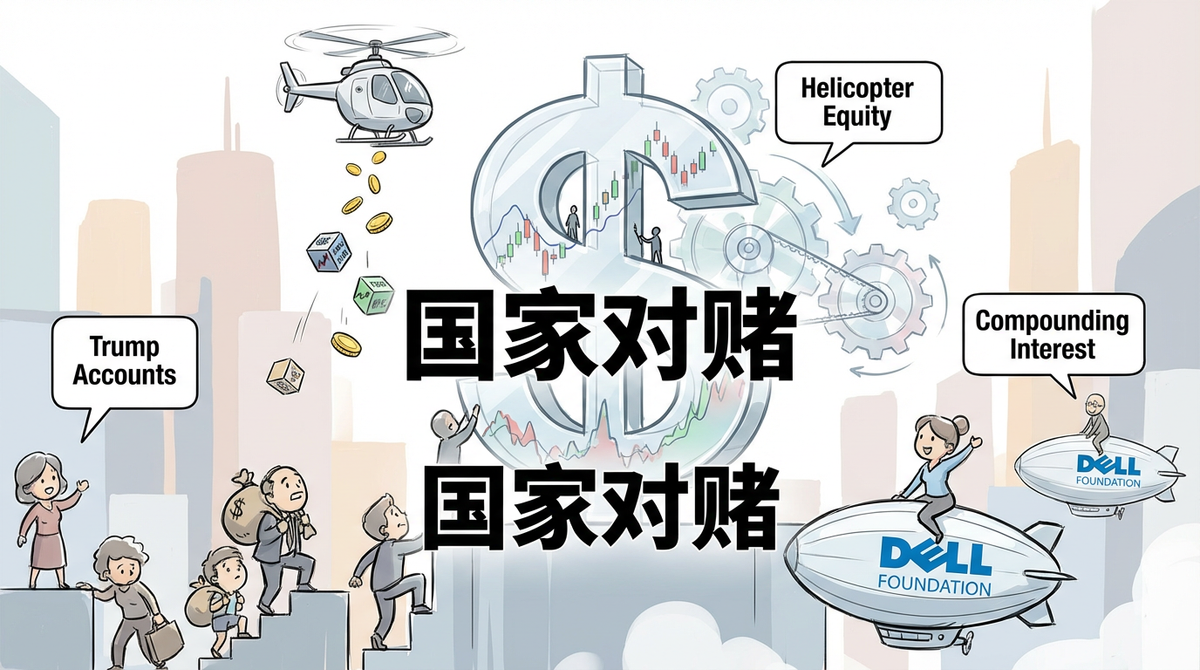

Trump Accounts: Helicopter Equity and the Future of American Capitalism

Explore the "Trump Account" initiative, a radical shift from welfare to "helicopter equity." This plan aims to reshape wealth, inequality, and the nation's future by anchoring the next generation's economic fate to capital market performance.

|  |

The Trump Account: America's Ultimate Gamble on Its Future

The "Trump Account" is more than just a social welfare program; it's a profound re-imagining of national governance and a high-stakes gamble on the future of wealth, inequality, and the very fabric of American society. This ambitious plan seeks to reshape our understanding of prosperity by anchoring the economic destinies of the next generation directly to the performance of the capital markets.

For the past half-century, government intervention in the economy has largely followed a predictable pattern: "helicopter money." From Keynesian demand-side management to quantitative easing during crises, the federal approach has consistently involved injecting cash directly into the hands of citizens to stimulate consumption and boost aggregate demand. Think of the 2008 tax rebates or the 2020 pandemic stimulus checks.

However, the Trump Account introduces a radically different, even disruptive, concept: "helicopter equity."

This isn't about immediate relief or fleeting consumer pleasure. Its ambition is far greater, aiming to reshape our children's economic future through mandatory asset lock-ins and the powerful engine of long-term compound interest.

From Cash to Capital: The Mechanics of the Trump Account

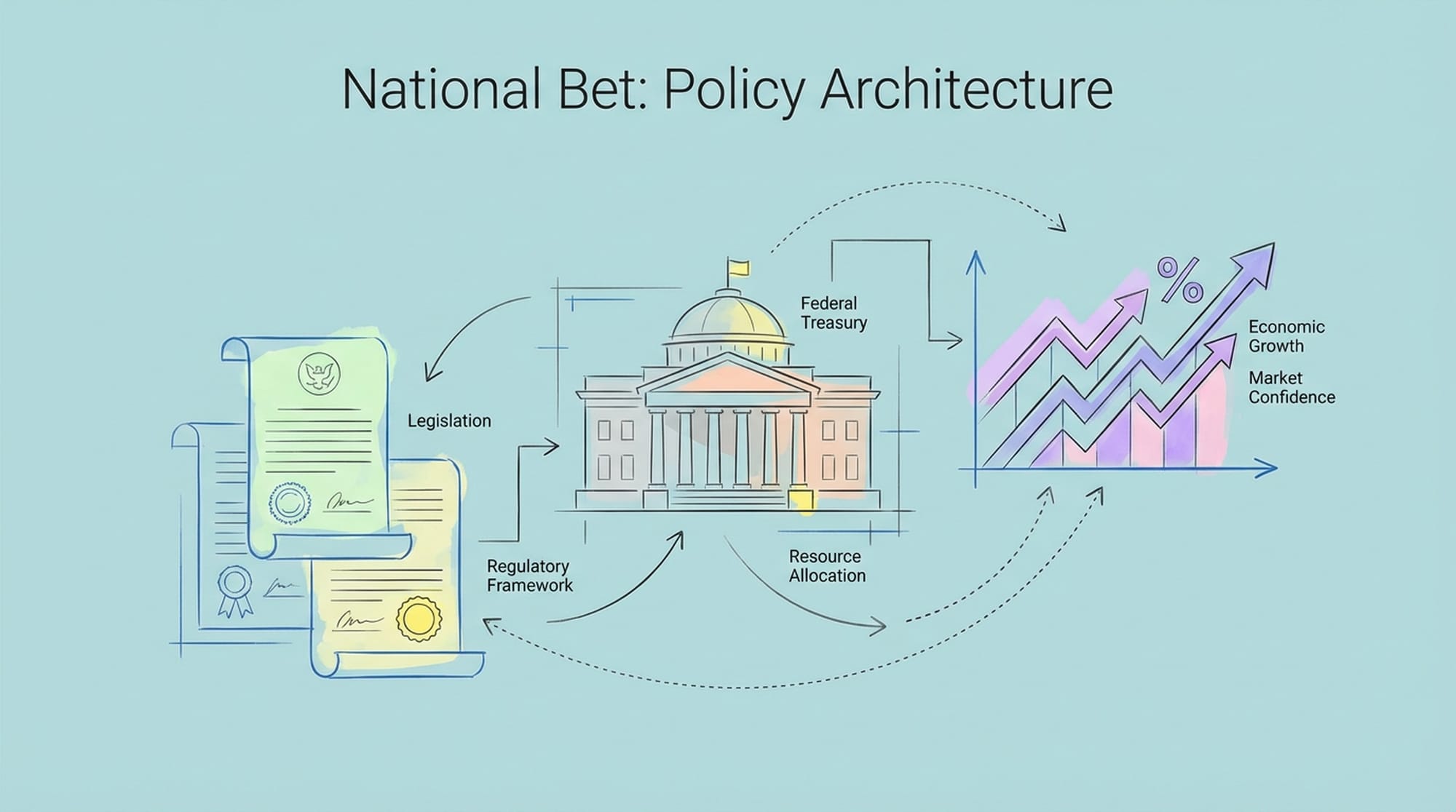

The legal foundation of the Trump Account rests on a tax and spending bill enacted in July 2025. This legislation establishes a tax-advantaged investment vehicle akin to a Roth IRA but with stricter limitations on beneficiary age and fund withdrawal.

At its core, the policy stipulates that every U.S. newborn with a Social Security number, born between January 1, 2025, and December 31, 2028, will receive a one-time federal seed deposit of $1,000. This specific timeframe, notably coinciding with a particular administrative term, carries significant political undertones.

These funds, managed by the Treasury Department, are then entrusted to private financial institutions for investment. To prevent management fees from eroding the principal, the bill caps annual management fees at a mere 0.10%.

Crucially, this is not a cash handout. The funds are designed as "untouchable" assets, mandatorily locked until the beneficiary reaches 18 years of age, unless in cases of death or severe disability. This 18-year lock-in period is not merely to leverage compound interest; it's to ensure the funds retain their character as capital rather than being diverted for immediate consumption.

Bridging the Generational Divide: The Dell Family's Intervention

A significant generational gap exists within the Great and Beautiful Act itself. It primarily covers newborns after 2025, leaving out children born before this period. This "cliff effect" could lead to vastly different outcomes for siblings within the same family.

Enter Michael and Susan Dell. Their $6.25 billion donation masterfully fills this policy void, marking the largest single philanthropic commitment to children in U.S. history and setting a precedent for private capital directly influencing national welfare distribution.

However, the Dell plan isn't universally inclusive. It utilizes sophisticated geographic and economic algorithms for targeted allocation. To qualify for the $250 Dell seed funding, children must be:

- Aged 10 or under (born before January 1, 2025).

- Residing in a postal code area with a median household income below $150,000.

- Not a recipient of the federal government's $1,000 grant.

This creates a three-tiered "helicopter equity" system:

- Tier 1 (Federal Universal): Newborns from 2025-2028 receive $1,000 from the Treasury.

- Tier 2 (Dell Targeted): Existing children aged 10 and under receive $250, subject to income and geographical limits.

- Tier 3 (Uncovered): Children over 10 or in high-income areas receive nothing.

The Dell family's involvement signals a fundamental shift in welfare policy logic: it's no longer solely reliant on tax redistribution but increasingly dependent on the "charitable capital" of the ultra-wealthy to patch gaps in public policy.

This algorithmic, postal code-based allocation, while aiming for precision, introduces new fairness challenges. Low-income families in high-cost-of-living areas (e.g., San Francisco or New York) might be excluded if their postal code's median income exceeds $150,000 due to gentrification.

Sustained Growth: The "Super IRA" for Minors

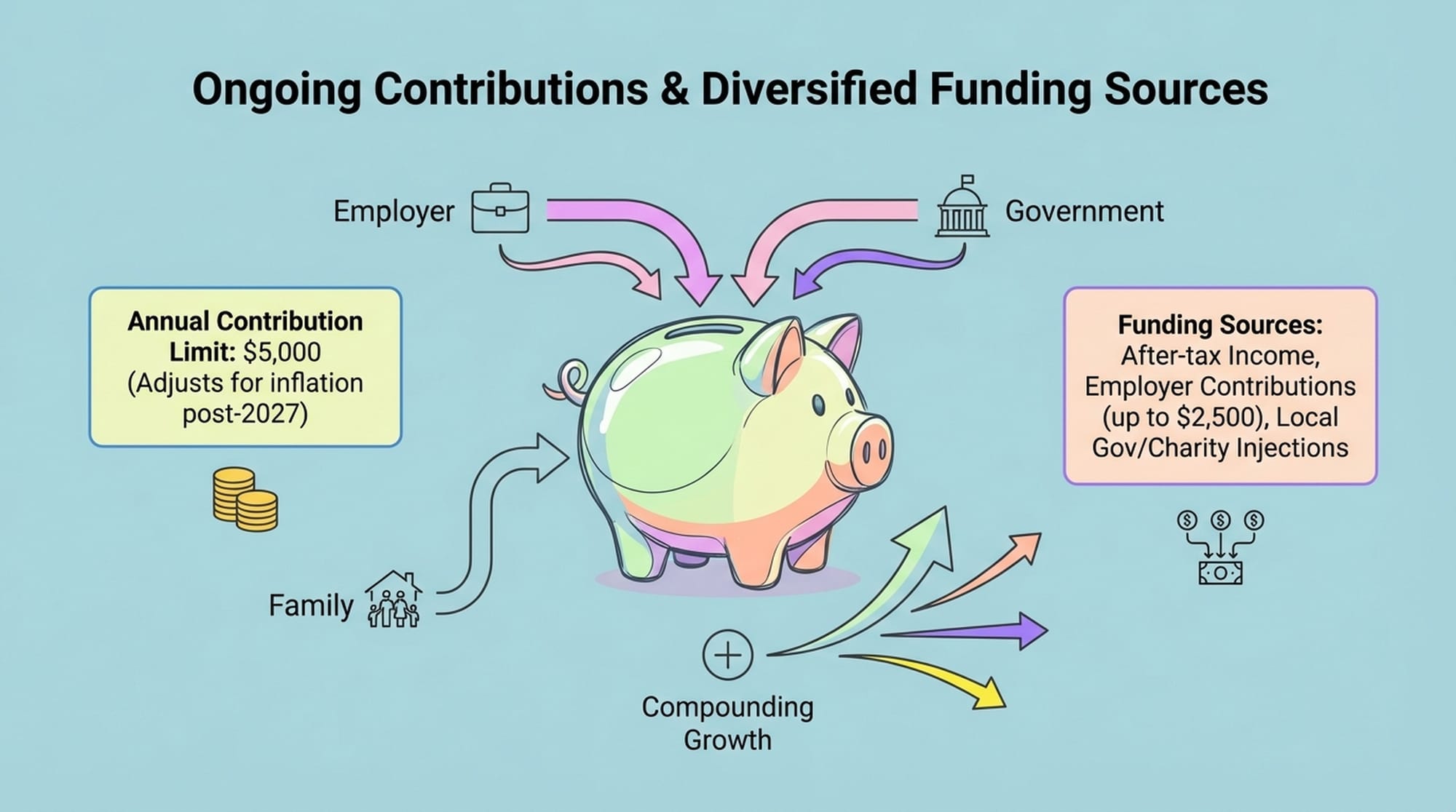

The long-term impact of the Trump Account isn't just about the initial seed money, but its capacity as a tax-advantaged investment vehicle. It permits annual additional contributions of up to $5,000, indexed for inflation after 2027.

The diverse funding sources are a key feature:

- Families can contribute after-tax income, with growth enjoying tax-deferred treatment.

- Employers can contribute up to $2,500 annually for employees' children, exempt from taxable income, creating a new form of tax-free compensation.

- Local governments and other charities can also contribute, without counting towards the $5,000 annual limit.

This structure essentially functions as a "super individual retirement account" for minors. Upon reaching 18, the account converts to a traditional IRA. Funds can then be used for specific purposes like higher education, a first home purchase, or starting a business. Withdrawals for other uses incur ordinary income tax and potential penalties, enforcing long-term capital accumulation through a dual mechanism of lock-in and tax benefits.

The Wall Street Mandate: Forced Investment and Market Impact

Perhaps the most striking feature of the Trump Account is its mandatory investment directive: funds must be invested in index funds tracking the broad U.S. stock market, such as the S&P 500. This legally binds the future wealth of millions of American children to Wall Street's performance and introduces a substantial, price-insensitive passive buying force into the market.

This aligns with the Inelastic Markets Hypothesis. Research by Gabaix and Koijen suggests that stock market demand elasticity is far lower than traditional finance theories assume. Every dollar inflow could increase total market capitalization by $5 or more. The Trump Account will create a national, mandated passive investment stream.

Consider the scale: with approximately 3.5 million U.S. births annually, federal seed funding alone would inject $3.5 billion into the market each year. Add the Dell Foundation's $6.25 billion one-time injection and potentially billions more in annual family contributions, and this forms a persistent, massive capital flow.

Unlike active investors who buy and sell based on valuation, these funds are driven by law and birth rates. Regardless of P/E ratios or economic cycles, as long as children are born and automatic deductions occur, capital will flow into S&P 500 components.

This mechanism could exacerbate the "head effect" in markets. Index funds are market-cap weighted, meaning new money disproportionately flows into mega-cap companies like Apple, Microsoft, and Nvidia. Academic studies confirm that passive investment flows significantly inflate the prices of large-cap stocks, often detached from fundamentals. Thus, the Trump Account could inadvertently become a stock price booster for corporate giants, strengthening market concentration through national policy.

The Asset Inflation Gamble and Sequence Risk

The Trump Account is also a gamble on asset inflation. While "helicopter money" primarily fuels consumer price inflation, "helicopter equity" directly impacts asset prices. Critics argue this policy inherently subsidizes asset holders. By artificially increasing demand for stocks without increasing supply (which may even decrease due to buybacks), the policy will drive up asset prices.

This creates a self-reinforcing feedback loop: federal funds and family savings are compelled to buy stocks, stock prices rise, especially for index-heavyweights. Corporate management, seeing rising stock prices, favors share buybacks over dividends, further reducing outstanding shares. This supply reduction, combined with the Trump Account's continuous buying pressure, propels stock prices even higher.

This is a national gamble, betting that this financial engineering can continuously generate paper wealth without a catastrophic valuation reversion at some future point.

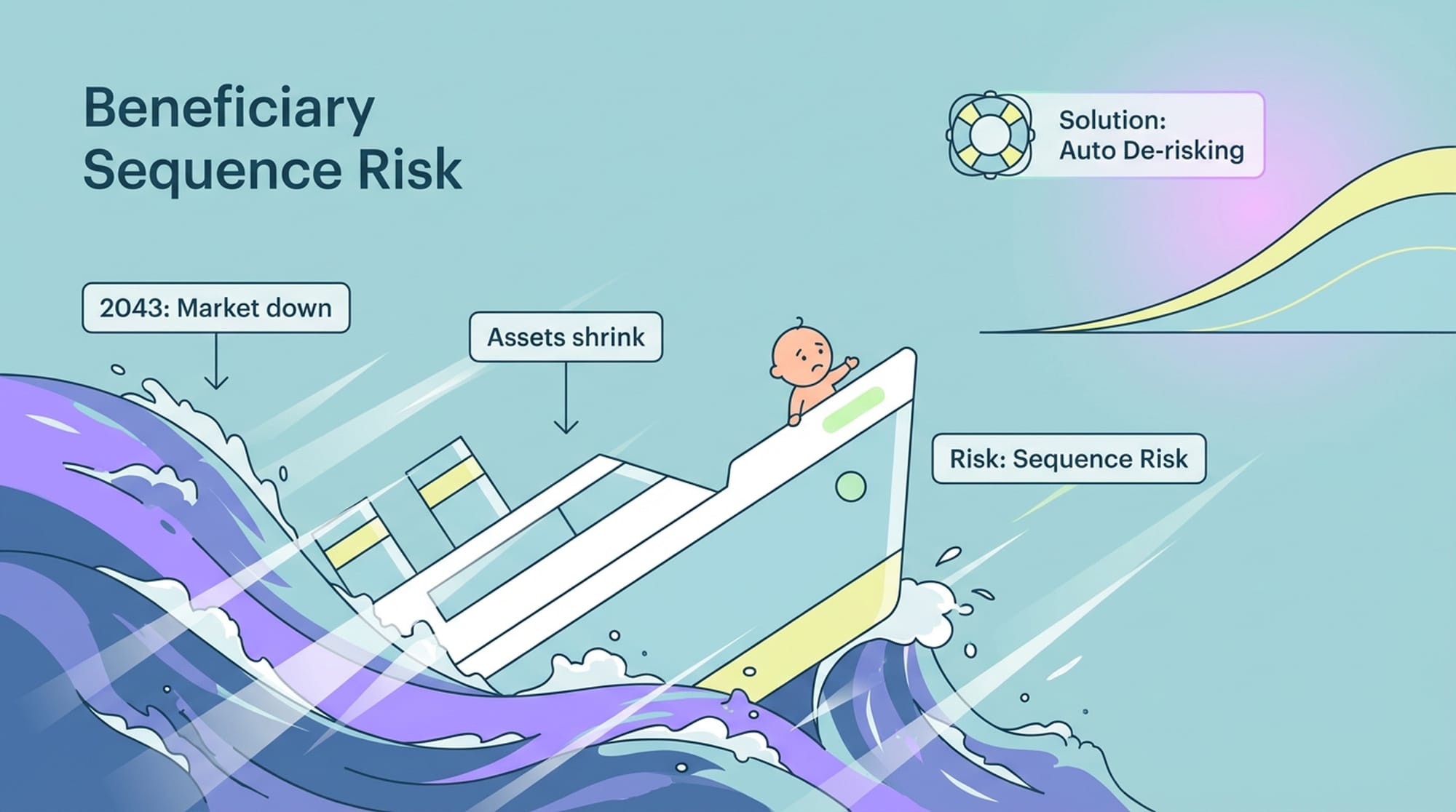

For beneficiaries, the greatest risk is "sequence risk." Unlike Singapore's CPF, which offers guaranteed returns, the Trump Account shifts all market risk to the individual. Imagine a "2043 Problem": children born in 2025 turn 18 in 2043. If 2043 coincides with a market crash similar to 2008 or 1929, leading to a 40-50% market decline, an entire generation's "national dowry" could be decimated overnight.

The current legislation mentions investing in "stock index funds" but doesn't specify mechanisms like "target-date funds" for automatic de-risking. If funds remain 100% in stocks as beneficiaries approach 18, they face extreme tail risk.

The Challenges of "Charity Governance" and Equity

The Dell family's involvement, particularly the "$150,000 median income" postal code threshold, signifies a new model of "charity governance." The Dell Foundation effectively acts in a quasi-governmental role, determining eligibility for social welfare.

Using postal codes as a proxy for economic status is a common big data governance tool but has significant flaws, such as "gentrification misjudgment." Low-income families in rapidly gentrifying areas might be excluded because new, high-income neighbors inflate the median income. Similarly, the "high-cost trap" could disqualify children in Silicon Valley or Manhattan, where $150,000 might barely cover basic living expenses, from receiving the $250.

When national welfare policy leaves vast gaps, relying on private philanthropists to fill them, the nature of the social contract shifts. Welfare becomes a gift based on the benevolence of the wealthy rather than a statutory right of citizenship. This model, while solving short-term funding issues, could undermine the long-term stability and predictability of public welfare systems.

Lessons from Abroad: Opt-in vs. Mandatory Systems

To better understand the implications, we can compare the Trump Account to international asset-based welfare policies.

- Singapore's Central Provident Fund (CPF): This represents the opposite extreme: highly mandatory and integrated. Singapore mandates a 37% contribution rate, far exceeding the Trump Account's voluntary contribution limits. CPF funds are intricately linked to housing, healthcare, and provide a risk-free guaranteed return of 2.5-4%. The Trump Account, in contrast, lacks this lifecycle integration and risk backstop, appearing more as an isolated savings plan than a comprehensive social security system.

The UK's Child Trust Fund (2002-2011): This offers a cautionary tale. Despite automatic account creation, over 758,000 accounts, totaling £1.4 billion, remained unclaimed when children turned 18. Many low-income or transient families, or those lacking financial literacy, were unaware of their assets.

The Trump Account's requirement for parents to actively complete forms for account opening, an "opt-in" rather than "opt-out" mechanism, combined with an 18-year potential for oversight, risks millions of low-income children, who most need these funds, never accessing them.

The "Baby Bonds" Counter-Proposal and Widening Inequality

Finally, the "Baby Bonds" proposal by Democrats like Cory Booker offers a contrasting philosophy. Baby Bonds advocate for differentiated grants based on family wealth, with the poorest children receiving the most funds, aiming to reduce wealth disparity.

The Trump Account, while offering an equal $1,000 federal seed, allows wealthy families to contribute an additional $5,000 annually for tax-free growth. Critics argue this effectively uses public funds to create a tax shelter for the wealthy, as only affluent families can fully utilize the $5,000 contribution limit.

Though nominally a "gift for every child," due to the exponential nature of compound interest and principal size, the Trump Account may ultimately exacerbate rather than narrow wealth inequality. Consider two scenarios (assuming a 7% annual return after 18 years):

- Low-income child: With $1,250 in seed funding and no further contributions, the account might reach ~$4,200, enough for a used car or a semester of community college.

- High-income child: With $1,000 federal seed and maximum annual family contributions of $5,000, the principal could reach $91,000, growing to nearly $200,000—a substantial sum for a down payment or elite university tuition.

This represents a potential 46-fold difference, with high-income families also leveraging the account to maximize intergenerational wealth transfer by avoiding capital gains taxes.

The "Future Pie" for "Present Bread" Trade-off

Critics fear the Trump Account isn't a mere addition to welfare but a prelude to future welfare reductions. Policymakers might use the argument that "everyone has a stock account" to justify cuts to Social Security or other benefits. If every child is deemed a "capitalist," the state's responsibility for poverty alleviation is logically weakened. More concerning are reports that accompanying legislation includes cuts to Medicaid and food stamps. This implies exchanging a "future pie" for "present bread"—a perilous trade for families on the brink of survival.

Three Scenarios for America's "National Gamble"

Based on current data and historical experience, we can project three potential futures for the Trump Account:

- Scenario A: Golden Age of an Ownership Society (Bull Market):

- Premise: Strong U.S. economic growth for two decades, AI-driven productivity boom, S&P 500 returns exceeding 8% annually.

- Outcome: By 2043, the first beneficiaries mature. Even low-income youth with only seed funding possess thousands in assets. Middle-class children have down payments for homes. This widespread asset appreciation eases class tensions, and youth support for capitalism rises.

- Political Impact: The Republican "investor class" strategy triumphs, with asset-holding voters favoring low taxes and deregulation, solidifying a center-right political landscape.

- Scenario B: Two Lost Decades (Stagflation):

- Premise: Long-term U.S. stagflation or a severe market correction after passive-driven valuations. Inflation erodes nominal returns.

- Outcome: After 18 years, the purchasing power of accounts is less than the initial $1,000 in 2025. Wealthy families diversify risk, while ordinary families tied to a single index suffer heavy losses.

- Political Impact: "National scam" narratives proliferate, public trust in the financial system collapses, and populism intensifies.

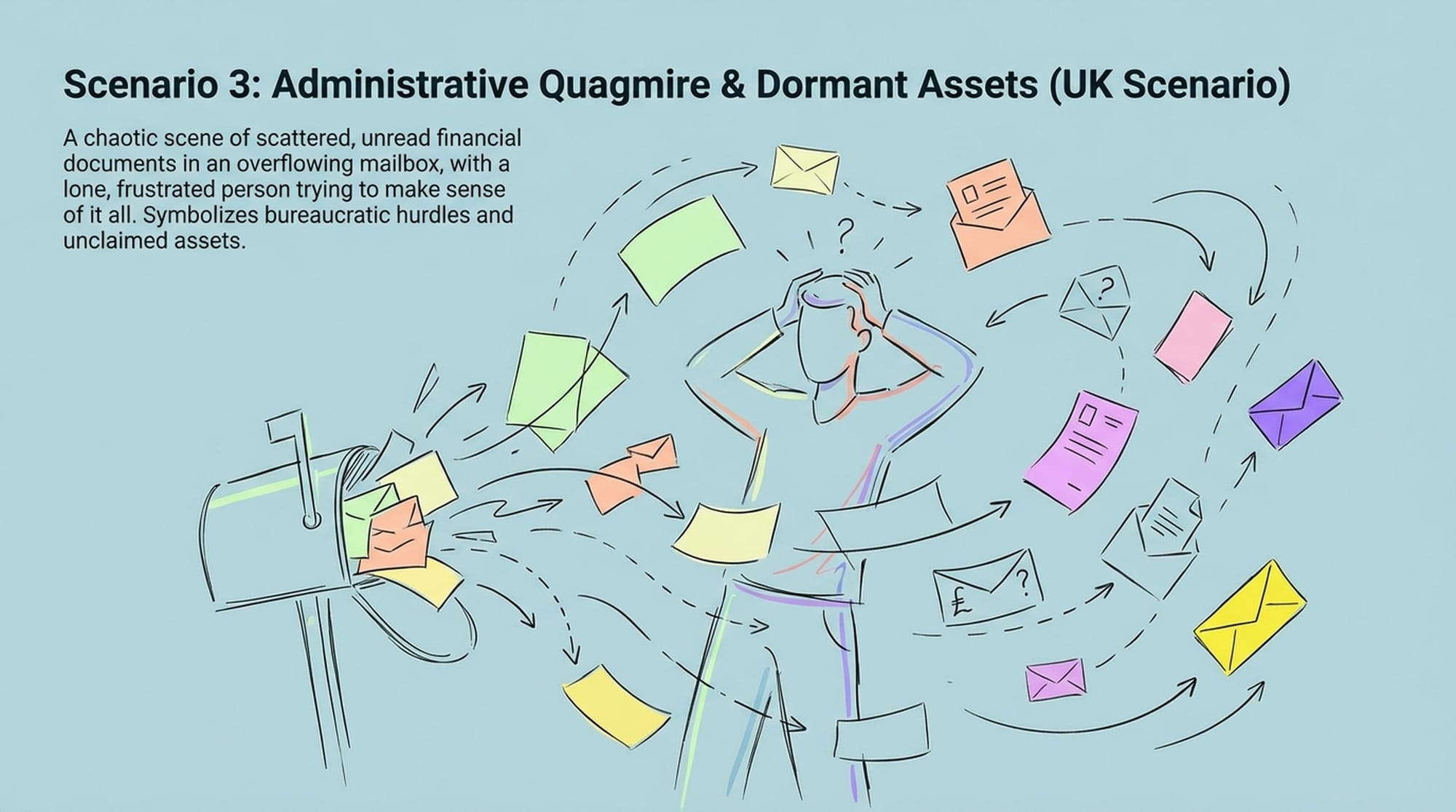

- Scenario C: Bureaucratic Quagmire & Dormant Assets (UK Scenario):

- Premise: Complex forms deter low-income families from opening accounts. Private managers lack incentive to service customers with only $1,000 balances.

- Outcome: By 2043, millions of accounts are dormant. Wall Street financial institutions quietly erode these "unclaimed assets" through management fees. Only well-educated families truly benefit.

- Political Impact: The policy is viewed as a regressive fiscal subsidy, sparking renewed criticism of bureaucracy and financial predation.

Conclusion: Locking Down the Future

The Trump Account and its "helicopter equity" philosophy are far from a simple welfare distribution; it's a profound restructuring of American national governance. It aims to transform every citizen into a stakeholder in the capital markets through the power of financial compounding.

This gamble hinges on three core assumptions:

- Market Assumption: That the U.S. stock market will always be an efficient wealth-creation machine, not a casino.

- Behavioral Assumption: That all families, regardless of wealth, possess the knowledge and patience to manage long-term assets.

- Social Assumption: That asset ownership can replace income redistribution as the ultimate solution to inequality.

The Dell family's massive donation, while fueling the plan, also exposes its fragility, relying on private capital to mend public institutions. If successful, it could create a generation of asset-owning middle-class citizens. If it fails, it risks burying an entire generation's economic security within the volatility of stock charts.

This is no longer merely "scattering money"; it's "scattering equity." It seeks to redefine not just welfare but the very relationship between citizens and capitalism. In this 18-year lock-in period, it's not just funds that are locked away, but America's entire imagination of "opportunity."

|  |