|  |  |

2026: The Great Rule-Reshaping and the Dawn of Deglobalization 2.0

As 2025 draws to a close, a palpable anxiety hangs over global markets, shifting abruptly from the fleeting optimism of a "soft landing" to a deep concern for 2026 – a year that promises a "great rule-reshaping." The global trading floor isn't merely reacting to minor economic fluctuations; it's undergoing a profound "defensive repricing," a fundamental re-evaluation of risk and opportunity.

This seismic shift is driven by a violent collision of two monumental forces: an escalated geopolitical tech war and a colossal miscalculation in global liquidity expectations, particularly following an unexpected hawkish move by the Bank of Japan. We are navigating a complex, even Gordian knot of interconnected crises, where investors are not just reacting, but actively rebalancing portfolios for what I call "Deglobalization 2.0." Capital is no longer blindly chasing growth; instead, it is desperately seeking "sovereign security" and "supply chain resilience."

Today's market tremors are not mere panic. They are the market’s early, brutal assessment of a deeper, more profound rupture in the global economic order that’s coming in 2026. The underlying question for investors is stark: How do you invest when the world itself is being torn apart and rebuilt, almost overnight?

Let's delve into the key events cementing this new reality, understanding not just what happened, but why it matters and how it will fundamentally reshape our world.

The New Silicon Curtain: AI Algorithm Export Controls

The most significant geotechnology development is the joint US-EU announcement of the "2026 Advanced AI Algorithm Export Control Framework." This isn't just another policy update; it marks the beginning of a new, far more devastating phase in the tech cold war.

Historically, restrictions focused on the physical layer: things one could see, touch, and count, like compute power (GPUs) and manufacturing equipment (ASML’s lithography machines). However, the recent coordinated strike by the US and Europe extends this control directly into the "soft power" core of AI. We are talking about AI foundation model weights and training architectures exceeding specific parameter thresholds. This shift in logic is absolutely critical.

Western strategic decision-makers have finally realized that merely blocking hardware hasn't fully stifled their rivals' pursuit of technological parity. Their new play is to block the literal "source code of intelligence."

This isn't about restricting finished products; it's an attempt to sever the flow of knowledge within the open-source community, specifically targeting certain geopolitical regions. Essentially, a "silicon curtain" has been dropped in the digital world, attempting to violently rip apart the global AI ecosystem into two incompatible, parallel systems.

For non-Western tech companies, particularly those reliant on open-source models for secondary development, this isn't merely a challenge; it's an existential threat and a survival-level blow.

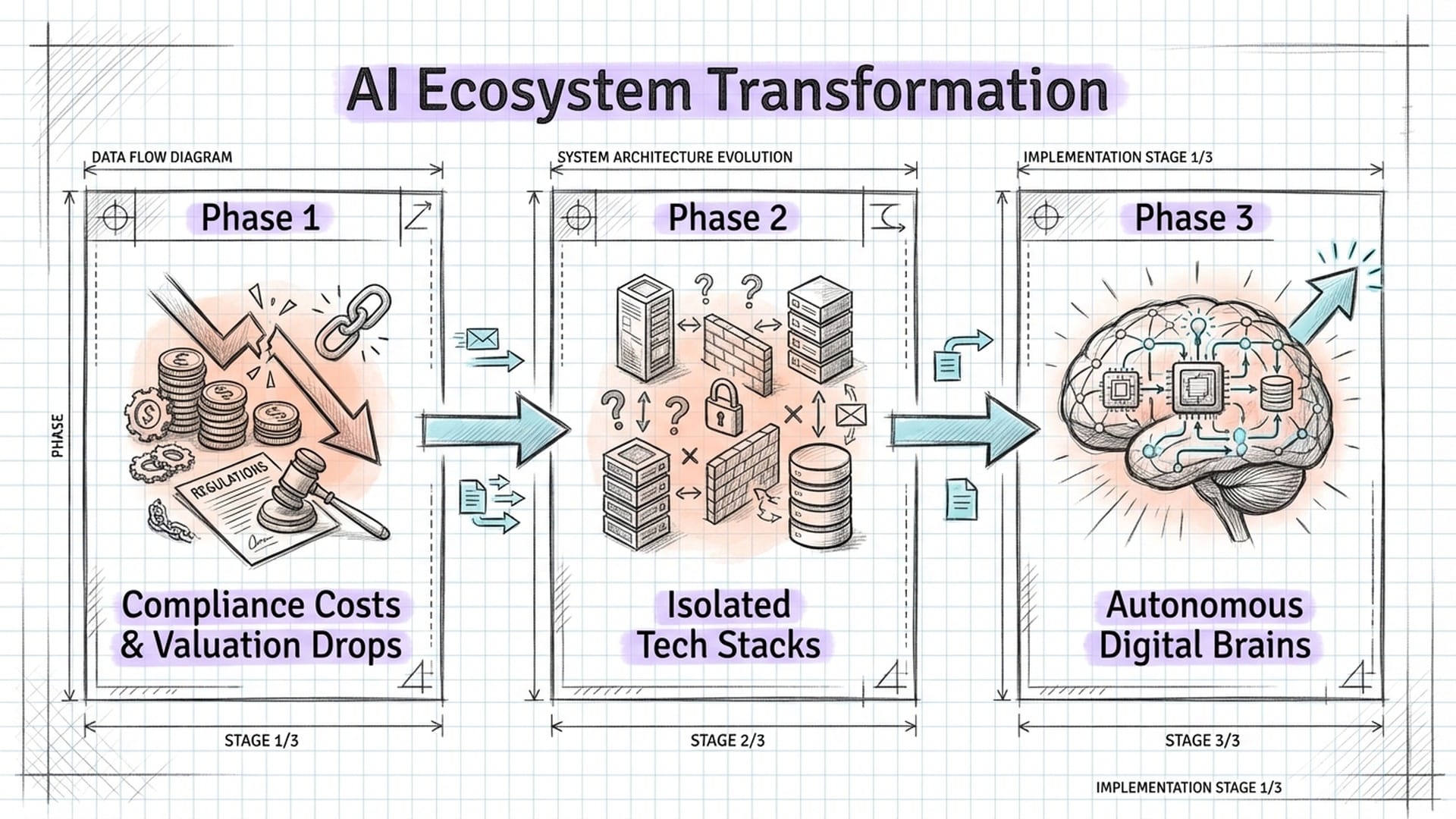

Short-Term Impact: Reassessments and Retaliation

In the short term, this is unequivocally bad news. All global tech sectors, especially software and SaaS companies, will face a severe valuation reassessment. Billions will be wiped off market books as the market prices in exploding compliance costs and the very real threat of retaliatory measures.

Long-Term Transformation: Autonomous Digital Brains

The long-term impact, however, is truly transformative. This move will accelerate the creation of two entirely separate, isolated AI technology stacks globally. While it will initially reduce efficiency and breed redundancy, over the long haul, it will force non-Western nations to accelerate their journey toward complete autonomy, from foundational algorithms to core frameworks. This isn't just reshaping the global tech landscape; it's redrawing it entirely, compelling entire nations and economies to build their own digital brains from scratch because they will have no other choice.

The Liquidity Shockwave: BOJ's Hawkish Pivot

Next, consider the macroeconomic policy bomb dropped by the Bank of Japan (BOJ). In the final trading hours of the Tokyo market, the BOJ's latest meeting minutes revealed an absolutely, shockingly aggressive hawkish stance, far exceeding market expectations. The governor explicitly stated that “2026 is a pivotal year to bid farewell to the legacy of negative interest rates,” and hinted at structural stickiness in inflation, rendering excessive monetary easing undesirable.

This was more than a signal; it was a sonic boom in the thin, illiquid year-end market, triggering a "butterfly effect." For decades, Japan has been the primary provider of the cheapest capital on Earth, serving as the funding leg for the global carry trade. Its policy pivot signifies that the last floodgate of the global liquidity dam is slowly, irrevocably closing.

The Looming Liquidity Drain

The market's immediate fear is a sharp appreciation of the Japanese Yen, which could force the liquidation of vast amounts of carry trade capital currently parked in US Treasuries, European equities, and emerging markets. This capital would be compelled to repatriate back to Japan, creating a terrifying "liquidity drain." This sudden "sucking sound" of capital leaving other markets to return home is the origin of the soaring volatility observed in Asian assets this morning.

In the short term, this is clearly negative for global risk assets, especially US tech stocks and emerging market currencies. We can also expect a sharp appreciation of Yen-denominated assets.

The End of Cheap Capital

The long-term ramifications are profound: this marks the definitive end of the era of cheap global capital. In 2026, the central tendency of global capital costs will structurally shift upwards, dramatically.

Any business model reliant on high leverage, any industry built on the assumption of perpetually free money, is about to face an existential reckoning—a brutal, market-driven culling. Get ready for a massive shake-up.

Resource Nationalism: The Critical Minerals Alliance

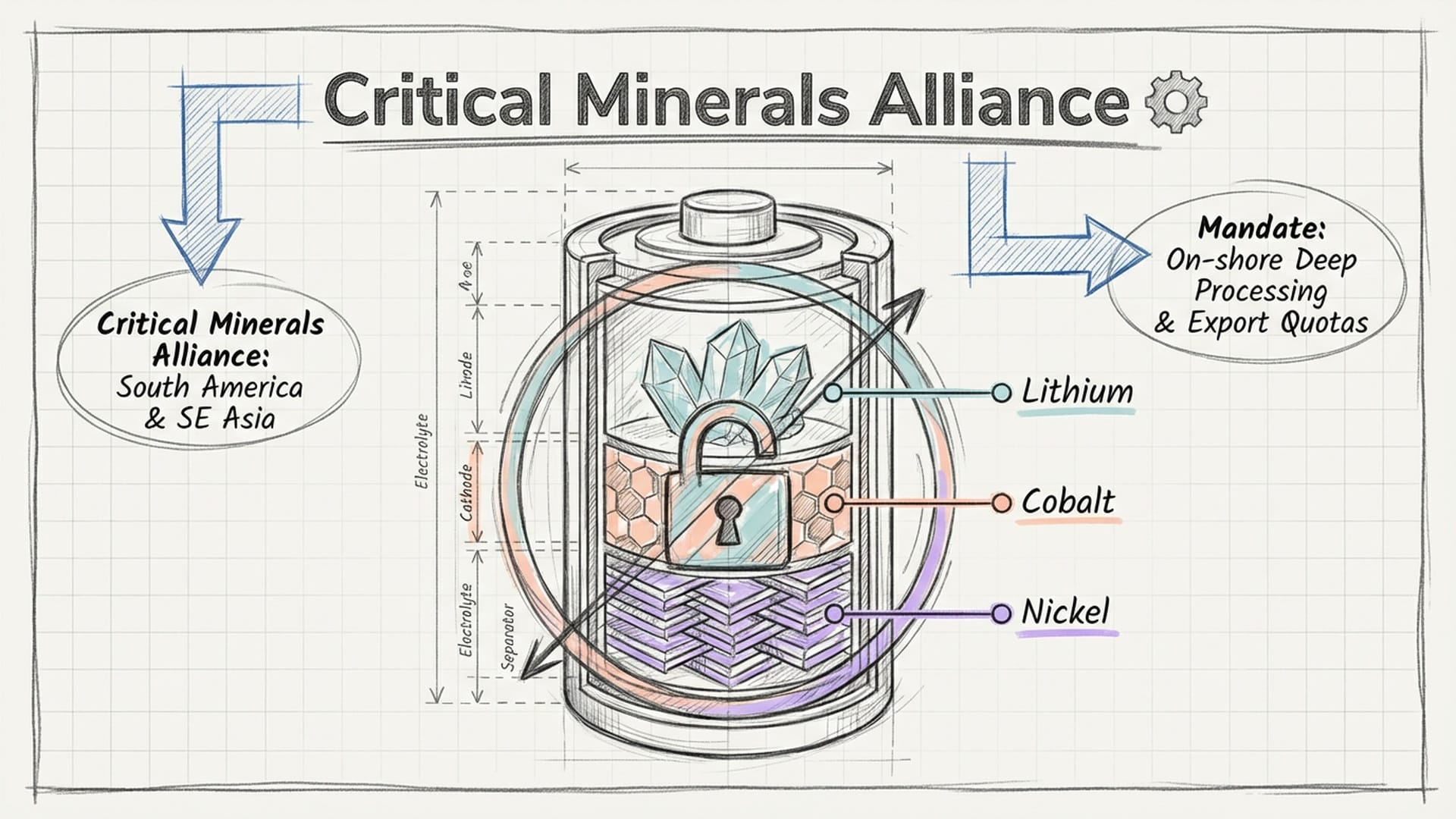

Finally, we must address the announcement by the "Critical Minerals Alliance" regarding export quotas for 2026. This isn't just about rocks in the ground; it's about control over the foundational elements of our future. A newly formed alliance of South American and certain Southeast Asian resource-rich nations has declared stringent export quota management on key battery metals—lithium, cobalt, nickel—starting January 1, 2026. Crucially, they are mandating a certain percentage of deep processing to be done in the countries of origin.

This move is the most extreme embodiment of "resource nationalism." It’s not just about tweaking prices; it's a bare-knuckle brawl for control over the entire supply chain. These nations are no longer content to be mere raw material excavators. They are leveraging their upstream monopoly to compel downstream high-value-added industries, such as battery manufacturing and EV assembly, to relocate operations to their shores.

For European and American automakers aggressively pushing for an energy transition, the uncontrollability of supply chain costs has just skyrocketed. They now face the terrifying prospect of "money, but no goods"—the risk of outright supply disruption, even if they have the cash to pay.

Market Implications: Windfalls and Hit Margins

In the short term, commodity futures prices for these critical materials will absolutely soar. Upstream mining companies will see a windfall in their stock prices. Downstream, however, for automakers, profit margin expectations are going to take a significant hit.

Long-Term Innovation and Friend-Shoring

The long-term impact, while transitional, is truly transformative. This will dramatically accelerate research and development into alternative technologies. Think sodium-ion batteries and solid-state batteries. Necessity is the mother of invention, and the mother just got a whole lot more demanding.

Simultaneously, it will force major economies to accelerate the establishment of their own "friend-shored" closed supply chain loops. They will build resilient, internal systems because they can no longer trust an open global market.

Navigating the Immediate Future: 24 to 48 Hours

The next 24 to 48 hours present a market in a hyper-sensitive state, a unique superposition of a "news vacuum" and an "overreaction period."

- Asymmetric Retaliatory Measures: Given the US-EU algorithm controls, observe whether Beijing deploys further countermeasures, perhaps targeting rare earth magnets or gallium and germanium exports. Any official statement could instantly ignite a massive year-end market rally or plunge us into chaos.

- Flash Crash Risk in JPY: With thin holiday trading and scarce liquidity, the BOJ's hawkish signal could trigger algorithm-driven, one-sided, violent swings in the Yen. For institutions holding significant dollar-denominated assets, the next 48 hours are the absolute last window to hedge against this currency risk.

- Sudden Geopolitical Disruptions: As 2026 nears, vigilance is crucial for potential flashpoints in regions like Eastern Europe or the Middle East. Such actions wouldn't be a slow burn; they would likely trigger a massive jump in safe-haven assets like gold and government bonds the moment markets reopen after the holidays.

In summary, the tail end of 2025 isn't a period; it's an ellipsis, a cliffhanger pregnant with uncertainty. Your strategy now needs to be defined by two things: absolute defense and rigorous liquidity management. We need to wait for the fog of the 2026 new world order to, hopefully, begin to clear.

Are you ready for what comes next?

|  |  |