|  |  |  |

The Great Inversion: Why 2026 Will Be Defined by Blackouts, Blue Collars, and Uranium

Imagine waking up in January 2026. The news heralds a booming economy, unprecedented GDP growth in the United States, and record-breaking stock market highs. Financial institutions like Goldman Sachs are celebrating a perfectly executed "soft landing." Yet, step away from the headlines, and a starkly different reality emerges. Your highly educated, white-collar roommate is struggling to find a job despite hundreds of applications, while your blue-collar friend, a specialist electrician, is inundated with work and investing in a second property. This is the paradox of 2026, a crossroads where traditional notions of value, careers, and global dynamics are being fundamentally inverted.

For two decades, we operated under assumptions that the digital realm reigned supreme, that software would conquer all, that globalization was an unstoppable force, and that a college degree guaranteed success. By 2026, these beliefs are not just outdated—they are dangerous. This article delves into a profound restructuring of civilization, moving wealth from the abstract to the tangible, from the generalist to the specialist, and from the ephemeral digital cloud to the foundational physical ground.

The Jobless Expansion: A K-Shaped Reality

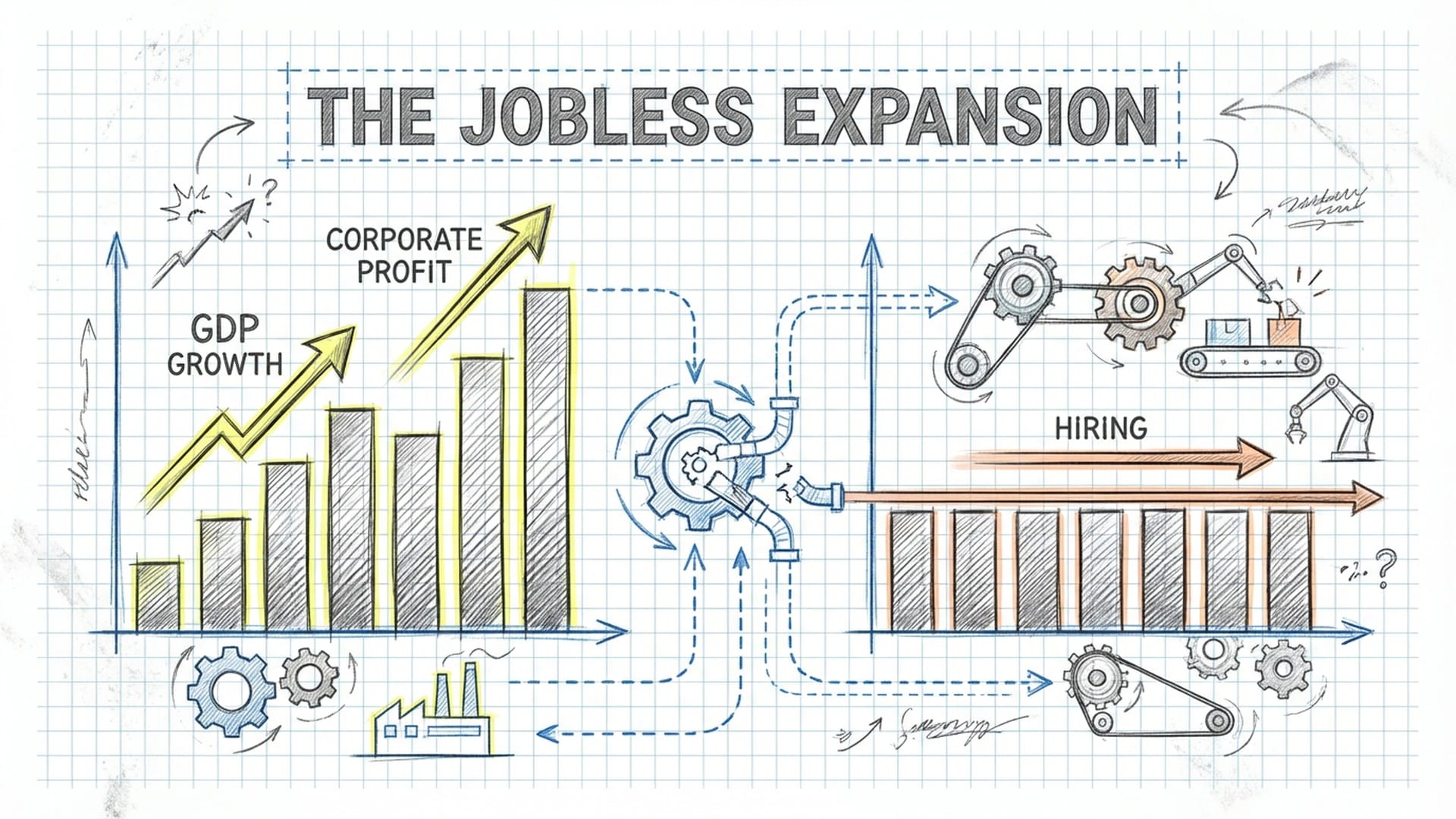

On the surface, the economy appears robust. Global growth remains resilient at approximately 2.8%, with the U.S. achieving a remarkable 2.6% growth, outpacing most G7 nations. The Federal Reserve has successfully navigated interest rate cuts without triggering hyperinflation, delivering the long-promised "soft landing."

However, beneath this veneer of prosperity lies a massive, terrifying catch: the decoupling of economic output from human labor.

For generations, Okun's Law dictated that GDP growth correlated inversely with unemployment—more production meant more jobs. That rule is now obsolete. In 2026, companies are generating greater value, achieving higher margins, and producing superior products with frozen headcounts. We are witnessing a "jobless expansion."

The initial wave of Artificial Intelligence, which began in 2023, has matured significantly. AI is no longer a novelty; it is deeply embedded within the corporate nervous system. Companies no longer require vast teams of analysts to process data; instead, a single expert can curate the output of an AI agent. This isn't leading to mass layoffs, but rather a drastic reduction in hiring. "Help Wanted" signs are disappearing, even as corporate profits soar.

This shift creates a K-shaped economic reality. Those who own capital—stocks, robots, land—are accumulating wealth at an unprecedented rate. Conversely, individuals relying on selling their time in mid-level, white-collar roles face a structural freeze. Their career paths are stagnating, leading to widespread professional anxiety and a re-evaluation of traditional career trajectories.

The Revenge of the Physical World: AI's Energy Demands

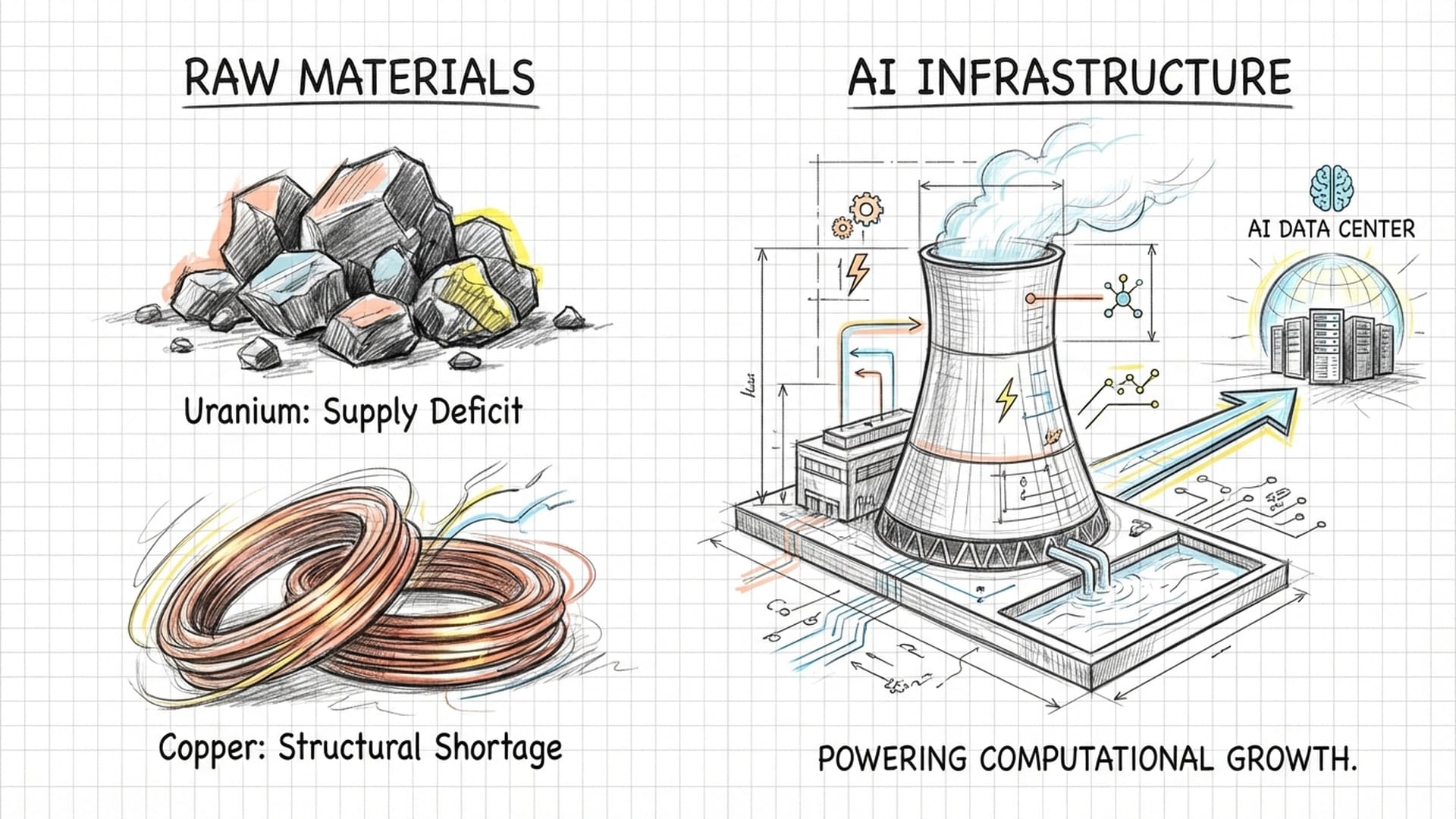

The prevailing narrative of the past decade centered on "The Cloud" as an ethereal, boundless realm where data resided without physical constraints. Yet, in 2026, the true cost of this digital paradise is being tallied, paid in physical resources. Artificial Intelligence, it turns out, is not just code; it is a physical beast with an insatiable appetite for electricity.

We are transitioning from the "training phase" of AI development to the "inference phase," where AI models are operational 24/7. This demands a computational power that our existing infrastructure simply cannot support. The cloud is indeed full, and latency issues are critical. An autonomous factory cannot afford to wait for data to travel to a distant server farm; it requires on-premise intelligence.

This urgent need is catalyzing a capital expenditure supercycle of unprecedented scale. Tech giants like Amazon, Microsoft, and Google are investing over $500 billion annually to construct the physical backbone required for this intelligence.

The real hidden wealth, however, lies not in the microchips themselves, but in their lifeblood: power. Data centers have become energy vampires, pushing our aging and congested power grids to their breaking point. A trillion-dollar AI economy cannot run on infrastructure built in the 1970s.

Consequently, utility companies—once considered staid investments—are now Wall Street's hottest commodities. They control the flow of power. Tech behemoths are striking direct deals with nuclear power plants, shedding the stigma once associated with nuclear energy due to its undeniable necessity for baseload power. While renewables like wind and solar are vital, their intermittent nature cannot sustain an AI data center that requires constant operation. This has triggered a uranium rush, driving up prices due to tight supply and the decade-long lead time for new mine permits.

Beyond uranium, copper is another critical resource facing a structural deficit. The global push for electrification and new localized grids cannot proceed without vast quantities of copper, creating a bottleneck that will ripple through the global economy.

If you're seeking the "next big tech trade," shift your gaze from software to the tangible: copper mines, uranium producers, and the utility companies that control transmission lines. The virtual world is fundamentally tethered to the physical, and the physical is now demanding a premium.

Global Fragmentation and Connector Economies

The geopolitical landscape of 2026 has fractured into a complex game of three-dimensional chess. The era of globalization, characterized by cheap manufacturing in China and seamless shipping to the West, is over. We are now in an age of "Trusted Blocs" and a strategy evolving from "China Plus One" to "China Plus Many." Companies, scarred by pandemics, trade wars, and shipping disruptions, are prioritizing resilience over efficiency, seeking to de-risk their supply chains.

This strategic pivot is fueling economic booms in specific regions known as "Connector Economies."

- Monterrey, Mexico: This city is now the "Nearshoring Capital" of the world. Its proximity to the U.S. border and integration into the North American supply chain are attracting billions in investments from automotive and electronics manufacturers eager to mitigate ocean freight risks and tariffs.

- Tamil Nadu, India: Quietly, Tamil Nadu has emerged as the electronics manufacturing hub of the Global South. Major contract manufacturers like Foxconn are establishing vast industrial complexes, moving beyond simple assembly to producing higher-value components and fostering a deep ecosystem of suppliers. India is transforming into a manufacturing titan, not merely an IT back-office.

- Vietnam: Vietnam plays a strategic dual role, with its northern region integrating with Chinese supply chains and its southern region serving Western markets. This makes it a crucial "bridge" economy.

However, a critical challenge looms: "Rules of Origin." Governments, particularly the United States, are using trade policy as a strategic weapon. A product primarily manufactured in one country cannot simply be given a minor finishing touch in another and relabeled. This has given rise to the industry of "Digital Provenance," where companies must meticulously track and prove the nationality of every component. Failure to demonstrate a product's origin, especially if linked to an adversary, means it cannot be sold. This audit trail is becoming more valuable than the product itself.

This new global map is not without peril. The risk of "Gray Zone" warfare—subtle yet impactful conflicts such as cartels using military drones to monitor logistics routes or cyber-attacks on shipping lanes—is escalating. This introduces a "Conflict Premium" to all goods and services. Security is no longer solely a governmental concern; it's a critical corporate line item, leading companies to invest heavily in private security to protect their global supply chains.

The Rise of the Blue-Collar Aristocracy and the UBI Debate

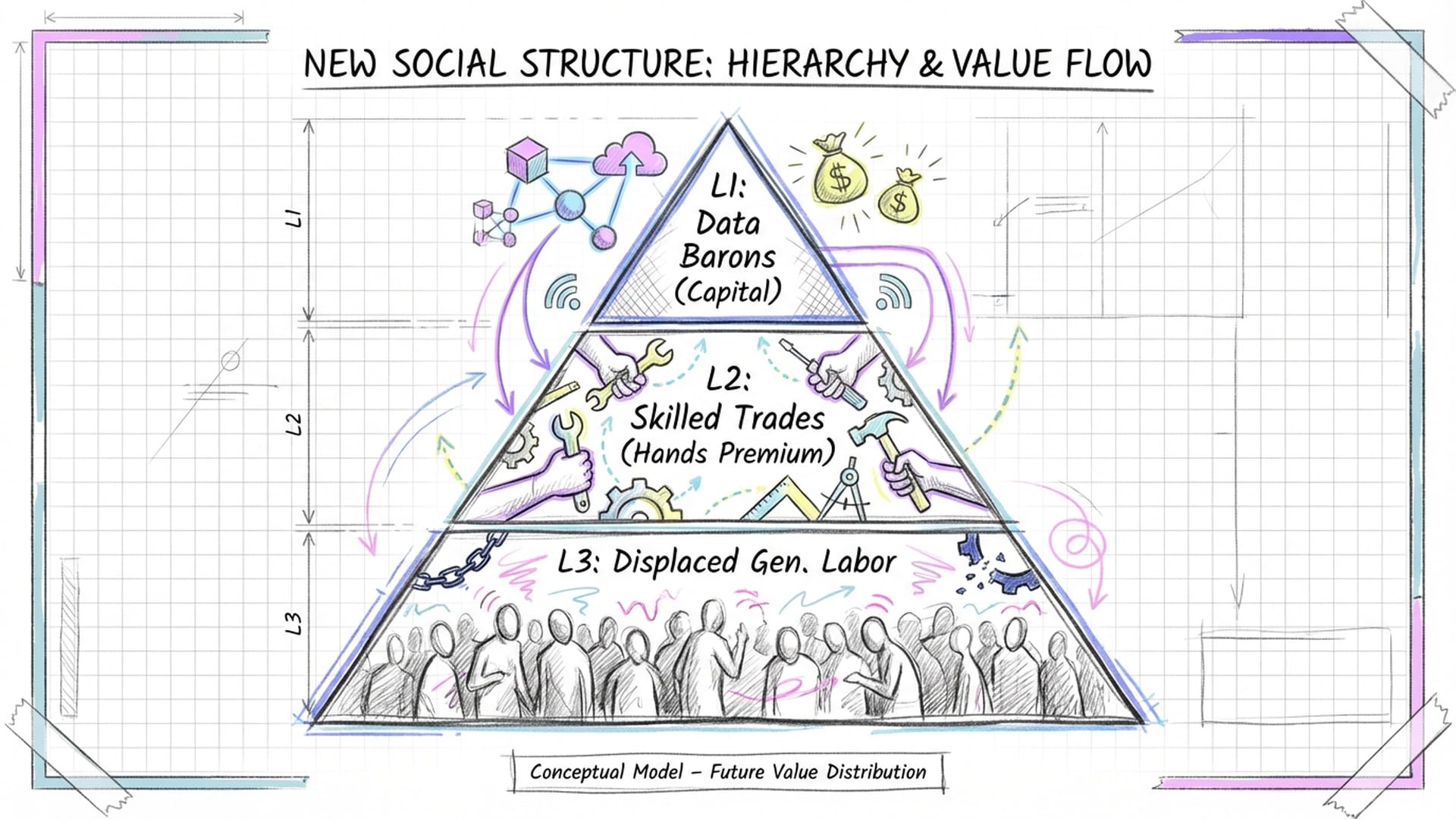

While white-collar jobs face stagnation—a "stagnant jobs" scenario—a profound shift is occurring on the other side of the labor market. "Email jobs" are declining, but "hand jobs"—roles requiring physical skills and tangible work—are experiencing a renaissance. This is the "Hands Premium."

You cannot use ChatGPT to repair a wind turbine, an algorithm to install high-voltage cooling systems in a data center, or prompt engineering to design new plumbing. As we construct the physical infrastructure for AI and green energy, the demand for skilled tradespeople is skyrocketing.

Electricians, welders, and specialized mechanics are becoming the new labor aristocracy. Stories abound of these technicians commanding six-figure salaries and substantial signing bonuses, while MBA graduates compete for unpaid internships. This represents a monumental cultural earthquake. For decades, society encouraged university education and desk jobs as the pathway to security. That advice is now obsolete. The secure path is increasingly the tangible path, where those who can manipulate the physical world are more resilient than those who solely manipulate symbols on a screen.

This shift, however, creates significant social tension. Wealth is concentrating at the apex—the "Data Barons" who control AI infrastructure—and a thriving blue-collar class. But the middle class, composed of generic administrators, copywriters, and mid-level managers, is being hollowed out. This necessitates a serious conversation about Universal Basic Income (UBI). In 2026, UBI is no longer a fringe idea; it's a practical necessity for maintaining social stability. Cities and states are piloting "Data Dividends," effectively taxing automated systems to support displaced workers. It is a messy, politically charged debate, but it is unequivocally the defining social challenge of our era.

The Rewiring of Finance: Institutional Digital Assets

For those who thought crypto was dead, 2026 reveals a different truth. While the "Wild West" era of meme coins and scams is over, it marks the dawn of the "Institutional Era" of digital assets. Regulatory clarity, spearheaded by legislation like the GENIUS Act in the U.S., has legitimized the sector.

The true "killer app" isn't Bitcoin; it's the Stablecoin. These digital tokens, pegged to the U.S. dollar, have subtly become the internet's default currency. With over $300 billion in circulation, they facilitate cross-border trade, business-to-business payments, and instant transaction settlements. The traditional banking system, with its sluggish processing times, simply cannot keep pace with an AI-driven world where decisions are made in milliseconds. Money must move at the speed of code.

We are witnessing the "Financialization of Everything." Real-World Assets—stocks, bonds, real estate, and private credit—are being tokenized and placed on blockchains, enabling 24/7, instantaneous trading. Imagine a small business in Mexico securing a loan from a London lender instantly, via a tokenized contract, bypassing multiple intermediary banks. This is no longer futuristic; it is happening now. Private credit is moving "on-chain," unlocking trillions of dollars in liquidity. Major banks, instead of resisting, are actively building this new infrastructure through "Permissioned Pools"—controlled environments that adhere to "Know Your Customer" (KYC) regulations. The very plumbing of global finance is being replaced by code, promising astronomical efficiency gains.

The New Frontiers: Orbital Compute and the Longevity Economy

Even in this physically grounded reorientation, human ambition continues to push boundaries. The Space Economy is finally achieving commercial velocity. With declining launch costs driven by companies like SpaceX, "Orbital Compute" is gaining serious traction. The energy-intensive data centers heating up our planet could logically reside in the cold vacuum of space, bathed in constant solar energy. What once seemed like science fiction is now attracting significant investment, with smart money viewing orbital placements not just for exploration, but for industrial real estate.

Simultaneously, the Longevity Economy is emerging as a $27 trillion opportunity. As global populations age, the market for extending "healthspan"—keeping people healthy and independent for longer—is exploding. Clinical trials for therapies reversing age-related diseases are showing real promise. This sector, dubbed Age-Tech, is projected to account for 20% of global GDP.

Navigating the Landscape of 2026

The world of 2026 presents a complex tapestry of robust growth and stagnant jobs, a migration of wealth to physical constraints, and a rapid reordering of global supply chains and financial systems. To navigate this new terrain effectively, consider this roadmap:

- Pivot to the Physical: If your portfolio or career is entirely digital, you are exposed. Seek exposure to assets that cannot be printed by central banks or generated by AI: land, energy, materials, and tangible skills.

- Embrace Volatility: The world is fragmented. Supply chains will break, and prices will spike. Build insurance into your strategy with assets like gold, commodities, and anything that retains value when currencies become unstable.

- Look for the Bottlenecks: In this new era, true wealth resides not in seamless flows but in chokepoints. Identify who controls crucial components like grid transformers, specialized copper mines, or the compliance software essential for cross-border trade.

The era of easy money, facile globalization, and comfortable white-collar careers has closed. A new, more demanding chapter is beginning—one focused on building the physical architecture of a new civilization. It is harder, grittier, and demands getting your hands dirty. But for those willing to look beyond digital screens and engage with the underlying physical reality, the opportunities are greater than ever before.

|  |  |