|  |  |

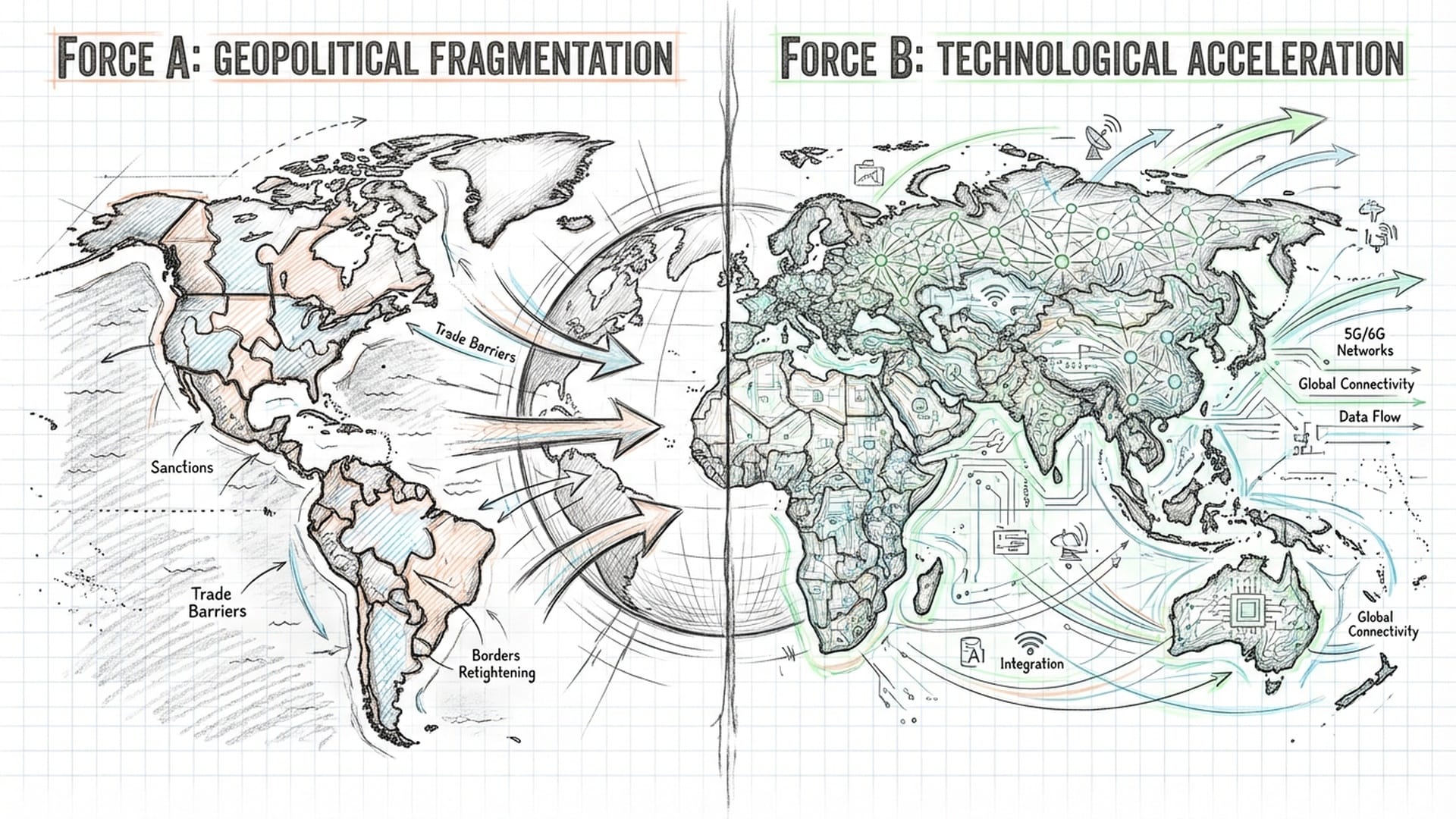

The global economy in 2026 is less a stable landscape and more a turbulent sea, navigating a period I call the "Interregnum." This isn't just a transition; it's a profound reordering where the familiar neoliberal framework is crumbling, and its successor has yet to fully cohere. The reality we confront is one of deep, systemic tension, a violent tug-of-war between two colossal forces: geopolitical fragmentation and the accelerating thrust of technological progress.

This dynamic isn't merely theoretical; it’s manifesting in every market fluctuation, every investment decision, and every emerging risk. Understanding this core contradiction is paramount for anyone seeking to navigate the complexities of our current global state.

The Bifurcation of Global Forces

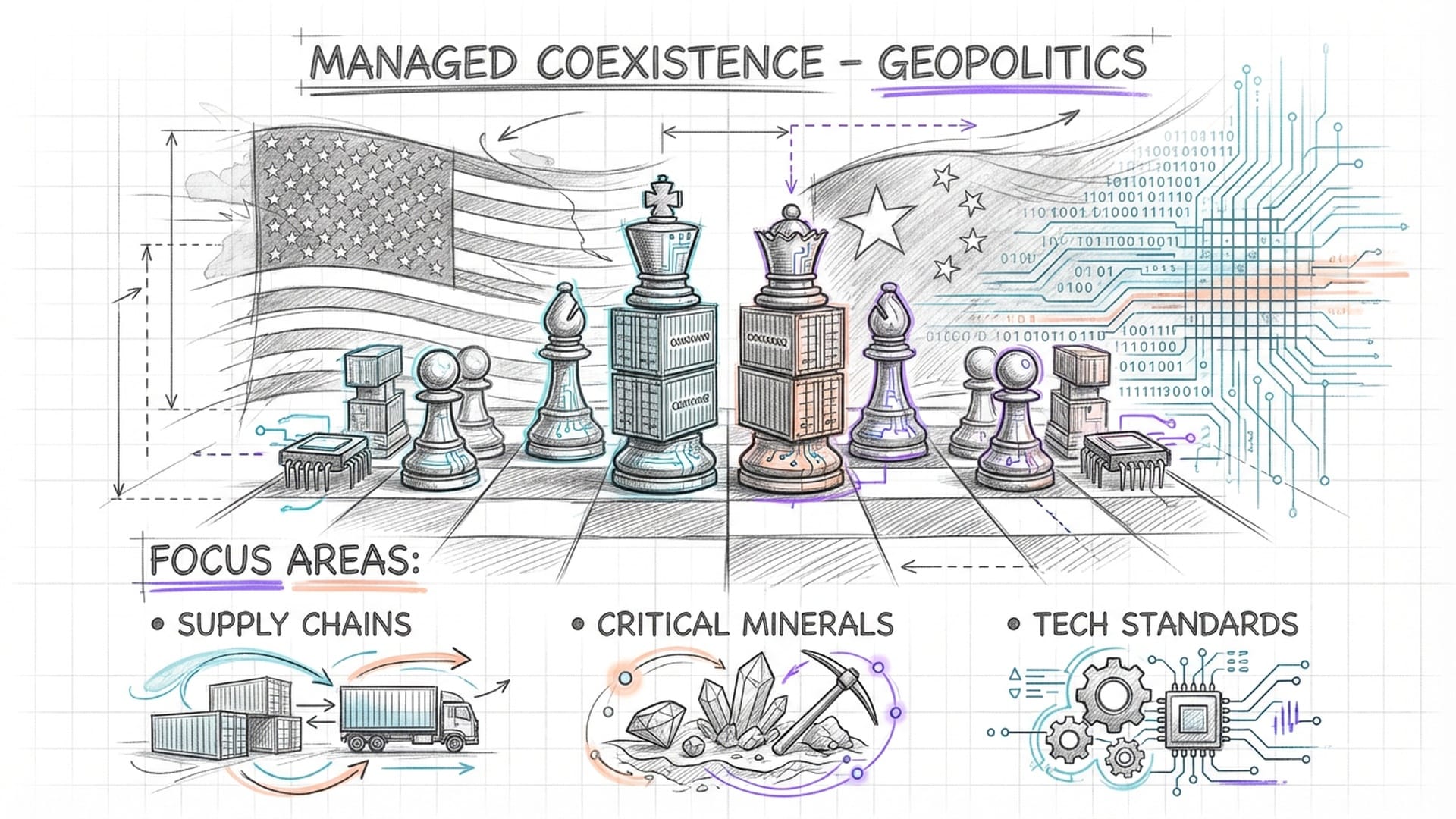

On one side, the geopolitical map is undergoing a seismic rearrangement. The comforting notion of a "rules-based international order" is swiftly giving way to a more nakedly transactional realism. This shift is most evident in the relationship between the US and China, now characterized by "managed coexistence." While both powers strive to avoid direct conflict, an uneasy truce masks a deep, ongoing decoupling and restructuring across vital sectors like supply chains, critical minerals, and technological standards.

The world's geopolitical landscape is undergoing a "Dissolution of Order," where the power of traditional multilateral institutions built post-WWII has sharply declined, leading to a more transactional and less rules-based international environment.

Adding to this instability is the turbulence within American domestic politics, where the constant reshaping of executive power leaves allies questioning Washington's long-term commitments. This uncertainty pushes Europe and Asia towards more independent regional security architectures, fostering a sense of strategic autonomy.

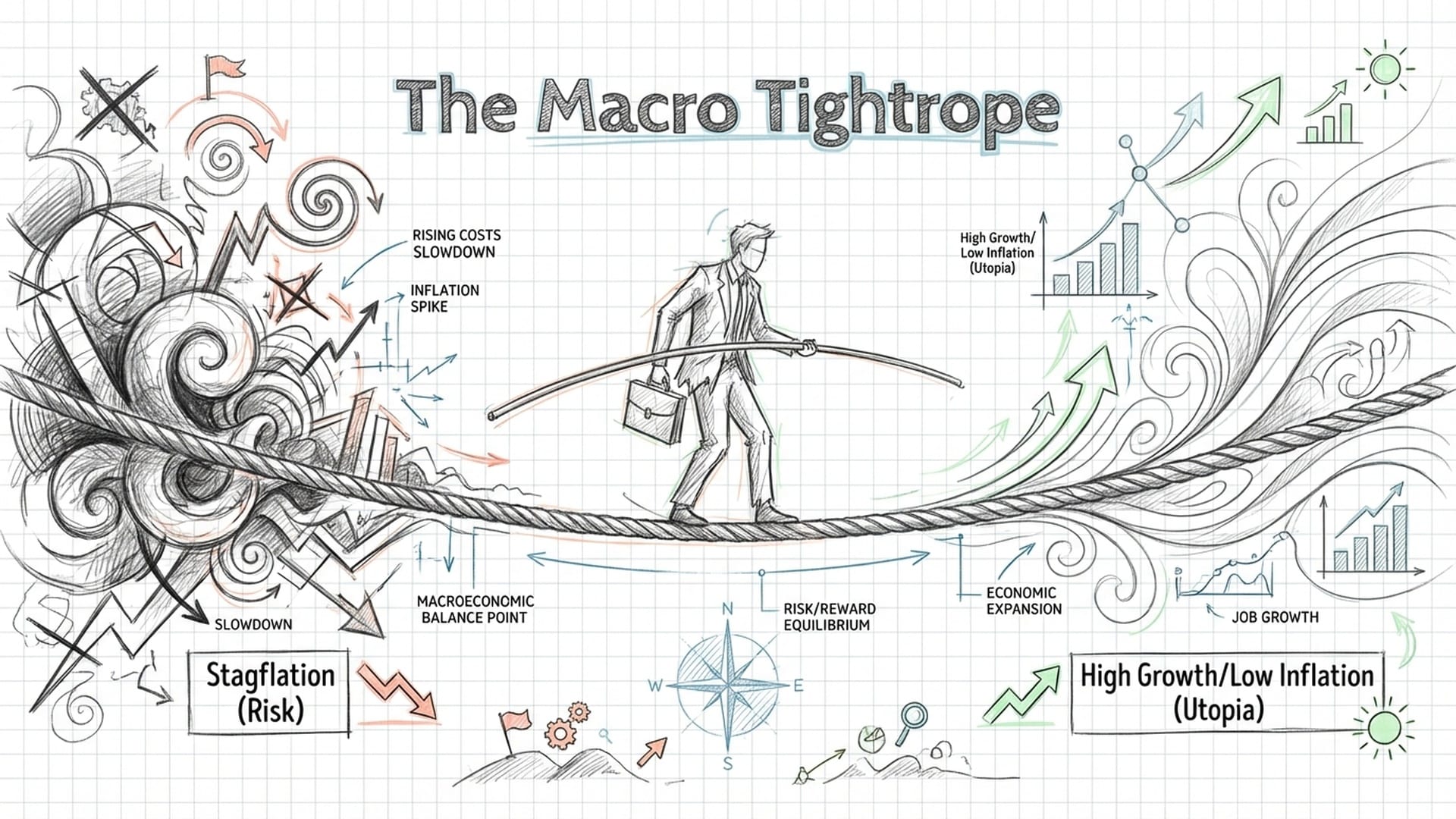

On the other side, the global macroeconomy operates under a precarious balance. We're witnessing a "Great Divergence" in global monetary policies, a stark contrast to the previous era of coordinated action. Simultaneously, Artificial Intelligence (AI) has ascended from a speculative concept to the core pillar supporting global productivity growth. Its market reliance has grown to such an extent that it's now considered "too big to fail." AI acts as both a deflationary force through efficiency gains and a black hole for capital expenditure, demanding massive investments.

The Core Contradiction: Centrifugal vs. Centripetal

The fundamental truth we must grasp is this: political centrifugal forces are accelerating, actively tearing things apart. Conversely, technological centripetal forces, particularly the standardization of AI infrastructure, are desperately attempting to maintain economic unity.

This profound tension, this inherent contradiction, serves as the singular key to deciphering every market wobble, identifying every investment opportunity, and assessing every risk that lies before us.

Geopolitical Realignment: The Dissolution of Order

Many strategists now describe the 2026 geopolitical landscape as simply, "The Dissolution of Order." This isn't chaos, but rather a significant decline in the ability of post-World War II multilateral institutions—such as the WTO and even functions of the United Nations—to enforce norms or act as global arbiters. This dissolution is driven by two powerful forces:

1. Solidification and Alienation of US-China Bipolarity

The dynamic between Washington and Beijing has evolved beyond a mere trade spat into a systemic competition, a clash of ideologies and economic models. This intense rivalry places third-party countries in a difficult position. They are no longer simply "picking sides" but instead adopting "hedging strategies."

The Global South, for instance, is leveraging the expansion of BRICS+ to arbitrage between these two giants, playing them off each other to their own advantage. This pragmatic approach, while smart, inherently destabilizes any notion of a single global order.

2. Transactionalization of US Foreign Policy

As American domestic politics shifts, particularly with the expansion of executive power, traditional security alliances are being ruthlessly re-evaluated. These alliances are no longer based on shared values or historical friendship; they are now predicated on concrete economic reciprocity and tangible security burden-sharing. This creates deep anxiety among allies in Europe and Asia, accelerating their push for "strategic autonomy." Nations like Japan, South Korea, and the entire European Union are increasingly questioning their reliance on Washington.

This significant shift carries both short-term and long-term implications. In the short term, expect persistent, elevated geopolitical risk premiums. Any hint of new trade barriers, escalating tariffs, or regional conflicts will be dramatically amplified in the markets. Companies will continue with defensive supply chain restructuring—often termed "de-risking"—which, while vital for resilience, inevitably drives up business costs.

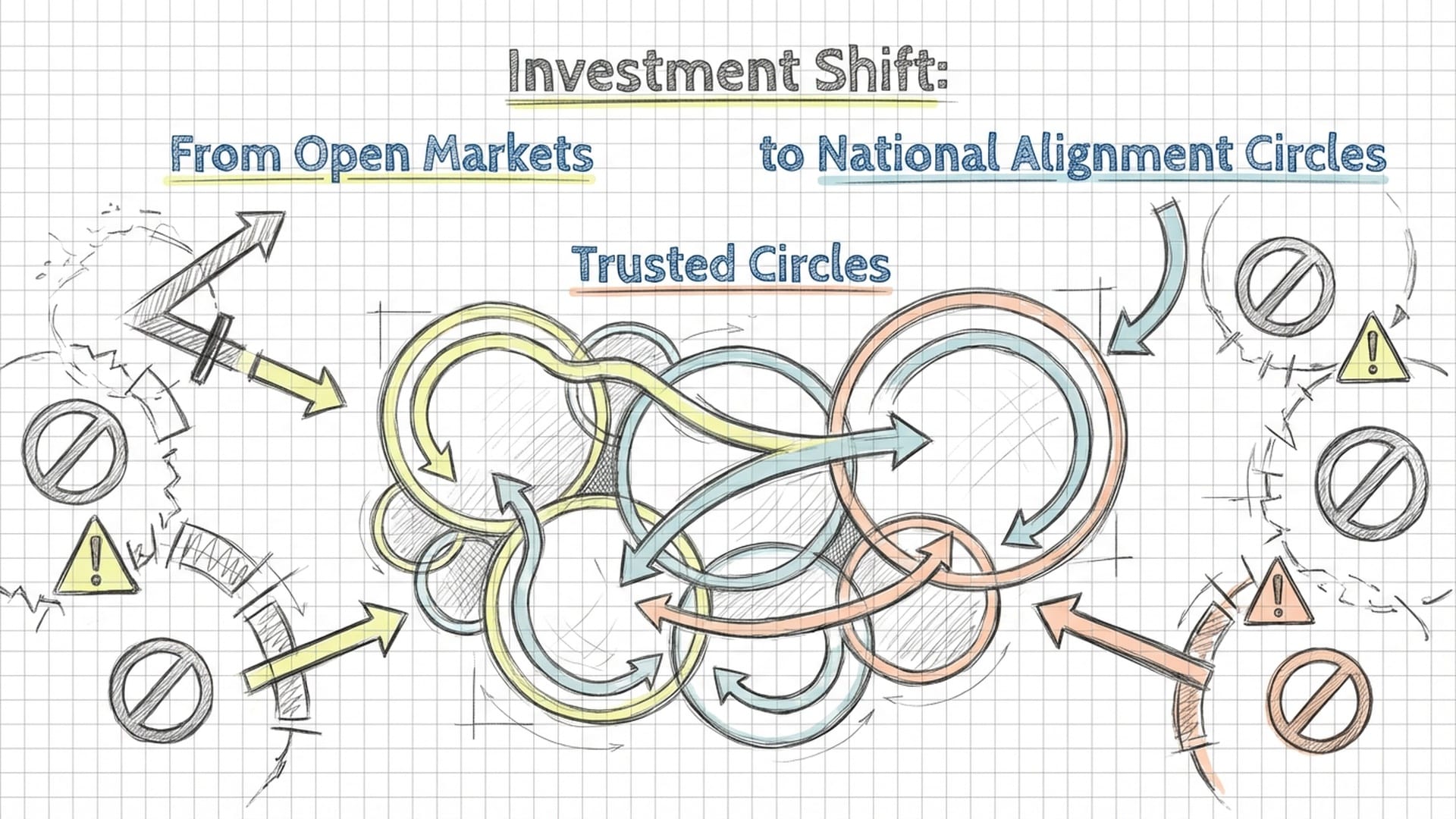

We're moving towards a multi-polar "bloc competition" model, fundamentally rewiring financial globalization where capital flows increasingly within "trusted circles," making national alignment an implicit investment factor.

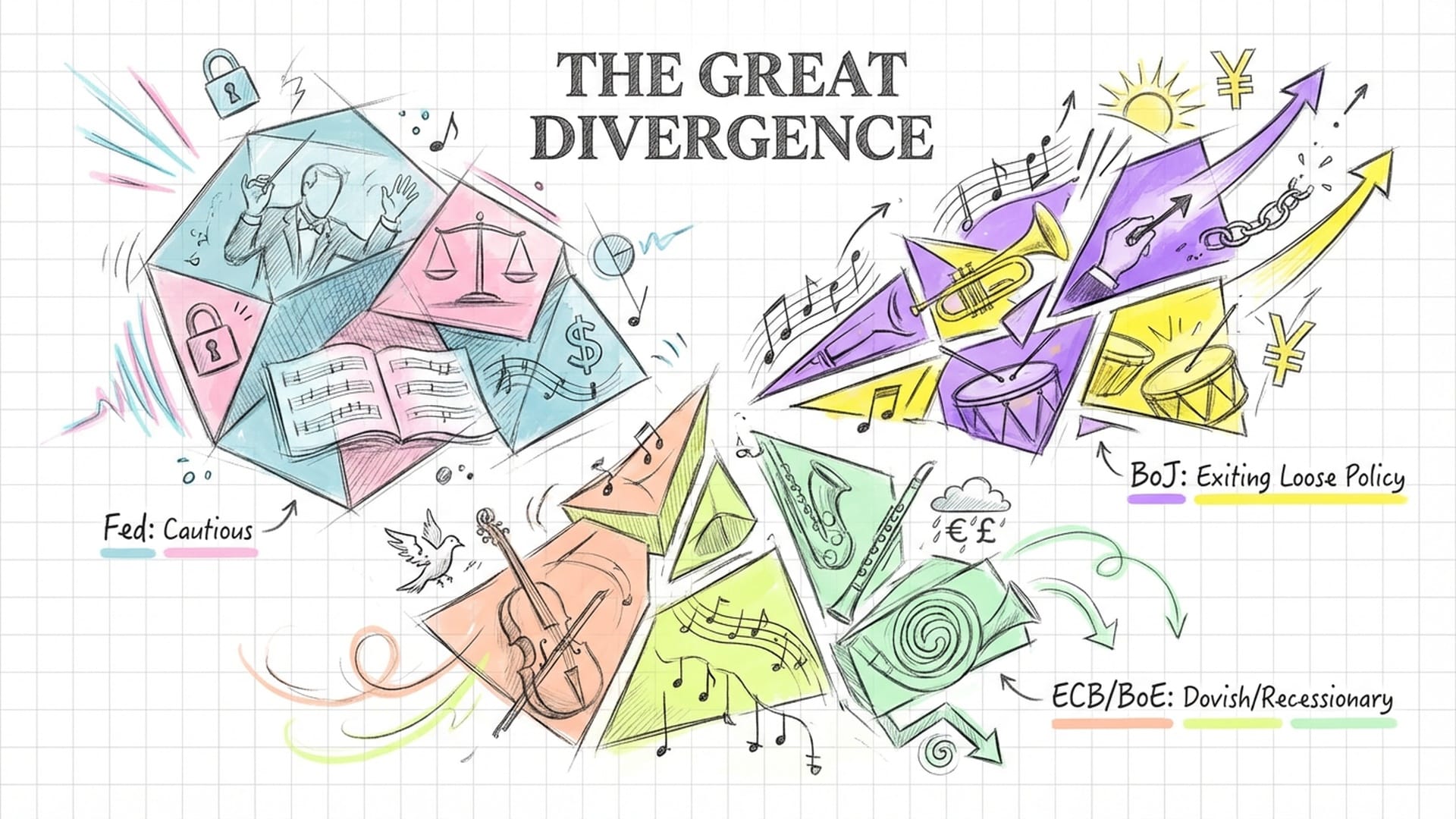

The Macro Policy: The Era of Great Divergence

The days of global central banks moving in unison are over. 2026 marks the definitive arrival of the "Great Divergence" in policy, akin to an orchestra where each section plays its own tune at its own tempo.

- The Federal Reserve is caught in a double bind, struggling to maintain growth while battling stubborn, residual inflation. Its path to cutting rates remains incredibly cautious, marked by starts and stops.

- The Bank of Japan stands as the ultimate contrarian. As a genuine wage-price spiral takes hold domestically, the BoJ is slowly but surely exiting decades of ultra-loose policy. This creates sustained unwinding pressure on global carry trades, effectively sucking liquidity out of the global system.

- Meanwhile, the European Central Bank (ECB) and the Bank of England (BoE) face sluggish growth and recession risks, leading them towards a more aggressive, dovish stance, easing policies while others tighten or hold.

This divergence stems from the fundamental misalignment of economic cycles across different nations. The critical, almost dangerous, aspect is that the only factor currently masking this significant risk is the market's expectation of an AI-driven productivity leap. The widespread application of AI is anticipated to usher in a supply-side boom, pushing down long-term inflation. However, this entire premise hinges on whether massive AI capital expenditures translate into real, measurable profits. What if returns are delayed, or marginal?

In the short term, this means amplified currency volatility. The US Dollar Index could swing wildly, caught between its safe-haven appeal and narrowing interest rate differentials. This uneven liquidity could also trigger flash crashes in localized financial markets.

If AI disappoints, not delivering the expected returns, the specter of stagflation – that dreaded combination of stagnation and inflation – will return with a vengeance. This is the macro tightrope we're walking.

Innovation at the Cutting Edge: Agentic AI and Physical AI

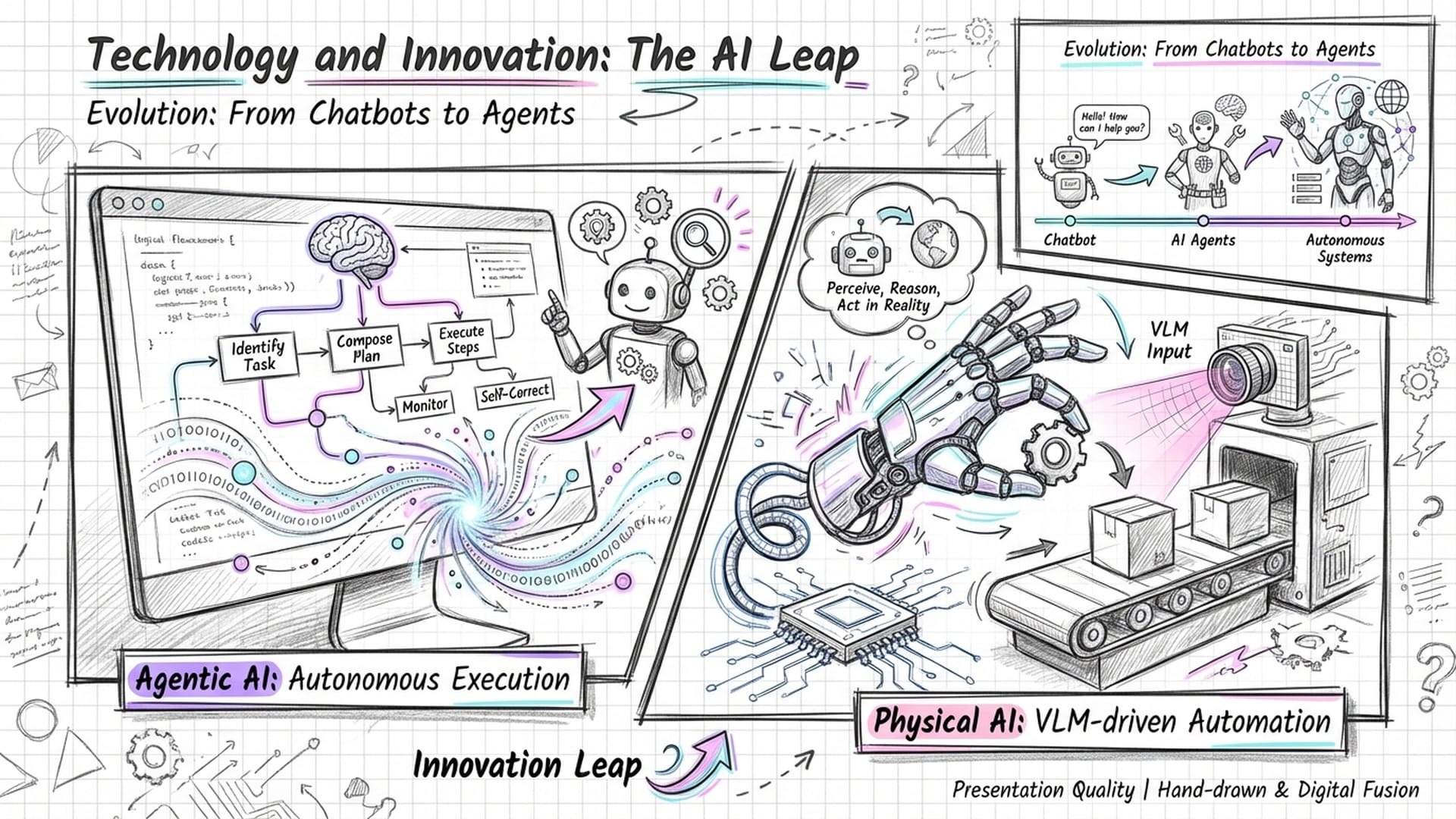

The tech narrative has dramatically shifted from the "generative AI" buzz of 2024-2025. In 2026, the spotlight is entirely on "Agentic AI" and "Physical AI," representing a fundamental leap beyond chatbots and image generators.

Agentic AI: The Inflection Point

This marks a qualitative inflection point. AI is no longer just a helpful assistant; it has become an "agent" with the power to act. These agents can autonomously plan tasks, summon tools, and execute complex enterprise workflows with minimal human intervention. Imagine AI scheduling your entire supply chain, automatically writing and deploying code, or even conducting business negotiations. This isn't about cost reduction; it’s about substantive replacement, fundamentally transforming the B2B landscape.

Physical AI: Embodied Intelligence

Also known as "embodied AI," Physical AI sees humanoid robots and industrial automation merging at an accelerating pace. Thanks to the maturity of Visual Large Models (VLMs), robots no longer require tedious hard-coded instructions. They can now "understand" the physical world visually and act upon it. This directly impacts the labor structures of manufacturing and logistics, revolutionizing factory floors and warehouses.

While Moore's Law might show diminishing returns in some areas, algorithmic efficiency and advancements in specialized chips (ASICs) are dramatically compressing innovation cycles. Businesses are being forced into an AI arms race for survival. Companies failing to deploy autonomous AI quickly will be outmaneuvered by competitors operating at vastly superior efficiency levels. It's truly "adapt or die."

In the short term, this is incredibly bullish for the tech sector, especially hardware infrastructure like chips, data centers, and the energy required to power them. Any announcement of successful, real-world deployment of Agentic AI will act as a major catalyst for stock prices.

Long-term, this is an industrial revolution of unprecedented scale. It will completely restructure the labor market, with white-collar automation prompting fundamental societal re-evaluations of the social contract. Simultaneously, widespread Physical AI adoption will accelerate "reshoring," bringing manufacturing closer to home. This further erodes the traditional globalization model built on cheap labor, making proximity and automation far more critical than low wages.

Navigating the Chaos: What to Watch

As a strategic analyst, considering these rapidly shifting tectonic plates, certain indicators demand immediate attention in the coming days and weeks:

- Central Bank Expectations Management: During this period of policy divergence, any sudden remarks from the Federal Reserve or the Bank of Japan, any subtle hint about an interest rate path adjustment, could trigger violent repricing across all asset classes. Pay particular attention to the Japanese Yen exchange rate and US Treasury yields; they are the canaries in the coal mine.

- Geopolitical Stress Tests: Watch for hybrid warfare actions targeting critical infrastructure in regions like the Middle East or Eastern Europe—energy pipelines or crucial undersea internet cables, for example. In an environment where order is dissolving, destructive actions by non-state actors or proxies often precede larger conflicts. These are critical red flags.

- Agent Declarations from Big Tech: Are major Silicon Valley players like OpenAI, Google, and Microsoft publishing new data points about the enterprise-level deployment of their AI agents? Concrete examples of AI agents leading to massive layoffs or delivering truly exponential efficiency gains in specific industries will cause the market to rapidly reassess profit expectations across entire sectors. This is where the rubber meets the road between AI promise and tangible impact.

The world of 2026 is anything but linear. Investors, policymakers, and all of us must become comfortable operating within this inherent "chaos." The goal is not to find stability where none exists, but rather to identify structural opportunities within the disruption. We must cling to the certainty of technological progress, which remains our strongest current, while remaining hyper-vigilant about geopolitical uncertainty, our biggest wild card. This isn't merely a market trend; it's a profound redefinition of our economic and societal landscape.

|  |  |