The End of Globalization: A Fractured World Economy

The global economic system as we know it is gone, replaced by a fractured, aggressive landscape. Leo Wang explains how 'America Only' policies, Europe's economic deterrence, and China's Global South pivot are reshaping trade, energy, and technology.

|  |  |  |

The Phantom Economy: Navigating a Fractured Global Order in 2025

The economic landscape we once knew, characterized by global markets, free trade, and interconnectedness, has dissolved, replaced by a far more volatile and aggressive system. As of December 2025, the subtle whispers of instability from earlier in the decade have solidified into concrete divisions, transforming trade into a weapon and rendering previous assumptions about global commerce obsolete.

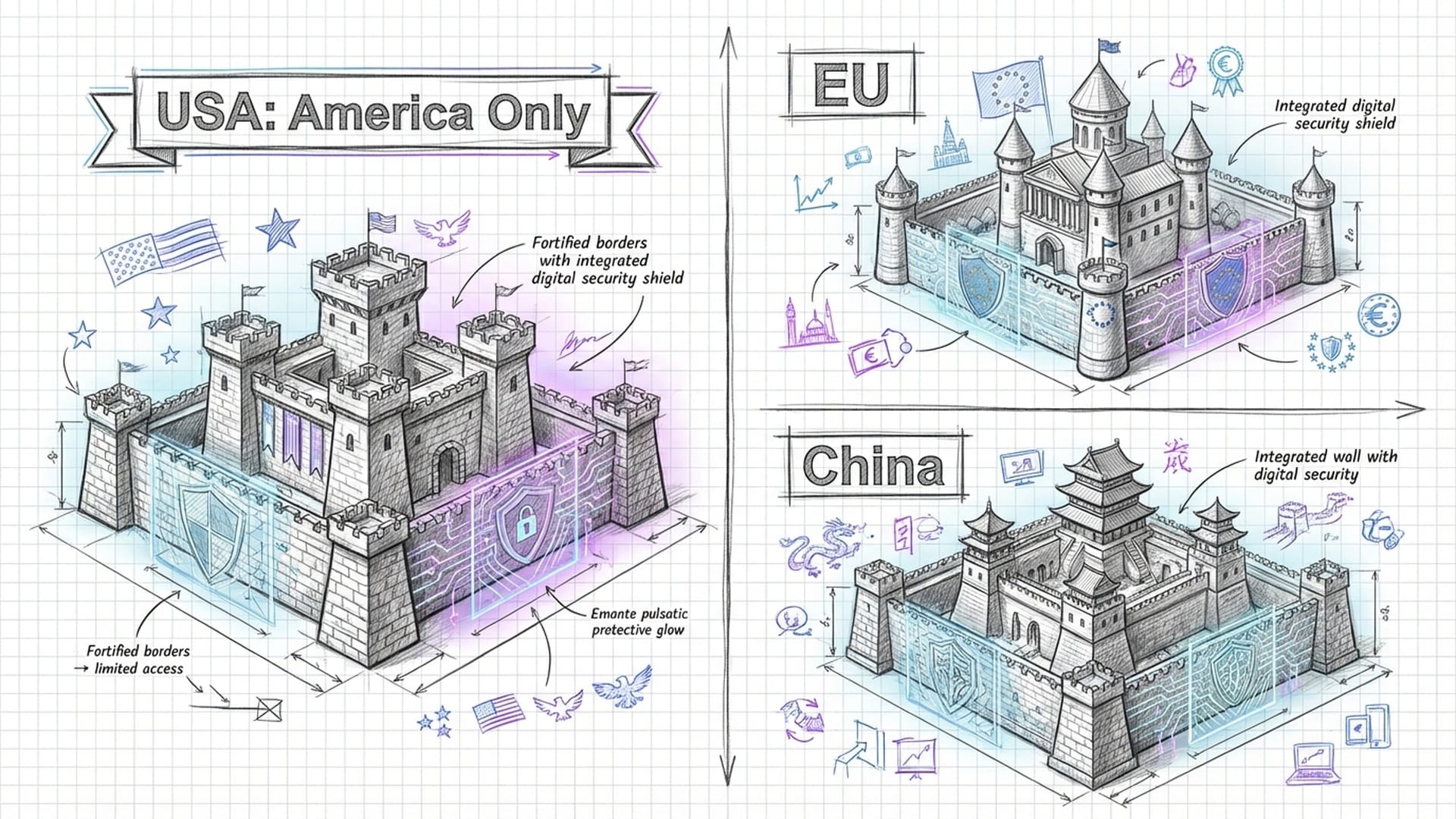

The United States, historically a staunch advocate for free trade, has shifted from an "America First" stance to an "America Only" approach, employing what can only be described as 'coercive protectionism.' In response, Europe and China are rapidly constructing their own economic defenses, each striving to protect their remaining interests. This isn't just about tariffs; it's a fundamental dismantling and reassembly of the world's economic engine.

The synchronized global growth model is dead. It has been replaced by a zero-sum game fueled by industrial policy and geoeconomic deterrence.

While U.S. equity markets might project an image of resilience, driven by deregulation and temporary protectionist benefits, deeper scrutiny reveals a troubling reality. The foundations are cracking under the weight of inflationary tariff pass-throughs, the chilling prospect of retaliatory trade wars, and the deliberate fragmentation of critical supply chains. These are not merely abstract risks but vivid indicators of systemic distress.

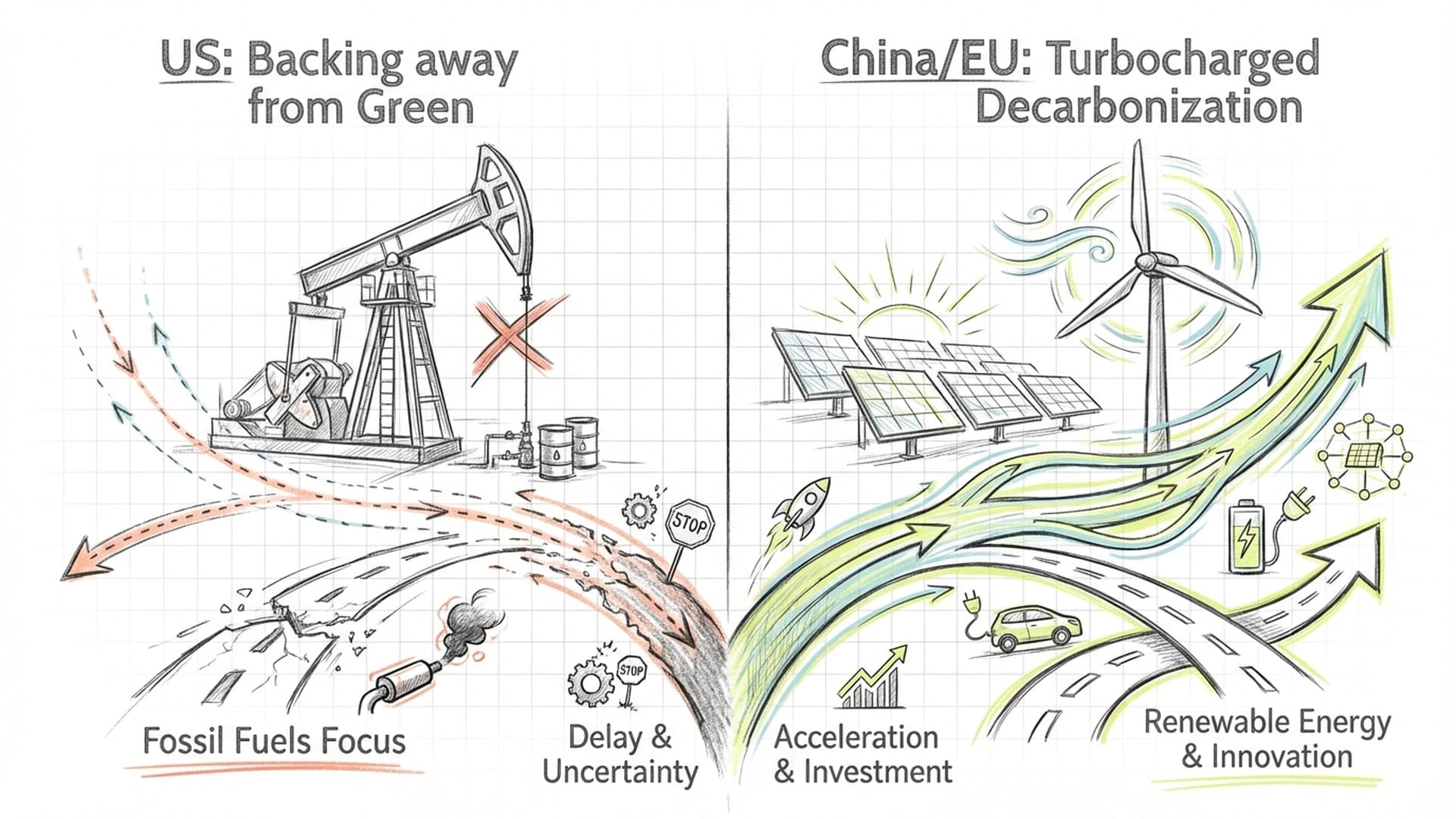

The Great Decarbonization Divergence: A Battle for Future Control

The global push for energy transition and technological supremacy is no longer a corporate buzzword but a national security imperative. A striking divergence is emerging:

- The U.S. is withdrawing from green subsidies, creating uncertainty and stifling investment.

- China and Europe are aggressively accelerating their industrial decarbonization efforts, pouring capital into future energy and manufacturing sectors.

This isn't merely a policy disagreement; it's a seismic shift of capital that will dictate the victors and losers in the long-term energy and manufacturing race.

Transatlantic Tensions: The Rise of Coercive Protectionism

The era of smooth international relations governed by the WTO is a ghost. The U.S. administration is now actively enforcing a new phase of coercive protectionism. We are witnessing:

- Universal baseline tariffs of up to 20% on all imports, with Chinese goods facing even steeper penalties. This isn't a measured approach; it's a 'sledgehammer.'

Europe is not passively accepting this. They are activating their 'economic deterrence' strategy by deploying their Anti-Coercion Instrument. This targets specific U.S. industrial and agricultural sectors, meaning American farmers and whiskey producers could become collateral damage in this escalating economic conflict.

The U.S. has abandoned free-trade liberalism for mercantilist nationalism, viewing trade deficits as national wealth draining away, and is prepared to use executive force to stop it.

Europe finds itself in an unenviable position, squeezed between U.S. protectionism and a deluge of low-cost Chinese exports. The luxurious stance of passive liberalism is no longer viable. They are compelled into a 'protectionism of deterrence' to safeguard their domestic industries from being hollowed out.

The Impact: Short-Term Volatility, Long-Term Transformation

The immediate future is bearish. A transatlantic trade war is not a hypothetical scenario but a looming threat. Multinational conglomerates, particularly in automotive and luxury goods, face significant repercussions. Expect heightened volatility in Eurozone equities and a challenging environment for U.S. exporters to Europe.

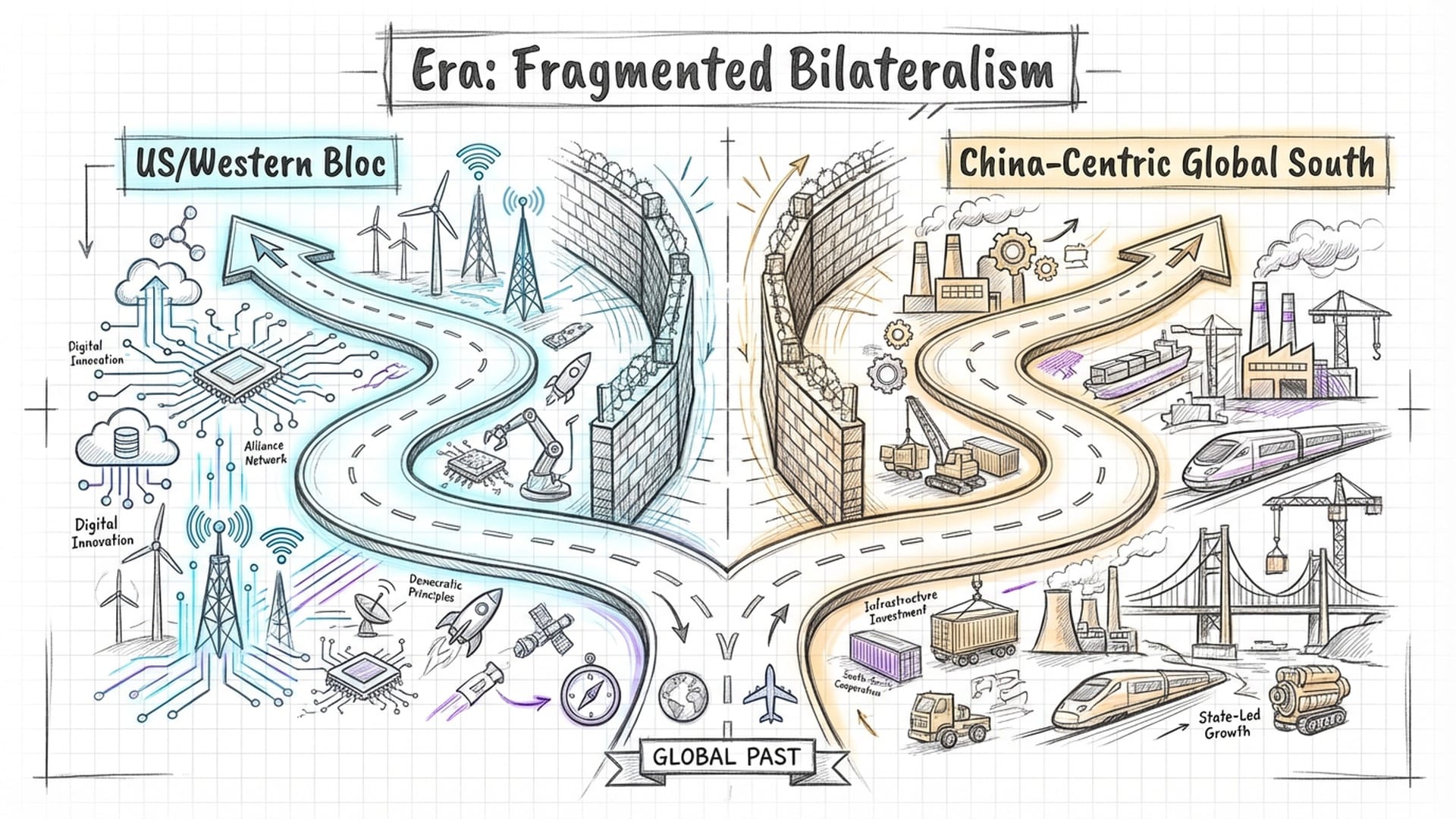

The long-term implications are far more profound, signaling the definitive end of the WTO-led era. We are sprinting towards 'fragmented bilateralism,' where supply chains are not simply adjusting but are permanently bifurcating. Companies must now plan for a high-tariff world as the new normal, making 'local-for-local' production strategies not just smart ideas but essential for survival.

China's Global South Pivot and the Tech Blockade

Facing Western containment and tariffs, China has executed a strategic and effective pivot. Rather than collapsing, China has:

- Surged exports to the Global South, including Southeast Asia, Africa, Latin America, and the

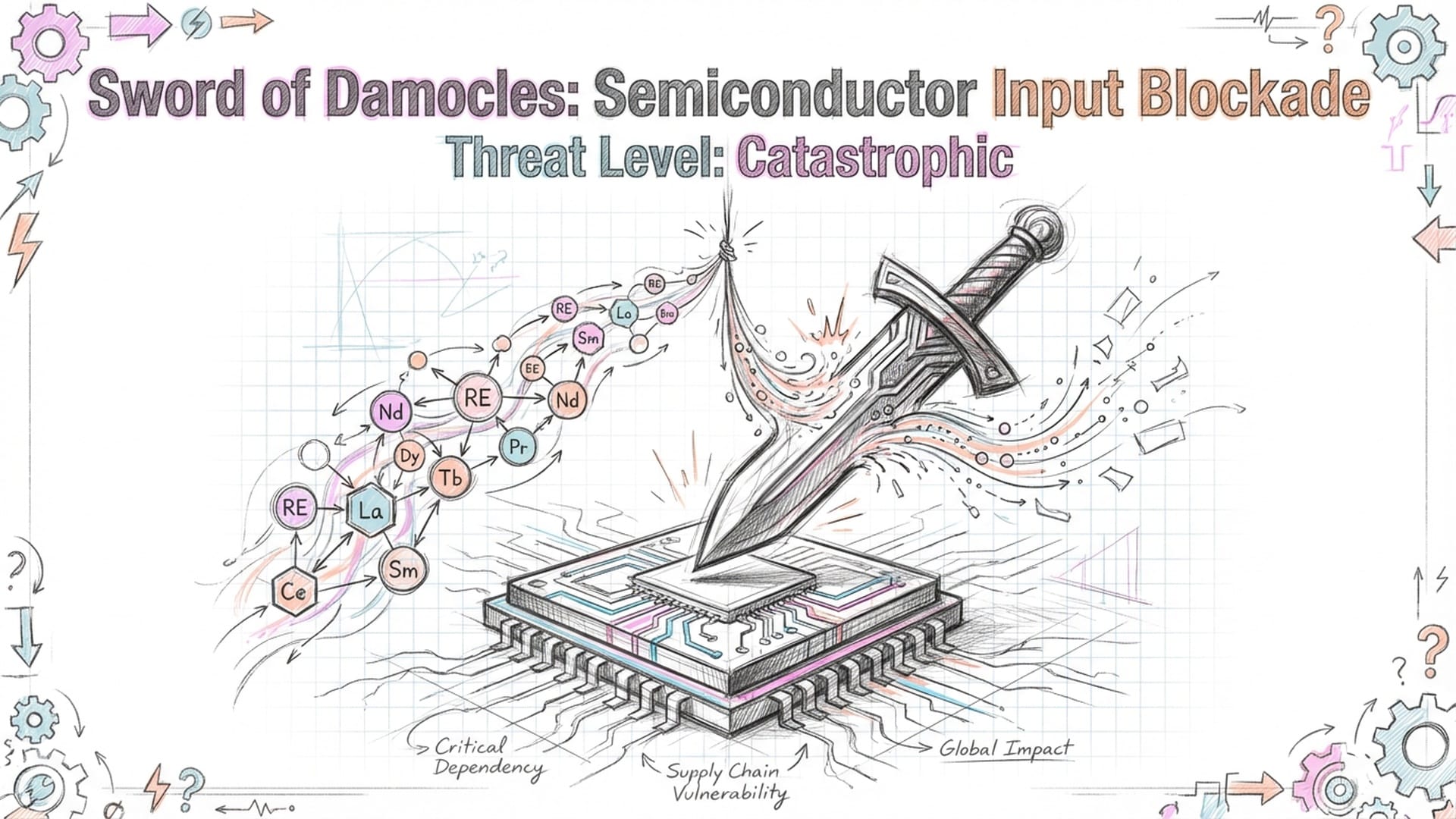

CRINKbloc (China, Russia, Iran, North Korea, with increasing ties to Indonesia, Saudi Arabia, Brazil). This has created a parallel universe of commerce, offsetting the decline in direct trade with the U.S. - Systematically tightened its grip on critical supply chains, particularly in rare earths and crucial component manufacturing, transforming economic leverage into a geopolitical chokehold.

This strategy integrates China's Made in China 2025 ambitions with the realities of Western efforts to limit its growth. By leveraging its immense industrial overcapacity, China is not just finding new customers but fundamentally reshaping the global economic order. It's about embedding Chinese standards, technology, and infrastructure into emerging economies, cultivating economic dependence on Beijing. This bolsters China's resilience against U.S. financial coercion and diminishes the effectiveness of Western sanctions.

The short-term market impact is that China's unexpected export resilience mitigates fears of an immediate economic collapse, preventing a global contagion. However, the long-term impact is more perilous: the hardening of two distinct global trade spheres: a U.S./Western-aligned bloc and a China-centric Global South bloc. Multinational corporations must now choose which world they will operate in.

The unspoken, terrifying truth is the risk of China weaponizing its dominance in semiconductor inputs and rare earths – a 'sword of Damocles' hanging over the entire tech sector.

What to Watch Next: The Tipping Points

In the immediate future, several key indicators will reveal the trajectory of this fractured world:

- The European Union's Response: Pay close attention to the specific wording of the EU's reaction to U.S. tariff enforcement. If the EU activates its Anti-Coercion Instrument and targets sensitive U.S. political sectors like agriculture or bourbon, rather than just general industrial goods, it signals a willingness to endure short-term economic pain for long-term deterrence. This would mark a significant escalation.

- Beijing's Regulatory Announcements: For tech investors and consumers alike, any sudden announcements from Beijing regarding export controls, especially on elements like gallium, germanium, or battery technologies, will be critical. As trade tensions escalate, the likelihood of China using its control over key supply chain components as an asymmetric retaliatory weapon increases significantly.

- Market Sentiment and Bond Yields: Brace for continued volatility in bond yields. This is the battleground where the inflationary pressures of permanent tariffs collide with the deflationary forces of trade fragmentation. The "Bond Vigilantes" may soon challenge U.S. fiscal expansion, particularly if the revenue from new tariffs proves insufficient to cover the burgeoning national deficit.

The world is transforming, and the old rules no longer apply. Understanding these shifts is paramount for navigating the complexities of the new global economic order.

|  |  |