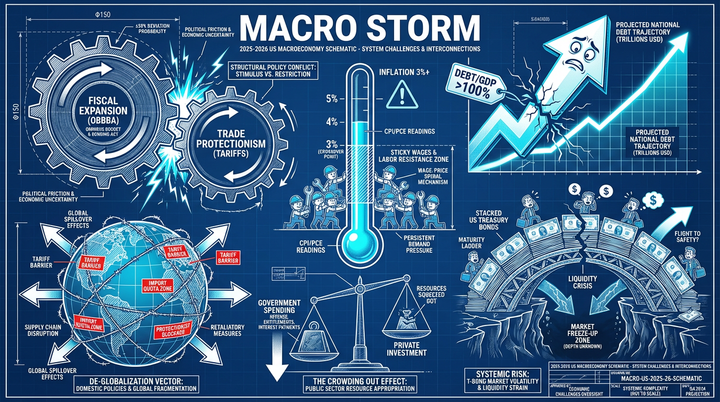

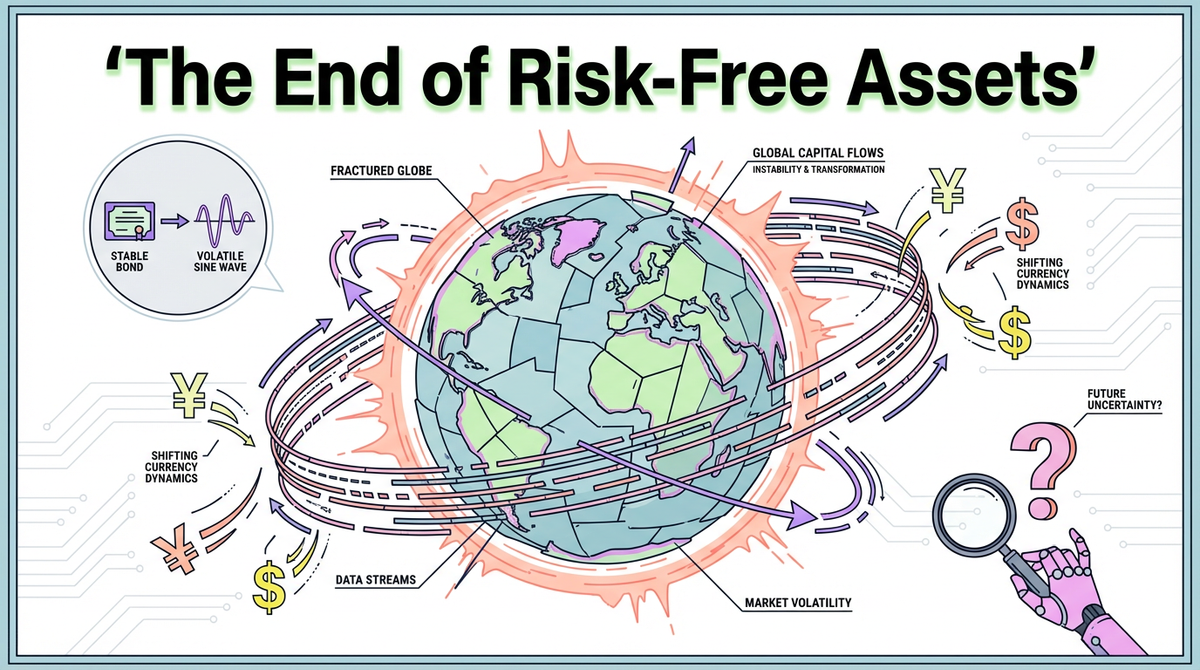

The End of Risk-Free Assets: Navigating a Shifting Global Financial Landscape

The bedrock of our global financial system is fracturing as the concept of 'risk-free' assets undergoes a silent, seismic shift. This article explores the collision of monetary policies, the rise of sovereign-neutral safety, and what it means for your investments in 2026 and beyond.

|  |  |  |

The Fissures Beneath the Foundation: Is the 'Risk-Free' Asset a Relic?

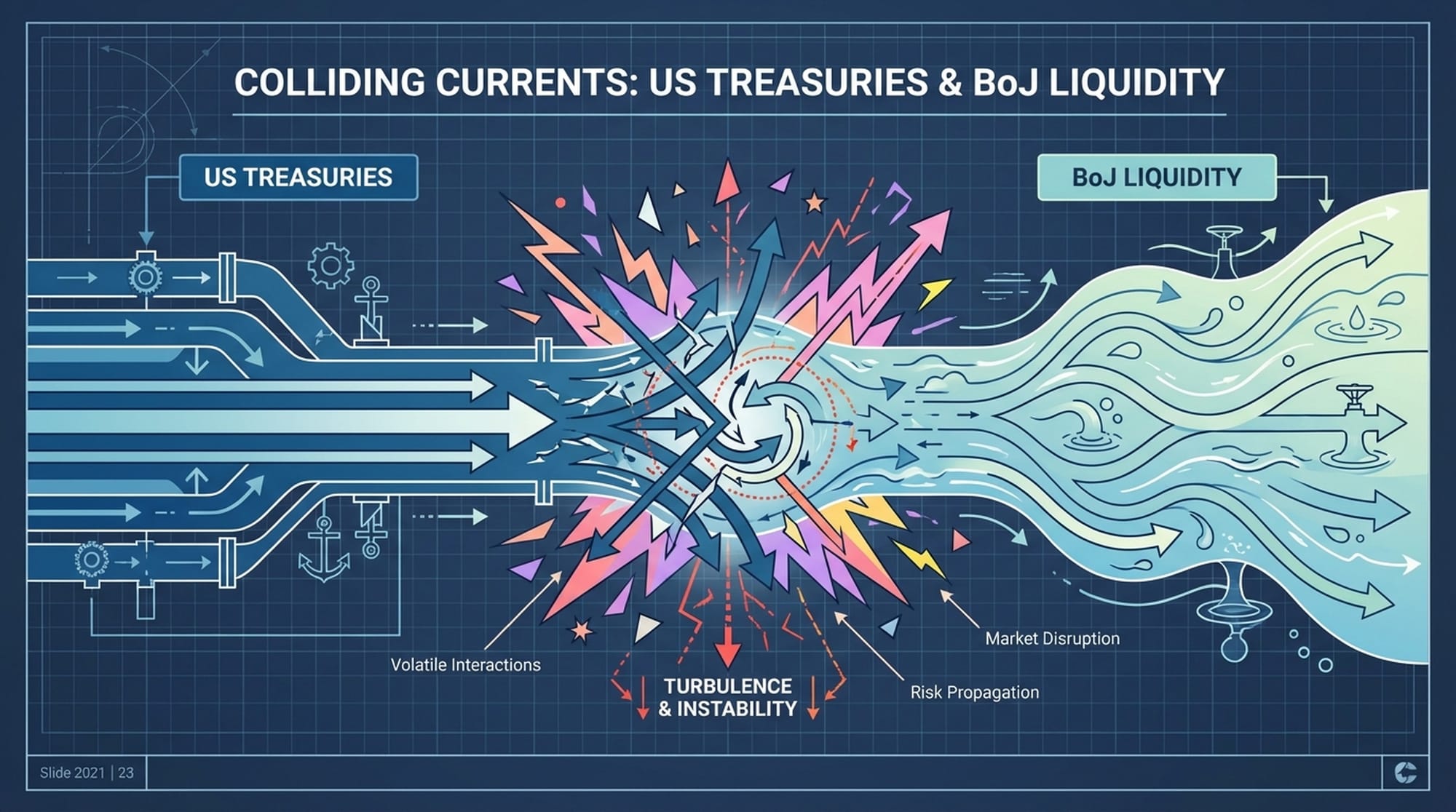

For decades, the concept of a 'risk-free' asset has been the bedrock of our global financial system, a seemingly unshakeable north star guiding investment decisions. Historically, this mantle was worn by US Treasury bonds, offering a secure harbor for capital worldwide. Complementing this, the Bank of Japan's expansive, cheap liquidity fueled global risk-taking, shaping our economic landscape for over thirty years. However, as we approach late 2025, these two dominant forces are not merely shifting; they are colliding, ushering in a period of unprecedented turbulence.

This isn't simply about the Federal Reserve's cautious rate cuts amidst persistent inflation or the Bank of Japan finally escaping its ultra-loose monetary policy. This represents a far more profound narrative: a structural re-evaluation of what 'safety' means in our intricately connected world. Yield differentials, once generous, are now converging. Economic policy, traditionally a tool for stability, appears to be weaponized. The overwhelming scale of fiscal dominance in the United States is beginning to erode the 'exorbitant privilege' of the US dollar and its sovereign debt.

"The 'risk-free' asset is becoming a relic. It's a ghost from a bygone monetary epoch. We are witnessing a regime change."

Our extensive data analysis from late 2024 confirms this transformation. The marginal buyer of US debt is no longer primarily price-insensitive sovereign nations like Japan and China, who historically parked vast reserves. Instead, this role is increasingly being assumed by price-sensitive private actors.

The Tremors of Change: Four Shifting Dynamics

Several key trends are converging to redefine global finance:

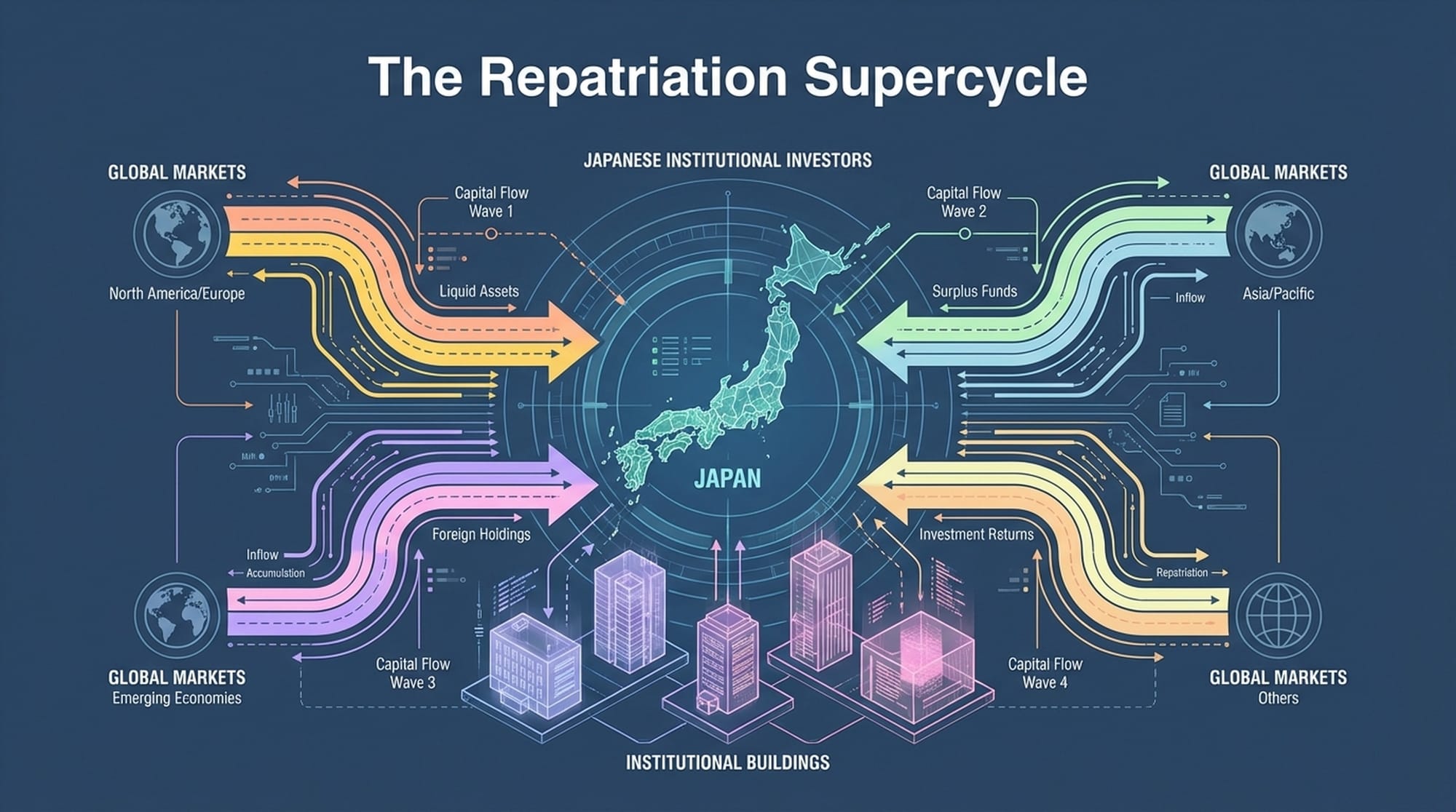

1. The Repatriation Supercycle

A significant tremor is the 'Repatriation Supercycle', wherein Japanese institutional investors, particularly their colossal life insurance companies such as Nippon Life and Dai-ichi, are structurally rotating out of unhedged foreign bonds. With 30-year Japanese Government Bond (JGB) yields now breaching 3.3% and domestic inflation finally normalizing above 2%, the economic rationale for exporting capital has evaporated. This 'home bias' has evolved from a mere preference into a regulatory and fiduciary imperative.

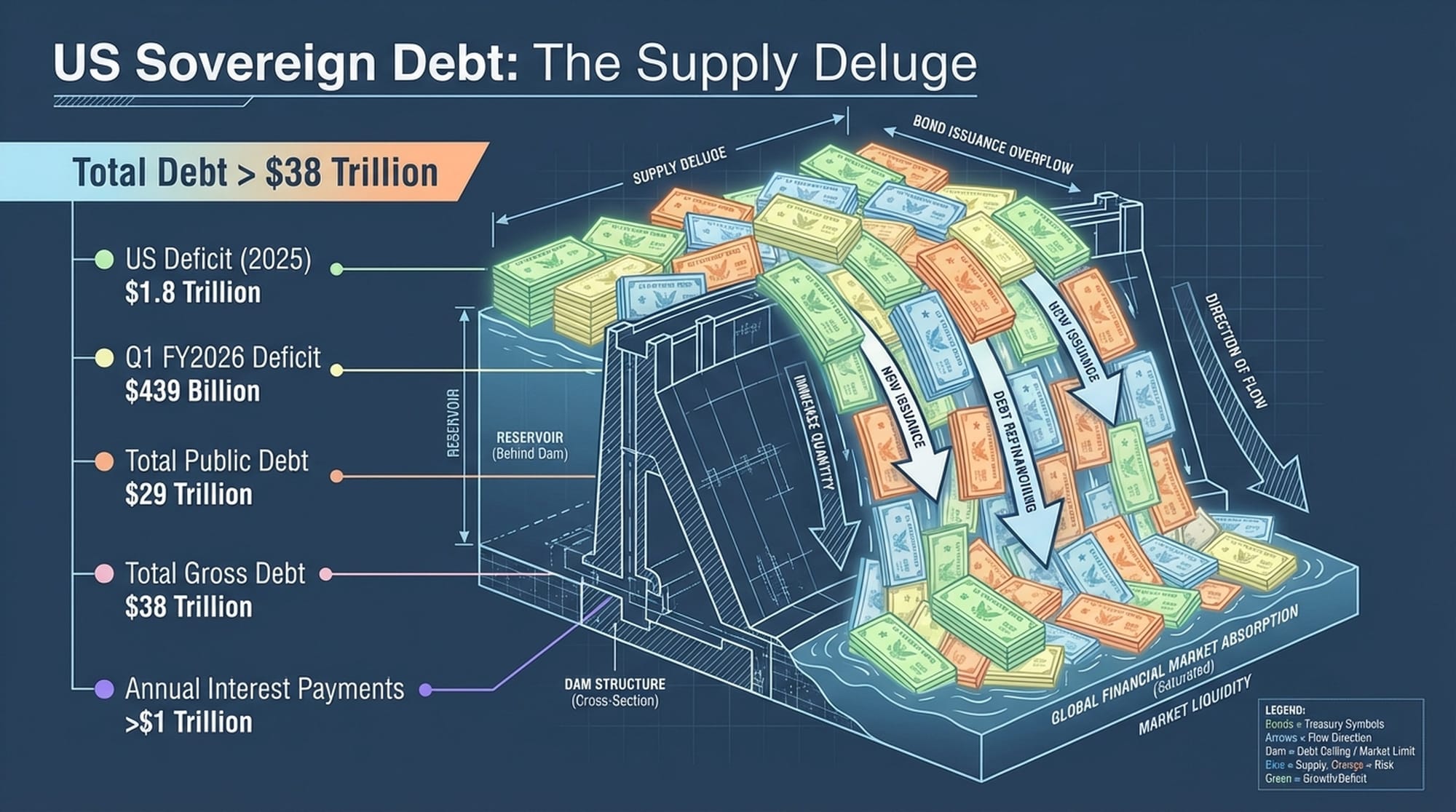

2. Term Premium Renaissance

The 10-year US Treasury yield, even with the Federal Reserve cutting rates, hovers near 4.13%. This isn't a temporary fluctuation but rather a reflection of a permanent expansion of the term premium. Investors are now demanding higher compensation—more yield—to offset the increasing volatility of US inflation and the concerning trajectory of America’s federal deficits, which are projected to sustain a $1.8 trillion annual pace. This signals a fundamental repricing of long-term US sovereign risk.

3. The Liquidity Mirage: Unwinding the Yen Carry Trade

Another critical factor is the 'Liquidity Mirage' stemming from the unwinding of the Yen Carry Trade. Often referred to as the 'dark matter' of global liquidity due to its pervasive yet often unseen influence, its constriction isn't sudden but persistent and suffocating. We are observing a fascinating and deeply concerning correlation flip: previously, Yen strength correlated with 'risk-on' sentiment, fueling global risk assets. Now, a strengthening Yen triggers equity sell-offs, especially within US tech stocks. This suggests a significant re-evaluation of how global liquidity functions.

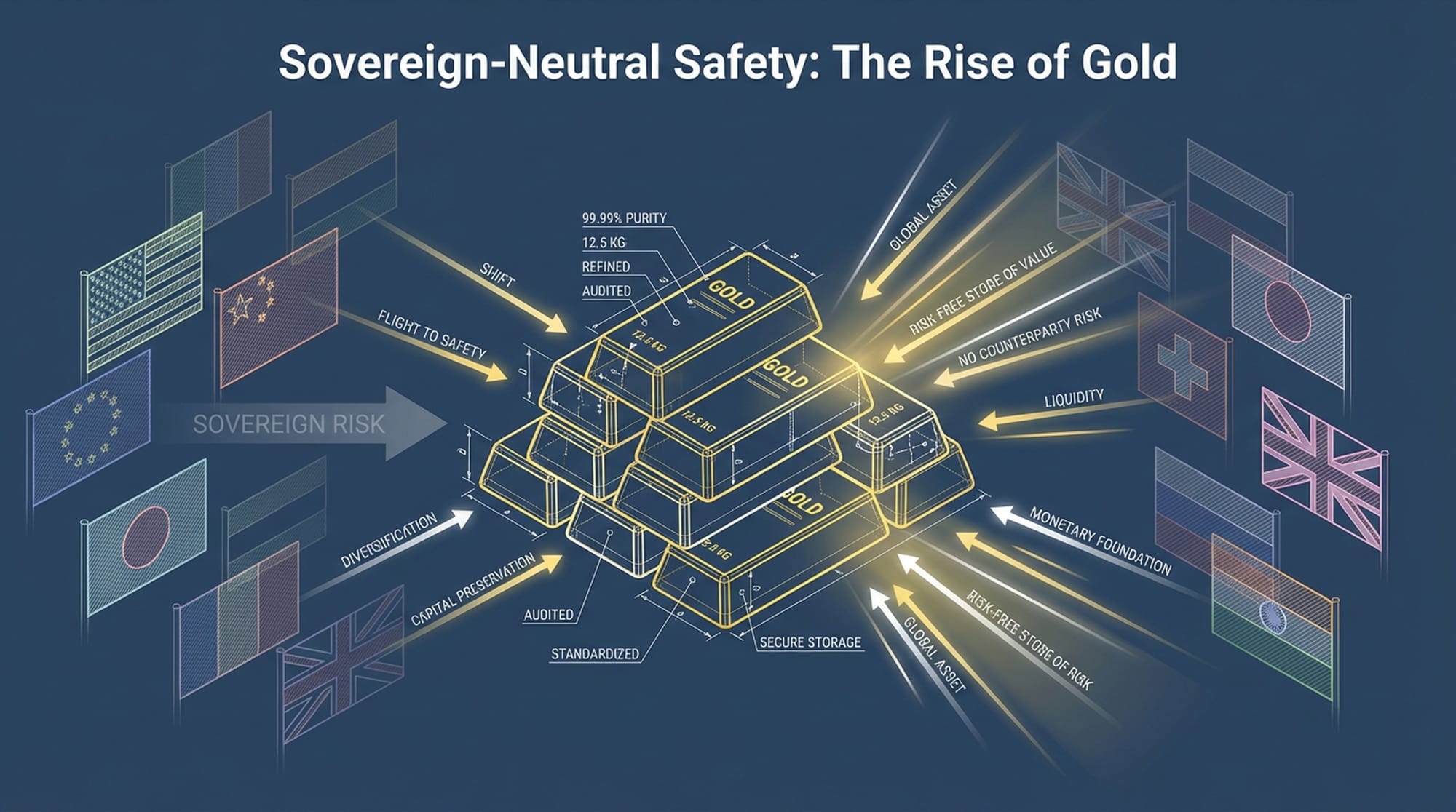

4. Sovereign-Neutral Safety: The Ascendance of Gold

Perhaps the most fascinating development is the rise of 'Sovereign-Neutral Safety'. Gold, defying traditional economic models, has surged 55% year-to-date, making it the best-performing asset of 2025. This isn't merely a flight to safety; it's a profound flight from sovereign risk, towards assets devoid of counterparty liability. The resilience of the Swiss Franc echoes this trend. Investors are actively seeking safety untethered from the fiscal health or political stability of any single government.

The Great Monetary Policy Divergence

What underpins these monumental shifts? The answer lies in the great divergence in monetary policy between the world's two most critical central banks: the US Federal Reserve and the Bank of Japan. The post-COVID era's synchronized global tightening has given way to a sharp decoupling, driven by fundamental clashes in economic realities.

The Fed's Hawkish Cut

On December 10, 2025, the Federal Reserve executed its third consecutive rate cut. This is what we term a 'Hawkish Cut.' While Chair Jerome Powell framed it as necessary to support a softening labor market, core inflation remains stubbornly stuck at 2.9%. This unveils a stark reality for bondholders: the Fed is cutting rates not because inflation has been vanquished, but because the real economy cannot sustain the cost of capital truly required to suppress it. The era of ZIRP (Zero Interest Rate Policy) is definitively over, buried under persistent inflationary pressures. The Fed is caught between a rock and a hard place, trying to engineer a soft landing while core inflation persists.

BoJ's Normalization Velocity

Conversely, while the Fed navigates a challenging descent, the Bank of Japan is managing a volatile ascent. Under Governor Kazuo Ueda, the BoJ has systematically dismantled its historically complex monetary machinery, signifying powerful 'Normalization Velocity.' The BoJ is poised to hike its policy rate to 0.75% at its December 19th meeting. Japan’s entrenched deflationary mindset has finally been broken. The 30-year JGB yield has surged past 3.3%, a steepening that is proving to be a potent catalyst for capital repatriation.

"The psychological and actuarial significance of the 'two percent threshold' for 10-year JGBs cannot be overstated."

The significant rise in JGB yields, particularly the 10-year yield flirting with the 2% threshold, holds immense psychological and actuarial importance. Life insurers can now effectively match their long-term liabilities with domestic assets. This has generated a voracious demand for super-long JGBs, providing direct evidence of capital remaining within Japan. Furthermore, the impending full implementation of a new solvency regime in 2026, imposing stricter capital charges on currency risk and duration mismatches, effectively regulates insurers into repatriating capital.

Norinchukin's Warning and GPIF's Adjustment

While life insurers represent a slow, tidal shift, the Norinchukin Bank saga serves as a sudden, violent squall. This massive agricultural cooperative bank, a whale in global markets, imploded due to a classic carry trade mismatch. Norinchukin was forced to liquidate over 10 trillion Yen (or $65 billion) in foreign sovereign debt, a fire sale that contributed significantly to volatility in US Treasuries. Even Japan's behemoth Government Pension Investment Fund (GPIF), managing approximately $1.8 trillion, is making adjustments. In an environment of increasing US supply, the absence of GPIF buying equates to a tightening of global liquidity.

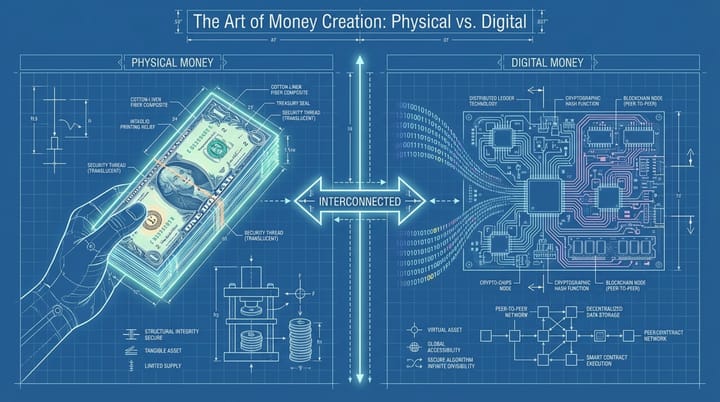

The US Sovereign Debt Conundrum: A Deluge of Supply

The withdrawal of Japanese demand coincides precisely with a deluge of supply from the US Treasury, creating a challenging US Sovereign Debt Conundrum. The US federal fiscal picture is deteriorating rapidly, with a deficit of $439 billion reported for just the first two months of fiscal year 2026. Alarming still, the Treasury is issuing debt at a pandemic-era pace during an economic expansion. Total public debt has surpassed $29 trillion, with gross debt exceeding $38 trillion. Crucially, annual interest payments on this debt now exceed $1 trillion.

A critical shift is evident in the ownership structure of America's debt. The official sector—foreign central banks, traditionally price-insensitive buyers—are either net sellers or neutral. The void is being filled by price-sensitive, domestic actors. Hedge funds, utilizing complex 'basis trades,' have increased their Treasury exposure by an estimated $1.4 trillion. In a novel development in 2025, stablecoin issuers have also emerged as systemic buyers of T-bills, intrinsically linking sovereign funding to the volatility of the crypto ecosystem.

The New Risk Landscape

The profound changes in the bond markets are reverberating across other asset classes, fundamentally altering global capital flows and risk perceptions.

The Yen-Nasdaq Correlation Flip

A critical signal for equity investors is the inversion of the correlation between the Yen and the Nasdaq 100. In the past, a weak Yen typically signaled 'risk on' and strong tech stocks. However, the new regime shows a strong Yen correlating with liquidity withdrawal and weak tech performance. This strongly suggests that a significant portion of the 'bid' beneath high-beta US tech stocks was historically funded by Yen leverage. As this leverage unwinds, the valuation multiples of the 'Magnificent Seven' come under significant pressure.

Redefining Safety: Gold's Triumph

With US Treasuries now exhibiting volatility akin to equities and the Yen undergoing a structural revaluation, global capital is aggressively seeking new definitions of 'safety.' Gold's impressive 55% surge year-to-date solidifies its position as the undisputed superstar of 2025, signaling a clear demand for 'sovereign-neutral' assets. The Swiss Franc has also maintained its status as a premier fiat safe haven. Bitcoin, however, has underperformed with a negative 1.2% return, suggesting it remains a 'risk-on' asset rather than a genuine 'risk-off' store of value.

The TINA Defense: A Counter-Narrative

Before concluding that the US financial system is on the brink, it's crucial to acknowledge a powerful counter-narrative: the TINA defense, or "There Is No Alternative." Despite its fiscal challenges, the US Treasury market remains unparalleled in its depth and liquidity, uniquely positioned to absorb global savings. There simply isn't another pool of assets large enough to accommodate the reserves of China, the oil wealth of the GCC, and the savings of Europe. The market may bend under pressure, but it has historically proven resilient.

Scenarios for 2026 and Beyond

Looking ahead, we envision three primary scenarios:

- Soft Unwind (50% probability): The Bank of Japan gradually hikes rates, while the Fed cuts moderately. US 10-year yields settle in the 3.75% to 4.25% range. Equities see steady gains, and gold continues to outperform.

- Fiscal Tantrum (30% probability): US inflation resurges, forcing the Fed to hold or even hike rates. 10-year yields spike to 5.5% or higher, leading to a 20%+ correction in risk assets, and further Yen strengthening.

- Deflationary Shock (20% probability): The synchronized tightening breaks the global economy. A classic 'flight to safety' ensues, causing US Treasury yields to plummet (meaning prices soar) as the recession trade takes over.

Navigating the New Regime: Recommendations

The era of 'risk-free' assets, as traditionally understood, has ended. The US Treasury market has transformed from a passive store of value into an active risk asset. Concurrently, Japan's normalization represents a tectonic shift in the availability of global funding.

For institutional allocators, our recommendations are clear:

- Reduce sovereign duration: Avoid the long end of the US curve unless yields significantly exceed 4.75%.

- Embrace gold as a primary hedge: Reallocate a portion of 'safe' government bond exposure to gold.

- Monitor USD/JPY: This currency pair has emerged as the new VIX (volatility index), signaling broader market stress. Stress-test portfolios for a potential move to 130-120 Yen/USD.

In this new regime, capital preservation directly necessitates active management of sovereign risk. Passive allocation is no longer a viable safe strategy.

|  |  |  |