|  |  |  |

The dollar is strengthening not because of global affection, but because it's trapped. This isn't a testament to its inherent stability or trustworthiness; rather, it’s a reflection of a world caught in a financial chokehold, a paradox where increasing geopolitical fragmentation, surprisingly, reinforces the dollar's grip. This post-2025 reality is shaping a dangerously volatile future for everyone.

For years, talk of de-dollarization has permeated global financial discourse. Nations are actively seeking to disentangle themselves from America's financial orbit, driven by geopolitical friction, sanctions, and the strategic weaponization of finance. Despite this growing political will, the dollar continues to tighten its hold. The reason is simple and stark: there is no viable alternative. This isn't about trust; it's about mandatory dependence.

The Illusion of Choice: TINA and the Dollar Trap

Economist Kenneth Rogoff, a renowned scholar of financial crises and currencies, has long highlighted the dollar's long-term fragility, contending its dominance likely peaked over a decade ago. Fundamentally, with concerns about US fiscal discipline and a rising global desire for alternatives, one might expect a decline. Yet, the immediate reality paints a different picture—a phenomenon I term the "dollar trap."

Rogoff isn't arguing for the dollar's fundamental strength but for its inescapable nature. The world is, quite simply, stuck with it.

"This isn’t a vote of confidence; it’s the lack of a viable escape route. The 'TINA' effect – 'There Is No Alternative' – is the dollar's true validator today."

While the Euro once held promise and the Chinese Renminbi is making incremental strides, neither has come close to displacing the dollar as the global anchor. Why is this the case?

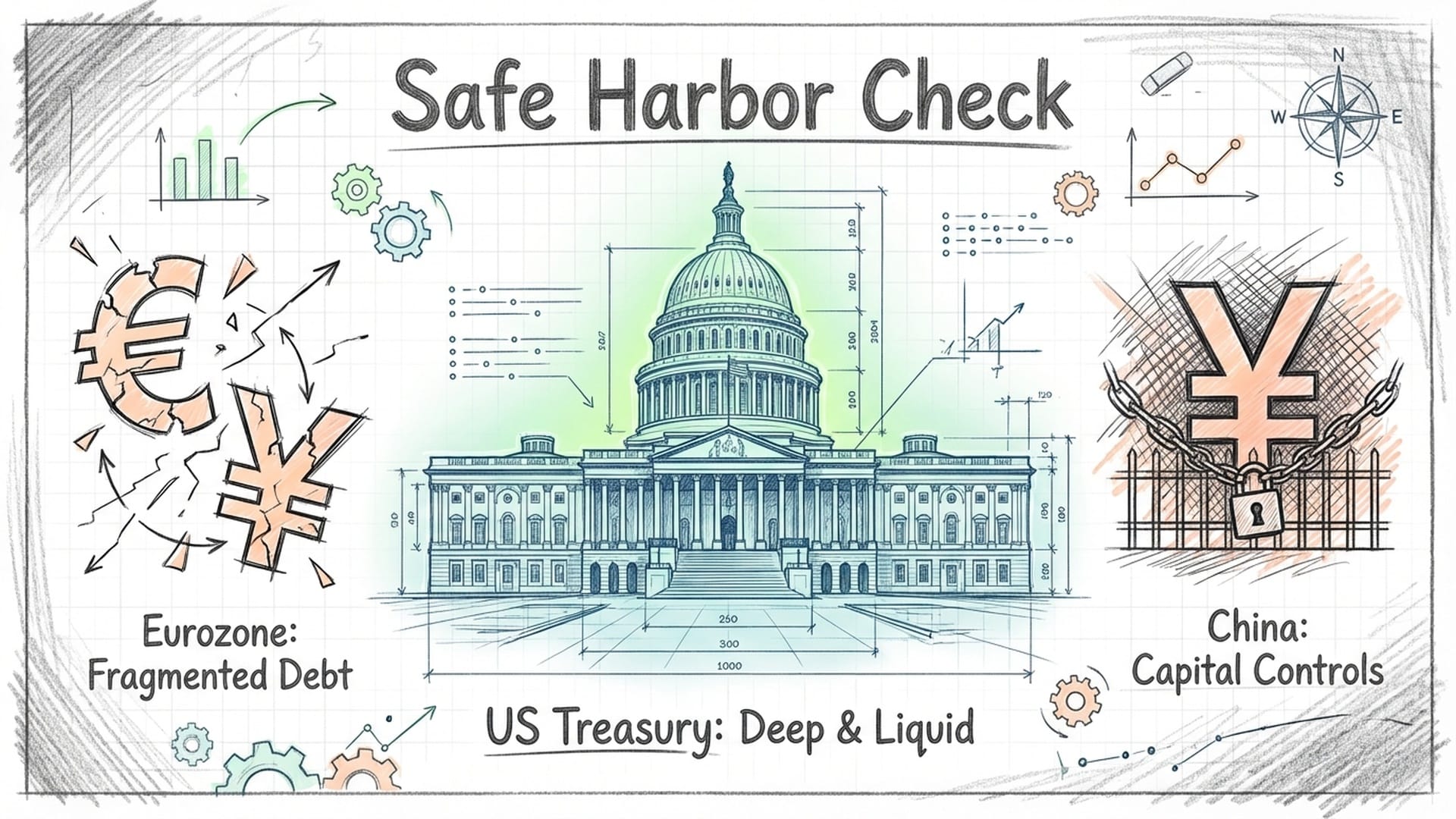

1. Liquidity and Depth in a Crisis

When global markets face turmoil, where do vast sums of capital seek refuge? The US Treasury market. It stands alone as the deepest, most liquid, and stable financial pool capable of absorbing massive capital flows during crises, offering a truly safe asset.

Consider the alternatives:

- The Eurozone: Its financial landscape is fragmented, lacking a unified sovereign debt market. Each member state issues its own debt, carrying distinct risks, preventing it from serving as a singular, cohesive safe harbor.

- China: Despite its economic might, China maintains strict capital controls. The Renminbi, though growing in importance, is neither freely convertible nor fully transparent, making it impractical for the scale required by a global reserve currency. Its monetary policy is often intertwined with political objectives, further reducing its appeal for large-scale international transactions.

For major central banks and multinational corporations seeking to park billions securely, the choice is consistently the dollar, every single time.

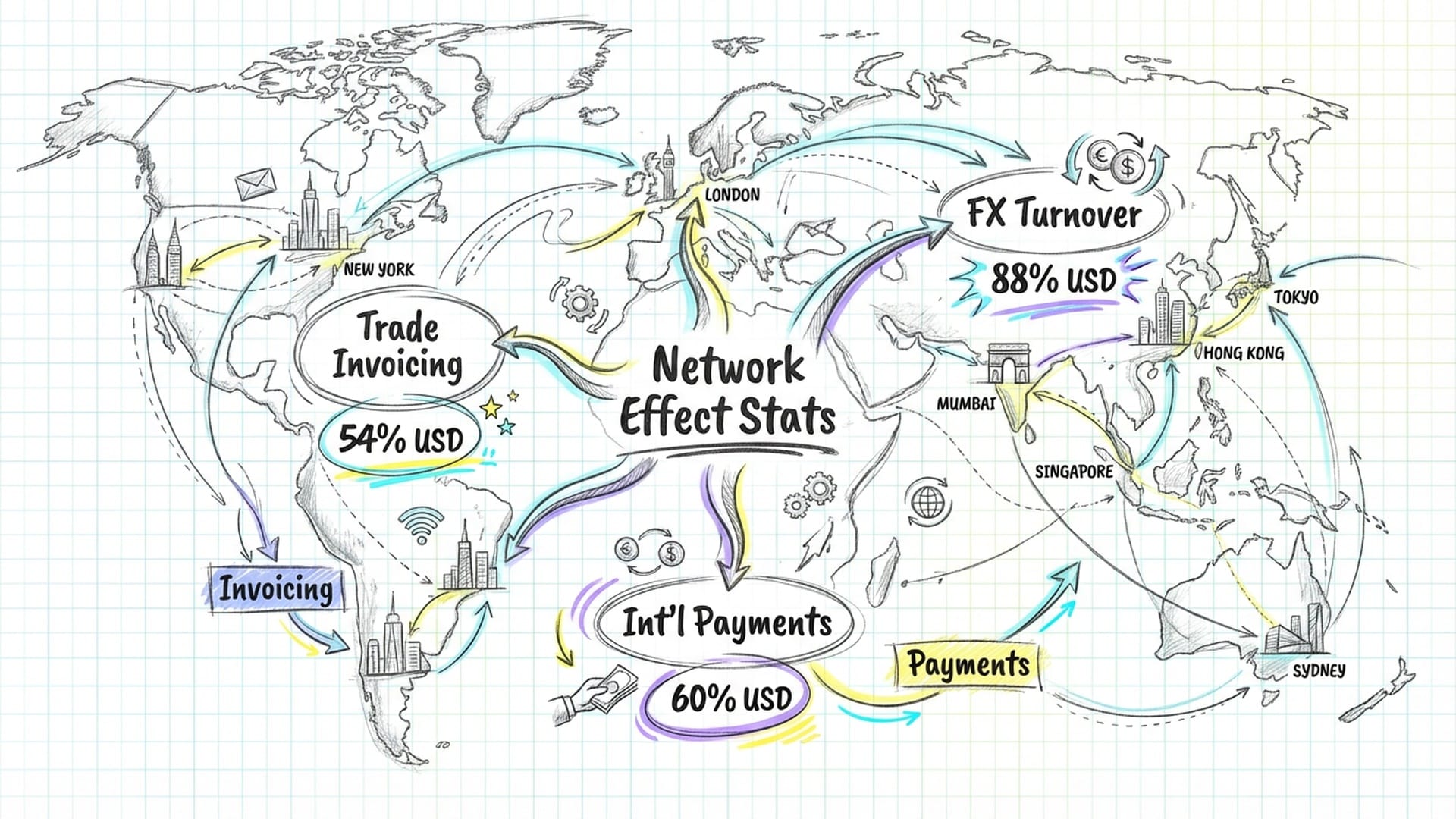

2. The Power of Network Effects

The dollar's role is self-reinforcing, akin to the first widely adopted social media platform or a dominant operating system. Its pervasive usage creates a compelling incentive for others to use it too. Currently, 54% of global trade invoicing and nearly 60% of international payments are conducted in dollars. This isn't born of loyalty to the U.S.; it's a matter of transactional necessity.

Imagine a German company importing raw materials from Brazil. The transaction will most likely be quoted and settled in dollars. This is because the Brazilian suppliers are likely using dollars for their own inputs, and the German company can easily convert Euros to dollars. Even nations actively hostile to the U.S. find themselves compelled to hold dollars to facilitate trade. They may resent it, but they need it.

This mandatory dependence is starkly evident in the efforts of countries like Russia and China to develop alternative payment systems such as CIPS and SPFS. While these systems have seen some progress in bilateral trade settlements, they often fall short when it comes to global trade volumes. They lack the necessary liquidity, speed, global reach, and critically, the trust required to compete with the dollar's established network effects. Consequently, third-party countries often default to the dollar or dollar-pegged intermediaries—not out of ideology, but pragmatism. They are stuck.

The Stubborn Persistence of Dollar Dominance

Official data from institutions like the IMF and the BIS underscore the dollar's tenacious hold, revealing a statistically exaggerated narrative of its demise.

- Global Official Foreign Exchange Reserves: The US dollar still accounts for approximately 57% to 58% of all allocated global foreign exchange reserves. While a decline from peaks of 70%, this figure has stabilized, stubbornly holding its ground rather than being in freefall.

- Diversification into Gold: A significant trend is the massive diversification into gold by central banks, reaching levels unseen since the Bretton Woods era. This signals a hedge against both the dollar and the inherent risks of fiat currencies, particularly in light of sanctions. However, gold serves as a store of value, not a transactional currency for high-frequency global trade. Nations are seeking long-term security in gold, yet remain dependent on the dollar for immediate liquidity and trade needs.

"Nations are hedging against the dollar. They're hedging against the risk of sanctions, against the stability of fiat currencies in general. But gold is a store of value. It's not a transactional currency for high-frequency global trade."

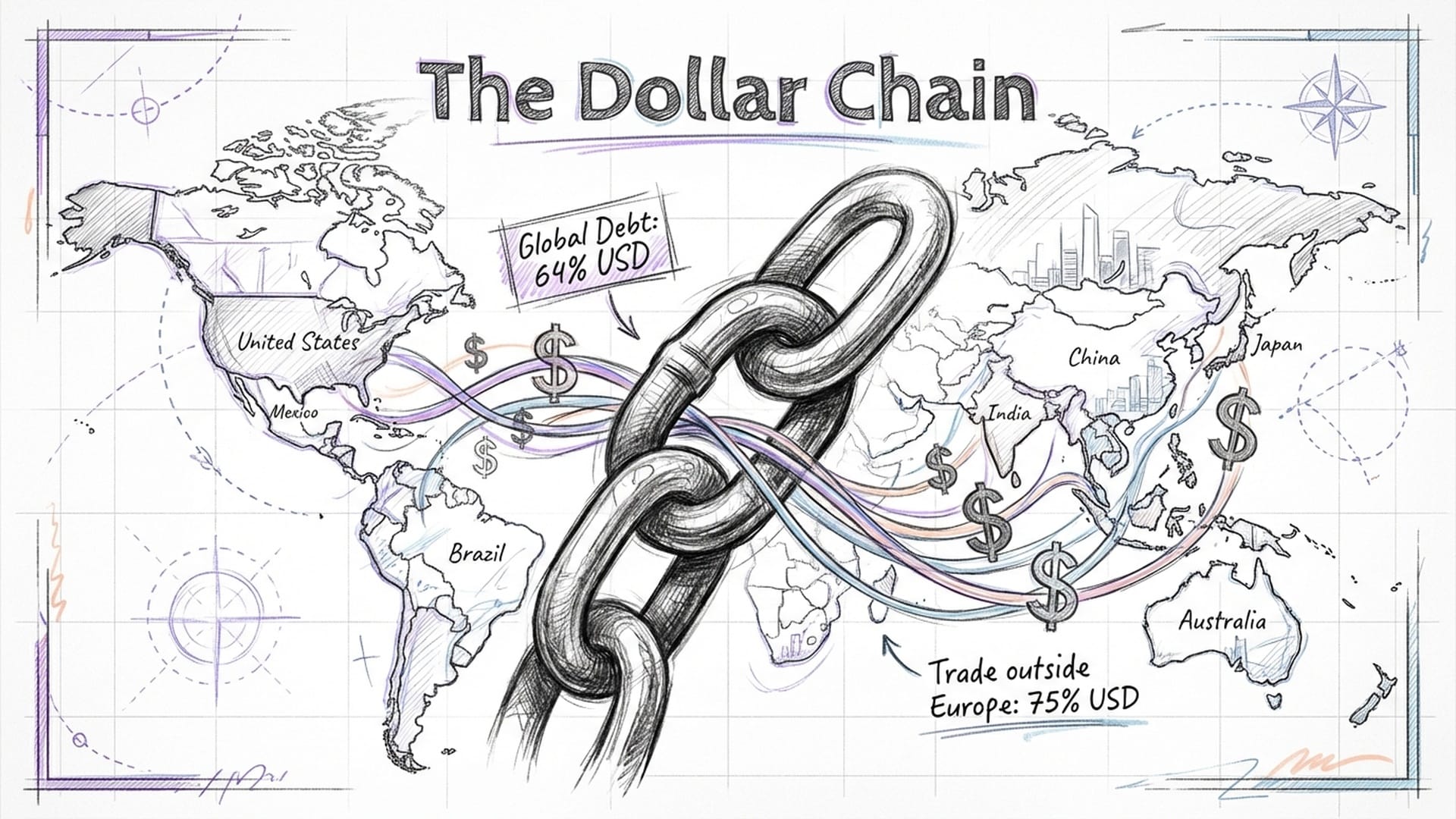

A Dollar Chain on Global Debt

Perhaps the most critical indicator of mandatory dependence is debt denomination. Approximately 64% of global debt issuance is denominated in dollars. This means emerging market countries, European corporations, and Asian banks, when borrowing internationally, largely take on dollar-denominated debt. This creates an absolute straitjacket, forcing them to generate dollar revenue to service these debts. Their economic stability and financial solvency are inextricably linked to US monetary policy and the dollar's value. It's a literal dollar chain, binding them securely.

Furthermore, the dollar remains on one side of 88% of all foreign exchange transactions, a metric virtually unchanged for years. Even when two emerging market currencies wish to trade, they often route through the dollar, which acts as the vehicle currency and the central hub of global currency exchange.

The Volatile Future: Geopolitical Fragmentation and Dollar Instability

This paradoxical situation—increasing geopolitical fragmentation alongside unyielding dollar dominance—is not a victory for the US. Instead, it's a structural vulnerability for the rest of the world, destined to fuel massive volatility and debt crises in the coming decade.

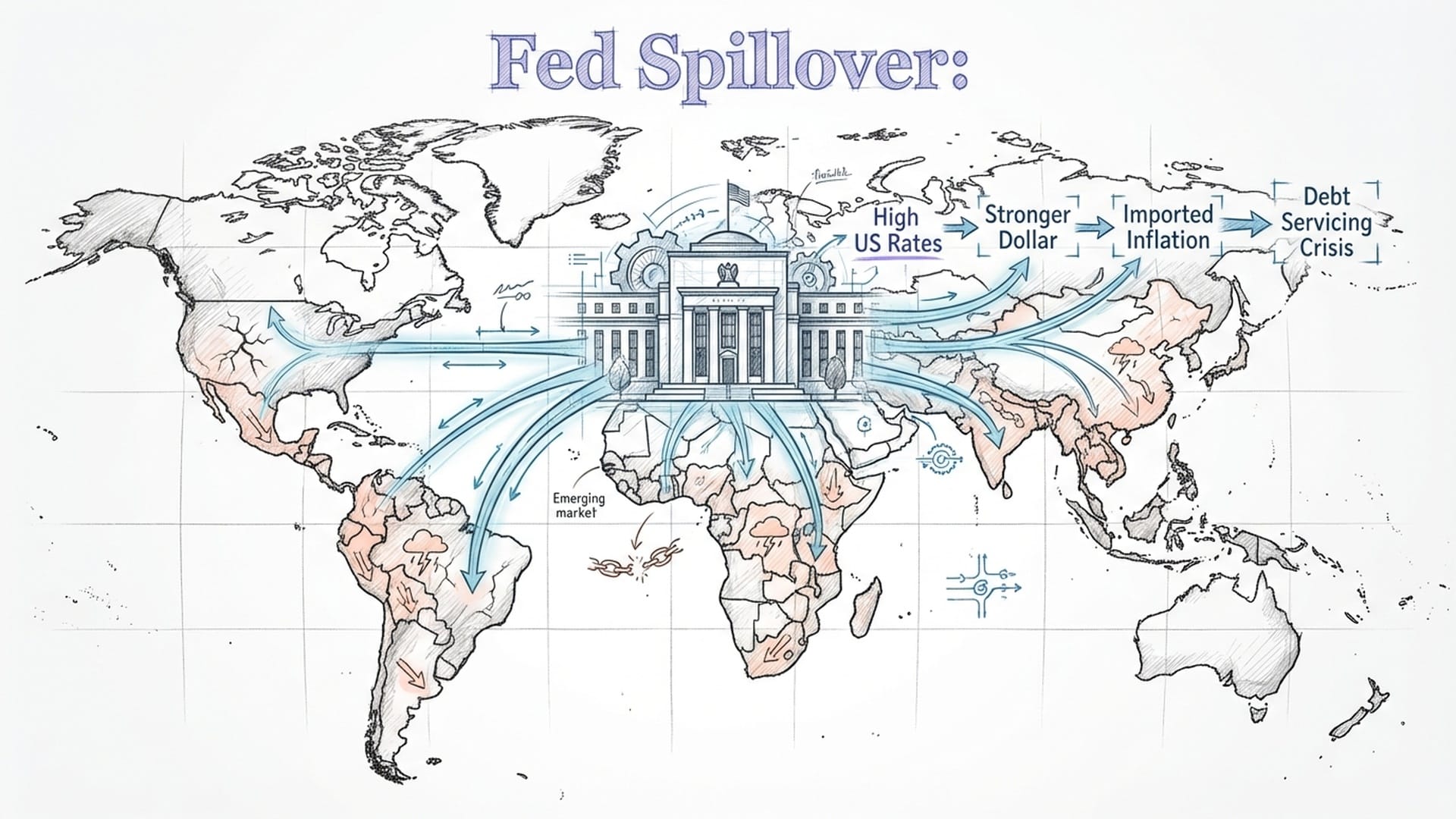

1. The Federal Reserve Spillover Channel

The US Federal Reserve operates with domestic mandates: managing inflation and promoting employment. However, given global reliance on the dollar for trade and debt servicing, the Fed's domestic actions effectively become global mandates. When the Fed tightens monetary policy to fight its own inflation, it doesn't just impact Americans; it exports financial tightening to the entire planet.

Higher US interest rates strengthen the dollar, creating a double whammy for emerging economies:

- Their imports, often priced in dollars, become more expensive, leading to imported inflation.

- The cost of servicing their substantial dollar-denominated debts skyrockets.

This invariably forces countries to hike their own interest rates, often aggressively, to defend their currencies and stem capital outflows. This response stifles domestic growth, potentially leading to recession. In our politically fragmented world, central bank coordination is eroding, fostering competitive devaluations and a "race to the top" in interest rates that could precipitate a global slowdown and widespread recession.

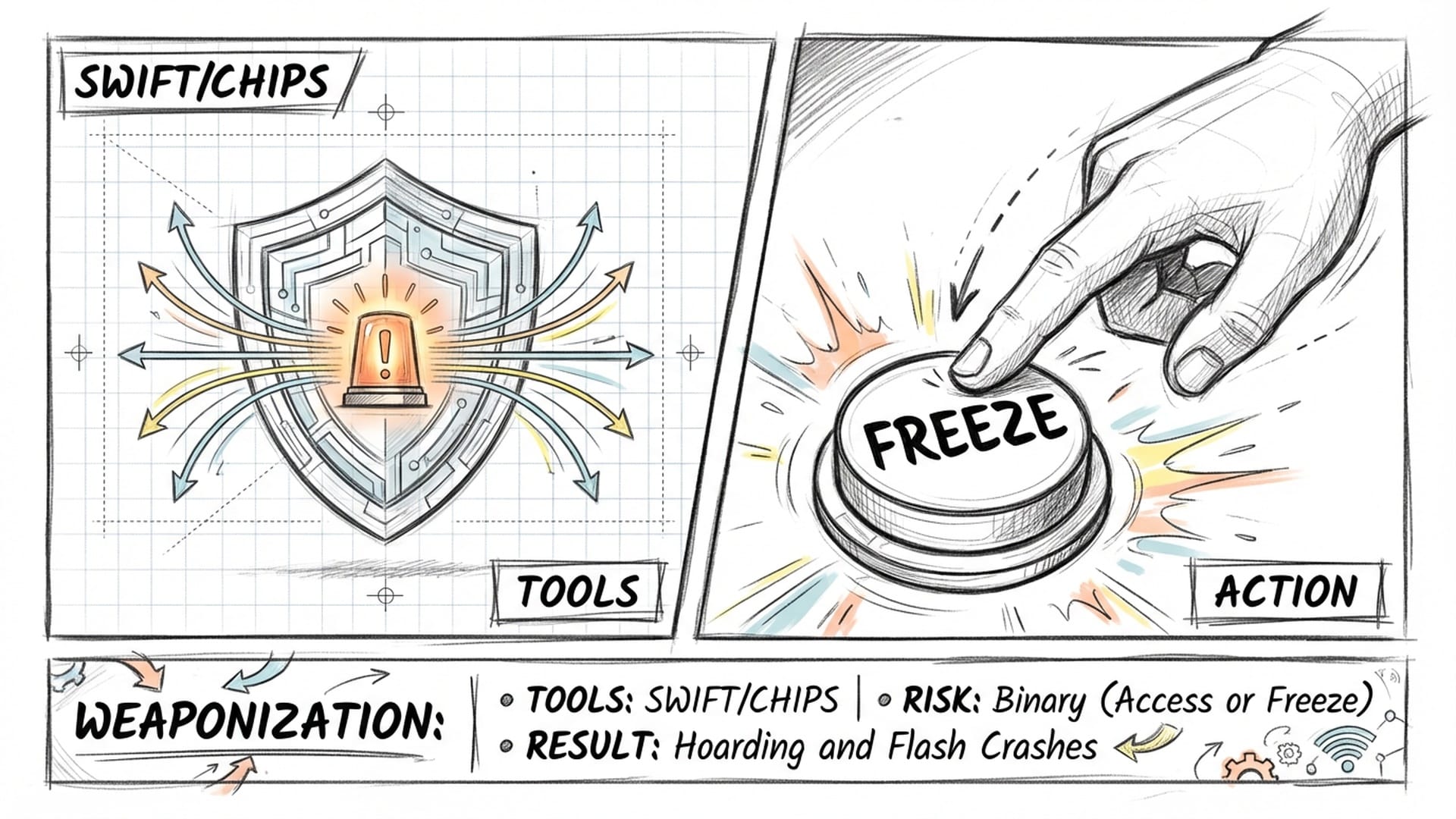

2. The Weaponization of Finance

Washington has effectively leveraged its financial system as a powerful foreign policy tool. The use of the dollar payment system (SWIFT, CHIPS) as a means of coercion creates binary risks. When a nation or even specific companies are sanctioned, their access to the global financial system can be instantly frozen. This results in sudden, severe localized liquidity freezes—a reality starkly demonstrated with Russia.

This capability sends shivers through central bankers and finance ministers globally. The fear of sanctions drives contradictory behaviors: simultaneously seeking alternatives while also hoarding dollars as a defensive measure, thus ironically strengthening the dollar in the short term. However, this also introduces flash crash risks, where a sudden panic-driven shift out of dollars or a major geopolitical event could trigger extreme volatility in currency markets. This phenomenon undermines trust in the supposed neutrality of the global financial system.

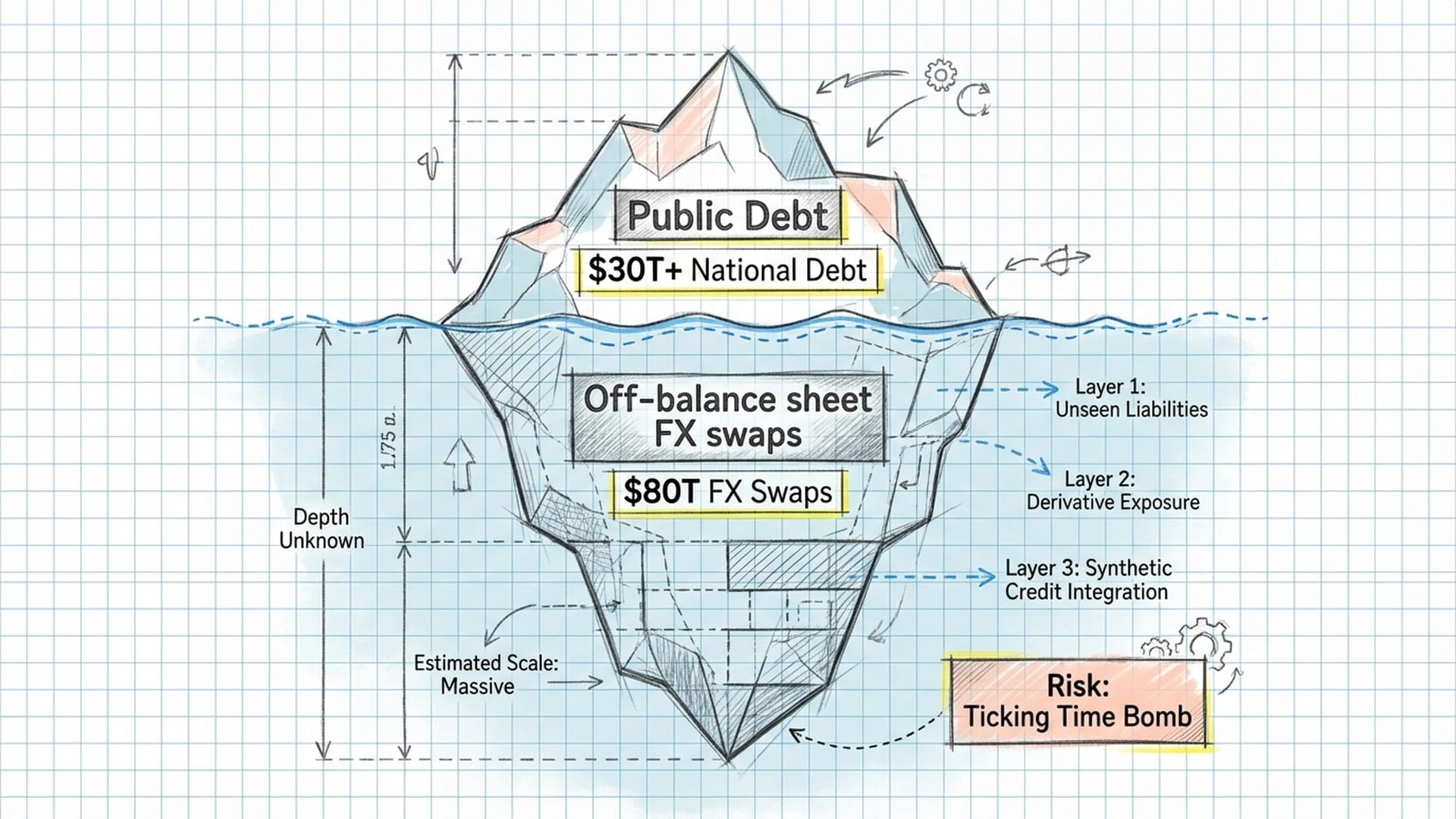

3. Structural Dollar Funding Gaps: A Ticking Time Bomb

The Bank for International Settlements (BIS) has highlighted a colossal, largely hidden debt within the global financial system: over $80 trillion in off-balance sheet FX swaps and derivatives. These opaque interbank contracts represent massive dollar liabilities for non-US banks, essential for funding loans, facilitating trade, and managing balance sheets.

In times of geopolitical tension or economic uncertainty, the liquidity in this vast swap market can instantly dry up. Banks become reluctant to lend dollars, leading to a sudden dollar shortage. The crisis pathway is terrifying: with no alternative lender of last resort for these offshore dollars beyond the Fed itself, a freeze in these markets could trigger a global credit crunch. Banks would be forced into deleveraging, selling off assets, sometimes at fire-sale prices, simply to obtain dollars, resulting in sharp market volatility and a global recession. This invisible tsunami of dollar debt is a critical ticking time bomb.

4. US Fiscal Indiscipline

Rogoff's "fragility" argument resonates strongly here. The soaring US national debt, continuously projected to climb, is paradoxically absorbed by the world due to the absence of other safe assets in sufficient quantity. This creates profound fragility.

What if there's a sudden loss of confidence—a "bond vigilante" moment—where investors collectively decide US debt is no longer risk-free? A spike in US bond yields would dramatically reprice the cost of capital globally. Every emerging market and highly leveraged country would face exploding borrowing costs, triggering a wave of debt crises. The dollar's current strength, therefore, is less a sign of US economic health and more a reflection of dysfunction elsewhere.

Shifting Sands: Gold and the "Financial Interregnum"

Historically, the dollar's strength has adapted to geopolitical shifts. After the US abandoned the gold standard in 1971, the dollar weakened. However, the establishment of the petrodollar system re-anchored its hegemony. Today, we lack such a new anchor. Current dollar dominance is maintained by inertia and the sheer lack of alternatives, not by new structural innovations.

From 2008 to 2020, the dollar consistently served as a "safe haven" during crises. But something shifted post-2022. The freezing of Russian central bank assets sent shockwaves globally, and the correlation began to fray. While the dollar still spikes during acute financial panics, there's a visible, steady diversification into gold during calmer periods, particularly in the geopolitical East. This suggests a decoupling of trust from the dollar as the ultimate store of value.

Counter-narratives, such as the de-dollarization efforts by the BRICS bloc and experiments with Central Bank Digital Currencies (CBDCs) like mBridge, are real. They've seen success in bilateral trade settlements (e.g., Yuan-Ruble energy trade). However, these efforts primarily address specific bilateral relationships and do not displace the dollar in third-party trade, which constitutes the majority. While promising technologically, these alternative systems currently lack the trust, legal frameworks, scale, and interoperability to truly challenge the dollar's entrenched network effects. This will take decades.

The Perilous Gap: Mandatory Dependence and Profound Instability

The dollar's hegemony is resilient amidst geopolitical fragmentation, but this resilience is coercive, driven by mandatory dependence and the "TINA" effect. Everyone is stuck. Yet, this intensified hegemony is also a source of profound instability. As the world fragments into competing blocs, continued reliance on a single currency managed by a potential rival—the United States—creates immense structural tension.

The next decade, leading up to 2035, promises to be incredibly turbulent:

- Increased Volatility: As countries attempt to diversify but fail to find truly liquid, scalable alternatives, capital flows will become more erratic. Expect sudden, sharp movements in currency markets, not just during crises, but even in response to moderate geopolitical shifts.

- Debt Crises: Emerging markets, caught between a strengthening dollar and a slowing global trade environment, will face heightened default risks. Their dollar debts will become unsustainable, pushing many to the brink.

We are entering a "financial interregnum." The old order of uncontested dollar dominance is receding, chipped away by resentment and geopolitical friction. However, a truly multipolar financial system is not yet ready to take its place. We exist in this messy, dangerous gap—a period where dependence is mandatory but deeply resented. It is in this interregnum that the risk of dramatic monetary shocks and systemic instability is at its highest.

|  |  |