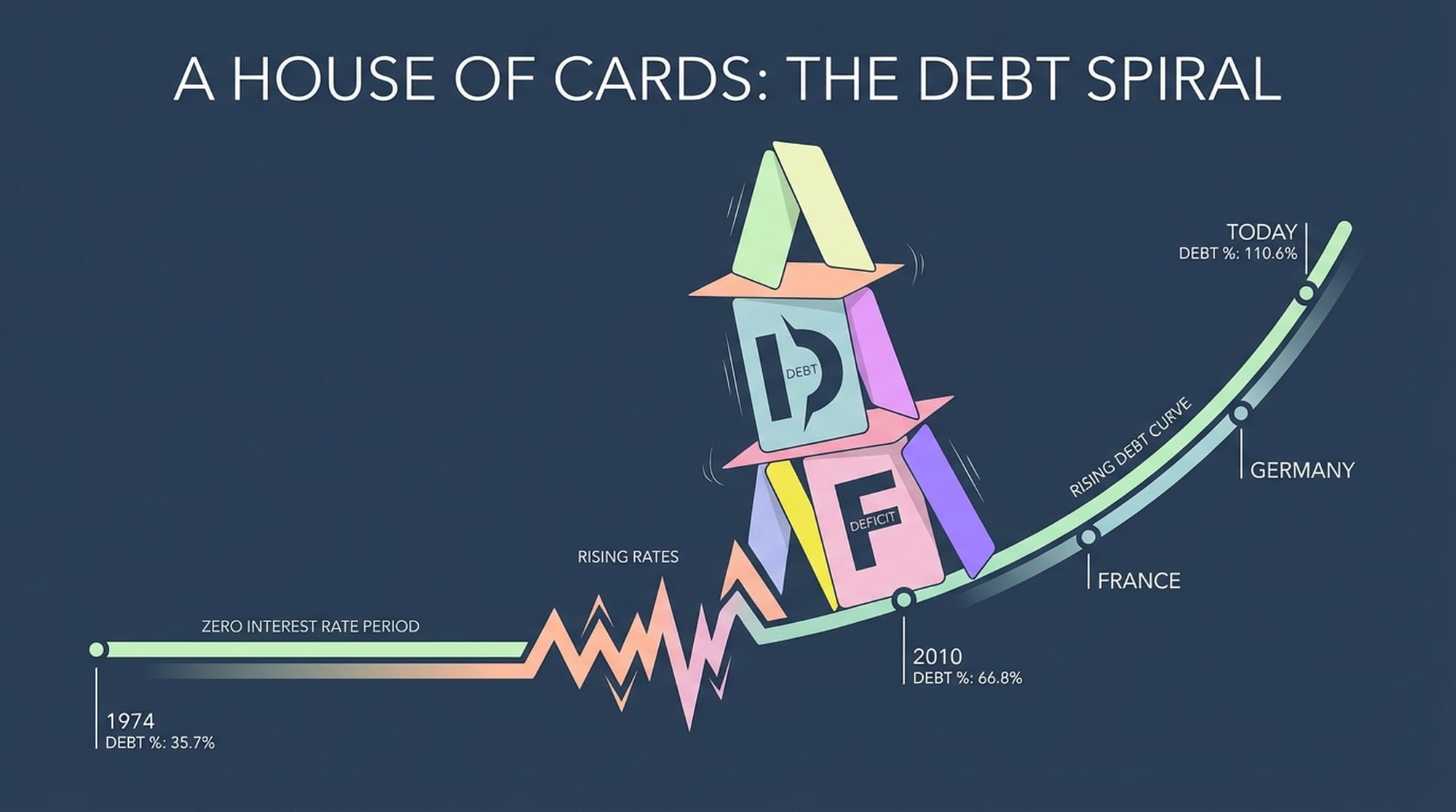

A House of Cards: The Debt Spiral

France's fiscal situation is perhaps its most precarious challenge. The nation has not had a balanced budget since 1974 – fifty years of continuous deficit spending. Public debt now stands at an staggering 112% of GDP.

In contrast, Germany, which had a similar debt-to-GDP ratio of around 80% in 2010, has since reduced it to 63%. France has moved in the opposite direction. Crucially, half of France's debt is held by non-residents, making the nation vulnerable to the volatility of international bond markets.

The era of "free money" (zero interest rates) allowed France to mask these issues for years. However, with rising interest rates, the cost of servicing this debt is exploding.

- This year, France will spend an estimated €50-€58 billion just on interest payments.

- By 2027, this is projected to hit €70-€80 billion.

This could soon become France's single largest budget item, potentially surpassing national education and defense budgets. France is literally borrowing to pay interest on past borrowing, creating a severe fiscal straitjacket.

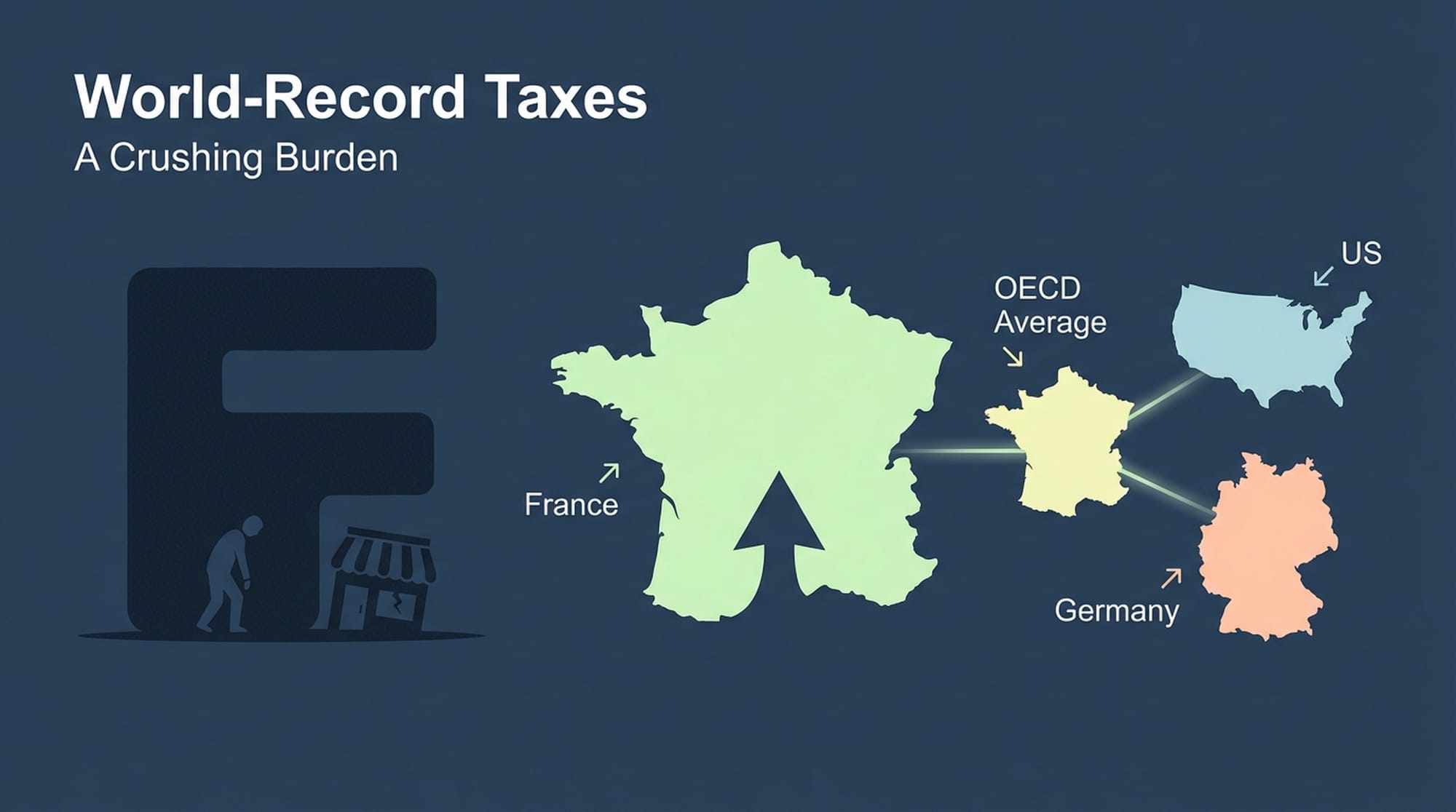

World-Record Taxes and Diminishing Returns

France boasts the highest tax-to-GDP ratio in the OECD, at 45.3%, significantly above the OECD average of 34%, the US at 26%, and Germany at 39%.

This extreme tax burden has profound consequences for both businesses and individuals. Consider a company that pays €82,000 to employ a mid-level manager; that manager will take home only €41,000 after all taxes and social contributions. Fifty percent of the value created by labor is captured by the state. This discourages hiring and instills a feeling of running in place among citizens.

Despite these world-record taxes, the return on investment for citizens is increasingly questioned:

- Healthcare: Despite spending more on healthcare than almost any other EU nation, France faces "medical deserts" where millions lack access to a doctor.

- Education: The once-proud education system is failing. The 2022 PISA results revealed a "PISA shock," with France suffering one of the steepest declines in mathematics in the entire OECD.

- Brain Drain (

fuite des cerveaux): Graduates from France's elite universities are increasingly leaving the country, meaning the state invests heavily in their education only for foreign economies to reap the productivity dividends.

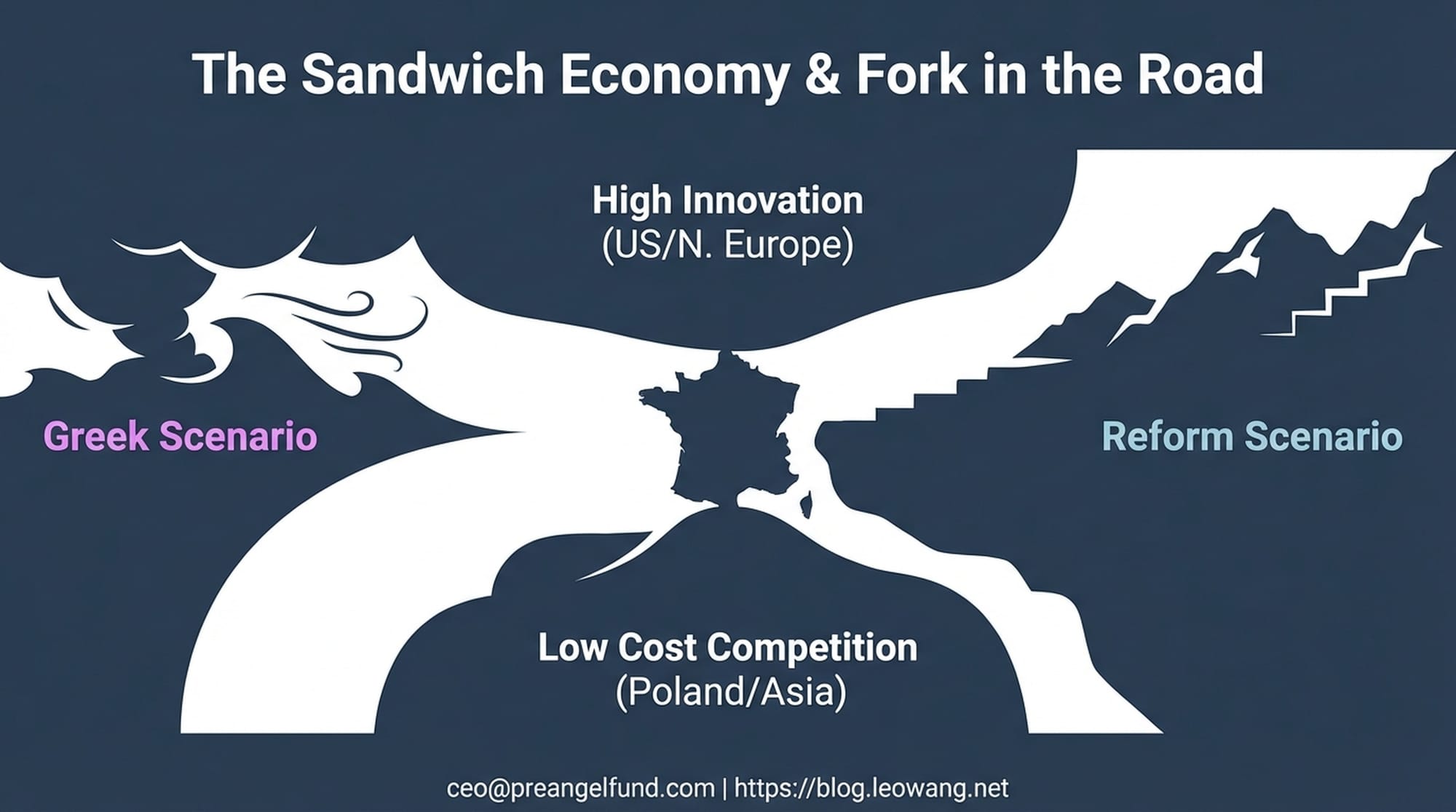

The "Sandwich Economy" and a Fork in the Road

France possesses undeniable strengths: its nuclear energy, global luxury market titans, and defense exports. However, these formidable pillars, while impressive, are not enough to offset the systemic issues. France is trapped in what can be described as a sandwich economy: squeezed from below by an inability to compete on cost (Poland, Asia) and squeezed from above by losing its edge in innovation and human capital (US, Northern Europe).

The current trajectory is mathematically unsustainable. With the end of zero interest rates, France faces a stark choice: embrace a radical reform scenario or risk a Greek scenario of severe economic crisis. As of late 2024, political fragmentation within France makes the reform scenario seem unlikely, suggesting that the "quiet decline" may persist until an external shock forces a more urgent correction.

The economic reality beyond the picture-postcard image of France is one of a nation living on the credit of its past glory and, tragically, on the debt of its future generations. It serves as a powerful reminder that even the most beautiful facades can hide deep structural cracks.

|  |  |