|  |  |

Our world is on the cusp of a fundamental transformation. The era of seemingly boundless economic expansion, which defined the last thirty years, is drawing to a close. From 2026 to 2035, we face a decade not of infinite growth, but of unavoidable constraints and profound shifts that will redefine how economies function and societies operate.

Imagine a future where your smartphone demands more power than your entire home, or the global financial system fragments under new pressures. Picture factories and farms being revolutionized by microscopic organisms engineered to produce everything from plastics to medicines. This isn't speculative fiction; it's the imminent reality we are stepping into.

The lines between the physical and digital are blurring. The escalating computational demands of AI are poised to trigger an unprecedented energy crisis, compelling us to rebuild our power grids from the ground up, all while the specter of sovereign debt crises threatens to unravel the very social fabric of nations.

We've just navigated a "Great Transition" from 2021 to 2025, marked by a global pandemic, escalating geopolitical tensions, and the meteoric rise of AI as a transformative force. But this was merely a prelude. What lies ahead is an intricate web of nine interconnected, massive trends that will collectively reshape our future. From an AI-driven energy crisis spurring a nuclear renaissance to geopolitical friction forcing "friend-shoring" and the de-dollarization of global finance, these shifts are unfolding against the backdrop of a colossal demographic transition and the largest wealth transfer in human history.

The Compute Conundrum: AI's Insatiable Hunger

The genesis of this new era lies in compute. If crude oil fueled the industrial age, then compute is the raw, untamed energy driving the 2026-2035 economy. However, this boundless expansion of digital intelligence is about to collide with a very physical limitation: our capacity to generate sufficient energy. The rapid advancements in AI are no longer solely about faster processors; they are fundamentally about our ability to power them.

The unbounded expansion of digital intelligence is about to slam into a concrete, physical wall – our ability to generate enough energy.

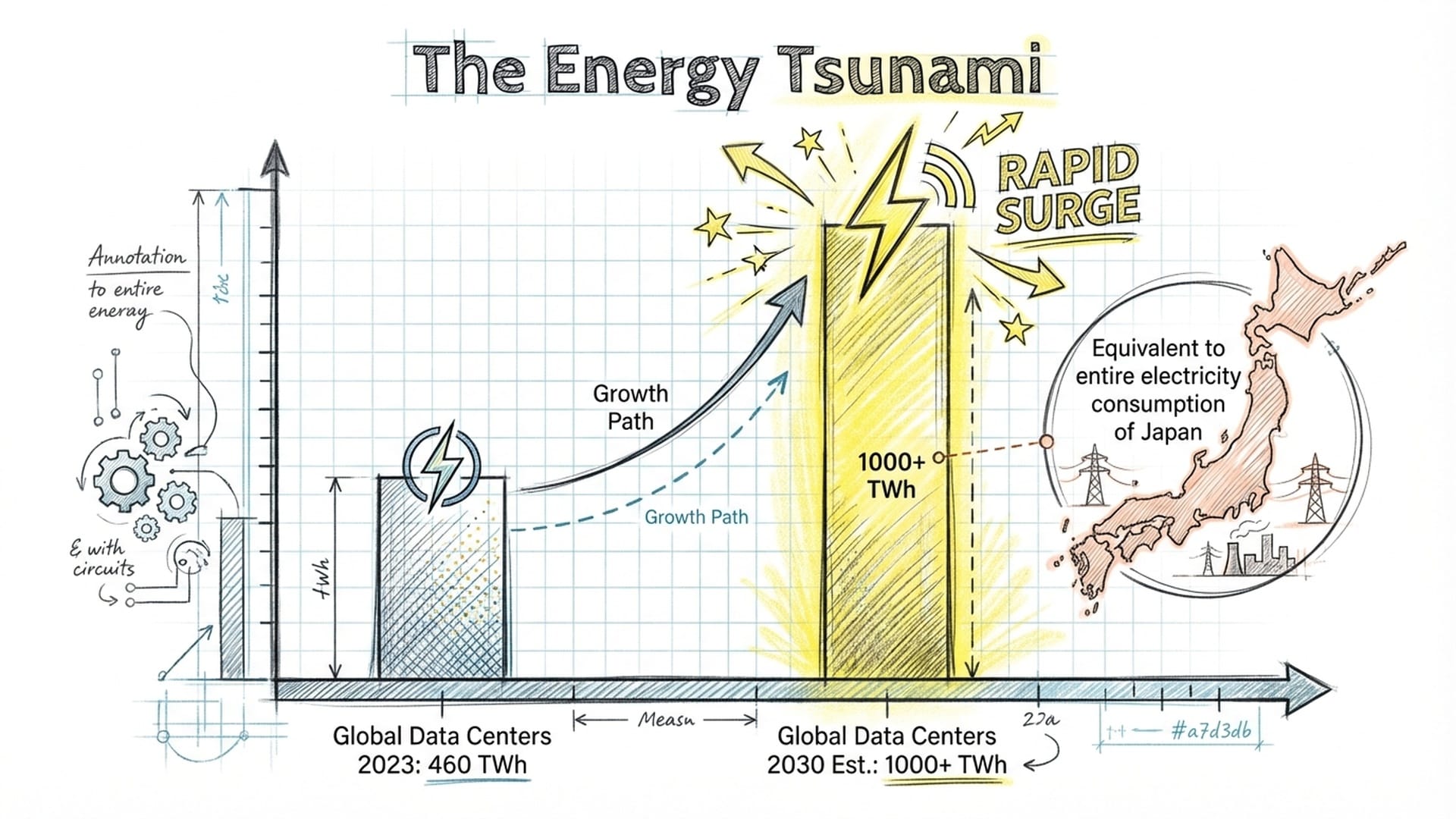

Consider the power demands of data centers. While efficiency gains kept consumption relatively stable from 2010 to 2020—lulling us into a false sense of security that technology would always get "leaner"—that era is decidedly over. As Generative AI moves beyond mere training to massive-scale inference and agentic tasks (AI that can independently plan and execute complex actions), its power consumption is spiraling exponentially.

Esteemed institutions like Goldman Sachs and the International Energy Agency are sounding urgent alarms. We are not merely approaching an energy crisis; we are on the eve of an energy tsunami. By 2030, global data center power consumption could surge by an astounding 160% to 175% above 2023 levels. This is akin to adding the entire electricity consumption of a major industrial nation like Germany or Japan to the global grid within a few short years. Even more conservatively, a high-growth AI scenario could see consumption literally double to over one thousand terawatt-hours by 2030. This isn't just more power; it's a constant, high-density, 24/7 load—a stress test for our existing infrastructure that we are demonstrably unprepared for.

The Grid Bottleneck: Rewiring for the Future

This brings us to the next critical bottleneck: the power grid itself. Our current grids were designed for the static, predictable loads of the 20th century. They are woefully inadequate for the dynamic, gigawatt-scale demands of hyperscale AI clusters that can emerge almost anywhere.

The IEA has warned that meeting both our climate goals and this surging digital demand will require doubling global grid investment to over $600 billion annually by 2030. Without this monumental investment, the grid will become the ultimate choke point, stifling AI's full potential. We are already witnessing this in regions like Northern Virginia, a major data center hub, where new facility connections face delays measured in years, not months.

The future grid must transcend its current form. It will need to be "smart," integrating AI to manage complex power flows, and adeptly balancing intermittent renewables with robust long-duration storage solutions.

So, where will this enormous supply of stable, clean power come from? Coal is a non-starter due to carbon neutrality commitments. While wind and solar are vital, their intermittency renders them unsuitable for providing the baseload power required by 24/7 data centers.

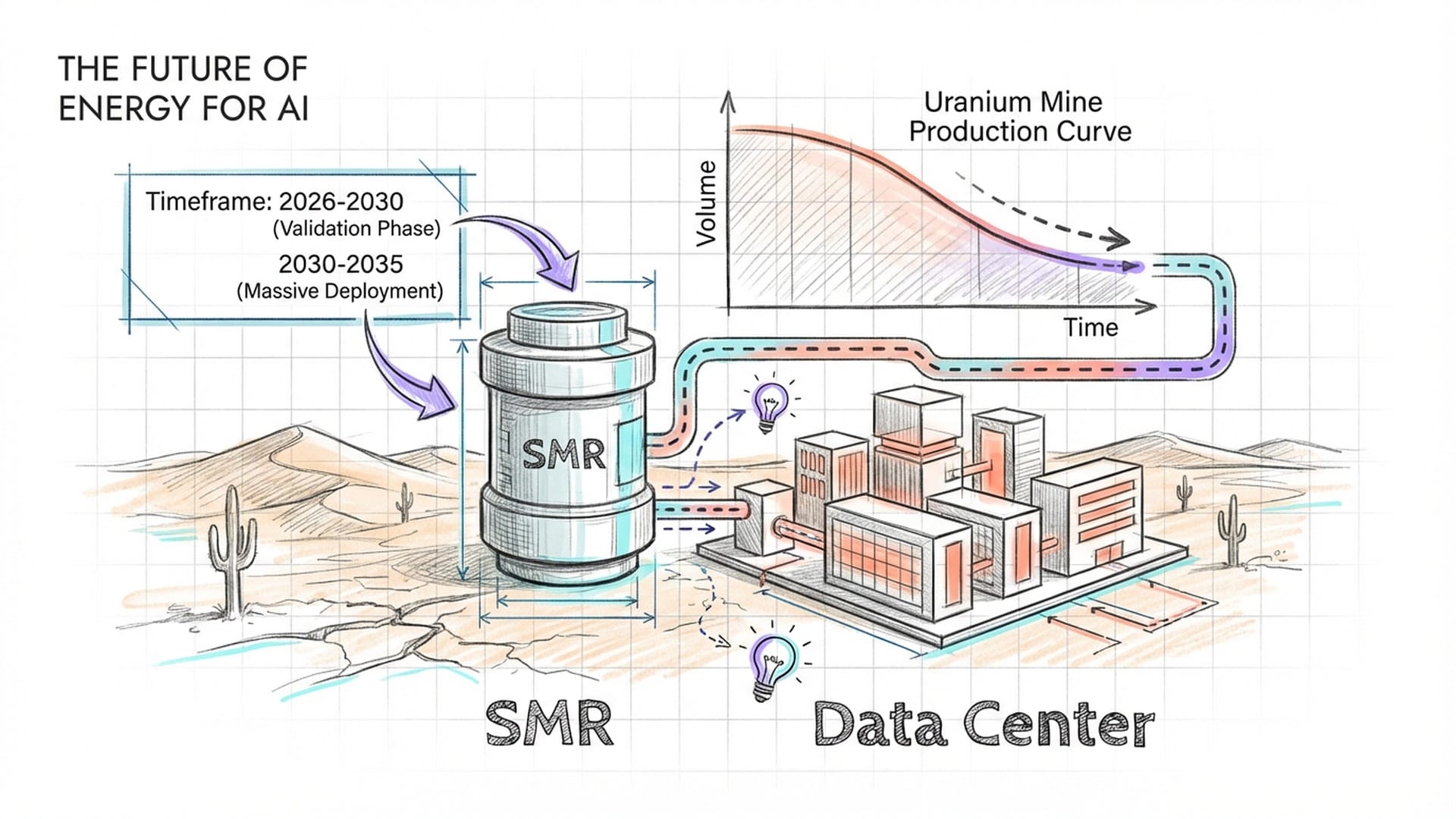

This leads us to an unexpected champion in the energy transition: nuclear energy, specifically Small Modular Reactors (SMRs).

The period from 2026 to 2030 will be the ultimate validation phase for SMR technology. These reactors offer a game-changing combination of reliability, dispatchability, and a small physical footprint.

The years 2026 to 2030 will be pivotal for SMR technology. Tech hyperscalers, the very companies building these massive AI data centers, are already bypassing traditional utilities. They are entering direct Power Purchase Agreements with nuclear developers, securing dedicated, off-grid power for their AI campuses. Commercial SMR deployments are anticipated to begin around 2030 and scale significantly by 2035. Their ability to deliver reliable, dispatchable power with a compact footprint makes them ideal for powering the next generation of digital infrastructure.

However, a critical challenge looms: the fragility of the nuclear fuel cycle. The World Nuclear Association projects a one-third increase in uranium demand by 2030 and almost a doubling by 2040. Simultaneously, output from existing mines is expected to halve by 2030 as reserves deplete. This creates a significant supply-demand chasm, suggesting structurally higher uranium prices and intense geopolitical competition for access to this vital resource. The control of the future economy will be intrinsically linked to who can supply compute power, and critically, how it is fueled.

Embodied AI and the Bio-Economy: Redefining Production

The physical world is also undergoing a radical transformation. 2025 is effectively "Year One" for Embodied AI. While the last decade focused on digitizing information, the coming decade will be about digitizing physical labor. Robots are no longer confined to automotive factories; they are breaking free into unstructured environments – our homes, hospitals, and warehouses.

These are not the clunky factory robots of old. Powered by multi-modal Large Language Models, they can comprehend the nuances of physics, process natural language commands, and execute incredibly complex tasks. They possess the ability to learn on the job, adapt, and refine their movements in real-time.

The market for these smart robots is set for explosive growth, projected from $24 billion in 2025 to over $214 billion by 2035. The fastest-growing segment will be humanoid robots. Morgan Stanley anticipates the market for humanoids reaching massive scale as unit costs plummet. This affordability is the key driver: the cost of a humanoid robot is expected to drop from $200,000 today to around $50,000 by the mid-2030s. This price point is comparable to a mid-range car, but unlike a car, a robot can work 24/7, without breaks, performing a multitude of tasks.

This revolution is not mere novelty; it’s born of absolute necessity. Nations with aging populations, such as Japan, China, and Germany, face an existential threat from shrinking workforces. Robots are no longer just "replacing humans"; they are literally filling a demographic vacuum. They will transform elder care, logistics, manufacturing, and countless other sectors, shifting the narrative from fear of job loss to the imperative of "saving the economy" itself.

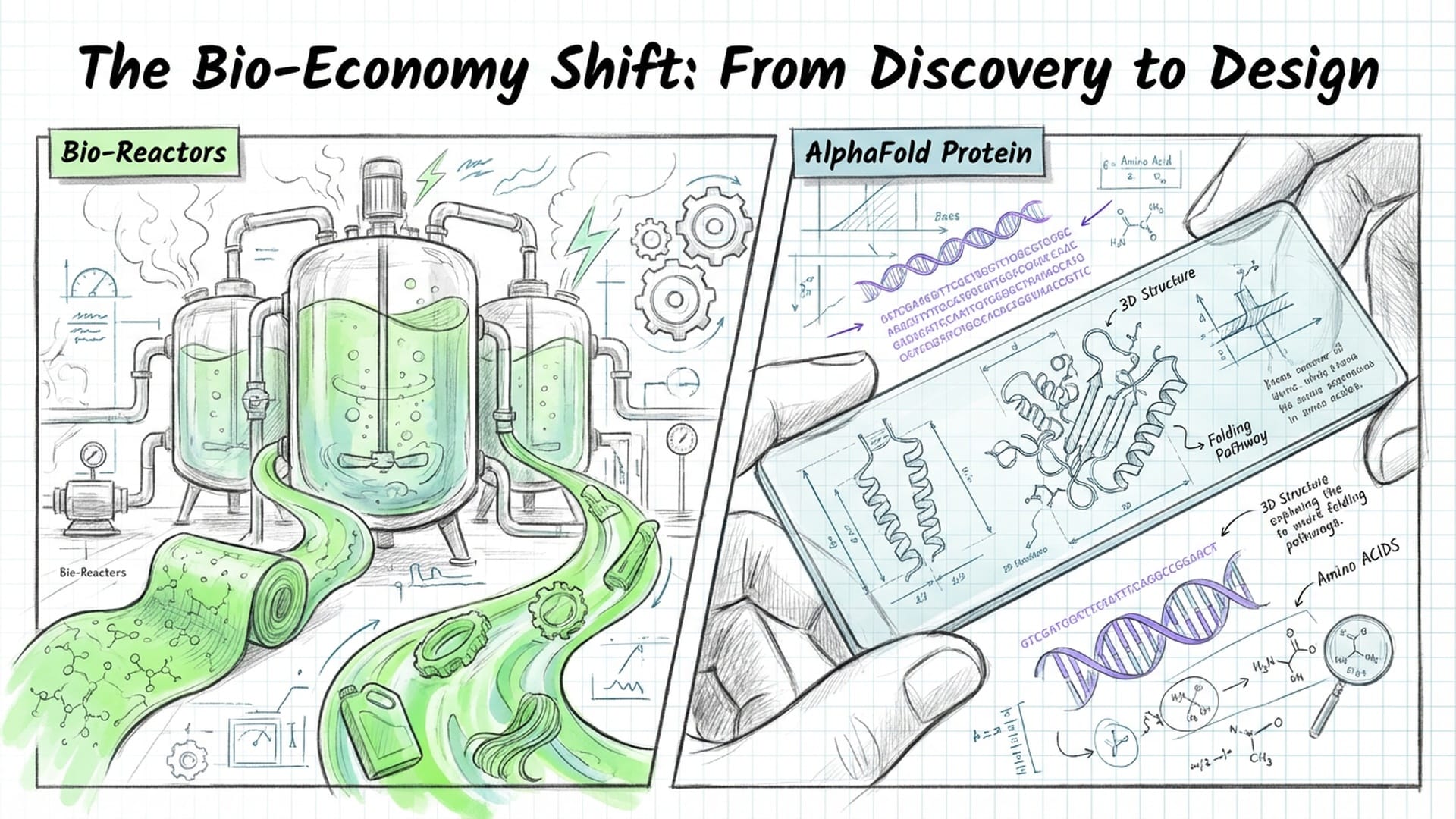

By 2035, the "Bio-economy" will rival the digital economy in strategic importance.

But what if the very building blocks of our manufacturing economy—materials, chemicals, even food—were derived not from fossil fuels or traditional agriculture, but from biology itself? This is the promise of synthetic biology, transforming biology from a slow, discovery-based science into a rapid, iterative engineering discipline. By 2035, this "Bio-economy" will rival the digital economy in strategic importance.

Imagine the convergence of AI and biology. Tools like AlphaFold have already accelerated protein design by orders of magnitude. The ability to simulate and synthesize genetic sequences in silico (in a computer) before testing them in vivo (in living organisms) slashes R&D cycles from years to mere weeks. This extends beyond new medicines; it's about redefining manufacturing entirely.

Engineered microbes will increasingly produce plastics, fabrics, and chemicals, decoupling production from our reliance on fossil fuels. In this new paradigm, national power will be defined not by oil reserves, but by biological data banks and bio-manufacturing capacity – massive fermentation infrastructures churning out the next generation of materials.

Reshaping Mobility and Global Supply Chains

Innovation extends beyond labs and factories to how we travel and connect. Decarbonizing aviation is a prime example. For short distances, Electric Vertical Take-off and Landing (eVTOL) aircraft are transitioning from futuristic prototypes to operational reality. This market is projected to soar from $12.5 billion this year to almost $86 billion by 2035. By the 2030s, "air taxis" will become a normalized mode of transport in major metropolitan areas, bypassing congested ground infrastructure.

For long-haul flights, however, battery density remains a challenge. The industry's path to net-zero carbon emissions will heavily depend on Sustainable Aviation Fuel (SAF). This market is expected to grow at a blistering pace, reaching over $350 billion by 2035. This necessitates massive investments not only in the fuel itself but also in the entire feedstock supply chain, from processing waste oils to creating synthetic hydrocarbons. This isn't just about greener flights; it's a fundamental reshaping of global agriculture and energy production.

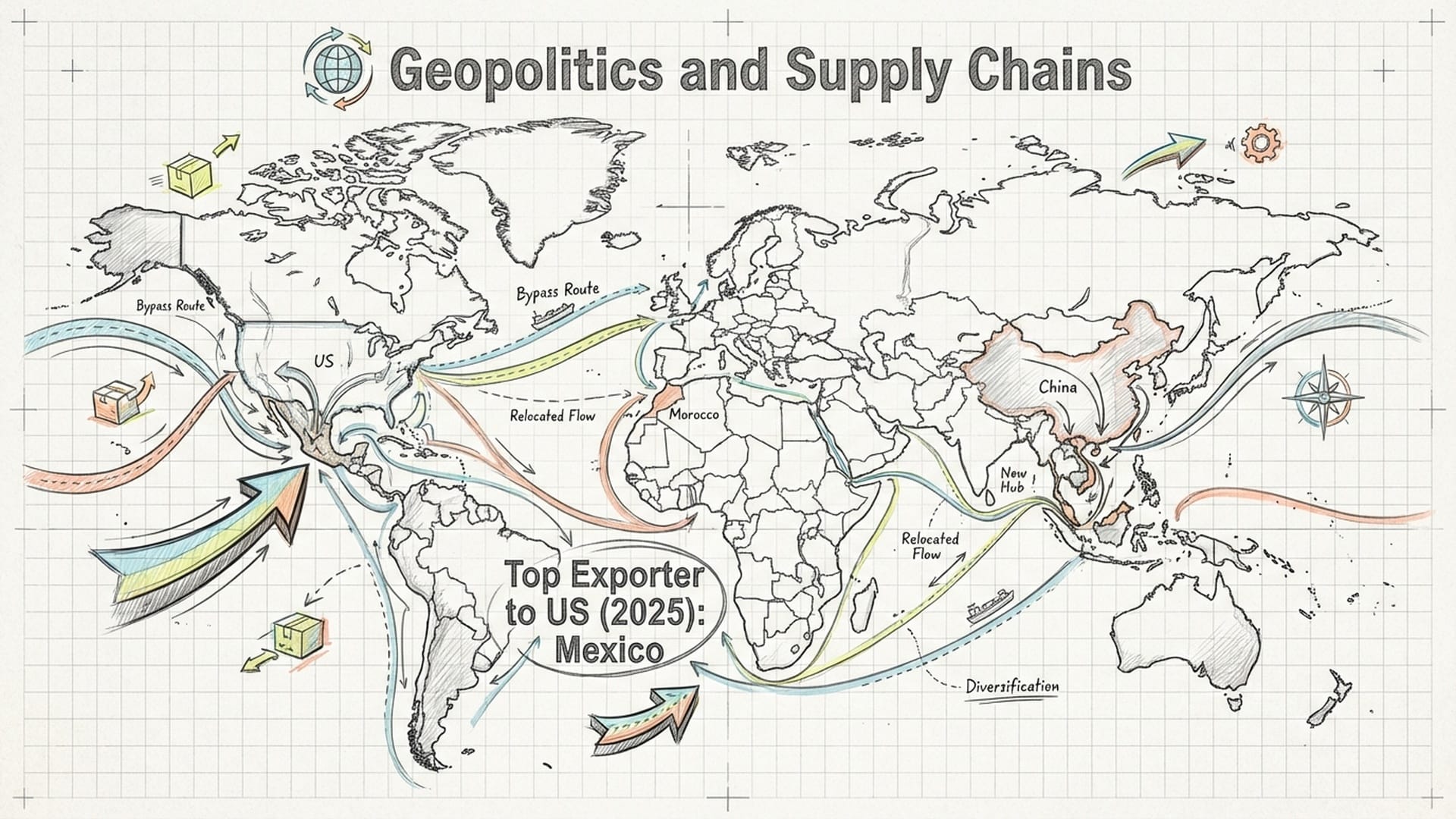

Now, let's address geopolitics and supply chains. Globalization, as we've known it, is not dying, but it is being radically re-routed. The core logic of supply chains is shifting from a relentless pursuit of "efficiency and lowest cost" to an absolute obsession with "security and resilience." We are entering an era of "friend-shoring." As direct trade between rival geopolitical blocs becomes increasingly fraught with tariffs, restrictions, and political tensions, trade is simply finding new arteries. It's flowing through intermediaries, giving rise to what we call "Connector Economies."

Globalization is not dying, but it is being radically re-routed from efficiency to security and resilience.

Countries like Mexico, Vietnam, and Morocco are rapidly emerging as pivotal hubs. For instance, Mexico surpassed China as the top exporter to the U.S. in 2025, driven by a massive near-shoring trend in auto and electronics manufacturing. To access Western markets, companies will require unprecedented end-to-end supply chain transparency, leveraging blockchain and AI to verify not just origin but also mandated labor standards and carbon compliance. This isn't merely about localizing production; it's about building trust, which is rapidly becoming a strategic asset.

The Financial Fault Lines: De-Dollarization and Debt

This geopolitical fracturing extends beyond goods and services, profoundly impacting the very architecture of global finance. While still dominant, the U.S. dollar faces unprecedented challenges. "De-dollarization" is no longer theoretical rhetoric; it's a visible, tangible trend playing out in central bank vaults and payment rails worldwide.

Central bank gold buying hit record levels in 2024 and 2025. This isn't just hedging against inflation; it's profound geopolitical hedging. Nations in the Global South, weary of weaponized sanctions, are actively diversifying their reserves, viewing gold as the only truly neutral, counterparty-free asset—a safe haven from political pressure.

Concurrently, the monopoly of the SWIFT international payment system is finally being challenged. Platforms like mBridge, a multi-Central Bank Digital Currency (CBDC) platform, allow central banks to settle cross-border trade directly in local currencies, completely bypassing the traditional correspondent banking system and, crucially, the U.S. dollar. Even the BRICS+ bloc is actively developing its own payment system, potentially anchored by gold or a currency basket, to facilitate trade outside the Western financial sphere. This doesn't signal an overnight replacement of the dollar but rather the creation of powerful alternatives. In a multipolar world, alternatives signify power.

Underpinning these technological and geopolitical shifts are two colossal human-centric trends: a rapidly shrinking global workforce and the largest transfer of wealth in human history. The period from 2026 to 2035 will be defined by their collision.

Baby Boomers are in the process of transferring an estimated $84 trillion to Gen X, Millennials, and Gen Z through 2045. This is more than a movement of money; it's a seismic shift in values. The next generation of wealth holders is unlikely to simply invest in traditional blue-chip stocks. They are far more inclined to invest in crypto assets, cutting-edge sustainable technology (ESG-focused investments), and alternative private markets. This transfer will inevitably exacerbate the wealth gap, concentrating assets in fewer and fewer hands, thereby creating the potential for significant social friction and political instability.

Simultaneously, the cost of aging populations is spiraling. Healthcare spending is on an unsustainable trajectory. In the U.S. alone, national health expenditure is projected to exceed 20 percent of GDP by 2033. This creates a "fiscal vise," relentlessly squeezing government discretionary spending on vital areas like education and infrastructure. The fundamental question becomes: how do we finance the future when the past is consuming an ever-larger portion of the budget?

These profound shifts necessitate an entirely new investment paradigm. The era of "easy money" and passive Beta returns is concluding. The next decade will be characterized by extreme volatility and dispersion, where winners will win big, and losers will be left behind. The "rising tide lifts all boats" dynamic, fueled by ever-lower interest rates and broad market correlations, is over. With interest rates settling higher and asset correlations breaking down, active management and true stock selection (Alpha) will regain their prominence. The chasm between early AI adopters (winners) and disrupted, slow-to-adapt industries (losers) will widen dramatically. The traditional 60/40 portfolio is heading for a significant reality check.

The face of finance itself is changing. Younger investors are embracing hyper-risk, high-reward instruments. Prediction markets, platforms like Kalshi and Polymarket, are transforming "events" into tradable asset classes, with volumes surging into the billions. Political outcomes, scientific breakthroughs, and even weather patterns are becoming financial instruments. Perhaps most alarming is the explosion of "Zero Days to Expiration (0DTE)" options, which now account for over 50 percent of S&P 500 options volume, injecting structural fragility and increasing the risk of "flash crashes" into the heart of the market. This financial gamification is a significant wild card.

Finally, and perhaps most perilously, we must confront the looming sovereign debt cliff. The fiscal sustainability of many major economies hangs by a thread. The U.S. Congressional Budget Office projects federal debt held by the public to reach 118 percent of GDP by 2035, surpassing even the peak from World War Two. More alarmingly, the interest payments on this debt will soon exceed the entire defense budget. This means we will spend more on servicing past debt than on protecting our nation.

With debt at such astronomical levels, governments face extremely limited options:

- Financial repression: Keeping interest rates artificially below inflation to slowly erode the real value of the debt—a hidden tax.

- Aggressive tax reforms: Targeting wealth and corporate profits, always met with fierce political opposition.

- Tolerating higher inflation: Accepting a 3-4 percent inflation target not as a system bug but as an accepted feature of this new economic reality, another way to devalue what is owed.

These are not easy choices, and each carries profound implications for citizens, businesses, and the very fabric of society.

Navigating the Future: Resilience, Adaptability, Foresight

So, how do we navigate this whirlwind? The years 2026 to 2035 will reward resilience, adaptability, and foresight like never before.

For nations, energy independence and secure supply chains are no longer desirable; they are paramount to national security and prosperity. For businesses, the rapid, effective integration of Embodied AI isn't merely about competitive advantage; it's about survival.

For investors, the old 60/40 playbook and traditional wisdom must be entirely rewritten. This new world demands the inclusion of hard assets, a commitment to active, discerning selection of investments, and the implementation of robust protections against the inevitable volatility of a world in profound and accelerating transition.

The game is changing. The rules are being rewritten. The question is: will you be ready?

|  |